Article

DOI:

https://doi.org/10.18845/te.v18i1.7002

Influence of skills and knowledge on the financial attitude of university students

Influencia de las habilidades y conocimientos en la actitud financiera de estudiantes universitarios

TEC Empresarial, Vol. 18, n°. 21, (January - April, 2024), Pag. 65 - 83, ISSN: 1659-3359

How cite: Loza, R., Romaní, G., Castañeda, W., & Arias, G. (2023). Influence of skills and knowledge on the financial attitude of university students. Tec Empresarial, 18(1), 65-83. https://doi.org/10.18845/te.v18i1.7002

AUTHORS

Renzi Loza*

Facultad de Ciencias Empresariales, Universidad Privada de Tacna, Perú.

renloza@virtual.upt.pe.

![]()

Gianni Romaní

Centro de Emprendimiento y de la Pyme – CEMP, Facultad de Economía y Administración, Universidad Católica del Norte, Antofagasta, Chile. Centro

para el Desarrollo Integral de los Territorios – CEDIT, Chile.

gachocce@ucn.cl.

![]()

Winston Castañeda

Facultad de Ciencias Empresariales, Universidad Privada de Tacna, Perú.

wiacastaneda@virtual.upt.pe.

![]()

Gerardo Arias

Facultad de Ciencias Empresariales, Universidad Privada de Tacna, Perú.

gerariasv@virtual.upt.pe.

![]()

Corresponding Author: Renzi Loza

ABSTRACT

Abstract

The article analyzes the influence of knowledge and skills on the financial attitude of university students. Financial knowledge, skills, and attitudes are components of what is called financial literacy. The theory of human capital emphasizes the importance of investing in human capital to enhance individuals' decision-making. The empirical analysis uses a sample of 531 university students from Tacna, Peru. The results of the proposed structural equation model corroborate that financial knowledge and skills directly and positively influence university students' financial attitude. The findings offer important implications for students and higher education institutions by highlighting the importance of incorporating courses and workshops on personal finance to acquire knowledge and improve students' financial skills and, consequently, facilitate the development of a financial attitude that allows them to make more informed financial decisions.

Keywords: Knowledge, skills, financial attitude, university students, structural equation model.

Resumen

El objetivo de este artículo es analizar la influencia de los conocimientos y las habilidades en las actitud financiera de estudiantes universitarios. El conocimiento, habilidades y actitud financiera son componentes de lo que se denomina cultura financiera. La teoría del capital humano enfatiza la importancia de invertir en capital humano para mejorar la toma de decisiones de las personas. El análisis empírico utiliza una muestra de 531 estudiantes universitarios de Tacna, Perú. Los resultados del modelo de ecuaciones estructurales propuesto corroboran que los conocimientos y habilidades financieras influyen directa y positivamente en la actitud financiera de los estudiantes universitarios. Los hallazgos ofrecen importantes implicaciones para estudiantes e instituciones de educación superior al resaltar la importancia de incorporar cursos y talleres sobre finanzas personales para adquirir conocimientos y mejorar las habilidades financieras de los estudiantes y, en consecuencia, facilitar el desarrollo de una actitud financiera que les permita tomar decisiones financieras más informadas.

Palabras clave: Conocimientos, habilidades, actitud financiera, estudiantes universitarios, modelo de ecuaciones estructurales.

Introduction

1. Introduction

In daily life, most people frequently engage in money-related behaviors. Adequate financial knowledge, skills, attitudes, and behaviors-collectively referred to as financial literacy-are essential for managing daily expenses and transforming assets or debts. Thus, individuals lacking these competencies can easily encounter financial (Liu & Lin, 2021). These facts prompt both developed and emerging countries to focus their educational policies on transmitting knowledge in the financial field, with the aim of equip individuals with the necessary skills, attitudes, and behaviors that promote financial well-being (Mungaray et al., 2021).

