Article

DOI:

https://doi.org/10.18845/te.v18i1.6950

The internationalization of Colombian Multilatinas: a composite indicator analysis

La internacionalización de las Multilatinas colombianas: un análisis de indicadores compuestos

TEC Empresarial, Vol. 18, n°. 21, (January - April, 2024), Pag. 43 - 64, ISSN: 1659-3359

How cite: López-Caicedo, J. C., Baena-Rojas, J. J., Gomez-Trujillo, A. M., & Bonilla-Calle, D. (2023). The internationalization of Colombian Multilatinas: a composite indicator analysis. Tec Empresarial, 18(1), 43-64. https://doi.org/10.18845/te.v18i1.6950

AUTHORS

Juan Camilo López-Caicedo

Business School. Fundación Universitaria CEIPA, Medellín, Colombia.

juan_lopezca@ceipa.edu.co.

![]()

Jose Jaime Baena-Rojas*

Business School. Fundación Universitaria CEIPA, Medellín, Colombia.

jose.baena@ceipa.edu.co.

![]()

Ana Maria Gomez-Trujillo

Business School. Fundación Universitaria CEIPA, Medellín, Colombia.

ana.gomez@ceipa.edu.co.

![]()

Daniel Bonilla-Calle

Business School. Fundación Universitaria CEIPA, Medellín, Colombia.

daniel.bonilla@ceipa.edu.co.

![]()

Corresponding Author: Jose Jaime Baena-Rojas

ABSTRACT

Abstract

This study employs a composite indicator to measure the degree of internationalization of Colombian Multilatinas. By using primary data available from the analyzed companies' website, the Colombian Multilatinas composite indicator (CMCI) is proposed, which includes six variables related to the Multilatinas’ patterns of internationalization that capture the essence of their productive participation abroad. The findings have managerial and academic implications as the analytical tool used to quantify the competitiveness and the degree of internationalization of Colombian Multilatinas offers important guidelines to improve aspects related to multilatinas' economic capacity, sustainability, technology, and human capital.

Keywords: Multilatinas, internationalization, Colombia, competitiveness.

Resumen

Este estudio emplea un indicador compuesto para medir el grado de internacionalización de las multilatinas colombianas. Utilizando datos primarios disponibles en los sitios web de las empresas analizadas, se propone el indicador compuesto de las Multilatinas colombianas (ICMC), que incluye seis variables relacionadas con los patrones de internacionalización de las Multilatinas que capturan la esencia de su participación productiva en el exterior. Los hallazgos tienen implicaciones gerenciales y académicas ya que la herramienta analítica utilizada para cuantificar la competitividad y el grado de internacionalización de las multilatinas colombianas ofrece pautas importantes para mejorar aspectos relacionados con la capacidad económica, la sostenibilidad, la tecnología y el capital humano de las multilatinas.

Palabras clave: Multilatinas, internacionalización, Colombia, competitividad.

Introduction

1. Introduction

Multilatinas are becoming global leaders in various industries: food and beverage (e.g., Bimbo), meat processing (e.g., JBS) and manufacturing of steel tubes (e.g., Tenaris). Research on the topic remains limited and it mostly focuses on multinational enterprises (MNEs) and emerging economies’ multinational enterprises (EMNEs) from Asia. Nevertheless, academic awareness of Multilatinas has increased recently (Cuervo-Cazurra, 2016a; Aguilera et al., 2017).

Multilatinas initial strategies for internationalization are commonly not the same as those of other MNEs; moreover, they usually do not possess similar size, goals, structure, scope, and experience. Thus, they must be examined aside and different methods to analyze their processes are essential. In the case of Colombian companies, with 80%, the preferred entry methods in international markets are exports (Gonzalez-Perez & Velez-Ocampo, 2014), while other MNEs are more inclined to tactic knowledge acquisitions and direct exposure which makes them to select entry modes like partial ownership. The above-mentioned can be engendered because Multilatinas generally present a lack of knowledge and experience to internationalize while other MNEs represent the opposite (Nelaeva & Nilssen, 2022).

There is a direct and strong correlation between internationalization and performance of EMNEs (Bıçakcıoğlu-Peynirci & Morgan, 2021), nevertheless, while EMNEs tend to obtain their profit from internationalization through monopoly-based activities and fail in establishing competitive advantages based on knowledge, MNEs are inclined to represent the opposite (Buckley & Tian, 2017).

To measure a firm’s degree of internationalization several indicators have been created and numerous variables are considered, one of the most commonly used indicators was proposed by the UNCTAD (2020) and is composed of “three ratios: foreign assets to total assets, foreign sales to total sales and foreign employment to total employment” (Trentini, 2021). However, as it was established by Gonzalez-Perez and Velez-Ocampo (2014) 80% of the Colombian firms start their internationalization process through exports, consequently, aspects such as foreign assets are not generally expected, therefore, the indicator just as others that do not consider the specific case of Multilatinas, could present unexpected variations that change the measure of internationalization.

The foregoing illustrates the differences between multinational enterprises (MNEs) and emerging economy multinational enterprises (EMNEs), highlighting the limitations of existing indicators in measuring the internationalization of Colombian Multilatinas. These differences are essential in defining a unique identity for these firms, emphasizing the significance of developing new indicators and approaches to accurately assess their internationalization.

