Article

DOI:

https://doi.org/10.18845/te.v18i2.7134

Green Business Strategy and its effect on Financial Performance: The mediating role of Corporate Social Responsibility

Estrategia de Negocios Sustentable y su efecto sobre el Rendimiento Financiero: El rol mediador de la Responsabilidad Social Empresarial

TEC Empresarial, Vol. 18, n°. 2, (Mayo - Agosto, 2024), Pag. 1 - 17, ISSN: 1659-3359

How cite: Castillo-Esparza, M. M. G. C., Maldonado-Guzmán, G., & Mejía-Trejo, J. (2024). Green Business Strategy and its effect on Financial Performance: The mediating role of Corporate Social Responsibility. Tec Empresarial, 18(2), 1–17. https://doi.org/10.18845/te.v18i2.7134

AUTHORS

Ma. Mónica Gloria Clara Castillo-Esparza*

Centro de Ciencias Económicas y Administrativas, Universidad Autónoma de Aguascalientes, México.

mony.castillojm@hotmail.com.

![]()

Gonzalo Maldonado-Guzmán

Centro de Ciencias Económicas y Administrativas, Universidad Autónoma de Aguascalientes, México.

gonzalo.maldonado@edu.uaa.mx.

![]()

Juan Mejía-Trejo

Centro Universitario de Ciencias Económico Administrativas, Universidad de Guadalajara, México.

juanmejiatrejo@hotmail.com.

![]()

Corresponding Author: Ma. Mónica Gloria Clara Castillo- Esparza

ABSTRACT

Abstract

Organizations are increasingly integrating environmental concerns in their strategic plans. This research analyzes how green business strategy (GBS) and corporate social responsibility (CSR) impact financial performance (FP). In addition, we analyze the mediating role of CSR in the relationship between GBS and FP. The empirical application uses structural equation modeling on a sample of 300 manufacturing firms from Mexico. The results show positive and significant relationships between GBS, CSR and FP, while the significantly positive mediating role of CSR was also verified. Thus, the environmental objectives set by the GBS contribute to the FP of Mexican manufacturing firms. CSR also collaborates to this end but only partially by mediating the relationship between GBS and FP. The findings support the importance of incorporating environmental concerns in businesses' strategic planning in order to ensure not only economic but also social benefits through GBS and CSR activities.

Keywords: Green business strategy; financial performance; corporate social responsibility; manufacturing companies; environment.

Resumen

Las organizaciones están integrando cada vez más cuestiones ambientales en sus planes estratégicos. Así, esta investigación analiza cómo la estrategia de negocios sustentable (GBS, por sus siglas en inglés) y la responsabilidad social corporativa (CSR, por sus siglas en inglés) impactan en el rendimiento financiero (FP, por sus siglas en inglés). Además, se analiza el rol mediador de la CSR en la relación entre la GBS y el FP. El estudio empírico utiliza el modelado de ecuaciones estructurales en una muestra de 300 empresas manufactureras de México. Los resultados muestran relaciones positivas y significativas entre la GBS, la CSR y el FP, mientras que también se verificó el papel mediador significativamente positivo de la CSR. Por lo tanto, los objetivos ambientales establecidos por la GBS contribuyen al FP de las empresas manufactureras mexicanas. La CSR también colabora en este sentido, pero solo parcialmente al mediar la relación entre la GBS y el FP. Los hallazgos respaldan la importancia de incorporar cuestiones ambientales en la planeación estratégica de las empresas para garantizar no solo beneficios económicos, sino también sociales a través de las actividades de GBS y CSR.

Palabras clave: Estrategia de negocios sustentable; rendimiento financiero; responsabilidad social empresarial; empresas manufactureras; medio ambiente.

Introduction

1. Introduction

The new era of the 21st century is framed by great global challenges such as imbalances in ecosystems, global warming, the scourge of human rights, pandemics, economic crises, etc., (Banerjee, 2002; Elkington, 2006; Secretaría de Medio Ambiente y Recursos Naturales, 2016; International Energy Agency [IEA], 2021; ONU, 2021; World Business Council Sustainability Development [WBCSD], 2021). Which urge energetic actions by governments, companies and society for its mitigation (Global Reporting Initiative [GRI] et al., 2015; Olayeni et al., 2021), through sustainable actions and accurate strategies that contribute to this end (Saget et al., 2020). According to this, manufacturing sector help solve economic problems but at the same time trigger pollution issues from their activities (Malik et al., 2021). In addition to considering economic objectives, they must contemplate environmental and social issues for communities and stakeholders (Comisión de las Comunidades Europeas [CCE], 2001; Le, 2022).

