Article

DOI:

https://doi.org/10.18845/te.v17i3.6848

Institutional trust and entrepreneurs' export behavior: An international analysis

Confianza institucional y comportamiento exportador de los empresarios: un análisis internacional

TEC Empresarial, Vol. 17, n°. 3, (September - December, 2023), Pag. 33 - 45, ISSN: 1659-3359

AUTHORS

Felipe De Anda

Universidad Panamericana. Escuela de Ciencias Económicas y Empresariales. Jalisco, México.

0003998@up.edu.mx.

![]()

Juan Carlos Baker

Universidad Panamericana. Escuela de Ciencias Económicas y Empresariales. Jalisco, México.

jbaker@up.edu.mx.

![]()

Edgar Demetrio Tovar-García *

Universidad Panamericana. Escuela de Ciencias Económicas y Empresariales. Jalisco, México.

dtovar@up.edu.mx.

![]()

* Corresponding Author: Edgar Demetrio Tovar-García

ABSTRACT

Abstract

The main goal of this research is to test the association between trust in institutions—e.g., police, law courts, property rights, government regulations, and public and private organizations—and entrepreneurial internationalization. The longitudinal analysis uses data obtained from the Global Entrepreneurship Monitor (GEM), the Heritage Foundation Index of Economic Freedom (IEF), World Bank Worldwide Governance Indicators (WGI), and World Development Indicators (WDI) for a sample of 88 countries during 2013-2018. Using factor analysis and panel data techniques that control for potential endogeneity, institutional trust is found to be significantly correlated with internationalization; however, this result is only valid for small and medium-sized enterprises (SMEs) in developing countries. Therefore, entrepreneurs from developing economies have to overcome the lack of institutional trust to successfully carry out their internationalization process.

Keywords: International entrepreneurship; institutional trust; social capital; networking; panel data.

Resumen

El objetivo principal de esta investigación es comprobar la asociación entre la confianza en las instituciones -por ejemplo, la policía, los tribunales, los derechos de propiedad, las normativas gubernamentales y las organizaciones públicas y privadas- y la internacionalización empresarial. El análisis longitudinal utiliza datos obtenidos del Global Entrepreneurship Monitor (GEM), el Índice de Libertad Económica (IEF) de la Fundación Heritage, los Indicadores Mundiales de Gobernanza (WGI) del Banco Mundial y los Indicadores de Desarrollo Mundial (WDI) para una muestra de 88 países durante 2013-2018. Utilizando técnicas de análisis factorial y de datos de panel que controlan la posible endogeneidad, se encuentra que la confianza institucional está significativamente correlacionada con la internacionalización; sin embargo, este resultado solo es válido para las pequeñas y medianas empresas (pymes) de los países en desarrollo. Por lo tanto, los empresarios de las economías en desarrollo tienen que superar la falta de confianza institucional para llevar a cabo con éxito su proceso de internacionalización.

Palabras clave: Emprendimiento internacional; confianza institucional; capital social; redes; panel de datos.

Introduction

1. Introduction

Trust is a complex concept -difficult to observe and measure- and with different connotations depending on the approach (Dyer & Chu, 2000; Griessmair et al., 2014; Gulati, 1995). It has been defined as “the willingness of a party to be vulnerable to the actions of another party based on the expectation that the other will perform a particular action important to the trustor, irrespective of the ability to monitor or control that other party” (Mayer., Davis, & Schoorman, 1995, p. 712 ). It has also been considered as “a belief that someone or something is reliable, good, honest, effective” (Mangeloja et al., 2022). In organization theory, for intra and interfirm exchange relationships, trust is understood as “an organization’s expectation that another firm will not act opportunistically” (Gulati & Nickerson, 2008, p. 688).

In addition, there are different types of trust. For instance, organizational trust is divided into knowledge-based trust and general trust. The former depends on the history of interactions between the trustor and the trustee, and the latter depends on the trustor's personality traits and cultural context (Griessmair et al., 2014). This cultural context includes the institutional environment, i.e., institutional trust, linked to the reputation of institutions and sanctions against opportunistic behavior (making behavior predictable).