For the purposes of this study, two key properties of composite indicators are worth highlighting. Firstly, composite indicators enable the proper ranking and consolidation of numerous variables within a single value. This consolidation facilitates a more comprehensive analysis of Multilatinas’ internationalization. Secondly, composite indicators allow for the identification of key constituents influencing the analyzed phenomenon (Lafuente, et al., 2022; Lafuente, et al., 2022a).

Although various indicators that measure the internationalization of companies have been created, there are few studies that analyze how can Colombian Multilatinas that possess numerous differences with companies from other countries quantify it. As follows, the present study proposes a composite indicator to measure their level of internationalization by answering the research question: What factors explain the heterogeneous degree of internationalization of Colombian Multilatinas?

To answer the research question, the four biggest Colombian Multilatinas included in the Ranking of Multilatinas 2020 proposed by América Economía were analyzed. The sample includes ISA, Grupo Argos, Grupo EPM and Empresa de Energía de Bogotá.

Therefore, this study includes a knowledge transfer product to society, whose main contribution is found in the identification of measurable factors and variables that can guide the decision-making of the stakeholders involved. Likewise, the contribution of this composite indicators allows to delimit in a practical way (based on official data published by internationalized companies) the capacities of certain Colombian Multilatinas and its applicability is reproducible with companies from other regions of the world. The research shows that to reach the most optimal levels of internationalization, the Economic Capacity factor is essential, followed by Human Capital, then Technology and finally Sustainability. This finding is derived from the perception of 57 experts from a Colombian Business School and, in any case, can be contrasted with perceptions of other experts in the field of international business.

This article is structured as follows. The first section provides a literature review of the internationalization processes of Multilatinas and introduces existing indicators for measuring internationalization, afterwards, the methodology of multiple case study is selected to analyze the sample and described with other methodological considerations including the selection of cases, data collection and analysis. Ultimately, findings and conclusions are formulated.

2. Literature review

Internationalization is a term that has been discussed for years, nonetheless one of the most used definitions by scholars was proposed in 2009, herein, internationalization represents “the degree in which a firm’s sales revenue or operations are conducted outside its home country” (Li, 2009).

The internationalization of Multilatinas, is an important topic of study because these companies have been occupying an important role in the international arena due to their competitiveness in cost and knowledge-intensive activities (Duque-Grisales et al., 2019). As claimed by Duque et al., (2021), the quantity of publications regarding this topic has increased since 2015; hence, the authors highlight that almost 60% of the research papers on this topic have been published since that year.

The internationalization process of Latin America companies involves the assignment of financial resources to balance the lack of familiarity within the target markets (Manotas & Gonzalez-Perez, 2020). A study conducted by Gomez-Trujillo (2021) on eleven of the Colombian Multilatinas analyzed by the Boston Consulting Group showed that most of them have consolidated their internationalization through acquisitions likewise, organizations tend to choose a place geographically close to Colombia to conduct this procedure. Gonzalez-Perez and Velez-Ocampo (2014), delve into the geographical aspects and affirmed that Multilatinas enjoy advantages when operating within the region. Similar levels of purchasing power, social and economic development, along with the low geographical, institutional, and physical distance, contribute to reducing the cultural impact of the internationalization process.

Before delving into the entry modes of Latin American companies, it is imperative to describe certain typical characteristics of this process. Gonzalez-Perez and Velez-Ocampo (2014) found that internationalization of EMNEs is carried out in sectors with less technological intensity. They also highlight the role of the importance of management leadership as a primary driver of internationalization, with access to information on target markets being especially important.

Multilatinas possess different strategies for internationalization. Firstly, Gonzalez-Perez and Velez-Ocampo (2014) note that firms from developing countries tend to maintain their production at their primary headquarters rather than establishing production facilities in multiple countries. Market selection is driven by different factors with the ease of doing business, market size, and international experience being the most important, nonetheless, the geographical distance is a key factor too. Another remarkable phenomenon in Latin America is the conversion of state-owned monopolies into privately held Multilatinas that continue to have relationships with the government and use those connections to expand internationally (Aguilera et al., 2017). The authors also present another method where companies benefit from the advantageous regulations to generate profits, which are then invested in foreign markets to mitigate the risk of regulatory changes. Finally, domestic market growth and deregulation are also associated with companies expanding their scope to foreign markets.

In the first strategy mentioned, government influence performs a key role in the internationalization of EMNEs. Nuruzzaman et al., (2019) argue that direct or indirect government support can reduce the regulatory obstacles of companies leading to changes on prices and improved competitiveness. Thus, institutional support positively influences the internationalization of EMNEs. Finchelstein (2017) by demonstrating the connection between state actions and the internationalization of Multilatinas. His study shows the case of three Latin American countries where State actions have influenced the path of companies and their internationalization endeavors.

In terms of the entry modes, Latin American firms are more likely to export before they advance to the subsequent stage of internationalization, then, their strategy increases gradually to have more control and commitment of resources while also acquiring knowledge of the market. In other words, the companies tend to follow the internalization process theory, it is substantial to notice that the internalization process theory establishes that the firms increase their exposure and presence in foreign markets gradually as their uncertainty is reduced, nonetheless, there are some firms that do not follow the same path, since they increase their operations abroad through acquisitions (Gonzalez-Perez & Velez-Ocampo, 2014). In numbers, the authors suggest that direct exports are the most frequent method of foreign operations with approximately 60% followed by indirect exports with 25.25%, M&A with 13.13%, FDI with 5.05%, franchise with 4.04% and license with 3.03%.

