In Hungary - similarly to a number of other European Union countries - governmental efforts to foster innovation are primarily directed at enabling the activities of large enterprises, or other innovation-related organizations (e.g., higher education institutions, research centers) that are well endowed with innovation resources and capabilities (European Commission, 2016, pp. 38-58). This means that the micro-, small-, and medium-sized enterprises (SMEs), which are also crucial actors of the innovation ecosystem, often fall outside the scope of these efforts (Tian et al., 2020). This governmental approach represents an outdated view in the sense that the production of codified, research and development (R+D) based knowledge (Science, Technology and Innovation, STI) is indeed primarily tied to large enterprises, and organizations with high R+D+I budgets (Jensen et al., 2007). Simultaneously, SMEs play a leading role in the type of innovation that is based on the knowledge obtained from work processes, usage and interactions (Doing, Using and Interacting, DUI) (Parrilli & Heras, 2016).

In this study we argue that Hungary should rely more extendedly on the decentralized innovation resources and capabilities available in the SME sector. Even when such governmental intentions arise occasionally, interest is primarily vested in the young companies with great growth potential founded in response to the initiative, while the renewal of more mature, established enterprises with considerable DUI experience rarely appears as a priority (also in the literature) (Almus & Czarnitzki, 2003; Dai & Cheng, 2015). One reason for the importance of their support is the fact that they work in a familiar environment. Their incremental innovation activity poses lower risks, since they have learned how to recognize which of their projects are likely to fail, and as such are able to complete them sooner. They have in their possession a more diversified portfolio relative to startups that further decreases the uncertainty surrounding innovation (Coad et al., 2016). DUI innovation requires a completely different policy support regime, since instead of the direct innovation funding that often concerns physical resources, it recognizes human resources as the most important element of business renewal.

In this study we set out to showcase the innovation performance of Hungary and examine the relationship between the intellectual capital components and innovation by relying on the GCP dataset of 1,243 mature Hungarian SMEs, including 456 SMEs reporting innovation outcomes.

The novelty and relevance of the study are the following:

-

This study constitutes the first attempt to analyze the relationship between intellectual capital and innovation among Hungarian SMEs using the GCP dataset.

-

The results enrich our knowledge regarding the mechanism through which intellectual capital and its components impact the innovation of SMEs.

-

Unlike in the case of the main body of literature concerning the innovation of SMEs, mature enterprises are the focus of this study, as opposed to young startup businesses.

-

Comparing to other studies concerning SME intellectual capital, our analysis is conducted on a relatively large sample.

Based on the recommendations of the latest intellectual capital publications, we focus on SMEs and not on large companies, the innovation context of impact mechanisms, and on the individual components of intellectual capital (e.g., Agostini & Nosella, 2017; Agostini et al., 2017; McDowell et al., 2018).

Moving on, we first discuss intellectual capital, its individual components, and its role on SMEs’ innovation activity. Second, we examine the innovation performance of Hungarian enterprises from a macro perspective based on the widely known and cited Community Innovation Survey (CIS) and European Innovation Scoreboard data (EIS). Third, we show the interrelationships of intellectual capital and innovation, as well as the areas of innovation in terms of existing/new products/services and existing/new technologies, their intensity, and success rate at the micro level using the data contained within the GCP dataset of 1,243 Hungarian SMEs.

2. Literature review and hypotheses

Similar to other complex social science concepts, intellectual capital has no generally accepted definition. The seminal study of Nahapiet and Ghoshal (1998) defines intellectual capital as the’s ‘the knowledge and knowing capability of a social collectivity’ (p.245). The omnipresent concept of knowledge is defined by Marshall (2009) as ‘our most powerful engine of production’ (p. 99), to which everyone’s work contributes. In the business context, two types of knowledge have been identified: explicit and tacit knowledge. Explicit knowledge is coded, and therefore easier to pass on, while tacit knowledge is implicit, and therefore difficult to identify or to disseminate (Edvinsson & Sullivan, 1996). However, to be able to generate value for the company, the sources of knowledge must be continuously and actively identified (Lerro et al., 2014). The literature treats knowledge as a type of intangible asset, which represents value for the company (Kaufmann & Schneider, 2004). Knowledge could also be viewed as a type of intangible asset representing value for the firm (Kaufmann & Schneider, 2004). Since the value is difficult to grasp or to define in material terms, intellectual capital measurement is complicated. The risk associated with such intangible assets is generally higher than with classic tangible assets. As such, most professionals are reluctant to include immaterial or intellectual capital in reports alongside physical and financial assets (Gu & Lev, 2010).