As such, trust is also linked to economic institutions. It is an informal rule (social norm, values, and custom) that constrains our behavior, attitudes, and preferences -individually and collectively- (North, 1991). Trust is also a tool to decrease transaction costs, i.e., the cost of using the price/market mechanism (Coase, 1937; Coase, 1998; Gulati, 1995; Klein et al., 1978; Williamson, 1993). Consequently, institutional trust shapes economic outcomes at the micro and macro-level. Particularly, the evidence suggests that institutional trust plays a major role in determining economic growth and development by creating a favorable environment for economic activities, e.g., for investment (Acemoglu et al., 2005; Kaasa & Andriani, 2022; Knack & Keefer, 1997), but not without criticism (Glaeser et al., 2004). In addition, trust has been used as a proxy for or as a form of social capital (Knack & Keefer, 1997; Putnam, 1995; Trigkas et al., 2021).

Note that trust is not only an interpersonal phenomenon, and institutional trust may encourage trust among trading partners (Dyer & Singh, 1998; Kaasa & Andriani, 2022). Consequently, a reverse causality exists between individual and institutional trust (Kaasa & Andriani, 2022; Mangeloja et al., 2022; Sønderskov & Dinesen, 2016; Welter, 2012). As such, institutional trust is linked to institutions in society, e.g., police, law courts, property rights, government regulations, and public and private organizations.

Institutional trust is necessary to legitimize public administration and public policies, to enforce laws and property rights (Hooghe et al., 2017; Kaasa & Andriani, 2022; Marien & Hooghe, 2011), thus enhancing economic activities -including entrepreneurship (Welter, 2012; Welter & Smallbone, 2011). Institutions in general, and institutional trust in particular, shape the way entrepreneurs behave by influencing risk, uncertainty, attitudes, and motives, as well as limiting or providing opportunities for business activities (which is particularly relevant in developing countries). Furthermore, entrepreneurs may also influence institutional trust by contributing to institutional change, e.g., not engaging in corruption practices (Welter, 2012; Welter & Smallbone, 2011).

Having said this, the role of trust in domestic entrepreneurial activities has been well documented (Mangeloja et al., 2022; Ovaska & Takashima, 2021; Smith & Lohrke, 2008; Sohn & Kwon, 2018; Trigkas et al., 2021). Overall, the empirical evidence suggests that trust has a positive effect on entrepreneurship (Mangeloja et al., 2022), but not without criticism (Ovaska & Takashima, 2021). Trust is a starting point for entrepreneurial activities, removing uncertainty and reducing transaction costs, thus providing a basis to start, develop and consolidate business opportunities. In this sense, the micro-level discussion of the determinants of entrepreneurial behavior -e.g., trust, cognition, emotions, effectuation- is well studied. In contrast, only recently the literature has begun to emphasize the relevance of the context -the macro-level- in which entrepreneurship occurs, including institutional trust (Mangeloja et al., 2022; Welter, 2012; Welter & Smallbone, 2011).

Furthermore, in this literature, the importance of trust for entrepreneurial internationalization has been less studied. At the micro level, it has been established that social capital, market knowledge, entrepreneurial proclivity, innovation, and risk-taking, are the key determinants of “the discovery, enactment, evaluation, and exploitation of opportunities-across national borders-to create future goods and services” (Oviatt & McDougall, 2005, p. 540 ), i.e., entrepreneurial internationalization. This literature mentions trust as a prerequisite for the creation of relationships under uncertainty and for the creation of international business networks (Vahlne & Johanson, 2013). In other words, trust simply moderates the effects of social capital, networks, or ties on internationalization (Leite et al., 2016; Ngoma, 2016; Shirokova & McDougall-Covin, 2012).

Nonetheless, it has been established that trust should be more relevant for international firm exchanges than for domestic firm exchanges; it is easier to trust domestic partners because of local reputational consequences and available information (Gulati, 1995). That is, firms trust similar partners, with similar (or the same) institutional environment that fosters goodwill trust and cooperation (Dyer & Chu, 2000; Dyer & Singh, 1998). Therefore, the better the institutional environment, the greater the institutional trust, the lower the transaction costs, and opportunistic behavior is less likely. This should be particularly important for entrepreneurial internationalization because the determinants of trust differ in different countries with different institutional environments (Dyer & Chu, 2000).