Nonetheless, it is significant to notice that Latin America provides a contrast when it comes to Born Global companies which are firms that since their creation expect to receive a portion of their income from international market operations, consequently, these organizations do not follow the internalization process theory, but they start their operations in an international market since the beginning of their life. It is mentioned that factors such as innovative capacity and the mindset (international oriented) of the directors are of deep importance for the internationalization process of these companies (Escandon-Barbosa et al., 2019).

Due to the importance of internationalization for companies, governments and scholars, the measure of it has become increasingly significant. Thus, many indicators of this phenomenon and multidimensional indices that aim to analyze the organizations’ presence abroad have been developed. Individual indicators are ordinarily used for the construction of composite indices such as the proposed by the UNCTAD (2020) that will be discussed subsequently (Szymura-Tyc, 2013).

The first index that will be analyzed was published by the UNCTAD (2020) and is one of the most used for quantifying internationalization, according since 1990 the organization has issued different indicators, their transnationality index (TNI) uses three variables for measuring the abroad presence of MNEs, those are: foreign assets to total assets, foreign sales to total sales and foreign employment to total employment moreover, their most recent index, called FDI lightness index measures the intensity of foreign operations in relation to domestic or global activities by using “the share of sales generated by foreign affiliates and the corresponding share of foreign assets” (Trentini, 2021). This index was primarily developed to comprehend the international involvement of digital MNEs, it is substantial to highlight that the UNCTAD’s indicators possess an advantage over the others in this list because the Organization relies on mostly available information across countries and companies. Nonetheless, according to Szymura (2013), the weakness of their indicators is the lack of consideration of factors that are uneasy to measure.

The second index is focused on Multilatinas, The Ranking of Multilatinas, proposed by América Economía is designed to compute the degree and potential of globalization for Latin-American enterprises using four dimensions: commercial strength abroad, employees abroad, degree of geographic coverage and expansion potential. It is substantial to note that the ranking is created under various initial conditions, it only considers Multilatinas with sales over US$230 million per annum and with presence in at least two countries different from the one of origin (América Economía Intelligence, 2021; Infobae, 2021).

The third index uses five ratio variables: foreign sales as a percentage of total sales (FSTS), foreign assets as a percentage of total assets (FATA), overseas subsidiaries as a percentage of total subsidiaries (OSTS), top managers’ international experience (TMIE) and psychic dispersion of international operations (PDIO). Through the following operation: FSTS + FATA + OSTS + TMIE + PDIO = DOI, calculates the degree of internationalization for a firm. Therefore, the values of DOI must be in a scale of 0.0 which means no international involvement to 5.0 meaning total international involvement. The advantage of this linear combination is the reduction of the spread of systematic and random errors, nevertheless, the author acknowledges the limits of his method and the speculative nature of the measure (Sullivan, 1994).

The fourth index is named internationalization index (INT) and was built under the consideration of numerous variables such as outward internationalization forms and markets (OIFM), inward internationalization forms and markets (IIFM), export share in sales and markets (EXSM), import share in sales and markets (IMSM) and firm international experience and markets (FIEM), each with a different weight within the measure. The index was designed to provide a more effective method for appraising the internationalization degree of companies at an initial stage (Szymura-Tyc, 2013).

The fifth measure of firm internationalization is named ratio of international market shares (RIMS) and is defined as the ratio between the market share for all the countries of the world (excluding the one used in the denominator) and the market share for the country where the country has its greatest market share. Consequently, RIMS range from zero for domestic firms to one for maximally internationalized firms (Marshall et al., 2020).

Considering the previously mentioned information, it is crucial to emphasize that there is a consistent pattern among most indicators, despite their inherent differences. One key aspect shared by them is the recognition of internationalization as a multidimensional construct (Hsieha et al., 2019). By acknowledging its multifaceted nature, researchers have sought to capture the complexity of internationalization by utilizing a variety of variables in their analyses.

Another noteworthy aspect observed in certain indicators is the utilization of heterogeneous weights for the variables. This approach offers distinct advantages as it accounts for the varying degrees of importance that different dimensions may hold in the context of internationalization. By incorporating such heterogeneous weights, indicators aim to provide a more accurate representation of the phenomenon. Notably, the use of endogenous weights proposed by experts has proven effective in developing composite indicators (Lafuente et al., 2022).

Ultimately, it is important to note that “there is neither single indicator nor an index that satisfactorily measures the overall degree of the internationalization of a firm” (Dörrenbächer, 2000), the aforementioned because as Sullivan (1994) stated, “the reliability of measuring the degree of internationalization of a firm remains speculative”.

Methods

3. Methodology

This study is based on a multicriteria approach based on Baena-Rojas et al., (2018) ; Baena-Rojas et al., (2016); Baena-Rojas et al., (2022) to construct the composite indicator. Then, according to literature review, various indices try to capture the essence of internationalization, they are both univariable and multivariable, even though the choice remains a debate among scholars. This is why Ietto-Gillies (2009) concludes that internationalization remains a multidimensional concept that depends on the analyzed framework.

