All productive sectors have been affected in some way by the disruption generated by the COVID-19 pandemic. Governments, organizations, and companies have been tested in their levels of resilience to overcome the multiple challenges that arose as a consequence of this situation (Al-Fadly, 2020; Alves et al., 2020; Gregurec et al., 2021). The response capacity of large corporations to crises cannot be compared to that of micro, small, and medium-sized enterprises (MSMEs), which are more vulnerable and therefore are supposed to be much more heavily impacted by such events (Alves et al., 2020). The latter do not have sufficient resources to face crises for prolonged periods and require timely government intervention to alleviate their negative effects (Fitriasari, 2020; Cepel et al., 2020). MSMEs do not have many options to generate income, and they are not sufficiently prepared to face a situation such as the one generated by the pandemic (Chirume & Kaseke, 2020; Bargados, 2021; Albonico et al., 2020). Due to their limited resources and the vulnerability of their supply chains, Paraguayan MSMEs are among the organizations that have been most affected by the consequences of the measures adopted by the government to curb the spread of the virus (Ferrer Dávalos et al., 2022).

The problems most frequently mentioned by MSMEs were those related to the decrease in demand and the consequent reduction in sales and income, as well as the interruption in the supply chain combined with the difficulty in accessing credit (Shafi et al., 2020; Twahirwa et al., 2021; Donthu & Gustafsson, 2020). Along these lines, Korankye (2020) notes that downsizing, organizational restructuring, and the fear of exit during the strongest periods of implementation of mitigation measures with imposed restrictions have also had a major impact on the operations of these types of organizations. Partial or total blockages in their operations have led in many cases to the definitive closure of several ventures, a change of line of business, or a change of business model (Burhan Ismael et al., 2021). This situation has worsened in developing countries such as Paraguay, where on the one hand the limited action of governments and on the other hand the poor quality of the business fabric have had, to a certain extent, an impact on the ability to successfully face this type of crisis (Sánchez-Báez & Sanabria, 2019). In this sense, although most Ibero-American governments have implemented support strategies for MSMEs, it seems that these were poorly designed since they had very little effect on mitigating the loss of income for them (García-Pérez-de-Lema et al., 2021; Sánchez-Báez et al., 2021; Ferrer Dávalos, 2021).

The influence of general and specific characteristics of the business fabric on some business outcomes has been addressed in studies on MSMEs in different contexts (Romero & Martínez-Román, 2012; Martínez-Román & Romero, 2013; Sánchez-Báez et al., 2018; Van Auken et al., 2021). MSMEs around the world have been negatively impacted by the pandemic (Breier et al., 2021; Fairlie, 2020), though some economic sectors have seen minor effects on their sales (Baum & Hai, 2020). However, many of these companies are not sufficiently able to create the conditions for a quick recovery from a crisis (Peric & Vitezic, 2015). Although many studies mention the organizational characteristics of MSMEs (Romero & Martínez-Román, 2012; Martínez-Román & Romero, 2013; Van Auken et al., 2021; Molina-Sánchez et al., 2022), there is not enough evidence in the literature on the specific case of Paraguay. Thus, this article tries to fill the information gap on Paraguayan MSMEs by providing some evidence related to the operations of these companies and the way they have faced the pandemic, since they represent 97% of the productive units in the country and generate approximately 61% of employment (MIC, 2019). Some studies show that the operational capacity of Paraguayan MSMEs and therefore their capacity to generate and maintain jobs has been negatively impacted by the pandemic (Sánchez-Báez et al., 2022). Therefore, taking into account the multiple effects of COVID-19 on businesses, this article studies some organizational characteristics that in some way could have impacted the sales of Paraguayan MSMEs during the pandemic and aims to report what happened in these firms in relation to supplier and supply chain relationships and how sales were affected during this period.

2. Literature Review: Organizational característicos of MSMEs during the COVID-19 crisis

2.1 Organizational characteristics of MSMEs during the COVID-19 crisis

The specialized literature includes organizational characteristics as factors that influence the results of MSMEs (Romero & Martínez-Román, 2012; Martínez-Román & Romero, 2013; Van Auken et al., 2021; Molina-Sánchez et al., 2022). In the context of these characteristics, relationships with customers and suppliers can be mentioned as relevant factors affecting the competitiveness of MSMEs (Porter, 1980). In this sense, the tendency is to see customers and suppliers as stakeholders; therefore, they can effectively facilitate transactions and cooperation along the business chain (Romero & Martínez-Román, 2012). However, a high dependence on certain suppliers can generate a strategic constraint that affects business activities in small and medium-sized companies (Guzmán-Cuevas et al., 2009).