On one side, the GBS incorporates environmental topics at the enterprise core and managerial levels (Banerjee, 2002; Olayeni et al., 2021). This also implies cost reduction and the incorporation of new clients, which allows to generate more profits and financing opportunities over their main competitors (Porter & Linde, 1995; Rădulescu et al., 2016; Ashton et al., 2017). While companies that strategically assume their social responsibilities transform the way they do business by implementing CSR actions (Acea, 2021). Together, GBS and CSR facilitate both environmental and social as well as economic objectives. Hence, it is important to know the actions implemented by the manufacturing industry. Bıçakcıoğlu et al. (2020) and Olayeni et al. (2021) show that GBS not only offers superiority over competitors, but also improves FP, despite that the link is not always positive (Lin et al., 2021; Tan et al., 2022). Also, CSR activities confer economic gains and promote companies among their stakeholders (Bokhari et al., 2023; Okafor et al., 2021). Although outcomes can be contradictory (Velte, 2022).

But on the other side, there is not enough evidence of what manufacturing companies are doing about GBS and CSR in developing countries (Le, 2022) and their benefits. That is how this research seeks to provide knowledge regarding the relationship between these variables in the Mexican manufacturing sector and their economic effects. Furthermore, this study proposes that the CSR plays a mediating role between GBS and FP, a scarce topic in the extant literature (Orazalin, 2020; Worokinasih & Zaini, 2020). At this point, it is worth asking whether strategic environmental activities in Mexican manufacturing companies allow economic and social benefits. To ascertain this, a thorough review of previous studies was carried out, and a structured questionnaire was developed and applied to 300 manufacturing industry managers. Subsequently, the data was analyzed using structural equations and the SMART-PLS program. The measurement and structural model, like the proposed hypothesis, were evaluated.

This study found positive relationships between GBS, CSR, and FP. A partial mediation of CSR actions is also verified. Therefore, companies committed to the natural environment as well as to society implement GBS. At the same time, they promote processes and products for such purposes (Banerjee, 2002; Olayeni et al., 2021). This has a favorable impact on CSR actions that consider environmental, social, and economic issues. Since CSR produces reliable products, take care of water and air, comply with legal regulations (Carroll & Brown, 2018; Malik et al., 2021). This way, GBS and CSR promote economic gains like increasing sales, profit margin, return on assets, cash flow, etc. The findings suggest that it is essential for companies glimpse the potential of assuming strategies aimed at reducing the negative effects on the natural environment through the mediation of social responsibility activities with results in favor of stakeholders and obtaining economic returns. This way, companies contribute to a more sustainable society (CCE, 2001) by being change agents in solving the great challenges that afflict humanity.

The document is initially composed of a literature review for each relationship between variables and their respective hypotheses, followed by the research model. It continues with methodology and shows the results, leading to discussion and implications. Finally, the study’s conclusions and limitations are collected.

2. Literature review and hypotheses

2.1 Green Business Strategy and Corporate Social Responsibility

The business role has changed so much, that it must deal with the pollution derived from its activities, in addition to providing social development (Ansoff, 1977). In this regard, the GBS defines guidelines aimed at reconciling the interests of manufacturing companies to reduce their negative impact on the environment. Such issues have been considered in the way of doing business for several decades, since the integration of aspects of a social or CSR nature within the objectives of companies is an integral part of the current management of the GBS. In addition to this, the growing interest of various manufacturing companies in their attempt to be sustainable, encourages them to take proactive actions and try to assume the costs derived from their environmental impacts, which allows them to obtain a good image with their stakeholders and foster their responsibility to society (Lyon & Maxwell, 2008; Aagaard, 2016).

In this sense, Carroll and Brown (2018) point out that currently the issues of care and protection of the environment, as well as social activities within companies receive special interest in practical terms, which are determined by those who advocate for a general benefit for the parties, offering both challenges and opportunities to change towards new markets. Hence, manufacturing companies in their attempt to protect the environment and reduce pollution, as well as implement recycling, have an impact on their CSR (Yang et al., 2019). Therefore, Jugón et al. (2019) reinforce the need to incorporate CSR activities into business strategies oriented towards sustainability, allowing adherence to the GBS to avoid and reduce pollution, a priority issue for stakeholders, while improving the image of the company CSR (Yang et al., 2019).