Hence, according to the previous literature review about internationalization the current composite indicator is modeled considering four factors. All of them, which were selected to capture the most fundamental concepts around the internationalization of Multilatinas. In this case: economic capacity, sustainability, technology, and human capital. Within each of the mentioned factors three variables were analyzed looking to capture all aspects of it.

The variables were selected because of their relationship with internationalization as can be observed in Table 1. Afterwards, adopting an overall average from 57 experts (professors) from a Colombian Business School. Thereby the variables were weighted to compose each factor, then the factors were also weighted to obtain the percentage of each criterion.

Table 1: Variables selected for the Colombian Multilatinas composite indicator (CMCI)

| Factor | Variable | Description | Justification |

|---|---|---|---|

| Economic Capacity (ECAP) | Total Sales (TOSA) | It refers to the funds received for the activities developed in compliance with the business mission through the sale of goods or services, in other words, all income that comes from the chief corporate purpose of the company (Plan Único de Cuentas, 2022a). | According to Milevoj et al., (2021) , a firm's total sales is strongly associated with its internationalization thus, it is a key factor when differentiating internationalized and non-internationalized firms. Moreover, Bruneel et al., (2018) , found out that a local mind-set sustains a negative impact in the growth of a company's international sales. |

| Costs (COST) | Includes those accounts related to the direct and indirect costs used for the production or provision of goods and services sold by the company (Plan Único de Cuentas, 2022b). | The competitiveness of a firm possesses a direct influence on its internationalization (Elena-Mădălina et al., 2017), this factor can be strengthened by various strategies, among them it is important to highlight the reduction of costs that is able to stimulate the international involvement of a company (Belniak, 2015). | |

| Total Assets (TOAS) | It groups all the accounts related to the tangible and intangible assets and rights owned by the company. Their sale can produce future benefits for the firm (Plan Único de Cuentas, 2022). | Kirca et al., (2016) , establish that the utilities and value generated by the assets is positively related to the firm’s size and presence abroad. Furthermore, one of the motives for the internationalization of EMNEs is the acquisition of strategic assets (Ahsan et al., 2020). | |

| Sustainability (SUST) | Emissions tCo2 (EMCO) | tCO2 is the acronym for the measurement of total carbon dioxide and it refers to the consolidated number of CO2 emissions produced by a firm; thus, it is a principal factor in the mitigation of global warming (Chen, 2022). | Firstly, Chen (2022) established that internationalization encourages firms to adopt more environmentally beneficial practices. Furthermore, as Perkins, & Neumayer (2008) proposed, international companies sustain more technology transfer, the aforementioned can accelerate the reduction of pollution in their processes trough environmentally sustainable innovations. |

| Gender Equality (GEEQ) | According to the United Nations (2022), gender equality is a human right and is based on the egalitarianism, therefore, the no discrimination of people based on their sex in any context. | In the first place, gender social agreements limit business decisions and techniques worldwide, affecting the company's capital, networks, and resources (Pergelova et al., 2018). Moreover, Zimmerman and Brouthers (2012) , discovered that the gender configuration of the senior executives strongly linked to the international diversification of a firm. | |

| Investment in Communities (INCO) | Investment in communities refers to a fraction of corporate social responsibility where the firms commit themselves to support local communities using resources in order to improve their life quality (Commission of the European Communities, 2001). | Aray et al., (2021) , argue that internationalization possesses various effects in corporate social responsibility, the most enormous is shown in activities that are relevant to the society and community. Moreover, supporting social-related practices is likely to reduce pressure between companies and regulators, the aforesaid, can lower costs and surpass regulatory barriers providing the company more resources to exploit within its internationalization course (Khojastehpour & Saleh, 2019). | |

| Technology (TECH) | Foreign Shareholders (FOSH) | It refers to the number of foreign investors within a firm, thus, it represents the fraction in which a company's stocks are owned overseas (Tsafack, & Guo, 2021). | It is significant to measure the degree in which they are owned internationally since the foreign direct investment (FDI) in a company provides technology transfers and most importantly export market access. Moreover, FDI often enhances productivity and reduces the technological gap, those prerogatives can be used to expand to other markets (Singh, 2017). Put differently, is an indicator of integration that demonstrates the links connecting economies. |

| Local Suppliers (LOSU) | It is a compound word that refers to the number of national companies that provide goods, inputs or deliver services to a firm (Taherdoost & Brard, 2019). | The number of local suppliers of a firm act as the opposite value of their presence in the global value chains (GVCs). Participation in GVCs measures how many intermediate supplies companies import to produce their goods, showing the integration of a firm in the global economy. Moreover, participation in the GVCs sustains a direct impact in the productivity of a company (DNP, 2021). In this manner, the contrary effect is expected when firms only possess local suppliers and are unintegrated in the GVCs. | |

| Remote Work (REWO) | It is a working method where employees are no longer exercising their activities from the headquarters of the companies but from wherever they choose through the virtual environments and communication technology systems (Allen, Golden, & Shockley, 2015; Ozimek, 2020). | Global integration allows the companies to carry their operations worldwide, thus, the geographical dispersion of a firm's workers acts as a consequence of the internationalization and the use of communication technology (Mayo et al., 2009) | |