Given the globalization of markets and the huge amount of possible international collaborative ventures, it is particularly useful to study the role of institutional trust in the possibilities of entrepreneurs and their firms to internationalize, or even to be born global (Coviello et al., 2011; Jones et al., 2011; Keupp & Gassmann, 2009). This research hypothesizes that the higher the level of institutional trust, the higher the level of entrepreneurial internationalization, ceteris paribus.

Accordingly, the contribution of this article is threefold. First, to the best of our knowledge, this is the first study to investigate the role of institutional trust in the international orientation of entrepreneurs on a global scale. Second, by doing so, this research contributes to the scarce literature on trust and internationalization in developing countries (Leite et al., 2016; Ngoma, 2016; Shirokova & McDougall-Covin, 2012). Third, this research recognizes and tests a direct link between institutional trust and internationalization (using a unique panel dataset).

The rest of the paper proceeds as follows. Section 2 describes the dataset and the empirical strategy. Section 3 presents and discusses the results. Finally, section 4 concludes.

2. Data and empirical strategy

The international entrepreneurship data are taken from the Global Entrepreneurship Monitor (GEM). Annually, the GEM develops a survey in 115 countries across the world, administered to 36 experts and a minimum of 2,000 adults per country. Because full datasets are available to the public only after 3 years, this research is limited to the years 2013-2018 (freely available on the official website). Within the GEM's most well-known index -Total early-stage Entrepreneurial Activity (TEA) 1 -, this research uses the following dependent variables to measure international entrepreneurship.

The rate of low-exporting entrepreneurs is measured as the percentage of entrepreneurs with 1-25% of customers outside their country (TEAEXPLOW).

The rate of high-exporting entrepreneurs is measured as the percentage of entrepreneurs with 75-100% of customers outside their country (TEAEXPHIGH).

The percentage of entrepreneurs with more than 1% of customers from outside their country, i.e., entrepreneurs with a weak international orientation (TEAEXPWK). 2

The percentage of entrepreneurs with more than 25% of customers from outside their country, i.e., entrepreneurs with a strong international orientation (TEAEXPST).

Note that weak international orientation (TEAEXPWK) is defined as the percentage of entrepreneurs within TEA who report that at least 1% of their customers live overseas (1% or more). For its part, strong international orientation (TEAEXPST) includes the percentage of entrepreneurs within TEA who report that at least 25% of their customers live abroad (25% or more). Therefore, the strong orientation is rarer than the weak orientation. As the reader can see in Table 1, on average, in the sample, across all countries and in the period under study, 47.38% of TEA entrepreneurs are at least 1% export-oriented and 17.30% of TEA entrepreneurs are 25% export-oriented.

The key explanatory variable -institutional trust- is measured following the institutional performance approach. That is, trust in public institutions is based on how individuals assess their efficiency, efficacy, competence, capability, ability, certainty, openness, transparency, impartiality, sincerity, and honesty (Kaasa & Andriani, 2022). Accordingly, we use two sources to obtain proxy variables of institutional trust: the Heritage Foundation and the World Bank Worldwide Governance Indicators (WGI).

The index of Property Rights (PR). It is one of the three variables used to estimate the Rule of Law pillar of the Index of Economic Freedom (IEF) by the Heritage Foundation. The other two variables are Government Integrity and Judicial Effectiveness, the former replaced the Freedom of Corruption index in 2017, and the latter is calculated from 2017. Given our study period (2013-2018), it is difficult to use these two variables without negatively affecting the sample size and comparability. Therefore, we look for other proxies of institutional trust in WGI.

Rule of Law index (RL) by WGI, reflecting perceptions of confidence in the rules of society, the quality of contract enforcement, property rights, the police, the courts, crime, and violence.

Control of Corruption index (CC) by WGI, reflecting perceptions of the use of public power for private gain, including both petty and grand forms of corruption, as well as the capture of the state by elites and private interests.