The COVID-19 pandemic has greatly affected supply and demand, which has caused a strain on supplier relationships in companies around the world, especially in MSMEs (Zhang & Fang, 2022). Recent findings suggest that the crisis caused by the pandemic had a significant negative impact on the financial performance, operating performance, profitability, access to financing, and customer satisfaction of MSMEs, which necessarily led to a restructuring of their relationships with suppliers and customers (Xiao & Su, 2022; Nevskaya , 2020; Martínez-Azúa et al., 2021). This situation has generated the fact that these companies, for example, find themselves in a dilemma when trying to meet financial commitments with suppliers within the supply chain, which have undergone modifications due to the effects of the crisis. Effective supplier relationships are recognized as generally driving sales forces to better performance levels (El-Ansary, 1993). However, during the pandemic, supplier relationships have been negatively affected by various factors that have generated delays or shortages in the supply chain; this has prompted certain strategy changes by MSMEs, and in some cases, such changes were key to surviving or even thriving for these companies during the pandemic (Marconatto et al., 2021; Todo & Inoue, 2021). In this context, some studies, such as those conducted by Sarkis (2021) and Kumar et al. (2021) , identified some emerging organizational, consumer, policy, and supply chain behaviors that impacted the performance of firms as effects of the COVID-19 pandemic.

Likewise, Twahirwa et al., (2021) ; and Marconatto et al., (2021) , point out that the main challenges for MSMEs as a result of COVID-19 include, on the one hand, the difficulty in the supply chain to access national and international inputs, and, on the other hand, the inability of customers to pay invoices. According to the literature analyzed on supplier relationships within their supply chain, the following hypothesis is put forward:

H1: The changes observed in supplier relationships (supply chain) due to the pandemic have negatively affected sales in MSMEs.

Likewise, some decisions regarding the activities considered operational and strategic by the business can have an impact on business results (Martínez-Román & Romero, 2013). But in crisis situations, these actions are threatened, so in the pandemic context, MSMEs were forced to change their business model and strategy (Mitroff & Anagnos, 2001; Seeger et al., 1998; Mansor et al., 2021). For example, resorting to outsourcing some operations as a strategy to reduce costs as well as to maintain or even increase their sales (Frangieh & Rusu, 2021; Mageto et al., 2020; Rusu et al., 2020) Some recent studies, such as those conducted by Mageto et al. (2022) and Zulkiffli and Padlee (2021) , have found that the outsourcing of some operations has a positive effect on the business performance of MSMEs and is a valid strategy through which these types of companies can access capabilities that they lack internally at a lower cost. In this sense, the increasing use of this strategy of outsourcing certain operations, such as the delivery of products to the final customer during the pandemic, could have contributed to the improvement of sales performance in MSMEs. Based on the specialized literature on the impact of outsourcing on MSMEs, the following is proposed:

H2: The outsourcing of MSMEs operations, as part of operational activities during the pandemic, has positively affected sales in these companies.

The literature also points out that an economic crisis has negative effects on investment (Bucă & Vermeulen, 2017). In this sense, economic crises generate uncertainty and lack of access to financing, which in turn lead to a decrease or paralysis of investments in companies (Vermoesen et al., 2013). Therefore, in addition to the negative effect on operational and financial activities caused by the COVID-19 pandemic, the crisis has also affected the investment activities of MSMEs (García-Pérez-de-Lema et al., 2022). Similarly, some studies showed that unfavorable macroeconomic conditions or exogenous shocks, such as those caused by the pandemic, can cause a slowdown in MSMEs investments in certain sectors (Sirin et al., 2022; Papadopoulos et al., 2020). Thus, in most cases, and due to increased vulnerability due to the pandemic, MSMEs showed a reduced capacity to expand investment to drive increased sales (Twahirwa et al., 2021). Policies and actions aimed at encouraging or discouraging investment in MSMEs, on the other hand, are strategic tools that have helped keep these businesses alive (Miocevic, 2021; Tian, 2021). Based on what has been analyzed in the literature, we propose the following hypothesis:

H3: The cancellation of investments by MSMEs, as part of strategic activities during the pandemic, has negatively affected sales in these companies.