On the other hand, Banerjee (2002) states in his research that the relationship between environmental management and the social aspect in companies is not significant. It could be emphasized at this point that the focus and interest in social and environmental issues, along with the assumption of responsibility, are oriented to continue providing benefits to manufacturing companies and offer very few to stakeholders (Banerjee, 2008). Aagaard (2016) emphasizes that even though CSR has been incorporated by large transnational corporations, on many occasions, it only serves as a marketing strategy, to the detriment of sustainability, innovation, and development. Therefore, it is worth questioning whether it is convenient to add to the GBS, activities to promote and support CSR at a strategic level, since the relevance and certainty of the benefits could be ambiguous (Villasmil, 2016).

However, Le (2022) emphasizes in his study of Vietnamese manufacturing companies that when implementing GBS, it should be done in collaboration with CSR, since he found a significant positive link. Similarly, the longitudinal research by Yuan et al. (2020) on publicly traded American companies, concludes that business strategy positively affects CSR, mainly when managed with an avant-garde perspective toward new opportunities and market development. While Yang et al. (2019) state in their study on Chinese manufacturing companies that the environmental aspect is crucial before the economic one between the relationship of the GBS and the image of CSR. Thus, in this way and according to the information presented previously, it is possible to formulate the following hypothesis:

2.2 Green Business Strategy and Financial Performance

In the 1990's, some manufacturing companies began to consider the environment in their business strategies, to improve their level of competitiveness and obtain environmental benefits (Porter & Linde, 1995; Florida & Davison, 2001). In addition, Shrivastava and Hart (1995) observed that several industrial accidents to the detriment of the environment put the activities of the industry under the magnifying glass, which required great changes both in the creation of new business strategies and in the establishment of environmental regulations. Therefore, companies should consider the restrictions imposed by the natural environment, incorporating new capabilities (waste reduction, ecological products, and technological collaboration), in support of strategically outlined sustainable economic activities to obtain greater competitive advantage and cost reduction (Hart, 1995).

However, since economic benefit is the main objective in most manufacturing companies, actions in favor of the environment should also pay for it, as well as allow compliance with government measures and satisfy the different stakeholders. Notwithstanding, this relationship was not entirely clear at the beginning of the century. In fact, the importance of incorporating environmental issues at a strategic level lies both in the competitiveness of the company and in the effect, they have on financial performance (Ilinitch & Schaltegger, 1995). But Liu (2020) points out that environmental activities impact´s on FP are not always positive and homogeneous because of industrial sectors differences. Even, the relationship can be non-linear, being negative at the beginning and showing positive effects only with greater application of the GBS, becoming negative again in its maximum implementation (Lin et al., 2021).

There is evidence in the export sector of the economic benefits of setting environmental goals as part of the strategy (Bıçakcıoğlu et al., 2020). Nevertheless, King and Lenox (2001) addressed the relationship between GBS and FP in American manufacturing companies to find out if such actions were worthwhile, but their results were inconclusive since the variables showed correlation rather than causation. While Rădulescu et al. (2016) showed mixed results regarding sustainable businesses and their impact on FP. So, such a relationship could be considered complex and inconclusive, more empirical studies are needed (Tan et al., 2022). Since the global business environment influences the results of the voluntary implementation of environmental issues from the strategy due to aspects of certainty, complexity, and munificence (Aragon-Correa & Sharma, 2003).

On the other hand, Molina et al. (2009) established in their analysis of quantitative studies on the impact of environmental management on FP, that even though it is obtained in the long term, FP exists most of the time. Furthermore, Leonidou et al. (2013) found in their study based on the hotel sector, that the environmental marketing strategy positively influenced the competitive advantage as well as the FP of the company. In the same sense, Olayeni et al. (2021) posited in their research of multinational companies in Nigeria, that GBS has a significant long-term effect on both environmental and financial performance mediated by the application of TQM. Also, a study of more than 3,000 companies listed on the stock market in 58 countries and its analysis for 13 years, determined that internal green management influenced FP (Miroshnychenko et al., 2017). Therefore, the importance of the topic lies in knowing the effect that the GBS has on the FP for a developing country like Mexico and its manufacturing industry. As a result, the following hypothesis is proposed:

2.3 Corporate Social Responsibility and Financial Performance

Although it is true that the CSR is far from being a recent issue, as according to Banerjee (2008) , since 1800 the state regulated that the actions of corporations were in accordance with the public welfare. But such regulations fell into disuse at the end of the 1900, acquiring importance and expansion again in the 1960's (Carroll & Shabana, 2010). For this reason, CSR has been approached from different perspectives over time. Since it has become a source of strategic and competitive advantage, with a focus on stakeholders and linked to FP, unlike the initial orientation of charity and moral obligation (Chapagain & Phil, 2010). Therefore, knowing the concrete results when carrying out CSR activities becomes a priority issue for managers of manufacturing companies around the world, who seek solutions and effective ways to face the challenges presented to organizations today.