Intellectual capital components include human capital, structural capital, and relational capital (Harangozó, 2007; Obeidat et al., 2021). Structural capital refers to the elements of knowledge in the company that are unrelated to humans. Relational capital represents the elements of knowledge obtained from the network of the company. Human capital denotes knowledge acquired by the individuals that positively contributes to both corporate value creation and individual performance. It is also closely related to the individual in possession of it, the organization cannot own it (Sveiby, 1997). Irrespective of whether the company operates in a knowledge intensive industry, the recognition and management of the knowledge embedded within the enterprise is vital for its long-term survival (Montequín et al., 2006). The management of intellectual capital represents a challenge for company executives; with the right strategy it opens up new avenues for company management, profit realization, and technology adoption, and could become an important source of competitiveness for enterprises (Obeidat et al., 2021).

The contents of the individual components of intellectual capital are showcased in Table 1 in detail. Table 1 also serves to identify the components of the intellectual capital of Hungarian SMEs included in the sample ( Appendix 1 ), and to enable the empirical study of their characteristics in the later chapters of the study.

Table 1: Components of intellectual capital

Source: based on (CEDEFOP, 2012, p.23).

So far, our emphasis has been on knowledge gains. However, in practice the key to success is the ability to innovate, or how the business could utilize this internal and external knowledge. This capability is called absorption (Cohen & Levinthal, 1990; Akhmetshin et al., 2017). Based on the CEDEFOP (2012) report, absorption capability is determined by the already known intellectual capital (Alvino et al., 2020; Obeidat et al., 2021; Mirza et al., 2022). Knowledge, both STI or DUI based, is the precondition for innovation that is mainly affected by the practical experiences and training of the employees, managers and owners. Organizational culture determines how the company is able to respond to novelty. In the absence of appropriate, receptive culture, and in the case of organizational resistance, attempts at innovation often wither away (Crepon et al., 1998; Lööf & Heshmati, 2006).

Besides the internal business determinants, external actors also play a marked role in innovation. Relationships with external actors (buyers, suppliers, competitors, different agencies, supporting organizations, etc.) provide the requisite information and knowledge for innovation. Network relationships are often able to compensate for the lack of resources that are particularly important in the case of resource-constrained small enterprises (Cohen & Levinthal, 1990).

Innovation activity is by itself the primary determinant of innovation together with strong competition, technological investments, and the need for the optimization of internal processes. Innovation activity is determined by two things, the ability to innovate and absorption, irrespective of whether the subject of innovation are the goods/services, production of goods/provision of services, the applied financial, marketing, management, and other methods or business models of the company (Cohen & Levinthal, 1990; Akhmetshin et al., 2017). Recent studies reinforce that the ability to innovate, and absorption are positively related to changes in the intellectual capital components of the company (Alvino et al., 2020; Obeidat et al., 2021; Mirza et al., 2022).

SME literature has examined intellectual capital in terms of various contexts. Some have identified the positive relationship between innovation and the intellectual capital components (e.g., Agostini & Nosella, 2017; Agostini et al., 2017). Others have observed that intellectual capital has a direct effect on business performance (e.g., McDowell et al., 2018; Khan et al., 2019; Beltramino et al., 2021; Adusei et al., 2022; Bansal et al., 2022), organizational climate (Dabić et al., 2018), internationalization (e.g., Reza et al., 2021; Villanueva-Flores et al., 2022), growth (e.g., Eklund, 2020; Dimitrov & Cozzarin, 2021), sustainable development (Alvino et al., 2020), competitiveness (Obeidat et al., 2021), and resilience (Agostini & Nosella, 2022).