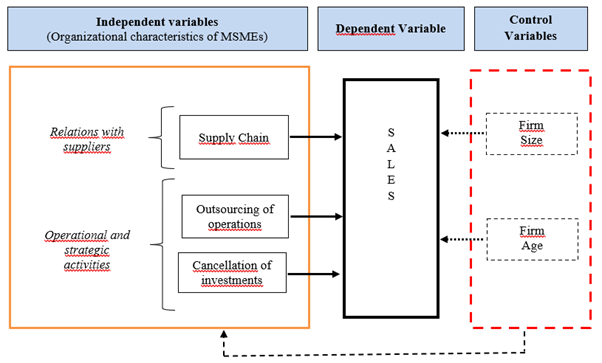

On the other hand, some control variables have been included in the study, such as the size and age of the firms. These allow us to analyze whether the impact caused by the organizational characteristics defined in this study depends to some extent on these variables; or, whether sales in these companies have been affected by the aforementioned variables. In this sense, similar studies have shown that both the size and age of the firms can have an impact on some organizational characteristics (García-Pérez-de-Lema et al., 2022; Sánchez-Báez et al., 2019; Romero & Martínez-Román, 2012; Madrid-Guijarro et al., 2009). Additionally, the literature notes that firm size and age are related to business performance and can affect sales growth in MSMEs (Sorensen & Stuart, 2000; Bibi et al., 2020; Varum & Rocha, 2013; Vaona & Pianta, 2008; Romero & Martínez-Román, 2012; Martínez-Román & Romero, 2013; Van Auken et al., 2021; Cesinger et al., 2018; Uhlaner et al., 2013). The inclusion of these control variables in the estimated econometric model allows for a more rigorous isolation of the effect of the variables defined as organizational characteristics on sales during the pandemic. Thus, based on the variables identified and the review of the literature, Figure 1 presents the theoretical model applied to this study, where the variables of the organizational characteristics that influence the results of the sales of MSMEs are represented.

3. Methods

3.1 Data

The data used in the research were collected through a survey of 360 firms nationwide selected from a stratified random sample, considering the following strata: economic sector (manufacturing industry, services, commerce, and construction) and company size (micro: 1 to 10 workers, small: 11 to 30 workers, and medium: 31 to 50 workers). However, for the analysis and presentation of the results, the commerce and construction sectors were grouped in the "other" category (Table 1). According to the sample design proposed in the study, a sampling error of 5.2% was determined with a confidence level of 95%, taking the population sizes from the statistics of economic units from the 2011 National Economic Census published by the National Institute of Statistics (INE, 2011).

Figure 1. Variables related to the organizational characteristics of MSMEs.

Source: authors’ development

Table 1. Distribution of the sample by company size, according to economic sector.

| Economic Sector | Size of the firms | |||

| Micro | Small | Medium | Total | |

| Industry | 64 | 28 | 21 | 113 |

| Service | 82 | 49 | 11 | 142 |

| Others | 54 | 34 | 17 | 105 |

| Total | 200 | 111 | 49 | 360 |

The survey was aimed at entrepreneurs and/or MSME managers and was conducted through a self-administered electronic questionnaire with closed questions that was distributed by e-mail between February and April 2021. The questionnaire was prepared based on a review of the existing literature on the various aspects investigated, as well as prior knowledge of the companies’ realities, which supported and justified the variables included as relevant to achieving the stated objective. It is also important to note that a team of researchers from the Ibero-American Observatory of MSMEs and researchers from the National University of Asunción collaborated in adapting the questionnaire to the Paraguayan context, considering that the questionnaire was used in the study titled "Economic impact of the COVID-19 crisis on MSMEs in Ibero-America" (García-Pérez-de-Lema et al., 2021).

3.2 Variables

The variables considered can be classified into three groups: sales (dependent variable), organizational characteristics (independent variables) and control variables.

-

Dependent variable: to measure the sales variable, interviewees were asked if sales had increased, remained the same, or dropped in 2020 compared to 2019. Since the grouping of the categories "increased" and "remained the same" was regarded as the category of interest, while the remaining one constitutes the reference category, we opted to convert this variable into a binary one for the study. This grouping was mostly caused by the sample's insufficient number of businesses reporting constant sales during those years. The resulting variable has two possible values: 1 (increased or maintained sales) or 0 (no change in sales) (decreased sales).

-

Independent variables:

-

Suppliers: This variable reveals details about the company's interactions with its suppliers during the pandemic. Using a 5-point Likert scale (1 being strongly disagree, and 5 being strongly agree), respondents were asked to rate their level of agreement with the statement, "The supply chain has been affected."

-

Operations outsourcing is a variable that offers insight into the company's operational activity. Using a 5-point Likert scale (1 being strongly disagree, and 5 being strongly agree), respondents were asked to rate their level of agreement with the statement, "We have increased the outsourcing of our operations."