The theory of human capital asserts that education and training improve people's ability to make decisions. Therefore, providing individuals with knowledge makes it possible for them to ensure their economic well-being (Salgado et al., 2023). Financial education, according to Avendaño et al. (2021) , can be interpreted as a process aimed at the development of knowledge, attitudes, abilities, skills, and behaviors that facilitate financial decision-making in people. Along the same lines, the OCDE (2020), defines financial education as the process by which financial investors and consumers improve their understanding of financial products, concepts, and risks and, through information, education, and/or advice, develop the skills and confidence needed to better understand financial risks and opportunities and make informed decisions.

It seems that financial literacy and financial education are equivalent concepts; however, they differ. Atkinson and Messy (2012) point out that financial literacy comprises the levels of financial knowledge, various financial behaviors exhibited, and attitudes towards long-term financial plans. Potrich et al. (2016) and Johan et al. (2021) emphasize that financial literacy encompasses the knowledge and attitudes reflected in the financial behavior of university students. Consistently, Molina-García et al. (2023) indicate that financial literacy is multidimensional in nature, comprising financial knowledge, attitude, and behavior, enabling individuals to take financial risks. All these definitions acknowledge the multidimensional nature of financial literacy, incorporating three elements: financial knowledge, financial attitude, and financial behavior. However, other authors, like Li et al. (2020) , expand the definition of financial literacy to include capabilities (skills) that can enhance investment returns for younger and better-educated households, while reducing returns for older and less-educated ones.

Despite all these definitions of financial literacy, there is no consensus regarding the possible interrelation of these dimensions. While some authors measure financial literacy as a single construct (Kadoya & Khan, 2020) , others view it as a second-order construct in which each dimension is distinguished. Atkinson and Messy (2012) state that financial knowledge and attitude precede financial behavior. This view is supported by studies from Potrich et al. (2016) and Molina-García et al. (2023) , who reached the same conclusion in university students. These results are consistent with the theory of planned behavior proposed by Ajzen (1991) , where he points out that the intention towards a specific behavior is determined by attitude, subjective norms, and perceived behavioral control. That is, Ajzen (1991) proposes that attitude is a determinant of intention and precedes behavior or action itself.

On the other hand, Gerrans (2021) points out that university students retain significant effects of objective and subjective financial education even three years after completing a personal finance unit, with only a modest decrease. The effects on behavior and behavioral intentions are less robust over time, as impulses reported immediately after termination dissipate within three years, although in absolute terms, positive behaviors remain high. Along the same lines, Moreno-García et al. (2017) indicate that university students with low levels of financial education are more trusting, risk-loving, and impatient; these traits are synonymous with the main causes of financial crises around the world. According to Mudzingiri et al. (2018) , understanding the financial attitude of university students requires knowledge of their preferences, financial knowledge, confidence, and personal characteristics.

Many university students acquire financial knowledge and skills in school (i.e., formal financial education) and through friends and family (e.g., family financial socialization). While the two channels have distinctive merits and limitations, little is known about how formal financial education and family financial socialization differ and interact when it comes to helping people acquire financial knowledge and skills (Jin & Chen, 2020).

Given this empirical evidence and considering the lack of consensus regarding the interrelation of the dimensions of financial literacy, this paper proposes to explore the relationship between financial knowledge and skills and financial attitudes. The focus is on university students in business sciences, as they are poised to be future participants in the local economy. It is essential that their university education fosters financial attitudes that will influence their financial behavior positively during their professional development. This article aims to answer the following research question: What is the influence of knowledge and skills on the financial attitudes of Business Sciences students at the licensed universities of Tacna?