Government Effectiveness (GE) by WGI, reflecting perceptions of the quality of public services and civil services, the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government´s commitment to such policies.

Finally, to create a proxy variable of institutional trust (IT), we use factor analysis to summarize in a single factor the information of PR, RL, CC, and GE (eigenvalue 3.66).

From World Bank World Development Indicators (WDI), and given the macroeconomic variables available with the IEF, a series of variables are analyzed to be used as control variables (taking care of multicollinearity concerns). Given the suggestions of prior empirical studies, the final list of controls includes: population (millions) entered in logarithms, GDP per capita (PPP) entered in logarithms, GDP growth rate (%), inflation (%), unemployment (%), foreign direct investment (FDI) inflow (millions) entered in logarithms, and average tariff rate (%). The final sample includes 88 countries over the years 2013-2018, with missing observations for some variables, thus affecting the number of observations included in the regression analysis. Table 1 shows basic descriptive statistics. In the annex, Table A presents the list of countries and Table B presents the correlation matrix of the key variables under study.

Table 1 Descriptive statistics

2.1 Empirical approach

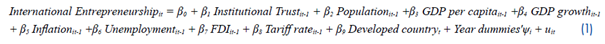

Equation (1) provides the econometric specification. In most regressions, the Hausman test indicates the use of the random effect models. Accordingly, this is the main method of estimation, often used in social science research, allowing the possibility that the effect of the explanatory variables varies across different countries.

The advantages of panel data in comparison with cross-sectional data are well known, including in the empirical analysis of institutional trust (Sønderskov & Dinesen, 2016). Panel data are more informative, show more variability and less collinearity among variables, and minimize bias from omitted, confounding, and time-invariant variables. In this context, note that the independent variables are entered with a one-year lag to account for endogeneity concerns, year dummies are entered to account for time-invariant variables, and a dummy variable for developed countries is included in the regression model given the expectation that the role of trust for internationalization should be different between high- and low-income countries. Moreover, we include a rich set of control variables.

Results

3. Results and discussion

All estimates in Table 2 were computed via random-effects models. The regression results of the full sample are in columns (1) to (4), suggesting that institutional trust (IT) is not associated with the rate of high-exporting entrepreneurs (TEAEXPHIGH) and strong international orientation (TEAEXPST). In contrast, there is evidence supporting a statistically significant positive link between IT and internationalization, when the latter is approached with the rate of low-exporting entrepreneurs (TEAEXPLOW) and the index of weak international orientation (TEAEXPWK).

Table 2 Random-effects estimates

The main difference between TEAEXPLOW and TEAEXPWK versus TEAEXPHIGH and TEAEXPST is the percentage of customers from outside the country. Because small and medium-sized enterprises (SMEs) are less resource endowed and less competitive firms than large companies (Wright et al., 2007; Zhu et al., 2007), it is possible to assume that, mostly, large companies (e.g., transnationals) are associated with a large percentage of customers from outside the country (TEAEXPHIGH) and a strong international orientation (TEAEXPST). For their part, SMEs are largely associated with a small percentage of customers from outside the country (TEAEXPLOW) and a weak international orientation (TEAEXPWK). Therefore, the regression results suggest that institutional trust is only relevant in the case of SMEs.

This finding agrees with prior empirical studies suggesting that institutional trust should be more important for SMEs. For example, in Russia, it has been noted that SMEs show low levels of international activity, despite government support (Shirokova & McDougall-Covin, 2012). Similarly, the disadvantages of the internationalization of SMEs have been noted in China, in the case of guanxi relationships (Ngoma, 2016). As such, the current results indicate that the lack of institutional trust is behind SMEs’ low internationalization levels, such as in Russia and China. Thanks to the method of the present research, this finding can be generalized.

The regression results do not suggest that the role of trust in developed and developing countries is different; indeed, the dummy for developed countries is not statistically significant. However, this could be a result of multicollinearity concerns. It is well known that the levels of institutional trust are higher in developed countries. In addition, prior empirical studies suggest that trust plays a major role in the domestic entrepreneurial activities of developing countries (Sohn & Kwon, 2018). Furthermore, it has been noted that “dishonest individuals are the more trusting individuals in countries with poor institutions, and the less trusting in countries with good institutions” (Anguera-Torrell, 2020).

