Article

DOI:

https://doi.org/10.18845/te.v17i3.6846

Lean manufacturing is the financial performance and sustainable finances problems solution?

¿La manufactura esbelta es la solución a los problemas del rendimiento financiero y las finanzas sustentables?

TEC Empresarial, Vol. 17, n°. 3, (September - December, 2023), Pag. 1 - 19, ISSN: 1659-3359

AUTHORS

Gonzalo Maldonado-Guzmán *

Departamento de Mercadotecnia, Centro de Ciencias Económicas y Administrativas, Universidad Autónoma de Aguascalientes, México.

gonzalo.maldonado@edu.uaa.mx.

![]()

Sandra Yesenia Pinzón-Castro

Departamento de Mercadotecnia, Centro de Ciencias Económicas y Administrativas, Universidad Autónoma de Aguascalientes, México.

yesenia.pinzon@edu.uaa.mx.

![]()

Raymundo Juárez-del Toro

Facultad de Contaduría y Administración, Universidad Autónoma de Coahuila Unidad Torreón, México.

r.juarez@uadec.edu.mx.

![]()

* Corresponding Author: Gonzalo Maldonado-Guzmán

ABSTRACT

Abstract

Lean manufacturing is gaining popularity among scientific, academic, and business communities; and is considered a valid strategy to generate financial performance and more sustainable finance. However, little is known about the influence of lean manufacturing on financial performance and sustainable finance of firms in the automotive industry. This study explores the relationship between lean manufacturing, financial performance and sustainable finance. The data was obtained from a self-administered questionnaire distributed to 460 Mexican firms that operate in the automotive industry. The results of the structural equation model (partial least squares) suggest that lean manufacturing have a positive and significant influence on both financial performance and sustainable finance.

Keywords: Lean manufacturing, financial performance, sustainable finance, automotive industry.

Resumen

La manufactura esbelta está ganando popularidad entre las comunidades científica, académica y empresarial, y se considera una estrategia válida para generar rendimiento financiero y finanzas más sostenibles. Sin embargo, se sabe poco sobre la influencia de la manufactura esbelta en el rendimiento financiero y las finanzas sostenibles de las empresas de la industria automovilística. Este estudio explora la relación entre la manufactura esbelta, el rendimiento financiero y las finanzas sostenibles. Los datos se obtuvieron a partir de un cuestionario autoadministrado distribuido a 460 empresas mexicanas que operan en la industria automotriz. Los resultados del modelo de ecuaciones estructurales (mínimos cuadrados parciales) sugieren que la manufactura esbelta tiene una influencia positiva y significativa tanto en el desempeño financiero como en las finanzas sustentables.

Palabras clave: Manufactura esbelta, rendimiento financiero, finanzas sustentables, industria automotriz.

Introduction

1. Introduction

In the last two decades, various initiatives have been adopted to make manufacturing processes more sustainable, and among all these initiatives, lean manufacturing is considered one of the most important solutions that have generated better results (Naeemah & Wong, 2023), particularly because lean manufacturing comprises a wide diversity of tools (Leksic et al., 2020). In addition, lean manufacturing allows managers of manufacturing companies to manage available resources more effectively and efficiently (Marie et al., 2022), as well as substantially improve the level of sustainability of the organization (Taucean et al., 2019; Marques et al., 2022). Lean manufacturing, which has been implemented in a variety of companies around the world, plays a fundamental role not only in business success (Chikán et al., 2022), but also in generating greater financial performance and sustainable performance (Alaaraj & Bakri, 2019).

In this sense, studies previously published in the literature have provided empirical evidence showing that lean manufacturing, can have significant positive impacts on financial performance of manufacturing firms (Fullerton & Wempe, 2009; Hofer et al., 2012; Negrao et al., 2019), and if lean manufacturing is adopted as a holistic strategy, it can also have significant positive effects on operational performance (Fullerton et al., 2014), as well as on the generation of more sustainable finances (Alaaraj & Bakri, 2019). However, as suggested by Bhasin (2012) , the benefits in financial performance derived from the implementation of lean manufacturing are not always obvious, since the connection between lean manufacturing and the measurement of the financial aspects of firms are very fragile, which can be considered as inconclusive and open to debate the relationship between these three constructs, for which researchers and academics need to provide more empirical evidence to strengthen this relationship (Dieste et al., 2021).

Therefore, the objective of this study is the analysis and discussion of the relationship between lean manufacturing, financial performance, and sustainable finance. To achieve this objective, an empirical study was carried out in the manufacturing firms of the automotive industry in Mexico, with a sample of 460 firms and estimating the model using Partial Least Squares Structural Equation Modeling (PLS-SEM), with the support of SmartPLS 4.0 software (Ringle et al., 2022). Furthermore, it is important to establish that the automotive industry is interesting for two basic reasons. First, because the production of vehicles in most of the manufacturing firms that make up the automotive industry in Mexico, like that prevailing in developing countries, is generally incompatible with care for sustainable development (Scur et al., 2019). Second, it is the industry that generates both a higher level of pollution (Farkavcova et al., 2018), and a greater contribution to the growth and economic development of Mexico.