For the research, students from the licensed universities of Tacna studying Business Sciences-including Commercial Engineering, Economics and Finance, Hospitality, and Accounting-were chosen. These students are engrossed in fields closely related to business, and Tacna’s economic landscape, closely tied to the region of Arica and Parinacota in Chile. This region generates millions of dollars in income for both cities, leading to economic interdependence. Hence, it is important to investigate whether the knowledge and skills acquired by these students in their respective courses influence their attitude towards financing. For this purpose, three questionnaires were developed: the first related to financial attitudes, the second to financial knowledge and the third to financial skills. The questionnaire was applied to 700 Business Sciences students from the last cycles of studies, of which 531 answered the applied instrument. To analyze the data, a multivariate correlational design was carried out, with a cross-sectional approach at an explanatory level, using the Structural Equation Model technique.

The study contributes to bridging the knowledge gap concerning the interrelationships between the dimensions of financial literacy, fostering a more profound understanding of how financial knowledge and skills relate to financial attitudes that precede specific behaviors. The findings yield practical implications that can motivate Business Studies students to acquire more knowledge and enhance their financial skills. This improvement in skills and knowledge will nurture more positive attitudes towards managing their finances, enabling them to make more assertive decisions. Consequently, they can enhance their quality of life by managing their economic resources more efficiently.

The article is structured into five sections. The second section presents the theoretical framework, including a review of the literature on the study variables. The third section details the methodology used (materials and methods). The fourth section presents the results, and the fifth section discusses them, concluding with the main conclusions, implications and future research directions.

2. Literature review

2.1. Financial knowledge and financial attitudes

For people to participate in today's economy, they must have financial knowledge, especially young people, as they face financial decisions that have significant consequences for their lives.

Financial knowledge has been related to financial decisions and better economic outcomes in people who have higher levels of economic and financial discernment (Cude et al., 2020). Therefore, financial knowledge is prior to behavior (decision).

Potrich et al. (2016) point out that the acquisition of financial knowledge allows one to have attitudes and achieve mastery of skills in personal finance, which reflects the level of financial literacy of people, while Mejía, (2016) defines attitude as the preparation for a particular type of action; in other words, the attitude precedes the behavior (action).

Attitudes toward behavior are among the most important factors influencing financial management, classified as the importance of money, perceived financial success, financial management strategies, and gender role attitudes toward financial management (Utkarsh et al., 2020).

For Castro-Gonzáles et al. (2020) , attitude towards money mainly refers to an individual's careful (or not careful) handling of money. Assessing attitude involves getting closer to people's financial intention while revealing their preferences and priorities regarding the function of money and its value over time. Intention could be a determinant of your attitudes regarding the management of your finances (García et al., 2021).

On the other hand, Atkinson and Messy (2012) , based on empirical evidence, proposed concepts about financial knowledge in which they indicated that they were related to the level of cognition achieved as a result of the discernment of theories or concepts related to finances. Likewise, they indicated that financial attitudes are given by those negative or positive intentions towards the management of finances, which in turn is reflected in their behavior, making this an essential element of financial literacy. The positive outcomes of being financially literate are driven by behaviors such as spending planning and creating financial security; the opposite would indicate behaviors, such as excessive use of credit, which would reduce people's financial well-being.

According Villada et al. (2017) , financial knowledge has become an essential skill due to the instability of global markets, asymmetric information in those markets, the increasing complexity of financial products, and the rapid growth of financial technology. Saldarriaga (2018) has identified the importance of acquiring financial knowledge and developing financial attitudes to manage risks, take advantage of financial activities, and align financial decisions with long-term personal or family goals. In the same line Philippas and Avdoulas (2020) , pointed out that male college students who keep expense records or whose fathers have a higher education have better financial knowledge and are therefore, better able to cope with an unexpected financial shock. Therefore, financial literacy may be a key driver of financial well-being among college students.

In Greece, Riitsalu and Murakas (2019) found that people's financial well-being is affected by subjective and objective financial knowledge, behavior in managing personal finances, and socioeconomic status. Financial knowledge is the main element of financial education, which is essential for the sustainable development of people and society; and requires significant scientific research demonstrating its influence on people and the economy, including non-monetary payments (Swiecka et al., 2021). The proper use of personal finances is facilitated by having sufficient knowledge about the necessary tools to develop finances in a balanced way, avoiding losses and, ultimately, reducing debt (Guzmán, 2022).