| Human Capital (HUCA) | Foreign Employees (FOEM) | It represents the number of employees that work outside the firm's host country, Santacreu-Vasut and Teshima (2016) , state that this percentage of workers present an opportunity for technology transfer. | As companies that operate in sectors with low technological exposure (Gonzalez-Perez & Velez-Ocampo, 2014), Colombian Multilatinas are firms that require physical presence in the various countries where they possess activities, thus, a workforce to operate. The foreign to total employee’s ratio measures the commitment of a firm abroad since it evaluates their capacities as outward investor and not just as a receiver. |

| Employee Satisfaction (EMSA) | Employee satisfaction represents the degree of contentment of the workers with their jobs within a firm, in other words, how much gratification they feel in the role they perform in the company (Auer and Antoncic, 2011). | Milovanovic et al., (2022) , state that the success of an internationalization process depends on the capacity of the firm to embrace change from both their internal and external environment. The authors say that change can only be achieved when the employees are involved, ready and open to it, it was shown that job satisfaction has a positive effect in their readiness for change, thus, the psychological barriers are crucial to the internationalization process. | |

| Average Training Hours (ATHO) | The average training hours represents the meantime expended by workers in instruction to develop their skills, according to Dumas and Hanchane (2010) , training should be included as a development strategy for the employees by the human resources department. | According to DNP (2021), a low level of internationalization is associated with the technological gap in firms. Technology represents a broad concept that covers various topics such as the employees' knowledge. The foregoing is difficult to acquire, and hours of training are essential, thus, it could be asserted that an increase in the training of the employees is associated with a reduction on the technological gap, therefore, an increase in the internationalization of a company. |

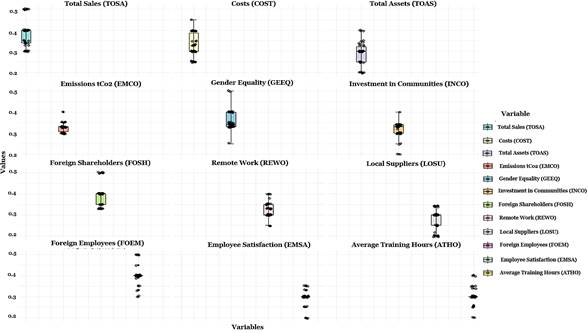

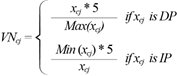

In other words, the weights of each factor and variable were supported the participatory method known as the Budget Allocation Process (BAP). In this sense, it was required the active involvement of expert professors in international business. Then, through a survey, they assigned a score ranging from 0 to 100 to each factor and variable based on their expertise, ensuring that the total sum equated to 100 (See Figure 3) (Karagiannis & Karagiannis, 2020; OECD, 2008).

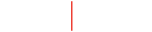

Similarly, it is displayed a box plot presenting key statistics derived from the survey’s results of the factors. The box plots offer a visual comparison of the medians and variability across the variables Economic Capacity, Sustainability, Technology, and Human Capital. The median values reveal that Economic Capacity tends to possess the highest values, followed by Human Capital, Technology, and Sustainability. Moreover, the interquartile ranges indicate considerable variability for Economic Capacity, while Human Capital and Sustainability exhibit similar levels of variability. In contrast, Technology demonstrates slightly lower variability. Notably, outliers are observed in certain variables, suggesting the existence of potential extreme values. These results offer insights into the distribution of the weights assigned to the factors by each professor (see Figure 1).

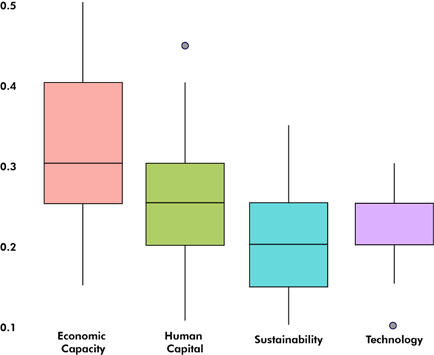

Likewise, following the proposed dynamic of Figure 1 it is also displayed the weights of the variables. As it can be seen, the interquartile ranges demonstrate significant variability for the variables across all spheres, except for Human Capital where the professors have assigned comparable weights. It is worth emphasizing the presence of outliers across most variables, indicating the existence of extreme values.

The results of each variable and factor were weighted to identify the internationalization degree of the companies, therefore, Figure 2 shows how the methodology works and the associated weights conforming to the survey's results. The survey uses accidental sampling with 57 respondents. All this considering the availability of resources at the time of the study. In any event, although it is non-probability sampling, it does not mean that it cannot show and properly compile the opinions of the experts in the weight they assign to each factor and variable (Otzen & Manterola, 2017; Rivaldo et al., 2022).

As follows, the composite indicator’s construction process involved the implementation of the following steps:

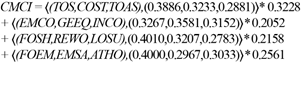

1. The weight of each factor and variable was determined by calculating the results from the survey using the simple average equation aiming to combine the expert’s opinions on the weight of each variable, as supported by Genre et al., (2013) , who argue that equal weighting is the best method for summarizing various forecasts. In this case, it is employed to compile the professors’ perceptions regarding the analyzed factors.

