Article

DOI:

https://doi.org/10.18845/te.v19i3.8135

The use of crowdfunding among music students: Analysis of key drivers and barriers

El uso del crowdfunding entre los estudiantes de música: Análisis de los principales impulsores y obstáculos

TEC Empresarial, Vol. 19, n°. 3, (Sep - Dec, 2025), Pag. 51 - 75, ISSN: 1659-3359

AUTHORS

Paula Montero-Benavides *

Universidad de Sevilla, Sevilla, España.

pmontero@us.es.

![]()

Gema Albort-Morant

Universidad de Sevilla, Sevilla, España.

galbort@us.es.

![]()

María-José Palacín-Sánchez

Universidad de Sevilla, Sevilla, España.

palacin@us.es.

![]()

María Dolores Oliver-Alfonso

Universidad de Sevilla, Sevilla, España.

moliver@us.es.

![]()

Corresponding Author: Paula Montero-Benavides

ABSTRACT

Abstract

This research proposes a model to analyze the factors associated with musicians’ intentions to undertake and use crowdfunding. Crowdfunding has become a crucial financing tool in the music industry, enabling artists to fund projects independently, engage directly with their audiences, and reduce reliance on traditional financial models. By fostering artistic innovation and economic sustainability, crowdfunding plays a vital role in the evolving cultural and creative sectors. However, despite its growing relevance, research on how music students perceive and consider crowdfunding as a financial alternative remains limited. To address this gap, this study collected data through an online survey of 130 higher education music students from a prestigious conservatory in western Andalusia, Spain. The empirical analysis, conducted using Partial Least Squares Structural Equation Modeling (PLS-SEM), suggests that personal attitude and perceived behavioral control are significantly associated with entrepreneurial intention, whereas subjective norms do not have a direct effect. Additionally, the intention to use crowdfunding is related to perceptions of a supportive infrastructure and the opportunity to test crowdfunding platforms before committing to them. These findings highlight the importance of integrating entrepreneurship education and financial literacy into music training, equipping students with the competencies necessary to develop, manage, and finance their projects. In addition, policymakers should consider expanding access to Fintech infrastructure and encouraging crowdfunding as a viable funding option. Also, crowdfunding platforms could benefit from enhancing technological support, user experience, and trust to drive greater adoption. Strengthening these areas collectively will foster financial autonomy for musicians and contribute to a more sustainable and innovative music industry.

Keywords: Entrepreneurial intentions, crowdfunding intentions, PLS-SEM, music students.

Resumen

resumen españolEsta investigación propone un modelo para analizar los factores asociados con la intención de emprender y utilizar el crowdfunding entre los músicos. El crowdfunding se ha convertido en una herramienta clave en la industria musical, permitiendo a los artistas financiar proyectos de manera independiente, interactuar con su audiencia y reducir la dependencia de la financiación tradicional. Al fomentar la innovación artística y la sostenibilidad económica, el crowdfunding desempeña un papel fundamental en los sectores culturales y creativos. Sin embargo, a pesar de su creciente relevancia, hay poca investigación sobre cómo los estudiantes de música perciben y consideran el uso del crowdfunding como alternativa financiera. Para abordar este vacío en la literatura, este estudio recopiló datos mediante una encuesta en línea a 130 estudiantes de educación superior de un prestigioso conservatorio en el oeste de Andalucía, España. El análisis empírico, realizado con PLS-SEM, sugiere que la actitud personal y el control conductual percibido están significativamente asociados con la intención emprendedora, mientras que las normas subjetivas no tienen un efecto directo. Además, la intención de usar el crowdfunding está relacionada con la percepción de una infraestructura de apoyo y la posibilidad de probar las plataformas. Estos hallazgos sugieren la importancia de integrar la educación emprendedora y financiera en la formación musical, dotando a los estudiantes de las competencias necesarias para desarrollar, gestionar y financiar sus proyectos. Además, los responsables políticos deberían ampliar el acceso a la infraestructura Fintech y fomentar el crowdfunding como una opción viable. Al mismo tiempo, las plataformas de crowdfunding podrían beneficiarse de la mejora del soporte tecnológico, la experiencia del usuario y la confianza para impulsar su adopción. Fortalecer estas áreas colectivamente fomentará la autonomía financiera de los músicos y contribuirá a una industria musical más sostenible e innovadora.

Palabras clave: Intenciones emprendedoras, intenciones de crowdfunding, PLS-SEM, estudiantes de música.

Introduction

1. Introduction

Surviving in the modern music industry no longer depends solely on artistic talent. Since the early 21st century, music entrepreneurship has gained prominence, giving rise to the musicpreneur-a musician who also acts as an entrepreneur to ensure career success and sustainability (Roberson, 2025). This shift requires musicians to understand finance, marketing, and business management, enabling them to take charge of their careers and adapt to a dynamic digital market. It departs from the traditional model, where musicians focused only on artistic creation without prioritizing income generation (Haynes & Marshall, 2018). Music entrepreneurship is increasingly recognized as a form of social entrepreneurship. It blends artistic and business elements to generate a positive social impact (Harding, 2011; Muhammad et al., 2021). Musical initiatives influence mindsets and emotions, reinforcing their role in social transformation (Praszkier et al., 2010; Rossiter et al., 2011).

From a broad perspective, social entrepreneurship involves innovative activities aimed at achieving social goals, either for profit or nonprofit (Muhammad et al., 2021). The success of social entrepreneurship is measured by the innovation and social outcomes achieved, rather than by the size of the organizations or business growth (Bacq et al., 2015). For social entrepreneurs, wealth creation is not merely a measure of financial value creation but also a means to achieve social impact or change (Kickul et al., 2018). Musical entrepreneurs often work toward societal well-being without forgoing the financial rewards of their professional activity. Music entrepreneurship enables both for-profit and nonprofit ventures, aligning business principles with social benefits. Social entrepreneurship has grown as a field of study in recent decades (Kickul et al., 2018), from which musical entrepreneurship has emerged (Muhammad et al., 2021). This is a type of arts-based entrepreneurship. According to Rivetti and Migliaccio (2017), studying arts entrepreneurship is often complex because it requires addressing different entrepreneurial processes and contexts within the creative and cultural industries. They emphasize the dichotomy between the artistic and economic aspects as a key research area.

The success of small and medium-sized enterprises, especially in their early stages, depends on factors such as leadership and financial management. Musicians’ entrepreneurial initiatives are crucial for building successful careers (Zhukov & Rowley, 2022). To promote them, music students need to also develop non-artistic competencies related to entrepreneurship, financial management, and fundraising (Munnelly, 2020). In Spain, higher music education is characterized by a strong focus on technical and interpretative aspects. Nevertheless, except for degrees related to music management, curricula generally do not include courses on entrepreneurship or business management.

Access to financing is a critical factor in entrepreneurial initiatives (Sandoval-Álvarez, 2023). Crowdfunding has emerged as an alternative to traditional financing, offering key advantages for social entrepreneurship. It showcases creative and innovative projects that combine economic and social sustainability, generates a stronger social impact by reaching a broad audience, and serves as a market test for new ventures (Kocollari et al., 2024). Crowdfunding is an innovative financial avenue, with its earliest applications occurring in the music industry (Montero-Benavides, 2021). Numerous contributors provide resources to entrepreneurial ideas in exchange for some form of monetary or non-monetary return (Torres et al., 2024; Baber, 2020). It serves as a tool for democratizing finance and identifying potentially successful projects (Alegre & Moleskis, 2021).