Additionally, lean manufacturing has not always generated successful results in all manufacturing firms around the world where it has been adopted and implemented (Benkarim & Imbeau, 2021). Despite the popularity of lean manufacturing in scientific, academic, and business community, the results of its application in companies are positive and negative (Naeemah & Wong, 2023), mainly due to the inappropriate use of the tools and the lack of understanding of the scales for their measurement (Salonitis & Tsinopoulos, 2016). According to some studies published in the literature, the failure rate of the implementation of lean manufacturing in manufacturing firms ranges between 50 and 90% (Esfandyari & Osman, 2010; Gerger & Firuzan, 2012; Secchi & Camuffo, 2019), even though lean manufacturing has been shown to improve performance and effectiveness of organizations through the elimination of processes that do not generate value (Quin & Liu, 2022).

In this sense, there is a need in the literature to provide robust empirical evidence in favor of the successful application of lean manufacturing, and its effect on manufacturing firms performance (Naeemah & Wong, 2023). Thus, this study contributes to lean manufacturing literature in two essential aspects. First, the inconsistency in the results of empirical studies previously published in the literature, which confirm that the relationship of lean manufacturing with financial aspects does not always assume tangible results (Losonci & Demeter, 2013; Ghobakhloo & Azar, 2018), may even have negative results (Galeazzo & Furlan, 2018), especially in sustainable finance (Bevilacqua et al., 2017a). Second, it contributes to the generation of knowledge of the effects and conditions in which lean manufacturing affect financial performance and sustainable finance (Dieste et al., 2021). Finally, these results may have important implications for entrepreneurs in the automotive industry, industry professionals, and government authorities.

2. Literature review and hypothesis

2.1 Lean manufacturing and financial performance

Lean manufacturing can be defined as a philosophy, concept or technique of manufacturing products that minimizes environmental effects and eliminates industrial waste and maximizes the use of available resources in the organization, to economically transform raw materials into finished products (Henao et al., 2019). For this reason, lean manufacturing has proven to be the most effective strategy for eliminating waste and activities that do not generate value (Gupta & Sharma, 2016), as well as for improving efficiency, productivity, income, value for the customer, and, particularly, financial performance of companies (Debnath et al., 2023). However, lean manufacturing not only seeks to improve value for customers, but also the elimination of industrial waste that is deposited in landfills to minimize environmental impact, CO2 emissions and the negative impact of production processes by environment (Baliga et al., 2019), which generates an increase financial performance (Alaaraj & Bakri, 2019).

Regarding the adoption and implementation of lean manufacturing in Mexican companies, there are relatively few studies that have focused on its analysis and discussion, some have focused on its implementation (Mitchell & Moreno, 2005; Bednarek & Niño-Luna, 2008; Colin-Lozano et al., 2019), process improvement (Niño-Luna, 2010; Flores et al., 2011), critical success factors (Pérez-Pucheta et al., 2019; De la Vega et al., 2020; Martínez-Martínez, 2021), production planning (Alvarado-Iniesta et al., 2014; Hernández-Vázquez et al., 2021), sustainability (Pazos et al., 2009; Monge et al., 2013) and, finally, sustainable economic performance (García-Alcaraz et al., 2021; García-Alcaraz et al., 2022). However, none of the studies carried out in companies in Mexico have focused on the relationship of lean manufacturing and financial performance of manufacturing firms, hence the importance of this study.

However, there is empirical evidence in the literature that has shown that the implementation of lean manufacturing in manufacturing firms in any country in the world has not always generated successful results (Benkarim & Imbeau, 2021). On one hand, there are studies that have found a negative relationship between lean manufacturing and financial performance, for example, Bevilacqua et al. (2017a) found that lean manufacturing does not generate a positive effect in financial performance, possibly these results are derived from an inadequate application of lean manufacturing tools, lack of employee training, limitation of resources or absence of development policies. Bevilacqua et al. (2017b) found that there is no difference in the application of lean manufacturing and low and high level of financial performance. Ghobakhloo and Azar (2018) reached the same conclusion, finding that lean manufacturing only has significant positive effects on operational performance, but not on financial performance. Finally, Galeazzo and Furlan (2018) , establishes that lean manufacturing does not always generate good results in firms’ financial performance.