Likewise, the CCE (2001) in the Green Paper, grants CSR an active participation in the construction of a better society and a sustainable environment. In addition, the benefits derived from its practice are undeniable, such as the recruitment and retention of collaborators, productive exercise within the legal framework, access to more sources of financing, higher quality and productivity, improvement of the brand image, cost reduction, higher sales, and customer loyalty (Fayad et al., 2017; Malik et al., 2021). In consequence, the relevance of the adoption of CSR lies in its results, since companies tend to direct their expectations towards FP (Miras et al., 2014; Okafor et al., 2021; Velte, 2022). At this point, it should be noted that the relationship between CSR and FP has been the subject of uninterrupted research and carried out in developed countries (Carroll & Brown, 2018).

However, Carroll and Shabana (2010) establish that the renewed and vast perspective of the CSR focuses its voluntary action on ethical altruism. This leaves behind the point of view based on economic gain and legal duties, which belongs to a view outdated commitment of companies to society (Maqbool & Zameer, 2018). In addition, philanthropic activities are associated with CSR without economic benefits, while those of a strategic nature do provide profits (Lyon & Maxwell, 2008). Likewise, there is empirical evidence of mixed results and no effects between CSR and FP (Maqbool & Zameer, 2018; Velte, 2022; Wang & Sarkis, 2017). Similarly, McWilliams and Siegel (2000) found a neutral effect in their research between the CSR and the FP, where they state that the measurement models used in previous studies could have incurred errors by not considering the investments in R&D.

Instead, Okafor et al. (2021) found that CSR activities increase revenue, profitability, and company value within the technology sector. This is in line with Bokhari et al. (2023) , who show a positive relationship between CSR and FP in the manufacturing and service sectors, and they also include variables at the institutional level. Similar case occurs in studies carried out by Fayad et al. (2017) and Maqbool and Zameer (2018) . Also, Nahuat et al. (2021) reports a positive link between CSR and large Mexican companies' performance in Tamaulipas. Even though the greatest contributions of studies have been made in developed countries, leaving aside the particularity of other nations (Miras et al., 2014; Carroll & Brown, 2018; Abdullah, 2021). Where in addition to facing the challenge of managing environmental and social issues, without losing sight of the benefit economic for companies, they face a scarcity of resources, lax legal frameworks in practical terms and public policies with objectives different from those of the private sector, among others. Therefore, under this scenario, the following hypothesis is stated.

2.4 Corporate Social Responsibility as a moderating variable

Currently, the implementation of the GBS becomes relevant due to the growing focus on business activities and their impact on the environment, plus the regulations that seek to assume the costs of the productive exercise (Banerjee, 2008). This includes collaboration in global agendas in favor of and care for the planet, which causes greater pressure on manufacturing companies around the world, since their decisions and practices are under the gaze of both internal and external stakeholders (Malik et al., 2021). In addition to uncertainty in the results to be found, since they must also provide benefits to the communities where they settle, without losing sight of the profitability (FP) of the company (Miras et al., 2014). Therefore, assuming such responsibilities offers opportunities for change and allows an understanding of CSR´s role since it is vital to the success of such objectives.

Rangan et al. (2015) affirm that the effectiveness of CSR requires coordination and commitment from management, but not all companies have a real interest in integrating it at a strategic level, since its application ranges from a focus on philanthropy, environmental sustainability and / or obtaining economic benefits, thus the FP is not the main objective in all cases. Chapagain and Phil (2010) designate CSR as a facilitator of economic and sustainable achievement, which makes it possible to see it as a critical tool in contemporary business practice, beyond being just a duty to stakeholders. Consequently, by paying both governments and manufacturing companies to prioritize environmental, social, and economic issues, they allow the development of competitive companies and nations, capable of leading and solving the problems that afflict humanity (Ruiz-Acosta et al., 2020).