Crowdfunding helps musicians raise funds and promote their work, especially by supporting young musicians entering the labor market. This alternative funding model fosters collaboration and challenges traditional music industry structures that often exclude emerging artists or socially driven projects. In this way, musical projects with a positive social impact gain both visibility and financial support. It connects musicians with their supporters or investors, creating a community that not only finances but also engages in the success of the project. Around fifty platforms have emerged in Spain (González & Ramos, 2022), but only a few focus on the music sector, with Verkami being particularly successful in financing musical projects (Montero-Benavides, 2021).

Previous research on potential entrepreneurship in music is often examined through entrepreneurship education or motivational factors. In line with other studies on artistic entrepreneurship (Brandenburg et al., 2016), most are qualitative (Haenfler, 2018), descriptive quantitative (Toscher, 2020), or a combination of both (Munnelly, 2020). In research on entrepreneurial intention, it is common to use a sample of higher education students, as this population is homogeneous in terms of age and qualifications (Liñán & Chen, 2009; Lafuente-González & Leiva, 2022). The quantitative method is the primary research method for studying students' entrepreneurial intentions (Tingting et al., 2022). Some studies focus on university students from various fields, including Arts (Menshikov et al., 2021). Notwithstanding, it is quite common to find quantitative studies on business or engineering students (Sandoval-Álvarez, 2023; Nasri, 2023). Despite this, higher music conservatory students remain an underexplored group. While most previous research on music entrepreneurship relies on qualitative methods and small samples, our quantitative approach offers a complementary perspective that may support broader applicability of the findings. Additionally, by exploring patterns and trends through statistical analysis, our study provides empirical insights into music entrepreneurship and crowdfunding intentions.

Several studies have explored factors influencing entrepreneurial intentions among university students (Anwar et al., 2021; Maresch et al., 2016) and the intention to use crowdfunding (Fanea-Ivanovici & Baber, 2021a; Islam & Khan, 2021). However, research combining both aspects is less common and typically focused on specific countries like Tunisia and South Korea (Nasri, 2023; Baber, 2022). Additionally, the factors linked to crowdfunding intentions are often analyzed from the perspective of funders, rather than future entrepreneurs. Our study addresses a significant gap by examining the intersection of entrepreneurial and crowdfunding intentions among music students, an underexplored group in the literature. It offers new perspectives on how these factors may relate in the context of funding musical projects. Our research not only enriches the existing literature by focusing on a unique population but also contributes to a broader understanding of the variables associated with both intentions, offering insights applicable to other artistic fields.

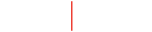

Our study addresses a knowledge gap by examining the factors associated with both entrepreneurial intention and the use of crowdfunding among higher music education students in Spain. In this country, Higher Artistic Music Education degrees are equivalent to university degrees. We propose a model based on motivational variables from the Theory of Planned Behavior (TPB) (Ajzen, 1991) and variables related to crowdfunding intentions drawn from the Unified Theory of Acceptance and Use of Technology 2 (UTAUT2) (Venkatesh et al., 2012), Diffusion of Innovations (DOI) (Rogers, 2003), Trust Theory (Mayer et al., 1995), and Risk Theory (Bauer, 1960). The TPB was selected for its robust framework, which is dominant in the literature for understanding entrepreneurial intentions. UTAUT2 and DOI theories were included due to their relevance in analyzing technology adoption and the diffusion of new ideas, such as crowdfunding within Fintech. Additionally, Trust and Risk theories are essential to examine how trust and perceived risk influence musical entrepreneurs’ decisions to use crowdfunding.

Data were collected from 130 students at the Higher Music Conservatory in Seville, Spain, and analyzed using Partial Least Squares Structural Equation Modeling (PLS-SEM). This approach is recommended for small samples like ours because it allows estimating complex relationships between dependent variables (Hair et al., 2013). Additionally, PLS-SEM facilitates measuring latent constructs, such as crowdfunding intentions, and simultaneously estimates direct and indirect effects. The analysis was conducted using SmartPLS 4.1.0.4 software (Ringle et al., 2024), widely used in management research.

Our findings suggest that personal attitude and perceived behavioral control may be associated with the entrepreneurial intentions of music students. This is consistent with the idea that musicians, like other entrepreneurs, can be motivated by a positive attitude toward entrepreneurship and confidence in managing business challenges. Additionally, the results indicate potential associations between facilitating conditions and trialability on crowdfunding intentions. This finding points to the relevance of organizational support and adequate technological infrastructure. It also indicates the value of providing opportunities to test platforms, thus facilitating their adoption.

Our research could help shape educational, economic, and financial policies that strengthen the music industry, aligning with Spain’s 2030 Agenda (Government of Spain, 2019). Promoting culture and education is key to sustainable development. Our work could inspire entrepreneurship training programs for music students, fostering entrepreneurial intentions and enhancing self-efficacy (Bae et al., 2014). Developing these skills in higher education is essential for musicians to create and manage their own businesses (Sternberg et al., 2022; Albinsson, 2018). Nevertheless, music education in Spain primarily focuses on technical and interpretive aspects, often lacking entrepreneurship training. This is crucial for ensuring both artistic and economic sustainability. Additionally, our findings could help develop financial strategies to ensure the music industry's economic sustainability. This includes supporting financial aid for music projects and strengthening government and private initiatives. Our research could also guide the optimization of crowdfunding platforms for entrepreneurial musicians. Here support guides are key to improving security and accessibility.

This paper is organized into five sections. The second section presents the theoretical framework and research hypotheses. The third section is dedicated to explaining the research methodology. The fourth section provides the empirical analysis. Finally, the fifth section offers a discussion and the conclusions drawn from the research.

2. Theoretical framework and research hypotheses

2.1. Theory of Planned Behavior hypotheses

The Theory of Planned Behavior (TPB), developed by Ajzen (1991) and rooted in psychology, has been applied across various fields, ranging from marketing to healthcare (Palos-Sanchez et al., 2019). The TPB remains the predominant theoretical framework in research on students' entrepreneurial intentions (Ismail et al., 2024; Tingting et al., 2022). This theory links antecedent or motivational factors of entrepreneurial behavior to both entrepreneurial intentions and actions. According to Ajzen (1991), individuals who believe that performing a certain action will lead to a positive outcome are more likely to prefer and intend to engage in that action.

Entrepreneurial intention (EI) refers to the state of mind preceding the action of launching a new business or venture (Thompson, 2009). For students, the initial entrepreneurial intention may later be undermined by obstacles or lack of conditions in the environment (Aguirre-González, 2020). In the music sector, entrepreneurial activities may also include launching musical projects or non-profit organizations. Although there is an extensive literature on the factors influencing students’ entrepreneurial intentions, the complexity of their interrelationships is not yet fully understood (Ismail et al., 2024), even more so in music students.