Therefore, institutional trust should not play a major role in developed countries. In contrast, in developing countries, the role of trust in the process of internationalization should be highly significant. As such, for a deeper understanding, the regression analysis is replicated by subsamples of developed (columns 5 to 8 in Table 2) and developing countries (columns 9 to 12 in Table 2).

Now, the empirical evidence suggests that institutional trust does not play a significant role in the process of internationalization of companies from developed countries. In none of the regressions are the IT coefficients statistically significant. In contrast, in the case of developing countries, the results are robust in the case of low-exporting entrepreneurs (TEAEXPLOW) and weak international orientation (TEAEXPWK). Hence, the findings suggest that institutional trust only plays a major role in developing countries and their SMEs.

As robustness checks, the regression analysis is replicated using separately the proxies of institutional trust, PR, RL, CC, and GE, including the IEF because of its strong correlation with the quality of institutions and people’s trust in them (Mangeloja et al., 2022; Ovaska & Takashima, 2021). With a focus on TEAEXPLOW, the main results are reported in Table 3. Overall, these regression results favor the main finding: institutional trust is significantly associated with entrepreneurial internationalization, particularly for developing countries and their SMEs.

In addition, many different specifications were explored, including and excluding control variables (to account for potential multicollinearity issues), without the lag-structure, and without the logarithmic transformation of some control variables. In addition to fixed effects, population-averaged and system GMM models were also analyzed. The main findings of the robustness checks, unreported due to lack of space and available upon request, are qualitatively the same as those computed via random-effects models.

Table 3 Additional robustness checks. Dependent variable: TEAEXPLOW

Concluding

4. Concluding remarks

Trust is a key variable that determines entrepreneurship (Mangeloja et al., 2022; Ovaska & Takashima, 2021; Smith & Lohrke, 2008; Sohn & Kwon, 2018; Trigkas et al., 2021), including entrepreneurial internationalization according to the main findings of this research. However, for internationalization, the relevance of institutional trust is robust only in the case of SMEs from developing countries.

An advantage of the current research is the use of panel data, yet two limitations of this study should be explicitly acknowledged. The first is limitations due to data availability in time and countries. Particularly, the proxy variables for internationalization are available from 2013 to 2018. Second, this research uses data aggregated at the country level. Consequently, future research should test the findings directly measuring trust and internationalization in a representative sample of SMEs. Note that this research and prior findings of case studies in Russia (Shirokova & McDougall-Covin, 2012) and China (Ngoma, 2016), should be useful to develop this research line.

In addition, for success in the process of internationalization in developing countries, it should be expected that knowledge-based or individual trust could be treated as a substitute for institutional trust (Welter, 2012; Welter & Smallbone, 2011). This should be explored in further research, the data on trust from the World Values Survey (WVS) could likely be useful.

Finally, there are two practical implications. First, policymakers should improve the quality of institutions not only to support economic growth, as is well known, but also to support entrepreneurial internationalization. Second, for practitioners, the lack of institutional trust in the country of origin must be overcome in order to successfully engage their companies in the internationalization process.

Acknowledgment

The authors thank the anonymous reviewer for critically reading the manuscript and suggesting substantial improvements. The study was implemented in the framework of the project Economía y Finanzas, inside of the Doctorado en Ciencias Empresariales at the Universidad Panamericana, Campus Guadalajara, México, where E.D. Tovar-García is the Ph.D. supervisor of F. De Anda and J.C. Baker

Notes

[1] The percentage of 18-64 population who are either a nascent entrepreneur or owner-manager of a new business.

[2] Another option is the total rate of exporting entrepreneurs (TEAEXP), calculated as 100 minus the percentage of entrepreneurs without customers outside their country. However, the TEAEXP figures (mean 47.37879; standard deviation 24.54248) are very similar to those of TEAEXPWK (mean 47.37627; standard deviation 24.50879). In practice, both variables yield the same regression results.

References

(1)

(1)