In the following we focus on studies that examine the interrelationships between intellectual capital and its components and SME innovation. Agostini et al. (2017) demonstrated a positive relationship between the intellectual capital components and innovation performance based on a sample of 150 manufacturing SMEs in the medium- and high-tech industries. McDowell et al. (2018) uncovered a relationship between human capital and organizational capital and organizational performance that was mediated by innovation. Agostini and Nosella (2017) established through the examination of 150 machine- and instrument-producing Italian SMEs that human capital is directly related to radical innovation, however its effect is moderated by the other two components. They found that organizational capital positively moderates the relationship between relational capital and radical innovation. Agostini and Nosella (2017) also observed the positive impact of intellectual capital on innovation and organizational performance based on a sample of 259 Argentine manufacturing SMEs. Dabić et al. (2018) captured the positive relationship between intellectual capital components and innovation through the lens of innovation culture based on a sample of 253 Croatian SMEs. Adusei et al. (2022) concluded through the examination of 244 Ghanaian SMEs that innovative leadership attitude and organizational ambidexterity simultaneously mediate the relationship between intellectual capital and performance. In the case of 170 Iranian SMEs, Hayaeian et al. (2021) found that intellectual capital is positively related to innovation, however, the effect of the human capital component only proved significant in the case of radical innovation, and not in the case of incremental innovation.

Based on the empirical literature we formulate the following hypotheses:

-

Hypothesis 1: The intellectual capital is positively related to SME innovation.

-

Hypothesis 2: The human capital component of intellectual capital is positively related to SME innovation.

-

Hypothesis 3: The structural capital component of intellectual capital is positively related to SME innovation.

-

Hypothesis 4: The relational capital component of intellectual capital is positively related to SME innovation.

In addition, we can also examine the relationship between small, family-owned enterprises and innovation. We now know that family businesses unequivocally differ from their non-family-owned counterparts in terms of both performance and the ways of operation and management (Miller et al., 2007; Poza & Daugherty, 2014). Therefore, another examination is worthwhile. Lately, inquiries into the innovation activity of this type of enterprise has received outstanding attention from researchers (Rovelli et al., 2021), and the results have shown that family-owned small enterprises are among the most innovative ones (Rondi et al., 2019).

3. The innovation performance of Hungary

It is widely known that there is an ongoing digitalization driven technological revolution is going on all around the world. Traditional knowledge transfer has been superseded by international, cooperation based, common knowledge creation. Innovation systems are globalizing to an increasing degree. At the same time, the Schumpeterian creative destruction (Schumpeter, 1943), described by the explosive growth of new industries and technologies also leads to the disappearance of traditional industries. These changes challenge traditional economic policy makers, especially in those countries where innovation systems perform less efficiently. Hungary falls into this category. In the following section let us review the performance of Hungary based on the measurements of the European Union’s (CIS) and (EIS).

The share of innovative businesses in the EU - employing more than 11 employees - is summarized by CIS (2020). Based on the latest data from 2020 (Table 2 ), 48.5% of small businesses in the EU with 11-49 employees were innovating, while 79.7% of large enterprises implemented some sort of innovation in the three years that preceded the survey. This means that there exists a 1.64 times difference based on firm size. Significant differences exist among countries: there is a nearly seven-fold difference between the leader, Greece (72.6%) and the last Romania (10.7%). Hungary ranks only 25th among the 27 members of the EU, whereby just 29.2% of its businesses employing 10+ employees were considered innovating in 2020. Just over one third of SMEs, and just over half of large enterprises introduced some form of novelty in the three years that preceded the survey that leaves Hungary well below the EU average. This ranking is worse than the overall innovation performance, where the country achieved somewhat better results.

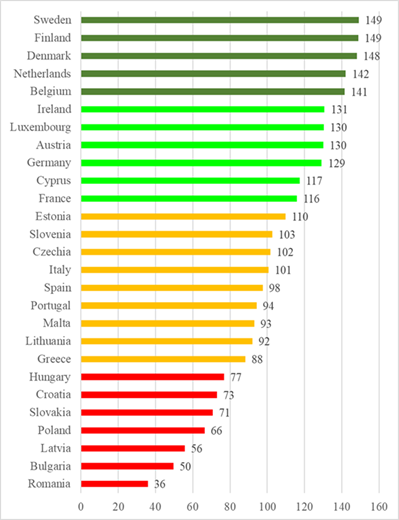

Table 2: Share of innovative enterprises within the EU27 countries based on CIS 2020

The EIS report yearly the innovation performance of the EU member countries. In 2022, the overall performance of Hungary was 76.7 points that was 70% the 109.9 points of the EU average (Figure 1). As a result, Hungary ranks 21st, leaving it in the last group of countries, among the emerging innovators cluster. As comparing to other former socialist countries, Hungary ranks ahead of Croatia, Slovakia, Poland, Latvia, Bulgaria and Romania, but lags considerably behind Estonia, Slovenia, Czechia and Lithuania. If we look at the changes over time, the EIS scores averaged around 70-72 points between 2015 and 2018, relative to which a moderate decline took place in 2019. At the same time, between 2020 and 2022, a marked improvement could be observed.