According to the TPB, the three motivational components that influence entrepreneurial behavior are personal attitude, subjective norms, and perceived behavioral control (Liñán et al., 2013). Individuals who have a favorable attitude, are positively influenced by social factors and perceive that they have control over their actions are more likely to develop the intention to engage in a favorable behavior (Baber, 2020). Building on this framework, the present study applies the TPB to examine how these three antecedent factors shape musicians' entrepreneurial intentions. According to Ajzen's formulation of the TPB, entrepreneurial intention is influenced by these key factors of entrepreneurial behavior (Liñán & Chen, 2009):

-

Personal attitude (PA), which pertains to a person's favorable or unfavorable judgment about entrepreneurship or business creation;

-

Subjective norms (SN), which refer to the perceived social pressure to engage or not engage in entrepreneurial behaviors, particularly whether “reference people” would approve or disapprove of the decision to become an entrepreneur;

-

Perceived behavioral control (PBC), which involves the perception of the ease or difficulty of becoming an entrepreneur, including the sense of being capable of doing so and the perception of behavioral controllability (Liñán et al., 2013; Gieure et al., 2019).

Recent literature reviews (Ismail et al., 2024; Andrade & Carvalho, 2023) indicate that numerous studies have analyzed the impact of TPB factors on students’ Entrepreneurial intention (EI). Personal attitude and perceived behavioral control positively influence EI (Sandoval-Álvarez, 2023). Nonetheless, Andrade and Carvalho (2023) argue that the relationship between subjective norms and EI is less balanced. Similarly, Tingting et al. (2022) suggest that PA and PBC have a more significant effect on EI than SN. Liñán et al. (2013) and Liñán and Chen (2009) argue that SN’s influence on EI is indirect through PA and PBC. This may explain why SN is considered to play a weaker role in EI.

Some studies (e.g., Blanco-Mesa et al., 2024) have not observed a significant relationship between the SN and EI of college students. Baber (2022) suggests that business administration students decide to become entrepreneurs personally and irrespective of family or peer influence. This finding is consistent with previous research (Doanh & Bernat, 2019; Nguyen et al., 2019). In a study on science and engineering students, Maresch et al. (2016) found that SN was negatively related to EI, and PBC did not have a significant relationship with EI. Other studies also show that PBC does not have a significant influence (Gieure et al., 2019) or its influence is weak (Nguyen et al., 2019). However, Fanea-Ivanovici and Baber (2021a, 2021b) surprisingly demonstrated a significant negative relationship between PBC and EI, suggesting that students who believe they cannot manage entrepreneurial tasks are more inclined to pursue entrepreneurship.

Despite some contradictory findings regarding the three factors of TPB, numerous studies have demonstrated the significant positive effects of PA, SN and PBC on EI (e.g., Mensah et al., 2021; Brito et al., 2022; Mehraj et al., 2023; Nasri, 2023). The literature strongly supports the notion that PA has a positive and significant effect on university students' EI (Karimi, 2020; Debarliev et al., 2022; Kaur & Chawla, 2023). Additionally, several studies have confirmed that SN positively and significantly influences university students' EI (Fanea-Ivanovici & Baber, 2021a, 2021b; Lin et al., 2022). Similarly, PBC has been identified as a positive predictor of EI among students (Doanh & Bernat, 2019; Baber, 2022; Nasri & Morched, 2023). From the planned behavior perspective, we would expect PA, SN, and PBC to play a role in shaping the EI of music students. Therefore, we have formulated the following research hypotheses:

H1: Personal attitude is positively associated with the entrepreneurial intention of music students.

H2: Social norms are positively associated with the entrepreneurial intention of music students.

H3: Perceived behavioral control is positively associated with the entrepreneurial intention of music students.

2.2. Unified Theory of Acceptance and Use of Technology 2 and Diffusion of Innovations theory hypotheses

According to a recent bibliometric study by Mansyur et al. (2023), research trends indicate that crowdfunding is a particularly significant area of interest within Financial Technology (Fintech). Studies have examined the factors that ensure success in crowdfunding from three perspectives: the projects themselves, the funders or resource providers, and the promoters or fundraisers (Alegre & Moleskis, 2021). From the latter perspective, behavioral intention toward crowdfunding can serve as a predictor of young entrepreneurs' use of crowdfunding platforms (Alshebami, 2022).

Various theories and models, primarily grounded in social psychology, have been developed in the scientific literature to analyze individual behavior regarding the adoption and use of new systems and technological tools. Among the most widely recognized theories in academia is the Unified Theory of Acceptance and Use of Technology 2 (UTAUT2) (Venkatesh et al., 2012). This research model is extensively used to examine how users accept and utilize a technological product (Mansyur et al., 2023; Sentanoe & Oktavia, 2022). The extended UTAUT2 model surpasses the original UTAUT model (Venkatesh et al., 2003) by addressing its limitations and broadening its application across various contexts.

The UTAUT2 model has been employed in research on the adoption of different technologies, including crowdfunding platforms (Al-Daihani et al., 2024; Kumar et al., 2024; Sentanoe & Oktavia, 2022). The model comprises seven key determinants of behavioral intention and user behavior: performance expectancy, effort expectancy, facilitating conditions, social influence, hedonic motivation, habit, and price value. One of the advantages of the UTAUT2 model is its flexibility. It can be customized and modified according to the study's objectives (Venkatesh et al., 2012).

Furthermore, The UTAUT2 can be supplemented with other models, such as the Diffusion of Innovations (DOI) theory (Rogers, 2003), for a more comprehensive understanding of technology adoption and usage. The DOI is a significant theory in Information Systems that describes the manner and pace at which innovations spread within a population (Kumar et al., 2024). The DOI examines how individuals decide to adopt a new technology based on five factors: relative advantage, compatibility, complexity, observability, and trialability (Palos-Sanchez et al., 2019). By integrating UTAUT2 and DOI, this study examines how facilitating conditions (FC) and trialability (T) influence crowdfunding intentions (CI) among music entrepreneurs. FC ensures the availability of adequate technical and organizational infrastructure, while T allows users to experiment with the platform before adoption. Both factors reduce adoption barriers and enhance accessibility, making crowdfunding a more viable funding option in the music industry.

Facilitating conditions (FC) are defined as the degree to which individuals believe that a technical and organizational infrastructure exists to support the use of a particular information system (Venkatesh et al., 2003). According to Baber (2022), crowdfunding platforms must provide an environment in which entrepreneurs feel confident that they can achieve their funding goals. In our study, FC refers to perceptions of the availability of technological and organizational infrastructures that facilitate the use of crowdfunding platforms. Examples of these are appropriate transaction systems or technical support for users.

Previous empirical research has shown inconsistent results regarding the relationship between FC and the intention to use crowdfunding (CI). In the context of funders, some studies have demonstrated a positive relationship between FC and CI (Al-Daihani et al., 2024). Yet, other studies have not found FC to have a significant impact on CI (Moon & Hwang, 2018; Sentanoe & Oktavia, 2022). Similarly, in relation to entrepreneurs, the findings are mixed. While some studies did not observe a significant relationship between the two variables (Fanea-Ivanovici & Baber, 2021a; Alshebami, 2022), other research suggests that FC has a significantly positive effect on CI (Islam & Khan, 2021; Baber, 2022). In this study, we anticipate that music entrepreneurs' belief in an infrastructure that supports the use of crowdfunding platforms will be positively associated with their intention to use them.