A person who possesses only financial knowledge may not exhibit behaviors expected of financial well-being (Huston, 2010). People can be financially literate when they know how to take care of their finances. However, they cannot be called financially capable unless it is reflected in their actual behavior (Goyal & Kumar, 2021).

In this sense, Mena (2022) states that most young people have a medium level of financial literacy, derived from a low level of financial knowledge, a high level of financial attitudes, and a medium level of financial behavior. Evidence shows that financial education programs have, on average, positive causal treatment effects on financial knowledge and subsequent financial behaviors (Kaiser et al., 2022).

According to Korkmaz et al. (2021) , financial knowledge determined by the understanding of concepts positively influences the ability to take financial risks. Consequently, financial literacy increases inconsistency for the risk-averse and decreases it for the risk-seekers by increasing risk-taking behavior.

As Yaringaño (2021) points out, in the Peruvian academic environment in which business students operate, particularly those who belong to the last cycles of study, a broader knowledge of financial aspects is promoted since their plans of study have courses such as finance, banking risk, stock market, investments, etc., which determines a more successful integration to the use of increasingly complex or sophisticated financial services for students who belong to the business field, as well as Very useful for students of other careers.

Considering the above, the following hypothesis is proposed:

2.2. Financial skills and attitudes

Financial skill is related to a person's ability to explore and use financial information to manage decisions and actions. It is the articulation between financial knowledge and the development of tasks on financial information, a scenario from which problems are responded to, situations are analyzed, and decisions are made. Financial skills are varied: data analysis, goal setting, strategy definition, problem-solving, planning, and control, among others (Avendaño et al., 2021).

Financial management skills are associated with general money management, such as having a bank account, managing bill payments, managing credit, and budgeting (Sahul & Jia, 2021).

As pointed out by Mancebón and Ximénez (2020) , financial skills have a positive influence on the promotion of healthy financial practices, understood as those behaviors of individuals that can favor their ability to face adverse financial situations throughout their life cycle.

In a study, Dare et al. (2020) point out that, in the Netherlands, different specific characteristics of the students showed that the financial education program increased students' knowledge and skill scores in carrying out transactions effectively but not in spending responsibly. Financial education programs allow students to immediately apply what they learn in practice; they can improve students' knowledge and skills regarding certain financial competencies.

Likewise, León et al. (2021) indicate that developing financial skills helps improve the quality of individual life, for this reason, students estimate that having clear goals, having a high level of self-confidence, and being constant are the main reasons that prompted them to make better decisions in the field of finances. In the same line, Paredes et al. (2018) point out that the development of skills and abilities to manage money based on knowledge of financial products, correct financial planning, and the practice of savings allows making correct decisions about personal or professional finances in meeting the objectives to be achieved in the short, medium, and long term.

On the other hand, Yepes et al. (2019) state that although students know the importance of savings and have the financial knowledge to manage their expenses and income, they do not have the skills to plan their expenses, as they fall into daily improvisation and the consumption of unnecessary things, losing control their expenses, leading them to have higher levels of debt. Therefore, the management of the personal finances of university students depends on the lack of management and control of their savings, since to the extent that they do not save and spend more than their income, it affects the control and management of their income, which in many cases they are lower than expenses.

The creation of financial education programs specifically designed to improve financial education is the first step so that people, especially young people, can correctly use financial products and services that allow them to better achieve their economic well-being (Ramos, 2018).

Having financial skills also allows for better control of expenses and debt in university students; as pointed out by Valenzuela et al. (2022) , access to financial services and products increasingly in young populations does not seem to coincide with the improvement of financial skills generating new potential vulnerabilities. This mismatch can have important implications, for example, in terms of responsible credit management, adequacy of long-term savings and retirement, and the social, economic, and financial inclusion of future generations.