2. The results of the factors and variables of each company were normalized, for that matter an adaptation of the equation proposed in Baena et al., (2018) was used. Considering the variables: C as the total analyzed companies, J as the number of variables within the methodology and x_cj as the variable j for the company, the normalized value VNcj is calculated through the Equation [1].

Equation 1: Normalization of values

Source: Baena-Rojas et al., (2018) ; Baena-Rojas et al., (2016) ; Baena-Rojas et al., (2022) .

Considering the Equation [1], it is coherent to establish that the results of each variable and factor will be transformed into a grade in the range of [0,5] depending on the relation between them and the internationalization concept. It can either be directly proportional (DP) in which case the first part of the equation is used or indirectly proportional (IP) using the second part.

3. Considering the weights proposed by the professors, Equation [2] for weighted average was used to obtain a conclusion with the normalized values. It was applied among variables to obtain the factor, similarly between factors to obtain the outcome of each Multilatina. In the equation, x represents the value of the variable or factor and w the weight associated with it.

Results

4. Data and Results

The sample for this study is composed by ISA, Grupo Argos, Grupo EPM and Empresa de Energía de Bogotá; the companies were selected because they are the four biggest Colombian Multilatinas of the Ranking of Multilatinas 2021 proposed by América Economía. Thus, they exhibit common characteristics, according to the ranking they must maintain sales over US$230 million per year and presence in at least two countries different from Colombia (América Economía Intelligence, 2021; Infobae, 2021).

The details regarding the internationalization processes of the companies from the sample are outlined below.

The firm started in 1967 at a Colombian house in Bogota and it was the first Colombian firm listed in the Colombian stock exchange in 2001 (Quinceno, 2017); at present, it has become a Multilatina with 3 business units that include electric power, roads and telecommunications and information and communications technology (ICT). Moreover, the company has 26,132 shareholders, as with other companies in the sector, it receives private, public, and state investment. Nevertheless, it is important to highlight that 9.02% of the company is owned by international investment funds and 0.02 by the ADR’s program (ISA, 2021a; ISA, 2021b).

The firm’s internationalization has numerous milestones; it started in 2001 with the creation of ISA Peru and continued in 2003 with the formation of ISA Bolivia. Afterwards, ISA expanded to the Central American market through the acquisition of shareholding in the company owner of the network EPR; the process advanced with the constitution of CTEEP in 2006, which allowed the entrance to the Brazilian market. Likewise, ISA initiated activities in pursue of electric integration between Colombia and Panama via the company ICP in 2009, ultimately, the firm entered the Chilean market through projects from INTERCHILE in 2012 (ISA, 2022a). Even though ISA has opened markets in other countries, the mentioned ones represent a clear sample of what the company has done in its internationalization course.

For 2020 the company-maintained presence in six countries from South and Central America (ISA, 2022b), nonetheless, it expects to open markets in the United States, Mexico, and Argentina for 2030 (ISA, 2022c). In terms of earnings by country, Brazil contributed with 37% of the total EBITDA followed by Colombia with 22.3%, Peru with 20.8%, Chile with 18.5% and others with 1.4% (ISA, 2022c). It is important to acknowledge the geographical patterns of internationalization that are recurrent in the other companies of the sample, the firm has opted to expand its domains within nations that are geographically close to Colombia, thus, countries with economic and social similarities. Moreover, the differences in the dates when the subsidiaries were opened suggest a gradual compromise of resources in the international markets.

Until December 2020, the firm had 4.352 employees and 268 managers distributed among the various countries of operation as follows: 48% were in Colombia, 35% in Brazil, 10.4% in Chile, 9% in Peru and 0.6% in Bolivia (ISA, 2022b).

To conclude, with regard to the assets, in 2020 they were divided in the diverse countries in this degree: 32.1% were in Brazil, 26.5% were in Chile, 23.9% were in Colombia, 16.4% were in Peru and 1.1% in others. Furthermore, indebtedness was distributed in this manner: 29.9% in Colombia, 29.5% in Chile, 21.4% in Brazil, 19.1% in Peru and 0.1% in others (ISA, 2022c).

The firm started with ninety-nine shareholders in 1934 under the name of Compañía de Cemento Argos. Presently, it is a holding company that controls three strategic business units: Cementos Argos, Celsia and Odinsa, companies in the cement, energy, and concessions industry, respectively. Additionally, the company has more than 875 million shares, it is noteworthy that 7% of its preferential shares are owned by international funds (Grupo Argos, 2019b; Grupo Argos, 2019c; Grupo Argos, 2019d).

The internationalization course of the group started through their company Cementos Argos, in 1998 the firm acquired cement companies in Panama, Dominican Republic and Haiti. Subsequently, in 2005 the business purchased cement assets in Texas, United States. Nevertheless, it was just the beginning of their conquest of American markets because in 2009, the group expanded their presence in the nation with the investment in assets in the states of Alabama, Georgia, South Carolina, and Florida, the previously said was strengthened in 2011 when the firm bought productive plants in the mentioned states. By 2016 the company had four productive plants in the United States, the last one was acquired in West Virginia, it was not until 2014 when Celsia extended markets abroad with the acquisition of assets in Panama and Costa Rica (Grupos Argos, 2019a).

In 2020, Grupo Argos maintained over 14.000 employees in the eighteen countries where it was present, according to the Ranking Multilatinas, the group makes 50% of its sales overseas. Furthermore, 37% of its workforce is outside Colombia (Grupo Argos, 2021; Infobae, 2021).