Trialability (T), as defined by Rogers (2003), refers to the degree to which a technological innovation can be tested by individuals before its actual use. According to Rogers, the adoption of technology is faster when there are more opportunities to try and experiment with it beforehand. Thus, T serves to validate new procedures, ideas, and systems before committing to their use (Alshebami, 2022). In the context of crowdfunding, users who familiarize themselves with platforms can reduce uncertainty and initial resistance. Boosting entrepreneurs' confidence in these platforms may increase the likelihood of their future use. In this study, T measures music entrepreneurs' perceptions of the opportunities to try and experiment with crowdfunding platforms before deciding whether to use them.

Islam and Khan (2021) found that T is a determinant of the actual use of crowdfunding platforms. According to these authors, entrepreneurs who believe they have more opportunities to experiment with crowdfunding platforms are more inclined to use them for fundraising. Nevertheless, that study could not prove that T was a predictive factor in the intention to use crowdfunding. Similarly, Alshebami (2022) could not demonstrate that T has a significant positive influence on the CI of potential entrepreneurs. However, in a recent study on crowdfunding behavior among entrepreneurs (Kumar et al., 2024), T was shown to have a significant positive influence on both CI and the actual use of crowdfunding. Based on the above arguments, we propose the following research hypotheses:

H4: Facilitating conditions are positively associated with the intention to use crowdfunding among music students.

H5: Trialability is positively associated with the intention to use crowdfunding among music students.

2.3. Trust and risk theories hypotheses

Research has shown that perceived trust, like perceived risk, is a highly influential variable in the adoption and acceptance of technologies such as crowdfunding (Jaziri & Miralam, 2019). Trust is defined as the willingness of one party to be vulnerable to the actions of another. This is based on the positive expectation that the other party will perform as anticipated without the need for supervision or control (Mayer et al., 1995). Trust is crucial for enhancing user motivation to engage with crowdfunding platforms (Moon & Hwang, 2018). Understanding how trust functions can lead to increased success rates for crowdfunding projects. Numerous studies have recognized trust as a critical factor influencing individuals' behavior toward technology use. Research has explored the impact of user trust in predicting technology utilization: This has been done in contexts such as mobile network transactions (Franque et al., 2023) and biometric payments (Sulaiman & Almunawar, 2022). In the literature on crowdfunding, the influence of trust has only been analyzed in fundraisers and funders (Fanea-Ivanovici & Baber 2021a, 2021b; Baber & Fanea-Ivanovici, 2023).

Perceived Risk Theory focuses on the factors that influence consumer decision-making and behavior (Bauer, 1960). In the context of innovation adoption, high levels of perceived risk negatively impact individuals' attitudes and behavioral intentions (Bayon et al., 2016; Wang et al., 2023). In the framework of crowdfunding, previous research has explored perceived risks only for the cases of funders and fundraisers (Fanea-Ivanovici & Baber, 2021a, 2021b; Islam & Khan, 2021; Baber & Fanea-Ivanovici, 2023). For investors, perceived risks often relate to the investment itself, the use of technology, or legal protection (Wasiuzzaman et al., 2022). On the other hand, entrepreneurs are concerned with risks related to service quality, transactions, or plagiarism (Jaziri & Miralam, 2019).

Perceived trust and perceived risk must be considered due to the uncertainty inherent in virtual environments (Mayer et al., 1995). The existing literature suggests that both factors play critical roles in online contexts such as crowdfunding. Perceived trust reflects entrepreneurs' beliefs about the technological capability, reliability, integrity, and honesty of crowdfunding platforms (Islam & Khan, 2021). Acceptance and use of crowdfunding may be determined by the level of trust and security associated with these platforms (Moon & Hwang, 2018), and can be measured from both the project promoters’ and investors’ perspectives.

Drawing on these insights, this study investigates the extent to which perceived trust and perceived risk influence musical entrepreneurs' intention to use crowdfunding platforms. In our study, perceived trust (PT) among potential music entrepreneurs represents confidence in the integrity of Crowdfunding platforms and the security of their personal and project-related information. Previous research has shown that funders' trust in platforms positively impacts their participation as users (Moon & Hwang, 2018; Sentanoe & Oktavia, 2022). Islam & Khan (2021) found a positive relationship between PT among Bangladeshi startup entrepreneurs and their intention to use crowdfunding (CI). Among the limited studies that have addressed trust in potential entrepreneurs (Alshebami, 2022; Fanea-Ivanovici & Baber, 2021a, 2021b), a positive outcome between PT and CI has also been observed.

Perceived risk (PR), as defined by Featherman and Pavlou (2003), is the likelihood of experiencing a loss while attempting to achieve a desired outcome through the use of electronic services. PR has also been explained as the uncertainty an individual has about a product, process, or technology before its use (Alshebami, 2022). In our study, PR includes risks associated with using crowdfunding platforms, such as the loss of privacy or the risk of business imitation. Generally, a user's PR tends to have a negative effect on their behavioral intention toward crowdfunding.

Previous empirical studies reveal that PR negatively influences the CI of entrepreneurs (Fanea-Ivanovici & Baber, 2021a), although some surprisingly show a positive influence (Fanea-Ivanovici & Baber, 2021b; Alshebami, 2022). Yet, other research has not demonstrated a relationship between these constructs. Studies by Kumar et al. (2024) and Islam and Khan (2021) indicated that CI is not influenced by PR among entrepreneurs or fundraisers. Some studies on funders also found that PR does not have a significant effect on their willingness to participate in crowdfunding (Moon & Hwang, 2018). However, these authors revealed that for participants with experience using crowdfunding, PR did have a significant effect on CI. Based on the above, we propose the following two hypotheses:

H6: Perceived trust is positively associated with the intention to use crowdfunding among music students.

H7: Perceived risk is negatively associated with the intention to use crowdfunding among music students.

2.4. Entrepreneurial and crowdfunding intentions hypothesis

Entrepreneurial intention (EI) measures the effort an individual is willing to exert to engage in entrepreneurial behavior (Liñán & Chen, 2009). Although not all intentions materialize into actual actions, there is a consensus that EI is a critical determinant of actual entrepreneurial behavior (Ajzen, 1991). Crowdfunding has recently assumed a prominent role in the successful financing of musical projects. Entrepreneurs' plans and expectations regarding the use of crowdfunding are interpreted as behavioral intentions (Islam & Khan, 2021). Measuring the intention to use crowdfunding (CI) is crucial. This is because it can positively influence the actual use of this funding method by entrepreneurs (Kumar et al., 2024; Alshebami, 2022).

A recent study on young entrepreneurs revealed that knowledge of and access to crowdfunding positively impact their entrepreneurial intentions (Festa et al., 2023). Furthermore, entrepreneurial intentions serve as an indicator of young people's business skills, as they reflect their understanding of alternative financial tools and their intention to use them (Fanea-Ivanovici & Baber, 2021b). Although less explored, the hypothesis of a positive correlation between EI and CI among university students has been confirmed in studies such as those by Baber (2022) and Fanea-Ivanovici and Baber (2021a, 2021b). Consistent with these findings, we propose the following hypothesis:

H8: The entrepreneurial intentions of music students are positively associated with their intentions to use crowdfunding.