These findings are corroborated by Rey-Ares et al. (2022) , who indicate that Spanish students who have short-term planning skills show a more prudent attitude towards risks and make better financial decisions that allow them a better quality of life.

Given the evidence previously presented, the following hypothesis is raised:

H 2: Financial skills directly and significantly influence the financial attitude of Business Sciences students at licensed universities in Tacna.

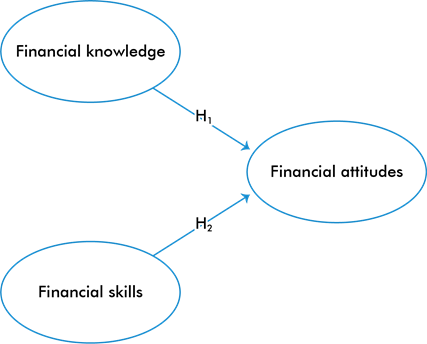

The literature review leads to the following conceptual model where financial knowledge and financial skills directly and significantly affect financial attitudes (Figure 1).

Methods

3. Materials and methods

3.1. Design and type of research

The research design corresponds to an empirical investigation with an associative and explanatory strategy with latent variables. In this design, the structural equation model will facilitate the simultaneous examination of a series of dependency relationships between the study variables (Ruíz et al., 2010).

The type of research corresponds to an ex post facto type, in which data is collected and explanatory hypotheses are proposed between variables in which only the independent variable is observed, not subjecting it to any manipulation (Rigo & Donolo, 2020).

3.2. Sample

Data collection was carried out in 2022 (the second year of the COVID-19 pandemic). Given the social isolation measures imposed by the Peruvian government to prevent the risk of contagion, three questionnaires were designed: two based on Avendaño et al. (2021) to measure financial knowledge and financial skills and another based on García et al. (2021) to measure financial attitudes. The questionnaires were adapted to the Peruvian reality and validated by one of the authors (see questionnaires and validation in Appendixes 1, 2, 3, and 4). Subsequently, they were sent online to students of Business from licensed universities in Tacna, Peru, in the last years of their studies, belonging to the professional careers of Accounting, Commercial engineering, Administration, International Business, Tourism and Hospitality, and Economics and Microfinance. In total, 700 students were reached.

In the first section of each questionnaire, an informed consent form was presented, along with the objectives of the study and a declaration of voluntary and anonymous participation, following the ethical principles of human research described in the Declaration of Helsinki.

The study sample was made up of students who answered all the questions in the questionnaires, a total of 531 university students belonging to the professional careers of: Accounting (44.3%); Commercial Engineering (20.4%); Administration (17.6%); International business (11.0%); Tourism and Hospitality (6.3%); and Economy and Microfinance (0.5%).

Of the total sample (531), 58.8% were women and 41.2% were men, aged between 18 and 25 years (84.3%); 26 to 30 years old (11.0%); 31 to 35 years (3.5%); and, 36-40 years (1.2%). 94.4% of the sample are single students, only 2.3% declared they were married, 1.6% have a partner. 54.8% are only studying, 26.2% are dependent workers, and 19. 0% declare themselves as independent workers.

3.3. Instrument and measurement of variables

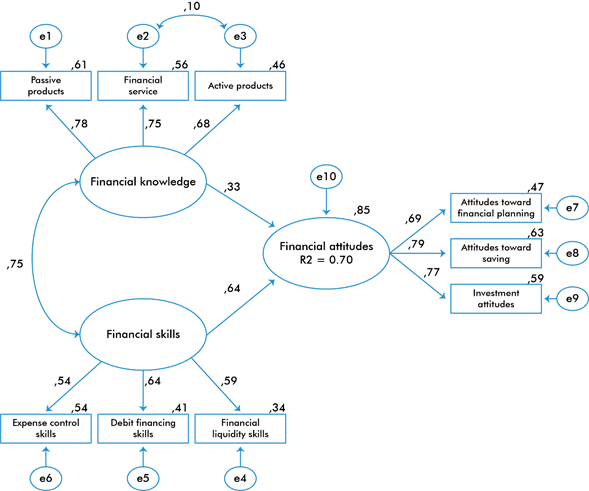

The proposed conceptual model consists of 3 variables, two exogenous and one endogenous. The exogenous variables are made up of financial knowledge and skills that explain the endogenous variable: financial attitudes.