On other hand, there are many studies that have found a positive relationship between lean manufacturing and business performance in manufacturing firms, for example, Chavez et al. (2015) suggested that lean manufacturing is positively associated with financial performance on manufacturing firms; while Nawanir et al. (2016) reached the same conclusion, finding that lean manufacturing generates a significant positive impact on financial performance. Sahoo and Yadav (2018) provided significant positive evidence of the relationship between lean manufacturing and financial performance on manufacturing firms. Negrao et al. (2019) reached the same conclusion, finding that lean manufacturing generates significant positive effects on sales and profit margin (financial performance); while Sahoo (2019) also obtained similar results, finding that lean manufacturing has a positive relationship with sales performance (financial performance). Finally, Shrafat and Ismail (2019) considered that lean manufacturing contributes directly to increasing the profit margin of manufacturing firms.

Despite the abundant empirical evidence existing in the current literature that has demonstrated the various benefits that the adoption and implementation of lean manufacturing has generated in manufacturing firms of different sectors, sizes, and countries (De Oliveira et al., 2019; Sordan et al., 2020), it is still not clear in organizations the results that would be obtained in the application of lean manufacturing practices at the level of financial performance (Arda et al., 2019), since the results obtained up to the have not always been positive (Naeemah & Wong, 2023), for which the relationship between lean manufacturing and financial performance is not yet clear (Benkarim & Imbeau, 2021). Therefore, researchers, academics, and industry professionals need to provide robust empirical evidence of the positive effects that lean manufacturing has on financial performance (Naeemah & Wong, 2023). Thus, considering the information presented above, it is possible to propose the following research hypothesis.

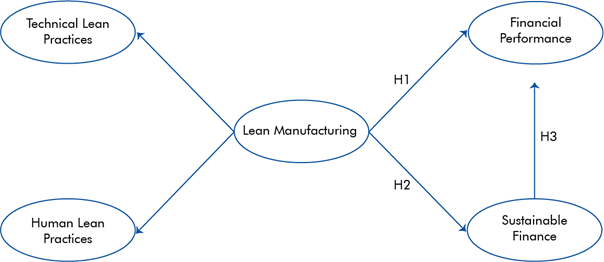

H1: The greater implementation of lean manufacturing, the greater financial performance

2.2 Lean manufacturing and sustainable finances

Lean manufacturing is a methodology that has gained great popularity among scientific, academic, and business community (Naeemah & Wong, 2023), because its application usually improves the effectiveness of sustainable performance and increases the level of competitiveness of manufacturing firms (Carvajal-Arango et al., 2019). These results encourage other companies to implement it, since lean manufacturing also allows the reduction of activities that do not add value, increases productivity, reduces variability, accelerates production cycles, and optimizes procedures by reducing the number of parts and steps (Qin & Liu, 2022). Additionally, lean manufacturing can contribute to the substantial improvement of climate change, the use of raw materials, energy, and water, as well as the reduction of air pollution and industrial waste (Afum et al., 2021), which generates an increase in the sustainable performance of manufacturing firms (Hariyani & Mishra, 2022).

According to literature review, there are several recent attempts to combine lean manufacturing and sustainable performance in manufacturing firms (Souza & Alves, 2018; Alaaraj & Bakri, 2019; Hariyani & Mishra, 2022; Dieste et al., 2021). During the last two decades, researchers, academics and industry professionals have analyzed the importance of lean manufacturing activities in different areas of companies (Dieste et al., 2021). In addition, various industries around the world, including the automotive industry, have adopted different lean manufacturing activities that have generated important transformations within organizations, as well as continuous improvement, value creation and elimination of industrial waste, which has allowed a significant increase in the efficiency of operational performance (Dieste et al., 2021), and in sustainable finances (Alaaraj & Bakri, 2019). For this reason, empirical evidence has been provided that suggests that lean manufacturing not only improves operational performance in manufacturing firms, but also sustainable finances (Hariyani & Mishra, 2022).

In the specific case of Mexico, there are few studies that have focused on the analysis of lean manufacturing and sustainability in the manufacturing industry, despite the social, economic, and industrial importance of this sector (García-Alcaraz et al., 2021), and the few studies that have been carried out have focused on the maquiladora subsector (García-Alcaraz et al., 2022). For example, Velázquez et al. (2006) analyzed lean manufacturing with main sustainability practices applied in the maquiladora industry, finding a positive relationship between both concepts; while Velázquez et al. (2014) analyzed main practices of pollution prevention and clean production, finding a positive relationship. Garcia et al. (2014) analyzed application of lean manufacturing with financial performance, finding a positive relationship between both concepts; while Díaz-Reza et al. (2016) analyzed application of lean manufacturing in maquiladoras and the generation of operational benefits, including greater sustainable performance.