Finally, Figure 1 illustrates our research model based on the previously described variables and hypotheses.

Methods

3. Research methodology

3.1. Survey and measurement scales

An online survey was conducted using a questionnaire created with Microsoft Forms to gather information from music students in Spain. The survey link was disseminated via email and through a QR code provided by the professors. Data collection was carried out within a one-month period during 2024. To assess the concepts outlined in the research model, a five-point Likert scale was employed, offering respondents options from "strongly disagree" to "strongly agree", thereby facilitating responses via mobile devices.

Validated scales from previous studies were employed to measure the constructs. Personal attitude (PA), social norms (SN) and perceived behavioral control (PBC) were adapted from Liñán et al. (2013), Nguyen et al. (2019) and Ma et al. (2020). The variable entrepreneurial intentions (EI) was measured using a scale from Liñán et al. (2013). Crowdfunding intentions (CI) and facilitating conditions (FC) were assessed using a scale from Baber (2022). Finally, the trialability (T), perceived risk (PR) and perceived trust (PT) variables were measured using a scale from Islam and Khan (2021). Moreover, the analysis included two control variables: gender and age. Created using Microsoft Forms, the survey maintained participant anonymity by not requesting any personal data. Participation was entirely voluntary. To provide a clear overview of the measurement process, Table 1 presents the key constructs, corresponding items, and their sources.

Table 1 Measurement of key concepts

| Construct | Items | Authors |

|---|---|---|

| Personal attitude (PA) |

Indicate your level of agreement with the following statements: PA1. A career as an entrepreneur seems very unattractive to me. PA2. If I had the opportunity and the resources, I would like to start my own business. PA3. Among several options, I would prefer anything but being an entrepreneur. PA4. Being an entrepreneur would bring me great satisfaction. PA5. Being an entrepreneur could offer me more advantages than disadvantages. |

Liñán et al. (2013) |

| Social norms (SN) |

SN1. My friends would support my decision to start a business or entrepreneurial project. SN2. My family would support my decision to start a business or entrepreneurial project. SN3. People in my environment would support my decision to start a business or entrepreneurial project. SN4. My social environment and current policies have a significant impact on my entrepreneurial initiative. |

Nguyen et al. (2019); Ma et al. (2020). |

| Perceived behavioral control (PBC) |

PBC1. Creating a business or an entrepreneurial project and keeping it viable would be easy for me. PBC2. I am prepared to create an entrepreneurial project or a viable business. PBC3. I can control the process of creating a business or an entrepreneurial project. PBC4. I know the practical details necessary to create an entrepreneurial project or a business. PBC5. I know how to develop an entrepreneurial project. PBC6. If I tried to create a business or an entrepreneurial project, I would have a high probability of success. |

Liñán et al. (2013) |

| Entrepreneurial intentions (EI) |

EI1. I am willing to do anything to become an entrepreneur. EI2. I will do everything possible to create and run my own business. EI3. I have serious doubts about starting my own business. EI4. I am determined to start a company in the future. EI5. My career goal is to become an entrepreneur. EI6. I have very little intention of ever starting a company. |

Liñán et al. (2013) |

| Crowdfunding intentions (CI) |

CI1. I intend to raise capital for my start-up through a crowdfunding platform in the near future. CI2. I expect to raise capital for my start-up through a crowdfunding platform in the near future. CI3. I plan to use crowdfunding in the near future. |

Baber (2022) |

| Facilitating conditions (FC) |

FC1. Crowdfunding platforms are capable of providing me with sufficient technical support to resolve any issues I may encounter during the fundraising process for my future project or business. FC2. Crowdfunding platforms have adequate transaction systems for fundraising for my project. FC3. Crowdfunding platforms have sufficient communication channels (chat and email) to connect with the appropriate technical support staff. FC4. Crowdfunding platforms have enough experience and knowledge in managing and facilitating fundraising for my project. |

Baber (2022) |

| Trialability (T) |

T1. I have sufficient opportunities to try and use crowdfunding. T2. I can experience crowdfunding. T3. I believe I do not have to put much effort into trying to use crowdfunding. |

Islam and Khan (2021) |

| Perceived risk (PR) |

PR1. I believe that using a crowdfunding platform to raise funds would not be risky. PR2. I believe that crowdfunding platforms do not hinder financial and personal privacy. PR3. I believe that sharing information about the business model on crowdfunding platforms does not pose a risk of imitation. |

Islam and Khan (2021) |

| Perceived trust (PT) |

PT1. I can trust crowdfunding platforms. PT2. I believe that a crowdfunding platform is trustworthy and has great integrity. PT3. I believe that my personal information and project-related data will not be exposed to unauthorized parties by crowdfunding platforms. |

Islam and Khan (2021) |

3.2. Sample and data collection

The survey utilized in our study was conducted with students from the Manuel Castillo Superior Conservatory of Music in Seville (Spain). Out of 586 enrolled students, 130 responses were collected. This sample is representative of potential entrepreneurs in the musical sector, as the student body originates from a prestigious musical institution in western Andalusia, Spain. The conservatory attracts students from various Andalusia provinces, notably Huelva, Cádiz, and Seville, as well as from other regions of Spain and abroad. Its status as the leading educational institution in its area underscores the importance of its internal operations and community connections in promoting cultural enrichment. Utilizing a sample of higher education students is common in research on entrepreneurial intention, as it ensures a homogeneous group with similar ages and qualifications (Liñán & Chen, 2009).

Regarding the profile of the participants, 53.1% identified as male (n = 69), 46.2% as female (n = 60), and 0.7% as other (n = 1). Most respondents were between 18 and 23 years old (71.5%, n = 93), followed by 24-34 (23.8%, n = 31). Only a few participants were under 18 or older than 34 (n = 6). In terms of specialization, the sample included students from all four main specialties offered at the conservatory: Composition, Choir Direction, Performance, and Musicology. Among the respondents, 76.2% were enrolled in Performance, 10.8% in Musicology, 9.2% in Composition, and 3.8% in Choir Direction. The distribution of respondents across specializations closely matches the enrollment percentages, suggesting that the sample reflects the institution’s academic composition.

To guarantee an adequate sample size, we conducted an a priori power analysis using G*Power 3.1.9.7 (Faul et al., 2009). We set the power at 0.95, the alpha level at 0.05, and included 8 predictors. The results showed that at least 74 participants were needed. Since our final sample included 130 individuals, we confirm that the study meets the required sample size.

3.3. Method

This study employs Partial Least Squares - Structural Equation Modeling (PLS-SEM) for the data analysis. The rationale for utilizing the PLS technique is well-documented and extensively discussed in the methodological literature (Hair et al., 2013). Several justifications underpin its use. First, our sample size (n = 130) is relatively small. According to Hair et al. (2019), PLS is recommended for studies with fewer than 250 observations. Second, PLS enables the simultaneous estimation of multiple and interrelated dependent relationships between variables, including both direct and indirect effects. Third, it facilitates the use of latent construct measurements, such as the intention to use crowdfunding. The research model and hypotheses were analyzed using SmartPLS 4.1.0.4 software (Ringle et al., 2024). This methodology and its associated statistical software are widely employed in fields such as marketing, business, and administration (Hair et al., 2013).