-

Investment cancellation is a variable that reveals information about the company's strategic endeavors. Using a 5-point Likert scale (1 being strongly disagree, and 5 being strongly agree), respondents were asked to rate their level of agreement with the following statement: "We have canceled planned investments."

-

Control variable: firm age and size were added as control variables since they can influence how sales fluctuate. According to national legislation, the number of employees was taken into account for the classification of business size: 1 to 10 (micro enterprises), 11 to 30 (small companies), and 31 to 50 (medium companies). A dichotomous variable called "age of the firm" has a value of 1 (mature companies) if the company has been in business for more than 10 years and a value of 0 otherwise (young companies, with operations equal to or fewer than 10 years).

3.3 Econometric model

The impact of internal organizational features on the sales of Paraguayan MSMEs during the COVID-19 epidemic was examined using a multivariate logistic regression model. One of the primary statistical methods for examining the relationship between one or more explanatory variables and a dichotomous response variable, which denotes the occurrence or non-occurrence of an event, is multivariate analysis. The logistic regression model, according to Hosmer and Lemeshow (2000) , has evolved into the industry standard for this kind of study. Moreover, because of the vast range of applications, it is regarded as the most significant model for categorical data responses (Agresti, 2019).

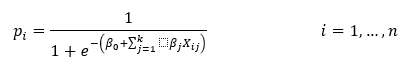

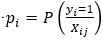

In this way, the variation in sales was described as a binary response variable, Y i, with the value 1 indicating an increase or maintenance of the company's sales over the analysis period and 0 indicating a decline. The logistic regression model with the logit transformation link's particular form is as follows:

Where  is the probability

that, given the values of the k explanatory variables X_ij, which correspond to the internal organizational

characteristics of the company, Y_i takes the value 1 (the company increased or maintained its sales during

2020 compared to 2019). While β_0 and β_j, which represent a constant term and the explanatory variable

coefficients, respectively, are the parameters of the model that need to be estimated.

is the probability

that, given the values of the k explanatory variables X_ij, which correspond to the internal organizational

characteristics of the company, Y_i takes the value 1 (the company increased or maintained its sales during

2020 compared to 2019). While β_0 and β_j, which represent a constant term and the explanatory variable

coefficients, respectively, are the parameters of the model that need to be estimated.

For the joint analysis of the parameters, the Hosmer and Lemeshow tests were used, with a maximum acceptable significance level of 10% in both tests. The goodness-of-fit analysis of the model was carried out using an individual significance test using the Wald test. The percentage of accurate classifications was considered as a global precision requirement for the model's validity assessment, together with the Negelkerke R2 coefficient.

Given that the regression coefficients of the model can only represent a direct or inverse link between the independent variable and the dependent variable and cannot be directly examined in terms of their magnitude (Cameron & Trivedi, 2005). Therefore, the marginal effects of each independent variable that was significant in the model were estimated in order to quantify the impact of each independent variable on the variance of the probability that an MSME increased or maintained its sales.

The Hausman simultaneity test was carried out in accordance with the procedures recommended in Gujarati and Porter (2010) and González (2006) in order to rule out any potential endogeneity issues caused by simultaneity bias when outsourcing operations and canceling investments were taken into consideration as likely endogenous variables.

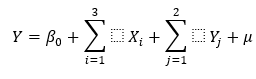

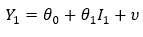

1- A system of simultaneous equations is posed

Where: Y: is the dependent variable already defined above.

X_i: are the control variables and the exogenous variable suppliers.

𝑌 1 , 𝑌 2 : are probably endogenous variables: outsourcing of operations and cancellation of investments, respectively.

𝐼 1 , 𝐼 2 are instrumental variables: "we have a risk management plan" and "measures have been taken to manage the company's liquidity", respectively. Both variables were measured according to the level of agreement on a Likert scale.

2- We tested if 𝐼 1 and 𝐼 2 are independent of Y by adding them to equation (2) and evaluating the significance of their coefficients. To ensure that the selected instrumental variables are valid, the estimated coefficients should be statistically equal to zero.

3- Equations 3 and 4 were adjusted and the estimated residuals were obtained.

4- The estimated residuals in equations 3 and 4 were added to equation 2, and the significance of the coefficients was evaluated. Considering the null hypothesis of no simultaneity, if the coefficient of each residual is statistically zero, it can be concluded that there is no simultaneity problem.

Ordinary least square regression was used to estimate the residuals in equations 3 and 4.