In recent studies, Munguía-Vega et al. (2019) found a positive relationship between lean manufacturing and sustainability; while García-Alcaraz et al. (2020) found a positive relationship between information and communication technologies, lean manufacturing critical success factors, and business performance. Morales-García et al. (2021) found positive effects between lean manufacturing, overall team efficiency, and social sustainability, while García-Alcaraz et al. (2021) found a positive relationship between application of lean manufacturing tools and economic sustainability. Finally, García-Alcaraz et al. (2022) found a positive relationship between lean manufacturing tools on sustainable performance in the maquiladora industry. In the context of the automotive industry, Martínez-Martínez (2021) found that the implementation of lean manufacturing generated a positive impact on workers and business results.

However, it is observed that most of the studies carried out in Mexico, as in any other country in the world, have focused on the relationship of lean manufacturing with environmental and social sustainability, leaving aside financial sustainability (de Oliveira et al., 2019), for which it is important to guide the studies in the analysis of these two constructs. In recent studies published in the literature, theoretical and empirical evidence has been provided of the relationship between lean manufacturing and sustainable performance, which allows not only to significantly increase the productivity and flexibility of the production processes of manufacturing firms, among those found in the automotive industry, but also sustainable finances (Buer et al., 2018). In this same line, Iranmanesh et al. (2019) , analyzed the impact of lean manufacturing on sustainable financial performance of manufacturing firms, and found that it allowed firms to win new customers and reduce production costs, by reducing industrial waste. Therefore, considering the information presented above, it is possible to propose the following research hypothesis.

H2: The greater implementation of lean manufacturing, the greater sustainable finances

2.3 Sustainable finances and financial performance

Sustainability, sustainable finances, and financial performance are an increasingly recurring topic in literature, and they are not easy to define, due to the different approaches that have been given to them. However, it is possible to define sustainability as "a process that integrates activities focused on achieving a balance between the environment, society and the economic areas of the company, through the appropriate use of resources" (García-Alcaraz et al., 2022, p. 39625), which is made up of environmental sustainability, social sustainability, and economic sustainability, the latter being the least analyzed in literature (de Oliveira et al., 2019). For its part, financial sustainability being a recent concept in the literature that emerged in the late 1990s (Zhou & Xu, 2022), it should not be surprising that there is no unified definition (Lee & Lee, 2022), but it is possible to define this concept as "financial resources and support intended to mitigate climate change and improve environmental quality and performance" (Bakry et al., 2023, p. 342 ).

Regarding financial performance, there is no unified definition in literature because it depends upon various factors such as board independence (Jaidi et al., 2021), board meetings (Eluyela et al., 2018; Buchdadi, 2019), woman director on the board (Jyothi & Mangalagiri, 2019), and board size (Shunu, 2017). According to this study, financial performance is defined as “the system that not only allows an organization to cascade down its business performance measures, but also provides it with the information necessary to challenge the content and validity of the strategy” (Ittner et al., 2003, p.716 ). In this context, He et al. (2019) , as well as Lee and Lee (2022) , considered that sustainable finances can encourage manufacturing firms to make greater investments in environmentally friendly projects, thus contributing to the development of a sustainable financial system, the which will improve both sustainable development and financial performance.

In the case of Mexico, the progress of sustainable finances has been slowed down by the global economic crisis, presenting great challenges not only for the country but also for Latin America and the Caribbean (López, 2022). However, in Mexico, as in Latin American countries, substantial progress was made in the management of environmental and social risks, particularly identifying, valuing, and disclosing the climate risks generated by manufacturing firms (Canchignia-Bassantes & Cárdenas-Perez, 2023). Faced with this situation, López (2021) considered that the sustainable finances of manufacturing firms in Latin American countries have a very long way to go, if they want to horizontally integrate sustainability in organizations and take advantage of financing opportunities that promote a sustainable economy.

However, while some studies have established the existence of a positive relationship between sustainable finances and financial performance of manufacturing firms (Park & Ghauri, 2015; Liu et al., 2016; Deephuose et al., 2016), other studies have found a negative relationship between both constructs (Neiling & Webb, 2009; Islam et al., 2012; Nobanee & Ellili, 2016), for which it is possible to establish that there is no consensus in literature, and the debate is open in the literature (Osadume & Ojovwo, 2021). To reach a consensus on the positive relationship between sustainable finances and financial performance, resent studies provided robust empirical evidence that demonstrates this relationship (Osadume & Ojovwo, 2021). Thus, the most notable empirical arguments are in the studies by Platonova et al. (2018) , and Mehmet et al. (2019) , provided empirical evidence that demonstrates a positive relationship between both constructs, using the statistical techniques of panel effects regression and a two-way ordinal regression.

In this sense, sustainable finances integrate all those green, social, and environmental financial activities that have been adopted and implemented in companies, which generally have the essential objective of significantly increasing long-term both sustainability and stability of financial performance of companies (ICMA, 2020). For this reason, Urban and Dariusz (2019) proposed the multilevel perspective model to describe the transition from traditional finance to sustainable finances, which was improved by Ziolo et al. (2019) , by adding social exclusion and negative externalities in the sociotechnical dimension of the model and indicated that the green economy and the financial market play an essential role in the level of innovation of companies. Thus, the traditional financial system of companies becomes sustainable if it considers the needs and requirements of the economy, society, and the environment, which has greater possibilities of increasing financial performance (UNEP, 2015). Therefore, considering the information presented in the previous paragraphs, it is possible to propose the following research hypothesis.