To ensure the reliability and validity of the measurement model, we assessed factor loadings, Cronbach’s alpha, Composite Reliability (CR), and Average Variance Extracted (AVE), following the thresholds recommended by Hair et al. (2019). Items with factor loadings below 0.70 were removed, and internal consistency was confirmed with Cronbach’s alpha and rho_A coefficients exceeding 0.70. Since Cronbach’s alpha assumes equal factor loadings, which may not always hold in SEM, rho_A and CR provide a more robust reliability assessment (Henseler et al., 2015). Furthermore, all AVE values were compared against the recommended threshold of 0.50 (Hair et al., 2019) to assess convergent validity. Additionally, discriminant validity was evaluated using the Heterotrait-Monotrait (HTMT) ratio (Henseler et al., 2015), confirming that construct correlations remained below 0.90. Multicollinearity was examined using Variance Inflation Factors (VIFs), ensuring that values remained below the 3.3 threshold proposed by Kock (2015).

The structural model was analyzed using bootstrapping with 5,000 resamples (Hair et al., 2014). This is a nonparametric resampling technique widely used in PLS-SEM to enhance the stability of parameter estimates and hypothesis testing. This process involved evaluating path coefficients, t-statistics, p-values, and bias-corrected confidence intervals to guarantee the significance and stability of the estimated relationships. The predictive relevance of the model was determined using R² values, following Falk and Miller’s (1992) criterion, and the Stone-Geisser test (Hair et al., 2019). Finally, an Importance-Performance Map Analysis (IPMA) was conducted, as recommended by Ringle and Sarstedt (2016), to enhance the interpretation of results. This technique identifies key antecedent constructs influencing the target variable, crowdfunding intentions, by mapping their importance and performance levels.

Results

4. Analysis and Results

4.1. Measurement model assessment

The measurement model section examines the reliability and validity to ensure the suitability of the individual items and constructs utilized in the research model. The results, shown in Table 2, indicate that all the standard factor loadings are above the recommended 0.7, except for PA1, PA3, EI3, EI6, and SN4. These indicators were subsequently removed. Factor loadings above 0.7 suggest that individual items have a strong association with their respective latent variables, suggesting adequate convergent validity (Hair et al., 2019). The model was then reanalyzed using the PLS Algorithm. After this, the item PBC1 achieved a value of 0.693, which is close to 0.7, and was retained.

Internal consistency was assessed using Cronbach’s alpha and the Rho coefficient, both of which exceeded the recommended threshold of 0.7. These results indicate that the items used to measure each construct are highly correlated internally, reinforcing the reliability of the measurements and the stability of the collected data. Additionally, all composite reliability (CR) values were above the 0.90 threshold. This suggests that the scales used exhibit a high level of consistency in measuring the underlying theoretical concepts, thereby enhancing the robustness of the measurement model. Furthermore, all the average variance extracted (AVE) values were greater than the recommended 0.50 (Hair et al., 2019). This confirms the convergent validity of the constructs and dimensions. These results indicate that, on average, the items used explain more than 50% of the variance of their respective latent variables, supporting adequate convergent validity and providing strong empirical backing for the model.

In addition to ensuring internal consistency and validity, we also examined potential collinearity and measurement bias in the model. Potential multicollinearity between predictor variables and common method bias (CMB) were also analyzed (Kock & Lynn, 2012). High correlations between variables can reduce their independent explanatory power, while CMB occurs when variations in responses are due to the measurement instrument rather than the true predispositions of the respondents. As shown in Table 2, all the internal variation inflation factors (VIFs) among the latent constructs range from 1.000 to 2.819, which is below the threshold of 3.3 proposed by Kock (2015). Therefore, the full collinearity test yielded satisfactory VIFs, indicating that the model is CMB-free. This confirms that the model is free from collinearity issues, ensuring the precision of the obtained estimates and the independence of each variable’s effects.

Table 2 Composite reliability and validity

Table 3 displays the assessment of discriminant validity using the Heterotrait-Monotrait (HTMT) ratio method to examine the distinct dimensions measured by each construct. This approach checks if the correlations between construct pairs are below 0.9, as recommended by Henseler et al. (2015). Discriminant validity guarantees that each construct measures a unique concept and is not overly correlated with others. This prevents redundancy and strengthens the model’s explanatory power. The results confirm that all the constructs meet this criterion. The highest HTMT value is 0.896, observed between PR and PT, indicating that while related, they capture different aspects of security and confidence in crowdfunding. Other constructs exhibit lower HTMT values, reinforcing discriminant validity. These findings confirm that all the analyzed factors-EI, CI, PA, SN, PBC, FC, T, PR and PT-are statistically distinct, strengthening the reliability of the conclusions and supporting the robustness of the measurement model.

Table 3 Measurement model: discriminant validity.

4.2. Structural model assessment

The research hypotheses were tested and assessed with a bootstrapping of 5,000 resamples (Hair et al., 2014). Table 4 provides the generated standard errors, t-statistics, p-value and 95% bias corrected confidence intervals (BCCI). This table also includes the explained variance of the endogenous variables through the R2 level (Chin, 2010). In this study, R² has a value of 0.565 (entrepreneurial intention) and 0.303 (crowdfunding intentions). Under these circumstances, all the endogenous variables fulfill Falk & Miller's criterion (Falk & Miller, 1992), surpassing the minimum value of 0.10, indicating satisfactory results. Additionally, the Stone-Geisser test was performed to obtain the predictive relevance test value (Q²) as recommended by Hair et al. (2019). In this study, Q² represents a value of 0.538 (entrepreneurial intention) and 0.236 (crowdfunding intentions). As Q² increases, the predictive relevance of our structural model improves.

The structural model results reveal that our hypotheses H1, H3, H4 and H5 have significant relationships with their respective variables. The direct relationships are robust and acceptable because they have t-values greater than 1.984. Nevertheless, the direct effect of hypotheses the H2, H6, H7 and H8 relationships are insignificant. Lastly, the control variables of age and gender have no significant effect on the crowdfunding intentions.

Table 4 Structural model results

The analysis suggests that a positive attitude toward entrepreneurship plays a key role in music students' predisposition to develop business initiatives, supporting H1. Personal attitude shows a significant and positive association with music students' entrepreneurial intention (β = 0.529, p < 0.001). This finding is consistent with previous studies highlighting personal attitude as one of the most critical factors in entrepreneurial intention (Kaur & Chawla, 2023; Sandoval-Álvarez, 2023). In the context of musicians, this result suggests that individual perceptions of entrepreneurship can be crucial in motivating the creation of music-related projects or businesses.

Hypothesis H2 was not supported (β = 0.035, p = 0.610), indicating that subjective norms are not significantly associated with musicians’ entrepreneurial intentions. This is consistent with studies questioning the impact of social norms on entrepreneurship (Blanco-Mesa et al., 2024; Baber, 2022; Nguyen et al., 2019). In environments where entrepreneurship is undervalued or perceived as a risky career choice, entrepreneurial intentions tend to be shaped more by internal factors than by social approval (Liñán, 2008). Similarly, music students in Spain may rely more on personal motivation and self-confidence than on social influence. In contrast, hypothesis H3 was supported (β = 0.358, p < 0.001), indicating that perceived behavioral control is positively related to entrepreneurial intention. This is consistent with previous research (Nasri & Morched, 2023; Mensah et al., 2021; Liñán et al., 2013). For musicians, this suggests that those who perceive greater control and confidence in their ability to manage a project or business in the music industry are more likely to engage in entrepreneurship.