On the one hand, the study of the mediation role of CSR between GBS and FP in the literature is scarce. Orazalin (2020) raised the relationship between the sustainable committees of the board and the social and environmental performance in companies in the United Kingdom through CSR, which had a positive effect when applied effectively. Similarly, Worokinasih and Zaini (2020) in their quantitative study in mining companies, used the disclosure of CSR practices as a mediator between good corporate governance and the market value of the company. They discovered a significant and positive correlation between the market value and the disclosure of CSR practices but found no such relationship between good corporate governance, CSR, and company value. On the other hand, even though Abdullah (2021) addressed the relationship between sustainable orientation and performance in manufacturing companies, mediated by the environmental aspect of CSR, its mediation is still not clear and could be considered inconclusive.

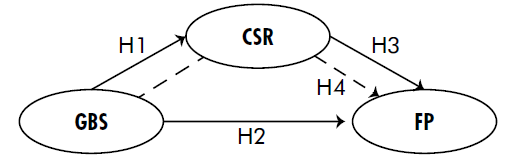

While Molina et al. (2009) determined in their literature analysis that it is necessary to incorporate variables that better explain the relationship between GBS and FP (Adams et al., 2012; Aragon-Correa & Sharma, 2003). Regarding this, the mediating role of CSR actions between environmental management and company performance was recently evaluated in small and medium-sized manufacturing companies, with significant positive results (Le, 2022). Therefore, it is up to researchers to make such assumptions and clarify the situation to know the influence and importance within the manufacturing sector. At this point, it is worth asking, what is the role that CSR plays in companies, does it really provide environmental and social benefits, as well as economic ones to the different interest groups when it is inserted into the GBS? Therefore, in this point and under the approach of the previous ideas, the following hypothesis is presented, also showing the theoretical research model (Figure 1).

Note: GBS=Green Business Strategy, CSR=Corporate Social Responsability and FP=Financial Performance

Figure 1: Theoretical research model

Methods

3. Methodology

3.1 Sample

Therefore, to respond to the hypotheses proposed in the research model (Figure 1), a cross-sectional empirical study was carried out in the manufacturing companies of Aguascalientes, Mexico to know the economic results from environmental and social activities. The business directory of the Mexican Business Information System (SIEM by its spanish initials) was consulted as a reference framework for the state of Aguascalientes in the year 2021. It had registered 1,427 manufacturing companies at the end of January. In addition, the survey to collect the information was designed to be answered directly by the managers and / or owners of the manufacturing companies, and it was applied through a personal interview to a sample of 300 companies selected through a simple random sampling, with a maximum error of ±5% and a reliability level of 95% and was applied during the months of April to September of the year 2021.

Therefore, this study seeks to know the environmental, social, and economic actions implemented by Small Medium Enterprises (SMEs). Since this allows them to align with current agendas at the local and international level (GRI et al., 2015). Most of the sample is made up of micro, small, and medium-sized companies (see table 1). In Mexico, the significance of SMEs lies in the fact that they represent 99.8% of all economic establishments. They provide employment to 68.4% of the total employed personnel. While they had an income of 52.2%, all this in the year 2018. Further, they contribute to the state's gross domestic product by almost 30% (Instituto Nacional de Estadística y Geografía [INEGI], 2020). In addition, the enterprises in the sample are made up of mature companies that have operated for more than 10 years, which is above 60%. Another important characteristic is that more than 70% are family capital, where they decide and take control of the company's strategic decisions (see table 1).

3.2 Variables

In accordance with the objectives of this research, scales from previous empirical studies in the literature were considered. Likewise, to measure the GBS, an adaptation was made to the scale proposed by Banerjee (2002) , who considered that it can be measured by items like “It has recently incorporated environmental activities into its strategic planning processes”.

Table 1: Sample characteristics

Regarding the CSR, it was measured through a scale of three dimensions: social responsibility (SR), which was measured by means of 6 items; environmental responsibility (ENR) measured through 6 items; economic responsibility (ECR) measured by means of 6 items, being adapted from the CCE (2001), Bigné et al. (2005) and (Herrera & Díaz, 2008). Finally, for the measurement of FP, an adaptation was made to the scale proposed by Leonidou et al. (2013) , who measured this construct through 7 items like “The economic benefits have increased”. All items on the three scales were measured using a 5-point Likert-type scale with 1=Strongly disagree to 5=Strongly agree as limits.