The construct of the exogenous variable financial knowledge consists of three dimensions (latent variables): passive financial products (items 1, 2, and 3), financial services (items 4, 5, 6, and 7); and active products (items 8, 9 and 10) of the Financial Knowledge Scale, with a Likert-type scale (see Table 1 and Appendix 1).

The construct of the exogenous variable financial skills is composed of the dimensions (latent variables): skills towards expense control (items 1, 2, and 3); skills towards debt financing (items 4, 5, 6, and 7); and, skills towards financial liquidity (which contain questions 8, 9 and 10), from the Financial Skills Scale, with a Likert-type scale (see Table 1 and Appendix 2).

The construct of the endogenous variable financial attitudes is made up of the dimensions (latent variables): attitudes towards financial planning (items 1, 2, and 3); attitudes towards savings (items 4, 5, 6, and 7); and attitudes towards investment (items 8, 9 and 10) of the Financial Attitudes Scale, with a Likert-type scale (see Table 1 and Appendix 3).

Table 1: Measurement of variables.

[i] Note.- Adapted from Avendaño et al. (2021) and García et al (2021)

3.4. Analysis procedure

Data analysis was carried out with the SPSS v. 26 statistical program and IBM SPSS AMOSS v.24. The analysis of the reliability and validity of the construct of the variables began, also evaluating the collinearity of the variables. Likewise, the correlation of the variables and their dimensions was measured through the Pearson Coefficient.

In the final part, the model is projected taking into account the endogenous and exogenous variables, the latent variables, the observable variables, the error variables, and grouping variables, which will be determined taking into account the revised theory. Likewise, to prepare the structural equation model, the following fit indices were taken into account: CMIN/DF, which must meet the condition of <3.00 to be acceptable; the squared error rate (RMR) must meet the condition of close to (Escobedo et al., 2016) ); the error of approximation (RMSEA), whose condition must be <=0.05 (Rappaport et al., 2020) ; the normed fit index (NFI) must meet the condition of =>0.90 (Hong & Jacobucci, 2019) ; the CFI, whose acceptable range is =>0.90 (Rueda and Zapata, 2018). And, the parsimony adjustment measures (PRATIO, PNFI, PCFI) that must meet the condition of being greater than 0.5 (Medrano & Muñoz-Navarro, 2017). Likewise, SPSS AMOS 26 was used for the diagramming and calculations of indices, the results of which are detailed below.

Results

4. Results

4.1. Assessment of the Reliability of the Construct of Variables

Table 2 provides a meticulous evaluation of the construct reliability of the variables and their respective dimensions, utilizing Cronbach's Alpha coefficient as a measure. A critical observation to underscore is that all coefficients surpass the foundational threshold of 0.7, indicating strong reliability. Specifically, the financial knowledge and financial skills constructs achieved high coefficients of 0.89 each, while the financial attitude construct had a coefficient of 0.88. Additionally, the Average Variance Extracted (AVE) was used to analyze the constructs' variables further, yielding coefficients that surpass the minimum criterion of > 0.5.

Table 2: Reliability and validity evaluation

Table 3 displays the collinearity values of the variables and their dimensions. The variance inflation factor (VIF) values obtained have an average of 1.65, which falls between the range of 1 and 5. This indicates that the predictor variables are moderately correlated.