Hypotheses H4 and H5 were supported, indicating that facilitating conditions (β = 0.201, p = 0.047) and trialability (β = 0.334, p = 0.001) are positively associated with the intention to use crowdfunding. These findings align with previous studies highlighting the significance of a strong technical and organizational infrastructure, as well as prior experience with platforms, in crowdfunding adoption (Kumar et al., 2024; Baber, 2022; Islam & Khan, 2021). For musicians, having access to a reliable transaction system and technical support can be relevant when deciding whether to use crowdfunding. Additionally, the opportunity to test platforms before committing to them can help reduce uncertainty and encourage the adoption of this alternative funding source.

In our study, perceived risk is not significantly associated with the intention to use crowdfunding (H6 was not confirmed, β = -0.183, p = 0.151), consistent with recent research that also found no such relationship (Kumar et al., 2024; Islam & Khan, 2021). Likewise, trust in platforms does not show a significant association with the intention to use crowdfunding (H7 was not confirmed, β = 0.179, p = 0.127). Although some studies identify trust as a key factor in crowdfunding adoption (Moon & Hwang, 2018; Sentanoe & Oktavia, 2022), our research found no evidence of this among music students. One possible explanation is that music students, as first-time users, may lack the experience to accurately assess potential risks or the level of trust needed to adopt crowdfunding. Unfamiliarity with financial tools often leads individuals to overlook perceived risks, prioritizing ease of use and technical support instead. In this context, accessibility and platform reliability may play a more decisive role in adoption. This suggests that, for music students, external factors which enhance platform accessibility and ease of use may have a greater impact on crowdfunding intentions than risk perception or trust.

Hypothesis H8 was not supported (β = 0.129, p = 0.259), indicating that entrepreneurial intention is not significantly associated with the intention to use crowdfunding. This finding contrasts with previous studies that have identified a positive relationship between these variables (Baber, 2022; Fanea-Ivanovici & Baber, 2021b). A possible explanation is that music students may lack sufficient financial literacy to perceive crowdfunding as a viable funding option, leading them to favor more traditional financial alternatives. Additionally, crowdfunding may be seen as a complex process requiring skills in marketing, promotion, platform management, and community building, which go beyond entrepreneurial motivation alone. These findings suggest that increasing financial literacy and exposure to crowdfunding mechanisms may be necessary to enhance crowdfunding adoption among music students. Furthermore, control variables such as age (β = -0.005, p = 0.948) and gender (β = 0.005, p = 0.999) are not significantly associated with CI. Given that the sample consists of music students with relatively homogeneous characteristics, variables such as gender or age appear to have no relevance in explaining crowdfunding adoption.

In addition to analyzing the direct effects, the study also examined whether entrepreneurial intentions mediate the relationships between personal attitude, subjective norms, and perceived behavioral control, and crowdfunding intentions. The analysis revealed that none of the indirect effects were statistically significant, indicating that entrepreneurial intentions do not act as a mediator in these relationships within our sample.

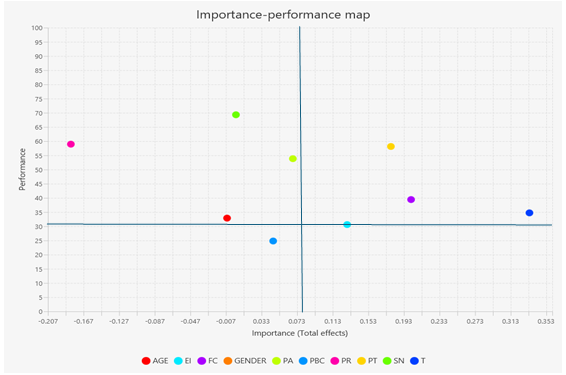

4.3. Importance-performance map analysis

This study employs a complementary technique called the Importance-Performance Map Analysis (IPMA), also known as priority map analysis or the importance-performance matrix (Ringle & Sarstedt, 2016), to further investigate the empirical outcomes. By utilizing average latent variable scores, IPMA helps identify the significance of key antecedent constructs while determining a specific target construct. Figure 2 illustrates the IPMA diagram, where the Y-axis represents the performance of antecedent constructs, and the X-axis denotes their importance in determining the target constructs. In this context, crowdfunding intentions is the target construct. The diagram is divided into four quadrants by two supplementary lines-one horizontal (performance) and one vertical (importance)-which represent the average values of both dimensions. This division allows us to evaluate values that are above and below the average. Though the quadrants are not initially labeled, the following labels are proposed:

First quadrant: values above the average in both the importance and performance dimension (upper-right quadrant). Second quadrant: values above the average in the importance dimension but which are currently below the average in the performance dimension (lower-right quadrant). Third quadrant: values below the average in both the importance dimension and the performance dimension (lower-left quadrant). Fourth quadrant: values above the average in the performance dimension and below the average in the importance dimension (upper-left quadrant).

As shown in Figure 2, the variables perceived trust, facilitating conditions, trialability and entrepreneurial intention are positioned in quadrant 1 (upper-right), indicating high importance and high performance. Being in quadrant 1 (high importance and high performance) suggests that these variables are particularly relevant to crowdfunding intentions and demonstrate strong perform in relation to the outcome. These variables should be prioritized to improve crowdfunding intentions. The variable entrepreneurial intention is bordering the line of the second quadrant, showing its high importance but lower performance compared to the other variables. No variables are located in quadrant 2 (high importance and low performance). This is a favorable outcome, indicating that all variables identified as important are also performing adequately.

In quadrant 3 (lower-left), which indicates low importance and low performance, we find perceived behavioral control. This suggests that while perceived behavioral control is not significantly related to crowdfunding intentions, its role in the overall model also appears to be limited. In quadrant 4, the variables age, perceived risk, social norms and personal attitude are positioned. These variables show high performance but lower importance relative to the others. This positioning indicates that these factors might not be as crucial for crowdfunding intentions in this study, although they still play a role in the overall model. Finally, it is observed that the control variable gender does not appear in the IPMA analysis. This may be due to the lack of significant association with the crowdfunding intentions variable. Its path coefficient is not significant, with a p-value well above the typical statistical significance threshold in the structural model.

Unlike previous studies (e.g., Kumar et al., 2024; Baber, 2022), this research applies IPMA to examine the specific role of entrepreneurship and crowdfunding among music students. These findings contribute to the literature on crowdfunding adoption in the music industry by emphasizing the importance of facilitating conditions, trialability, and entrepreneurial intention. The results highlight the potential relevance for crowdfunding platforms of providing trial opportunities and technical support to better attract musicians seeking alternative funding sources.