3.3 Analysis

The analysis of the research model was carried out through Partial Least Squares Structural Equation Modeling (PLS-SEM) using the SmartPLS software (Ringle et al., 2015), which has been applied in different areas and disciplines (Dijkstra & Henseler, 2015) since its inception in 1970 (Bagozzi & Yi, 1988). Since it analyzes connections that can become complex between dependent and independent variables, while it considers their measurement error and focuses on the variance of the dependent variables (Hair et al., 2021), it also provides estimates of the measurement and structural models (Martínez & Fierro, 2018). Likewise, in assessing the validity and reliability of the measurement model, the internal consistency of the model is evaluated through Cronbach's alpha, the composite reliability index, and the reliability of the rhoA (Hair et al., 2021), it is also evaluated convergent validity, average variance extracted, and discriminant validity (Fornell & Larcker, 1981).

Results

4. Results

4.1 Measurement model

First, convergent validity is indicated by loadings above 0.708, which are satisfactory since the construct explains more than half of the variance of each indicator (Hair et al., 2021). The proposed research model shows loadings ranging from 0.659 according with Bagozzi & Yi (1988) in the CSR to 0.927 in the GBS (Table 2). Meanwhile for internal consistency determined by Cronbach's Alpha, the analysis yields values from 0.817 to 0.935, complying with the optimal values (Hair et al., 2021), in addition to assuming those recommended for the composite reliability index and the rhoA (Bagozzi & Yi, 1988). The average variance extracted (AVE) shows values above 0.5, which are adequate (Fornell & Larcker, 1981) since the construct explains more than half of the variance of the indicators. The model´s prediction ability is asserted using the Blindfolding procedure in PLS of the cross-validated communality of Q2 (Table 2), with all values positive and above zero (Tenenhaus et al., 2005).

Regarding discriminant validity, Henseler et al. (2015) emphasize that it has been commonly evaluated by the Fornell and Larcker criterion and by cross-loads. However, they add an alternative and systematic criterion, such as the matrix or HTMT ratio, which is more precise.

The HTMT ratio accuracy differentiates one construct from another, with a value of 0.85 (conservative) or 0.90 (maximum). The confidence interval, containing the unit value, verifies no discriminant validity. The values for Fornell and Larcker criterion are satisfactory, along with optimal cross-loads, indicating that a construct shares less variance with others than with itself. Also, HTMT ratio values are less than 0.85 (see Table 3), demonstrating the reliability and validity of the model (Henseler et al., 2015; Hair et al., 2021).

Table 2: Assessment of the measurement model

Table 3: Discriminant Validity

Note: ENR: Environmental Responsibility; ECR: Economic Responsibility; GBS: Green Business Strategy; FP: Financial Performance; SR: Social Responsibility. A PANEL: Fornell and Larcker criterion: the diagonal elements are the square root of the shared variance between the constructs and their measures (AVE). For Discriminant Validity, these must be higher than those off the diagonal. B PANEL: Cross-loading of the indicators of all the constructs.

4.2 Structural model

On the other hand, when analyzing the structural model and evaluating the relationships between constructs, the determination coefficients (R²), the predictive relevance (Q²), the size and significance of the path coefficients and the f2 effects are considered (Martínez & Fierro, 2018). The results of the model regarding the adjusted R² and its predictive power in the sample for the endogenous variables of FP and CSR are 0.276 and 0.262 (Table 4). In addition, all the Q² values are positive and above zero (Table 1), and the variables´ VIF values are below 3 (Hair et al., 2021). To verify the fit of the model, the SRMR of 0.046 is within the recommended range (Hu & Bentler, 1998), as well as the unweighted discrepancy of the least squares (dULS) of 0.975 and the geodesic discrepancy (dG) of 0.371, values that are below the 95% HI (Dijkstra & Henseler, 2015), they show that the model´s fit is significant (Table 4).

Table 4: Structural Model

Note: GBS: Sustainable Business Strategy; CSR: Corporate Social Responsibility = (ENR: Environmental Responsibility; ECR: Economic Responsibility; SR: Social Responsibility); FP: Financial Performance. Two tailed, t-values and p-values in parentheses. Bootstrapping 95% confidence intervals (based on n=10,000 subsamples). Abbreviations: SRMR: standardized root square residual; dG, geodetic discrepancy; dULS, unweighted least squares discrepancy: based on Bootstrap 95% percentiles.