The group is a holding company in the sector of public services owned by the municipality of Medellin, their most important company EPM was created in 1995 when the Medellin’s council decided to unite four entities in the city: energy, aqueduct, sewerage, and telephones. Nowadays, the group maintains seven business units in the following sectors: energy generation, energy transmission, energy distribution, gas, water supply, wastewater, and waste management (Grupo EPM, 2022a).

As other companies of this list, Grupo EPM has acquired diverse companies to commence its internationalization course, between 2010 and 2011 the holding purchased firms of electric distribution in Guatemala, El Salvador, and Panama (Grupo EPM, 2022b).

Up to 2020, the group had presence in six countries among South and Central America; they were: Mexico, El Salvador, Guatemala, Colombia, Panama, and Chile; in terms of their sales 64% of them were made overseas. Moreover, 19.12% of their employees worked internationally (Grupo EPM, 2022c; Infobae, 2021). The holding’s investments in infrastructure were 3.1 billion COP in 2020, from that amount: 68% was achieved through EPM and the remaining 32% was accomplished by the international and national subsidiaries in a rate of 50/50 (Grupo EPM, 2022c).

Founded in 1896 by the Samper Brush brothers, the group was a pioneer in the Colombian electric energy sector (Grupo Energía de Bogotá, 2022a). Currently, the group is a holding company with eleven subsidiaries and shareholdings in big firms within the energy and gas sector. Moreover, the group has over nine thousand shareholders with 65.7% of the shares, the municipality of Bogotá is the principal (Grupo Energía de Bogotá, 2022b; Grupo de Energía de Bogotá, 2022c).

The group arrived to international lands for the first time in 2002 by establishing a subsidiary named Red de Energía del Perú (REP) with ISA, this firm was dedicated to the transmission of energy in the country, afterwards, the group bought 60% of the shares in Cálidda, the unique distributor of gas in Lima and Calalo, their presence in the Peruvian gas industry was strengthened by the acquisition of Contugas, in 2017 both companies distributed 71% of the gas consumed in Peru (El Tiempo, 2017). Their internationalization continued in 2009 when the company extended its presence to Guatemala by creating Trecsa, the main electricity distribution firm in the country. Ultimately, the group landed in Brazil thanks to the association with the biggest energy company in the country, Furnas, along with the state-owned enterprise (SOEs) they created Gebbras, an organization in the energy distribution sector (El Tiempo, 2017).

In 2020, the holding had presence in four countries: Colombia, Peru, Brazil, and Guatemala, 30% of its EBITDA was earned internationally and 70% in Colombia. Moreover, 79% of its debt was held in USD while only 21% was in COP (Grupo de Energía de Bogotá, 2020). It is substantial to note that 43% of the group’s workforce works abroad (Infobae, 2021).

4.2 Data Analysis

Considering the above-mentioned, the proposed methodology was applied to identify the most internationalized company within the sample, for that matter sources outlined in Table 2 were used. Using the obtained information, Table 3 shows the values for the companies in each of the variables.

Table 2: Sources of primary information for each variable

As follows, Equation [1] is used to normalize each of the obtained values in the range [0,5] and Equation [2] is used to obtain the value of each factor considering its variables. The results of the methodology are shown in Table 4 which also shows the weights associated with each variable and factor.

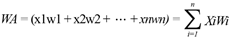

4.3 Results

It should be noted that the results show that the weights of the factors have an amplitude of 11.75% considering the economic capacity as the most crucial factor from professor’s perceptions and sustainability as the least significant. The following step consists in using Equation [2] and the results of Table 3 to obtain a clear outcome regarding the level of internationalization for each company, thus weighted averages of each factor are added. By doing so, the results are presented in detail within Table 4 and Figure 4 also.

Table 3: Values obtained for each variable

Table 4: Scores and description’s ranges of Colombian Multilatinas composite indicator (CMCI) per factor

| ISA | Grupo Argos | Grupo EPM | Grupo de Energía de Bogotá | |

|---|---|---|---|---|

| Economic Capacity (ECAP) | 3.3 | 2.9 | 3.7 | 2.8 |

| Sustainability (SUST) | 2.8 | 4.6 | 2.0 | 2.3 |

| Technology (TECH) | 4.2 | 4.8 | 2.5 | 2.5 |

| Human Capital (HUCA) | 4.9 | 4.0 | 2.8 | 3.4 |

Considering Table 4 and Figure 4 the composite indicator is completed with a depiction of this current study. In this way, the evidence suggests that Grupo Argos is the most internationalized firm and the most prepared enterprise for today's global environments while Grupo de Energía de Bogotá represents the lower internationalized firm within the sample.

Similarly, if the obtained data are compared in terms of strong and weak points with the analyzed cases. For example, it is possible noticed that the value of the weakest factor of ISA (sustainability) is the second largest among the analyzed Multilatinas with 2.8.

Also, Grupo ARGOS has a clear bottleneck in Economic Capacity factor regard all the other considerer firms with 2.9. Meanwhile, Grupo EPM and Grupo de Energía de Bogotá report a relatively balanced structure with a clear high performing in Economic Capacity and Human Capital factor with 3.7 and 3.4 respectively.