Concluding

5. Discussion and Conclusions

Musical entrepreneurship shows significant potential for further study in the academic field. The analysis of this sector is often complex due to the entrepreneurial characteristics and uncertainty of music industries (Rivetti & Migliaccio, 2017). At the same time, the cultural and creative industries, including the music sector, contribute not only to the economy but also to social cohesion (Ateca Amestoy et al., 2021). Aligned with the 2030 Agenda, culture is promoted as a key driver of innovation and social transformation (Government of Spain, 2019). Musical entrepreneurship supports these goals by driving new sustainability models in the sector, fostering creativity, and ensuring financial autonomy for artists. Our study advances empirical research on entrepreneurial intentions and crowdfunding among future musical entrepreneurs. By building on the existing research, it introduces a model that examines key factors associated with these intentions, informed by the TPB, UTAUT2, DOI, Trust, and Risk Theories.

This research expands the understanding of entrepreneurial and crowdfunding intentions among students in higher music conservatories, a group largely overlooked in the literature. Unlike most previous research on musical entrepreneurship, which is typically qualitative and based on small samples, this study employs a quantitative approach. This allows for an objective analysis and the generation of generalizable insights, identifying key factors related to musical entrepreneurship and its funding within the creative industries. Additionally, the findings highlight the relevance of fostering an entrepreneurial mindset and attitudes in music. They also emphasize how financial and technological infrastructure support the development of music businesses. This research not only enriches the existing literature on entrepreneurship and crowdfunding but also provides insights applicable to any cultural or artistic domain. Furthermore, it identifies key factors potentially associated with the development and funding of entrepreneurial initiatives, contributing to a more sustainable and innovative creative economy (Bayon et al., 2016; Lafuente et al., 2023).

The results showed significant relationships between personal attitude and perceived behavioral control factors on entrepreneurial intentions. Nonetheless, they did not demonstrate the same relationship with subjective norms, as suggested by Blanco-Mesa et al. (2024), Baber (2022) or Nguyen et al. (2019). Consistent with previous works (Kumar et al., 2024; Baber, 2022; Islam & Khan, 2021), a significant relationship between facilitating conditions and crowdfunding intentions (CI) is confirmed. Similarly, we suggest a positive association between trialability and CI, a finding in line with the study by Kumar et al. (2024). Facilitating conditions and the ability to test crowdfunding platforms may play a relevant role in the intention to use this alternative financing.

Our study cannot confirm a significant relationship between perceived risk (PR) and CI. Likewise, perceived trust (PT) does not appear to have a significant association with CI. These results are consistent with the research by Islam and Khan (2021) and Kumar et al. (2024). The relationship of PR and PT with CI may depend on prior experience with crowdfunding platforms. Moon and Hwang (2018) found that PR did not influence funders' willingness to use crowdfunding but had a significant impact on CI for those with prior experience. This suggests that PR and PT play a more complex role, affecting only experienced users rather than first-time users. This may apply to music students, who often have little entrepreneurial experience or familiarity with crowdfunding. Their limited knowledge of this alternative financial source could further shape their perceptions of risk and trust in crowdfunding platforms. Lastly, very few studies show a significant relationship between EI and CI (Fanea-Ivanovici & Baber 2021a, 2021b; Baber, 2022). In our study, we cannot verify that relationship. Although musicians may have a positive predisposition toward entrepreneurship, they may not necessarily seek financing through crowdfunding. Their lack of prior experience in these fields may shape their perception of trust and risk, ultimately influencing their crowdfunding intentions as future entrepreneurs.

This analysis contributes to the theoretical understanding of the factors associated with entrepreneurial intention and crowdfunding adoption in the music sector, offering valuable insights for its advancement. It builds on the Theory of Planned Behavior, the Unified Theory of Acceptance and Use of Technology 2, the Diffusion of Innovations model, as well as Trust and Risk theories. These theoretical frameworks provide a foundation for understanding the psychological, behavioral, and technological aspects related to entrepreneurial and crowdfunding intentions among musicians. By integrating these theories into a model, this study contributes to empirical research on musical entrepreneurship and alternative financing beyond traditional sources. The findings serve as a basis for future research on the various factors influencing musicians' crowdfunding decisions and can inform the development of key guidelines for improving funding strategies in the music sector.

The results have relevant implications for economic policies, educational institutions, and crowdfunding platforms. It is essential to develop strategies that facilitate musicians’ integration into entrepreneurial and financial ecosystems, expanding their opportunities for professional growth. Policymakers should guarantee access to Fintech infrastructure and promote the development of crowdfunding platforms tailored to the music industry. Funding policies should not only improve musicians' access to financial resources but also educate and encourage them to consider crowdfunding as a viable option within their academic training. Similarly, educational institutions should incorporate entrepreneurship and financial training into music education or, if not feasible, design specific programs for students and graduates. This training is crucial for developing the entrepreneurial mindset and skills necessary to create and manage musical projects or businesses. Additionally, providing financial literacy is essential so that musicians understand the various funding options available in the market, including crowdfunding.

For crowdfunding platforms, integrating the factors identified in this study may help enhance their processes and better support music entrepreneurs. Strengthening organizational and technological infrastructure is essential for improving user experience and fostering engagement (Lafuente et al., 2020). Additionally, initiatives such as promoting crowdfunding platforms among young musicians could encourage them to explore and experiment with these tools. This, in turn, may increase user engagement and participation. This will ultimately foster their future involvement as entrepreneurs and investors. Ensuring security and transparency is crucial, as it equips project creators with the necessary knowledge and control to mitigate risks when choosing alternative funding sources. These efforts will not only drive adoption but also contribute to the long-term sustainability and growth in the art industry.

This study has some limitations that should be considered when interpreting the results. It does not analyze how entrepreneurial and crowdfunding intentions evolve over time, which may affect the stability of the factors examined. To address this, a longitudinal study could be conducted to assess the relationships established in the research model at different points in time. Additionally, although the model is based on constructs validated in the literature, there may be hidden or unobserved variables, such as entrepreneurial education, financial literacy, or prior experience in entrepreneurship, that may influence the decisions of music students. The lack of previous empirical studies on this population in Spain also requires caution when generalizing the findings. The national education system primarily focuses on technical and artistic training, with less emphasis on entrepreneurial skills. Furthermore, different educational and cultural environments may shape perspectives on entrepreneurship and music financing. All these factors should be considered when assessing the applicability of our results.

For future research, it is recommended to incorporate new items and constructs that could influence the intention to pursue entrepreneurship and use crowdfunding. The lack of entrepreneurial and financial knowledge among music students underscores the need to analyze factors like entrepreneurial education and financial literacy. Future studies could examine the relationships between entrepreneurial competencies, financial knowledge, motivations, or prior entrepreneurial experience and musicians’ entrepreneurial intentions. These factors may play a key role in their ability to launch and sustain business ventures. Additionally, access to crowdfunding may positively impact young people's entrepreneurial intentions (Festa et al., 2023). Investigating the financial environment of music entrepreneurs could provide insights into financial sources, particularly alternative financing. Furthermore, integrating qualitative methodologies could offer a deeper understanding of the individual and contextual factors influencing musicians' entrepreneurship and crowdfunding decisions. A mixed-methods approach, integrating quantitative data with interviews or case studies, would provide a more comprehensive analysis. Finally, a promising research avenue is to examine musicians' entrepreneurial behavior across Spain or other countries to assess cultural differences.

References