Continuing the analysis of path coefficients, the value of the GBS-CSR relationship is 0.515, with statistical significance since its p-value is 0.000, in addition to an f² of 0.370. This evidence allows us to approve the H1 hypothesis of the positive and significant influence that GBS exerts on CSR. Le (2022) shows that GBS works with CSR in Vietnamese enterprises. Also, Yang et al. (2019) verified that the application of environmental strategies has a positive impact on CSR´s image. On the other hand, the path coefficient of the GBS-FP relationship is 0.260, with a p-value of 0.000 and an f2 of 0.074, verifying hypothesis H2. Similar results were obtained by Molina et al. (2009) , Leonidou et al. (2013) , Miroshnychenko et al. (2017) and Olayeni et al. (2021) , who found economic benefits with environmental protection when actions were carried out strategically by companies.

Likewise, the path coefficient in the CSR-FP relationship was 0.342, with a positive sign, a p-value of 0.000, and an f2 value of 0.124. This finding supports the notion of the impact of CSR activities on FP. It supports the H3 hypothesis validating, echoing similar findings in the studies of Miras et al. (2014) , Maqbool and Zameer (2018) and Ruiz-Acosta et al. (2020) . To finalize the analysis of the structural model, the mediation role exerted by the CSR between the GBS and FP variables is evaluated using the bootstrapping technique (Zhao et al., 2010). Since the path coefficient obtained from the indirect effect is 0.176 with a p-value of 0.000, which results in a positive impact as a mediator variable. The H4 hypothesis of mediation of CSR activities between GBS and obtaining FP is accepted, results like those shown by Wang and Sarkis (2017) and Le (2022) . Therefore, the mediating role of CSR must be considered complementary and partial, since all the relationships proposed in the research model were significant, and their influence was not excluded (Hair et al., 2021).

Discussion

5. Discussion

The findings allow to verify the initial positive and significant influence of all the hypotheses raised. It is observed that SMEs enterprises in the manufacturing industry in Aguascalientes, Mexico, not only reduce their negative effect on the environment by adopting GBS activities but also provide economic gains. When companies execute strategic environmental actions through the GBS while simultaneously consider the needs of the community and a broader group of stakeholders through CSR activities, they manage to obtain FP. Therefore, the theoretical contribution of this research focuses on confirming economic gains for implementing GBS and CSR actions in the manufacturing sector in a developing country. In addition, the role that CSR plays between GBS and FP is analyzed as an essential part of this inquiry since it was verified that it exerts a partial mediation between both variables. Therefore, this research contributes to the body of knowledge of strategic management.

The results found for this study show a strong relationship between GBS and CSR like the findings found by Yang et al. (2019) and Le (2022) . Managers and policymakers need to focus on the efforts undertaken by manufacturing companies regarding pressing environmental issues, as it has verified that environmental actions implemented through strategy minimize the negative impact on the environment and have a significant incidence on CSR. CSR activities focused on environmental, social and economic dimensions help to anticipate fines, loss of good image, and irreversible harm to local ecosystems. This not only allows for a more significant impact on all stakeholders (Malik et al., 2021) but also emphasizes the importance of embracing risks associated with adopting CSR alongside GBS (Le, 2022) for the common well-being, rather than solely focusing on economic benefits.

On the one hand, the analyzes carried out show positive statistical significance for the relationship between the GBS and the FP in the Mexican manufacturing SMEs. But on the other hand, the total number of large, public, and private companies in the manufacturing sector at the national level for 2018, only 23.3% issued expenses to protect the environment and less than 30% complied with environmental regulations (INEGI, 2021). Environmental topics are considered by GBS to improve products and processes, same as it poses environmental goals from a key role to the entire enterprise. Additionally, Olayeni et al. (2021) and Miroshnychenko et al. (2017) found that companies caring for the environment adopted green practices allowed them to improve their FP. This research demonstrates with empirical results the significant influence of integrating environmental issues strategically to obtain monetary gains. Hence, that is a compelling reason not to hesitate to implement the GBS by micro, small, medium, or large company managers in the manufacturing sector and protect the natural environment.

The link between CSR and FP has not always been clear (Velte, 2022). But this study shows favorable empirical results like Bokhari et al. (2023) , Nahuat et al. (2021) and Okafor et al. (2021) . Companies that consider social, economic, and environmental issues in their objectives facilitate the economic benefits, which translate into volume increases in sales, marginal profits, cash flow, etc. These findings are of great interest to managers and government entities involved in the promotion and adoption of CSR. While it is true that companies have shown growing interest and implemented CSR´s activities (Nahuat et al., 2021), there is still much to be done in Mexico. Therefore, theoretical contribution of this research focuses on the mediating role of CSR activities between the actions launched from the GBS and obtaining FP. Although there is an indirect effect exerted by the CSR, a result like that found by Wang and Sarkis (2017) and Le (2022) . Such influence is only partial in nature since the direct relationships between each variable studied show a greater impact.