Table 3: Collinearity test: variance inflation factor (VIF)

4.2. Correlation of variables

The objective of the research was to determine the influence of knowledge and skills on the financial attitudes of Business university students enrolled in licensed universities in Tacna. To achieve this objective, the Pearson Correlation statistical test was employed to identify correlations between the exogenous variables (knowledge and skills) and the endogenous variable (financial attitudes). It can be highlighted that the variables with the highest level of correlation were: financial skills (FSK), with a correlation coefficient of 0.70, followed by passive products (PP) 0.85, and financial services (FS) 0.81. In contrast, the variables that demonstrated lower levels of correlation included expense control (CC) with a coefficient of 0.547, debt financing (DF) 0.40, and financial liquidity (FL) 0.329. Detailed results are comprehensively presented in Table 4.

Table 4: Correlation of variables

4.3. Model Estimation

The proposed model considers financial attitude as an endogenous variable that is influenced by financial knowledge and financial skills. After estimating the model, satisfactory indices were observed, which fall within acceptable ranges of goodness of fit measures. These measures are detailed as follows: the CMIN/DF = 2.31 which satisfies the condition of being less than 3.00; the squared error rate (RMR) is 0.69 which meets the condition of being close to 0; the error of approximation (RMSEA) is 0.050 which meets the condition of being less than or equal to 0.05; the normed fit index (NFI) is 0.97 which is an acceptable range meeting the condition of being greater than or equal to 0.90; the CFI is 0.98 which is an acceptable range meeting the condition of being greater than or equal to 0.90. Moreover, the parsimony ratios are as follows: PRATIO (0.73), PNFI (0.72), and PCFI (0.72), which meet the condition of 0.5. Therefore, the proposed integrated explanatory model based on structural equations exhibits a high goodness of fit with the empirical data. It effectively explains the financial attitudes of Business university students through financial knowledge and skills.

It is also important to highlight that the model achieved an R-squared coefficient of 0.70, indicating that the financial knowledge and skills of university business students predict 70% of financial attitudes. Therefore, the model shows a high level of adjustment in the proposed theoretical model.

The results presented in Figure 2 indicate that financial knowledge has a direct and significant impact on financial attitude (p-value < 0.001). Specifically, it was found that 33% of financial attitudes among university business students from licensed universities in Tacna are determined by their financial knowledge, thus supporting Hypothesis H1.

Similarly, the study found that financial skills also have a direct and significant influence on financial attitude among university students of Business careers, with a p-value < 0.001. In fact, 64% of financial attitudes among university students of Business from licensed universities in Tacna were found to be determined by their financial skills, thus supporting Hypothesis H2 (See Figure 2).

Concluding

5. Discussion

The objective of this study was to determine the influence of financial knowledge and skills on the financial attitudes of Business students from licensed universities in Tacna. The linear model elucidated that financial knowledge and skills have a significant effect on financial attitudes, which supports the hypotheses proposed. According to these results, having financial knowledge and skills comes before having a financial attitude and, therefore, financial behavior (decision). This conclusion is in line with the findings of Potrich et al. (2016) , Johan et al. (2021) , Atkinson and Messy (2012) , and Molina-García et al. (2023) , who also found that attitude and knowledge precede behavior. However, the current study shows explicitly that financial knowledge and skills are the precursors to financial attitudes, which then lead to financial behavior. This finding shows that knowledge and attitude are not variables at the same level but that knowledge is prior to attitude; the greater the financial knowledge, the greater the attitude toward financing. The same holds true for skills. These findings help us understand the complex relationship between the different aspects of financial literacy and support the multidimensional definition of financial literacy.

Hypothesis H1: Financial knowledge has a direct and significant influence on the financial attitude of Business students at licensed universities in Tacna was accepted. This was determined by achieving a causal index of 33%, which showed that knowledge about passive products, financial services, and active products explains the financial attitude of these students. These results are consistent with Arias (2020) findings, which stated that financial literacy, specifically knowledge about financial products, has a significant impact on access to the financial system, influencing access to the financial system by 70%. This is consistent with Limache (2018) study, which found that only 47.8% of university students at Marcelino Champagnat University in Lima have basic financial knowledge. However, students from management-related fields had a significantly higher average. Therefore, it is necessary to introduce financial education programs to increase financial knowledge in the field of finance (Kaiser et al., 2022).