H3: The higher the level of sustainable finances, the higher the level of financial performance

Figure 1 can better appreciate the planting of the three research hypotheses of this study.

Methods

3. Methodology

3.1. Sample design and data collection

The study was carried out in Mexico, particularly in the manufacturing firms that make up the automotive industry, which had a registry of 950 companies as of January 30, 2020. In addition, it is important to establish that the manufacturing firms surveyed are registered in different business chambers and belong to various local, regional, national, and international organizations, for which the empirical study did not focus on a particular group or association. Additionally, the analysis of the automotive industry was considered pertinent, which is essentially concentrated in the center and north of the country, not only because it is one of the industries that generates an important percentage of the gross domestic product, and high levels of employment, but also because the growth and development of the Mexican economy and society are based on the automotive industry.

Secondary data was collected from companies registered with the Mexican Association of the Automotive Industry (AMIA) during the first month of 2020, using a structured questionnaire which was applied through a personal interview to each of the managers, from a sample of 460 companies selected by simple random sampling, with a maximum error of ±4% and a reliability level of 95%, applying the survey during the months of april to september 2020. Pilot studies are essential to ensure validity when questionnaires are self-administered or contain self-developed scales (Bryman, 2016; Hair et al., 2016). Table 1 presents some of the most relevant characteristics of the sample of 460 manufacturing firms used in this study, and it is observed that a little more than 66% of the manufacturing firms of the Mexican automotive industry have more than 10 years in the market; a little more than 73% are small and medium-sized companies; and a little more than 73% are non-family businesses.

Table 1 Sample characteristics

3.2 Variables measurement

Lean manufacturing is commonly measured through multiple perspectives such as philosophy, practices, manufacturing system, manufacturing paradigms, performance capabilities, and socio-technical systems (Treville & Antonakis, 2006; Shah & Ward, 2007; Hong et al., 2014). From these perspectives, socio-technical systems offer a more holistic view of lean manufacturing, since lean manufacturing practices are, by nature, technically oriented on how machinery and equipment work, how production systems work, and how it is given maintenance to the team (Hyer et al., 1999), as well as human elements in how employees are empowered, what the culture of teamwork is like, and how relationships with suppliers are built (Likert, 2004). In this context, for lean manufacturing measurement, an adaptation was made to the scale developed by Möldner et al. (2020) , who considered that lean manufacturing can be measured through two factors.

On one hand, technical lean practices which are defined as an extension of the implementation of technical aspects of improvement programs of manufacturing firms, which include computerized systems, product tracking devices, and data management systems (Hong et al., 2014), being measured through 5 items. On other hand, human lean practices which refer to implementation of socio-behavioral aspects of company improvement programs, which include the empowerment of workers, and continuous improvement through systematic initiatives, being measured by means of 5 items. Financial performance was measured an adaptation to the scale developed by Leonidou et al. (2013) , which can be measured through 6 items, and sustainable finances was measured an adaptation was made to the scale proposed by Bansal (2005) , and Chan (2005), which can be measured through 6 items.

As a step prior to the analysis of data obtained, the database was cleaned to eliminate the possible errors generated in its capture, as well as to replace the missing values with the arithmetic mean of the sample of the corresponding question, that is, those questions that were not answered by manufacturing firms, thus replacing only five missing values. Once this activity was completed, the data was analyzed using PLS-SEM to determine, on one hand, reliability and validity of the measurement scales used and, on other hand, to respond to the hypotheses posed. Table 2 shows the items used to measure lean manufacturing, financial performance, and sustainable finances, and it can be seen that all the items of the three scales have a factorial load greater than 0.70, as well as values of Cronbach's Alpha, Dijkstra-Henseler rho, and CRI greater than 0.7, and AVE values greater than 0.5 (Hair et al., 2019), which allows establishing the existence of reliability and validity of the three measurement scales used.

Table 2 Measurement model assessment

3.1. Sample design and data collection

The study was carried out in Mexico, particularly in the manufacturing firms that make up the automotive industry, which had a registry of 950 companies as of January 30, 2020. In addition, it is important to establish that the manufacturing firms surveyed are registered in different business chambers and belong to various local, regional, national, and international organizations, for which the empirical study did not focus on a particular group or association. Additionally, the analysis of the automotive industry was considered pertinent, which is essentially concentrated in the center and north of the country, not only because it is one of the industries that generates an important percentage of the gross domestic product, and high levels of employment, but also because the growth and development of the Mexican economy and society are based on the automotive industry.