At this point, the Mexican manufacturing SMEs are dealing with urgent issues to solve. GBS and CSR allow them accomplishment with regulations, satisfy their stakeholders, while generating economic benefits for company survival. This study provides knowledge about interactions between GBS, CSR and FP. Emphasis is also placed on the significant relationship found for CSR in its mediating role. The promotion and adoption of these variables should be based on national strategies that allow manufacturing sector to align each company towards sustainability and well-being not only for the country, but for the entire planet. Nevertheless, there must be a strong legal framework that enable clear and forceful actions to achieve a climate of certainty and security national about sustainability. There is an opportunity in the country to take a more dynamic position regarding to the protection of natural environment and comply with international objectives. At the same time promote a strong strategic vision to contribute to sustainable development from the business management trenches (CCE, 2001).

Concluding

6. Conclusions and limitations of the research

Current trends reveal the focus on sustainability and the moderate use of the planet's natural resources (Angus & Westbrook, 2021), assigning companies a fundamental role. Since global energy consumption only for the industrial sector it is for 40% based on fossil fuels (IEA, 2021). Therefore, the results found in this study serve as a basis to guide managers and policymakers in attention to environmental (GBS), social (CSR) and economic (FP) issues, as priority lines of action, to mitigate unfavorable impacts on systems. Thus, by planning actions from the GBS that reduce negative impacts on the environment, whether from processes or products, the opportunity is given to limit not only environmental damage but also to reduce production costs in the long term (Porter & Linde, 1995).

This inquiry may guide the Mexican manufacturing sector toward cleaner production, social benefits, and economic gains in caring for the natural environment. The manufacturing family SMEs are taking control of their responsibilities to the environment and stakeholders. They are providing favorable results in environmental, social, and economic topics. Managers, executives, and government agents can contribute to the protection of the environment with forceful actions in the Mexican manufacturing sector. In addition, by setting environmental objectives from the company's strategy, they facilitate the inclusion of CSR and obtaining of economic benefits. This reduces the implicit risks of human activities, specifically of the manufacturing industry.

The variables of this research are essential to consider them within business agendas since the results obtained show economic benefits when applying GBS and CSR activities. They also allow company leaders to reduce the harmful effects on society derived from its activity (Ashton et al., 2017; Banerjee, 2008; Malik et al., 2021). Therefore, the efforts of both companies and governments should be directed towards the promotion and application of strategies that help to mitigate the negative effects of business activities (Bossle et al., 2016). Also complying with national and international standards that allow them to achieve such objectives in each one of the spheres of activity.

The influence of each of the relationships analyzed is highlighted and its impact is verified. Additionally, the research question is addressed, as it is observed that CSR mediates the relationship between strategic nature activities in support and care for the environment and the subsequent economic benefits derived from them. But only partially or moderately within the context of manufacturing companies of an emerging country like Mexico. Therefore, by emphasizing the need to make transformational changes from the business position and assume today's challenges, work is done in favor of not only specific sectors or more sustainable societies but a sustainable future in balance with a more just and inclusive world, where in addition to achieving these objectives, long-term business permanence is equally favored (WBCSD, 2021).

Finally, the study limitations are appreciated, since the data collection was carried out during the COVID-19 health crisis, which could have influenced the manufacturing companies’ performance and affected activities and actions to favor the CSR. Hence, it is recommended to carry out the study in more stable times, as well as analyzing the variables studied over a longer period, take caution about FP measures and consider more reliable ones. Where it is possible to observe if the current results remain the same or change significantly (Kraus et al., 2020). Likewise, the analysis carried out on the whole manufacturing, could not show whether certain subsectors benefit from the implementation of CSR. It is also suggested to carry out analyzes that consider the size of the companies, since this is a determining factor in the adoption of CSR (Orazalin, 2020) and of GBS (Darnall et al., 2010). Also, enterprise maturity or the majority control of family ownership could play a key role. It suggests studying the control variables that can affect relationships between GBS, CSR, and FP. Therefore, future research is necessary to clarify their impacts.

References