The present study provides both theoretical and empirical evidence supporting the hypothesis H2 which states that financial skills have a direct and significant impact on the financial attitude of university students studying Business Sciences at licensed universities in Tacna. The study found that financial skills related to expense control, debt financing, and financial liquidity explain the financial attitude of Business Sciences students from these universities. The study found a causal coefficient of 64%. These findings are consistent with those of Avendaño et al. (2021) , who pointed out that undergraduate students from a public higher educational institution in the city of Ocaña (Colombia) have a keen interest in learning and researching financial topics. However, they also showed some limitations in understanding certain topics and specific skills in finance. Similarly, León et al. (2021) found that the financial skills of students at the National Autonomous University of Honduras have a positive influence on their ability to access financial services. The study found that a greater number of students with financial skills possess both a credit card and a checking account in a financial institution, which enables them to have a better understanding of financial products and services.

Based on the above, it can be concluded that the financial attitudes of university students in Business at licensed universities in Tacna are directly and significantly influenced by their knowledge and skills. Furthermore, a high index of goodness of fit was found between the empirical data and the structural equation model proposed, which explains financial attitudes based on the financial knowledge and skills of university students in Business careers.

6. Conclusions, implications and future lines of research

This study has provided us with a deeper understanding of how financial skills and knowledge influence the financial attitudes of Business students at licensed universities in Tacna. The results confirm a direct and significant relationship between the study variables. Additionally, the study shows that knowledge and skills come before attitude, which, in turn, precedes people's financial behavior. This is a significant contribution to this field of research.

The findings of this study have significant practical implications for higher education institutions. It highlights the need for personal finance courses and workshops to educate university students and help them develop a favorable financial attitude, make informed decisions, and improve their financial behavior. This will contribute to their personal and professional development and enhance their performance. Financial education courses and workshops should be incorporated into the curricula of all university careers, not limited to economics and business majors only. They should also be included in technical and higher education institutes. As an example, the University of Quindío (Colombia) created an elective financial education course for all faculties and proposed the creation of a web portal called Edufiquindio when they realized that students lacked the ability to save and had excessive debt (Carvajal et al., 2016). Similarly, Ergün (2018) suggests that university education programs should offer more courses on financial literacy to help students manage their finances better and achieve greater financial well-being.

In the same vein, students, regardless of gender, have the opportunity to enhance their financial literacy by taking advantage of the financial training programs provided by their educational institutions. Through these programs, students can improve their financial knowledge and skills, which can help them make better decisions and develop a positive financial attitude. Moreover, it is essential to transfer this knowledge to your family, friends, and acquaintances to spread awareness about financial literacy and its importance.

The study's limitations include examining only Business careers students who have taken financial literacy-related courses. Future research should include the entire university population, including those who have and have not taken financial literacy courses, to identify any significant differences in their financial attitudes. Further studies could also explore gender as a moderating variable to determine whether women's knowledge and skills affect their financial attitude. Moreover, the effect of financial knowledge and skills of Business careers students could be compared with other universities.

Another limitation is related to its population, which consists only of university students from the business carrers of Commercial Engineering, Economics and Finance, Tourism and Hospitality, and Accounting from licensed universities in Tacna. However, it can be broadened to include universities in the Southern Peru region, such as Arequipa, Moquegua, Cusco, Madre de Dios, and Apurimac. Additionally, the relevance of its application could be extended to a national and even international level.

Finally, another limitation of the study is that it only considered a specific period of time. It would be more informative to evaluate the trend in students' behavior after taking courses related to financial knowledge over a more extended period. This would help to determine whether students showed improvements or setbacks in their financial attitude and skills over time.

References