Secondary data was collected from companies registered with the Mexican Association of the Automotive Industry (AMIA) during the first month of 2020, using a structured questionnaire which was applied through a personal interview to each of the managers, from a sample of 460 companies selected by simple random sampling, with a maximum error of ±4% and a reliability level of 95%, applying the survey during the months of april to september 2020. Pilot studies are essential to ensure validity when questionnaires are self-administered or contain self-developed scales (Bryman, 2016; Hair et al., 2016). Table 1 presents some of the most relevant characteristics of the sample of 460 manufacturing firms used in this study, and it is observed that a little more than 66% of the manufacturing firms of the Mexican automotive industry have more than 10 years in the market; a little more than 73% are small and medium-sized companies; and a little more than 73% are non-family businesses.

Table 1 Sample characteristics

3.2 Variables measurement

Lean manufacturing is commonly measured through multiple perspectives such as philosophy, practices, manufacturing system, manufacturing paradigms, performance capabilities, and socio-technical systems (Treville & Antonakis, 2006; Shah & Ward, 2007; Hong et al., 2014). From these perspectives, socio-technical systems offer a more holistic view of lean manufacturing, since lean manufacturing practices are, by nature, technically oriented on how machinery and equipment work, how production systems work, and how it is given maintenance to the team (Hyer et al., 1999), as well as human elements in how employees are empowered, what the culture of teamwork is like, and how relationships with suppliers are built (Likert, 2004). In this context, for lean manufacturing measurement, an adaptation was made to the scale developed by Möldner et al. (2020) , who considered that lean manufacturing can be measured through two factors.

On one hand, technical lean practices which are defined as an extension of the implementation of technical aspects of improvement programs of manufacturing firms, which include computerized systems, product tracking devices, and data management systems (Hong et al., 2014), being measured through 5 items. On other hand, human lean practices which refer to implementation of socio-behavioral aspects of company improvement programs, which include the empowerment of workers, and continuous improvement through systematic initiatives, being measured by means of 5 items. Financial performance was measured an adaptation to the scale developed by Leonidou et al. (2013) , which can be measured through 6 items, and sustainable finances was measured an adaptation was made to the scale proposed by Bansal (2005) , and Chan (2005), which can be measured through 6 items.

As a step prior to the analysis of data obtained, the database was cleaned to eliminate the possible errors generated in its capture, as well as to replace the missing values with the arithmetic mean of the sample of the corresponding question, that is, those questions that were not answered by manufacturing firms, thus replacing only five missing values. Once this activity was completed, the data was analyzed using PLS-SEM to determine, on one hand, reliability and validity of the measurement scales used and, on other hand, to respond to the hypotheses posed. Table 2 shows the items used to measure lean manufacturing, financial performance, and sustainable finances, and it can be seen that all the items of the three scales have a factorial load greater than 0.70, as well as values of Cronbach's Alpha, Dijkstra-Henseler rho, and CRI greater than 0.7, and AVE values greater than 0.5 (Hair et al., 2019), which allows establishing the existence of reliability and validity of the three measurement scales used.

Table 2 Measurement model assessment

Results

4. Results

4.1. Reliability and validity of measurement scales. measurement model

The data of the empirical study were generated through the design of a survey and analyzed using the SmartPLS 4.0 software. Additionally, statistical analyzes in terms of the structural equation model, partial least squares were used to measure the effects of lean manufacturing on financial performance and sustainable finances. In addition, the evaluation of the reliability of the measurement scales of the three constructs was carried out using Cronbach's Alpha, Composite Reliability Index (CRI), Dijkstra-Henseler rho, and Average Variance Extracted (AVE) (Hair et al., 2019), while the discriminant validity was evaluated through two tests: Fornell and Larcker Criterion, and Heterotrait-Monotrait (HTMT) ratio (Henseler et al., 2015; Hair et al., 2019).

The results obtained from PLS-SEM application (Table 3), show that both Cronbach's alpha, CRI, and Dijkstra-Henseler rho have values that range between 0.904 - 0.957; 0.925 - 0.966; 0.906 - 0.957, respectively, which indicates that they are good data and are above recommended values by Bagozzi and Yi (1988) , and Hair et al. (2019) , AVE has values that range between 0.638 - 0.852, which are above recommended values by Fornell and Larcker (1981) , Bagozzi and Yi (1988), while Fornell and Larcker Criterion is significant because AVE values are higher than the square of the correlations between each pair of constructs, HTMT has values that range between 0.198 - 0.569 which are higher than recommended value of 0.08 (Henseler et al., 2015), which indicate the existence of discriminant validity of the three measurement scales used.