It is crucial to point out that considered variables possessed different weights in the calculation. Moreover, the results show that Grupo Argos has the best infrastructure in terms of the analyzed factors on the whole, thus it enjoys a greater opportunity of expansion to other international markets as it follows the international process theory.

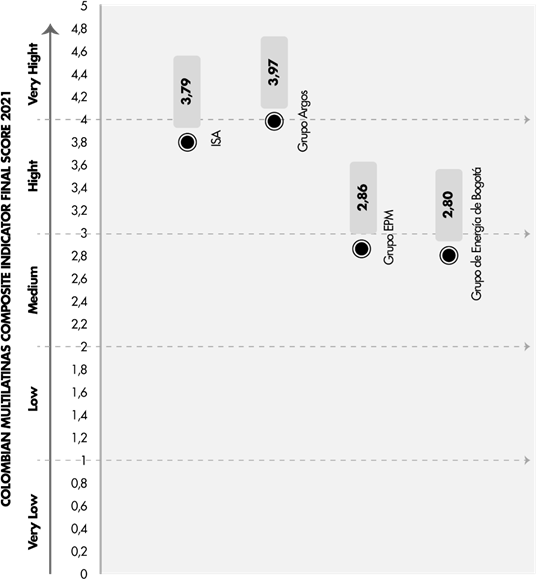

The Frobenius inner product notation is used in equation [3] to construct the Colombian Multilatinas Composite Indicator (CMCI). Each variable's weight within the equation reflects how it will affect how internationalization is calculated. Notably, the CMCI computation gives the most weightage to the Economic Capacity (ECAP) composed by TOS, COST, and TOAS. Therefore, any changes in this economic environment would cause the CMCI index to change significantly. Additionally, the Human Capital (HUCA) is another significant element, with FOEM and ATHO showing the highest weight percentages of 40% and 30.33%, respectively. This means that changes in the number of foreign employees and the average training hours would have a significant impact on the total HUCA score and, as a result, the composite indicator as a whole.

In conclusion, the Colombian Multilatinas Composite Indicator emphasizes the significance of competitiveness as a primary driver of success for companies and economies, as stated by Porter (1990) . It also recognizes that the ability of a firm to reach potential markets and business networks plays a substantial role in achieving competitiveness. The aforesaid, because competitiveness is directly linked to internationalization (Elena-Mădălina et al., 2017), likewise, internationalization positively impacts a firm’s performance and enhances competitiveness. In other words, the expansion of a company’s activities abroad enhances its chances of prevailing in the market (Manotas & Gonzalez-Perez, 2020). Therefore, the selected variables of the composite indicator were chosen since they provide information on the competitiveness of Multilatinas and their capacity to expand to new markets, as these factors are inherently connected.

Concluding

5. Concluding remarks, implications, and future research lines

5.1 Concluding remarks

The increasing importance of Multilatinas in the world’s stage is unmatched with the attention they have received (Cuervo-Cazurra, 2019), thus, how to measure their degree of internationalization remains unclear since the existing indicators are unable to properly assemble all the differences in the identity of these novel players.

In this line, it is crucial to develop alternative approaches to measure the internationalization of Colombian Multilatinas. For that purpose, we propose a novel structure named Colombian Multilatinas Composite Indicator that uses four factors with different weights assigned by a survey conducted in 57 experts from Colombian Business School, those are: economic capacity, sustainability, technology, and human capital. It is observed that the composite indicator appropriates variables used in other indicators, that is due to the fact that they are significant when measuring the internationalization of a Colombian Multilatina, nonetheless, it is the complete structure and assemblage of the indicator what makes it more appropriate to achieve declared goal since, it quantifies and compiles the various specific patterns of Multilatinas and connects them with their competitiveness and development in international markets, notwithstanding the above-stated, the nature of the measurement remains speculative.

5.2 Implications

The importance of studying how to measure the level of internationalization of Colombian Multilatinas lies in the fact that these firms provide insights that are unavailable through the study of other EMNEs (Cuervo-Cazurra, 2019). For both researchers and enterprises, the CMCI serves as an important resource for comprehending and evaluating internationalization. Its significance for small and large firms lies on its analytical advantages such as the holistic measurement, comparative analysis among Multilatinas, growth potential identification and support for managerial decision-making. Therefore, the indicator can be used as a tool for managers to measure the potential of firms, comprehend their competitiveness, and elucidate how Multilatinas are ranked in their internationalization course.

Nevertheless, it is significant to acknowledge the limitations of the present study. Firstly, the heterogeneity of the sample could cause variations in the outcome, furthermore, since this article uses a non-probabilistic sample, the results cannot be generalized to other Multilatinas. Secondly, the selected companies are all Multilatinas from Colombia, therefore, they are geographically limited, future research should include the measurement of internationalization for Latin American firms from other countries. Ultimately, the limits of the multiple case study methodology can influence the results and restrict the collection of data.

5.3 Future research lines

To conclude, Multilatinas are utterly different to other EMNEs and MNEs. Therefore, they should be examined and treated separately. Indicators that measure the degree of internationalization of MNEs shall longer be unused in measuring the Multilatinas’, and all the metrics should be tailored to the Multilatinas’ patterns, Thus, more research in the topic is necessary in order to enhance our comprehension of them and gain different insights that expose the Latin American reality.

References