Table 3 Measurement model. reliability, validity and discriminant validity

4.2. Structural model

To respond the hypotheses raised in this study, the use of PLS-SEM was considered pertinent, through SmartPLS 4.0 software (Ringle et al., 2022). Furthermore, it is important to establish that PLS-SEM is commonly used in two essential aspects. On one hand, in theories that have not been widely developed in literature (Hair et al., 2019), from a diversity of knowledge disciplines, particularly in business sciences (do Valle & Assaker, 2015; Richter et al., 2016). On other hand, when the central objective of using PLS-SEM is prediction and explanation of the research model basic constructs (Rigdon, 2012), which facilitates measurement error explanation and has greater statistical power than regression multiple sums of scores (Hair et al., 2021). Table 4 shows the results obtained from the application of the structural model.

Table 4 Structural model

[i] Note: LM: Lean Manufacturing; TLP: Technical Lean Practices; HLP: Human Lean Practices; FIP: Financial Performance; SUF: Sustainable Finance. One-tailed t-values and p-values in parentheses; bootstrapping 95% confidence intervals (based on n = 5,000 subsamples) SRMR: standardized root mean squared residual; dULS: unweighted least squares discrepancy; dG: geodesic discrepancy; NFI: normal fit index; HI99: bootstrap-based 99% percentiles.

Table 4 indicate the estimated data obtained show acceptable levels by generating an adjusted R2 greater than 0.10 (Henseler et al., 2014; Hair et al., 2019). Similarly, SRMR value of 0.070 is lower than the recommended value of 0.080 (Hu & Bentler, 1998), as well as values of geodetic discrepancy (dG) 0.445, and unweighted least squares discrepancy (dULS) 1.471, are higher to HI99 values (0.501 and 1.992, respectively), which allows verifying the significance of the research model used (Dijkstra & Henseler, 2015). In summary, estimated data verify that lean manufacturing has positive effects, both at financial performance (0.382; p-value 0.000), and sustainable finances (0.215; p-value 0.000), and sustainable finances also has positive effects on financial performance (0.437; p-value 0.000) in manufacturing firms.

Additionally, estimated data provide robust empirical evidence in favor of hypothesis H1, which establishing that lean manufacturing increase financial performance of manufacturing firms in automotive industry and are consistent in line to Negrao et al. (2019) , De Oliveira et al. (2019), and Sordan et al. (2020) . The main reasons that could explain this positive effect are, on one hand, the knowledge that managers have of different benefits generated by the application of lean manufacturing, not only in terms of reducing industrial waste, but also in economic and financial terms. On other hand, the strong pressure that manufacturing firms in automotive industry have on the part of clients, stakeholders, and the public administration to reduce both the levels of emission of polluting gases, and industrial waste that are deposited in landfills, as well as to produce vehicles that do not use fossil fuels (hybrid and electric) to make them more environmentally friendly.

These results also verify that lean manufacturing has positive effects on sustainable finances of manufacturing firms in automotive industry, which provides empirical evidence in favor of hypothesis H2, and are consistent with the results obtained by Martínez-Martínez (2021) , García-Alcaraz et al. (2021) , and García-Alcaraz et al. (2022). The main reasons that could explain this positive effect are, on one hand, increasing use of various tools that make up lean manufacturing in manufacturing firms in automotive industry (e.g., lean six sigma, just-in-time, total quality management), which has allowed not only to reduce production costs by using recycled materials, but also to improve its financial sustainability. On other hand, by using more renewable energy in vehicles production and the reuse of materials from vehicles that have completed their life cycle, companies in the automotive industry have not only reduced non-compliance with regulations environmental issues, but also to increase their sustainable finances.

Finally, estimated data also verify that sustainable finances have a positive impact on financial performance of manufacturing firms in automotive industry, thereby providing robust empirical evidence in favor of hypothesis H3 and being consistent with results found by López (2021) , López (2022), Canchignia-Bassantes and Cárdenas-Pérez (2023) . The main reasons that could explain this positive effect on manufacturing firms in automotive industry are, on one hand, the financial costs of implementing projects that improve sustainability, since generally these financial costs are lower compared to the benefits obtained in increasing financial performance of organizations. On other hand, companies in the automotive industry contribute to improving the environment and global warming by financing projects that reduce CO2 emissions and volatile organic compounds into the atmosphere.

4.3 Implications and limitations

The data estimated have different implications for managers, automotive industry manufacturing firms, and public administration. On one hand, strong national and international partner pressure to which executives of manufacturing firms in automotive industry are exposed, due to adoption and implementation of new production systems that substantially reduce industrial solid waste sent to landfills municipal, and the emission of polluting gases into the atmosphere that damage environment, which requires managers not only to incorporate new tools that improve production systems and processes, but also new business models that improve sustainability management through of search for internal and external financing for the development of productive projects that generate a positive impact on sustainable development, both of organization as a whole and of localities where they are located.

However, the adoption and implementation of lean manufacturing is not a common practice in all manufacturing firms that make up automotive industry in Mexico, as in any other Latin American country, coupled with fiscal policies absence that promote the adoption of lean manufacturing various tools that lean manufacturing has, as well as the scarce training of most of the workers of companies. On the contrary, the results obtained in this research work provide robust empirical evidence that establishes that application of lean manufacturing tools positively affects financial performance, as well as the financial sustainability of companies in the automotive industry, for which public administration, not only in Mexico but in any other Latin American country, should promote lean manufacturing practices through policies and training programs.

On other hand, this study, through an extensive review of the literature, incorporates a research model that contemplates lean manufacturing human-technical practices, which have been sparingly used in the literature, and their relationship with financial performance and sustainable finances, which provides a holistic point of view that generates a more complete explanation of the relationship between this three concepts (Osadume & Ojovwo, 2021; Dieste et al., 2021). In this context, implementation of environmental and sustainability activities in manufacturing firms in automotive industry is a relevant issue from the point of view of public administration of the Latin American countries, particularly because it is one of the regions of the planet where high levels of pollution and environmental degradation are generated, derived from the fact that most of manufacturing firms in automotive industry that have settled in the territory lack green technologies, coupled with the lack of strict environmental laws that improve sustainability.

In this sense, public administration must design and implement public policies that promote a multiplier effect in manufacturing firms in automotive industry, not only in the adoption and application of lean manufacturing tools in their production systems, but also in financing projects whose main objective is to improve environment and sustainability. Additionally, both national and international business organizations and chambers related to the automotive industry must facilitate access to sustainable or green financing for all companies that participate in the supply chain, for implementation of productive projects that reduce levels of environmental pollution, which will allow not only to reduce the negative effects of climate change, but also to improve both financial performance and sustainable finances of organizations.

Additionally, this empirical study has several limitations that are important to consider when performing interpretation of the results obtained. First limitation being that referring to the measurement scales of lean manufacturing, financial performance, and sustainable finances, since these three variables were measured with subjective indicators obtained through surveys (subjective data). For this reason, in future studies it will be pertinent to incorporate objective data from manufacturing firms (e.g., percentage in the reduction of time in production processes; percentage in the reduction of production costs, financial statements, number of sustainable projects with financing own), to verify whether the results obtained are similar or not to those obtained in this study.

Second limitation of this study is that the relationship between lean manufacturing practices, financial performance, and sustainable finances may have more significant positive results if a more specific combination of lean manufacturing practices is used throughout a study more holistic research model, that generates a discrimination of the multifaceted concept of lean manufacturing. Therefore, in future studies, lean manufacturing with all their dimensions should be considered, to see if the effects it has both on financial performance, and sustainable finances of manufacturing firms, differ or not from those results obtained in this study.

Concluding

5. Conclusions

The estimated data in this paper allow us to establish three essential conclusions. First, refers to research model used since, on one hand, it shows a high internal correlation by generating a strong significant positive correlation between lean manufacturing, financial performance and sustainable finances, which allowed acceptance the three research hypotheses proposed and, on other hand, offers a more holistic vision by incorporating the indicators that have been scarcely analyzed in the literature, for the measurement of both lean manufacturing, financial performance and sustainable finances. In addition, the publication of empirical studies of lean manufacturing measured through technical and human lean practices, and its relationship with financial performance and sustainable finances, has received little attention from researchers, academics, and industry professionals, compared to those studies that are oriented towards the drivers and conceptualization of lean manufacturing (Dieste et al., 2021; Osadune & Ojovwo, 2021).

In this context, an attentive call is made to scientific, academic, and business community to guide their future studies in the contribution of robust empirical evidence that establishes the positive effects that lean manufacturing has, both in financial performance and Sustainable finances of manufacturing firms since the empirical evidence provided so far in the literature allows us to conclude that the adoption and implementation of lean manufacturing in manufacturing firms does not always generate successful results. Second conclusion derived from estimated data, is that this study confirms that even though there are several studies published in the literature that analyze and discuss the effects of lean manufacturing on performance, only a small part of those studies has focused on the effects of lean manufacturing on financial performance, and studies examining the effects of lean manufacturing on sustainable finances are even rarer.

Finally, a third conclusion of this study is that the results obtained need to be contextualized in future research, in which different types of analysis and characteristics of lean manufacturing practices, financial performance and sustainable finances are considered, since the results expected from the cause-effect of the relationship between lean manufacturing, financial performance, and sustainable finances, will depend on the measurement of the three variables as well as the internal and external contextual conditions in which organizations develop (Dieste et al., 2020). However, it is possible to conclude that lean manufacturing practices are considered in the literature as an excellent option for manufacturing firms in the automotive industry, to explain both successes and failures, not only at the level of financial performance, but also in the generation of sustainable finances (Galeazzo & Furlan, 2018; Dieste et al., 2019).

References