Figure 1:Innovation performance of the 27 EU members based on the EIS 2022

Note: dark green: innovation leaders; light green: strong innovators; orange: moderate innovators; red: emerging innovators Source: EIS 2022.

Examining the components of the overall EIS innovation performance, it becomes clear that the partial performance of the individual elements is uneven. In the case of linkages, sales impacts, finance and support, attractive research systems and the use of information technologies, the scores are above the 70% average. In the case of linkages, we highlight the ratio of innovative SMEs participating in different cooperation arrangements (83% of the EU average), which is an encouraging value. This positive picture is clouded, however, by the fact that the high value is the result of public-private co-publications, and not that of innovative SME collaborations. Digitalization, firm investments, and environmental sustainability are around the 70% Hungarian average. However, considerable catch-up is required in the areas of human resources, innovators, intellectual assets, and employment impacts. Interestingly, the issues regarding human resources appear to be more severe than financial problems that is related to the underdeveloped nature of the Hungarian educational system. In the case of the financing position, the low R+D expenditure of the public sector deserves special attention. Critically low score can be observed in the innovator category, where 32.2% of SMEs undertaking process innovation is particularly alarming relative to the EU average. Convergence in the absence of digitalization-based process innovation is hardly conceivable.

Examining the expressly business natured EIS components, we find that the value of in-house product innovators with market novelties is fairly high (88.5%), while the value of in-house market innovators without market novelties, which are not new to the market (53.1%) is low, pointing to an absorption problem, a notion that is reinforced by the value of innovators that do not develop innovations themselves (54.3%). The value of innovation active non-innovators is high (91.6%). However, it seems that these activities do not often lead to the successful introduction of innovations to the market. The value of non-innovators with potential to innovate is outstanding (225.8%) that could indicate motivation problems. The value of in-house business process innovators (29.5%) relative to the EU average is critically low; however, this is hardly surprising given the generally low levels of business process innovation.

The CIS and EIS aggregate the characteristics and determinants of innovation in the EU countries and Hungary from a macro perspective. In the following section, we examine all of this from a micro perspective by utilizing the Hungarian dataset of the GCP, with special emphasis on the analysis of the interrelations of intellectual capital.

4. The characteristics and interrelationships of SME innovation and intellectual capital based on the Hungarian dataset of the GCP

In this section, we examine the innovation variables of SMEs and the intellectual capital components that directly and indirectly contribute to innovation activity, based on firm level data. For empirical illustration, we utilize the Hungarian SME dataset of the Global Competitiveness Project (GCP) (https://www.sme-gcp.org/ ). The data was collected with the help of participating institutions and specialized service providers between 2016 and 2022. The broader aim of the questionnaire was to measure firm level competitiveness based on the performance of individual competencies. The questionnaire placed special emphasis on the assessment of the determinants of the areas and results of innovation, as well as those of intellectual capital as identified by the conceptual model. The entire process of the survey and the construction of the dataset represent methodology under the professional supervision of the GCP (Lafuente, et al., 2020a ; Lafuente et al., 2020b). The questionnaire used by GCP teams is homogeneous for enhanced comparability of results. Recent work by Alonso and Leiva (2019), Balogh et al. (2021) , Lafuente and Vaillant (2021a), and Lafuente et al. (2021b) corroborate the validity and robustness of the GCP databases.

The course of the survey was the following: After initially establishing communication through the phone, personal meetings took place. In the case of enterprises with less than 20 employees, the respondents were one of the owners involved in the operational management of the firm, and in the case of enterprises with more than 20 employees, one of the leading officials of the SME (irrespective of ownership position). The interviewer of the questionnaire provided support throughout the process, during the course of which closed questions had to be answered almost exclusively. The questionnaire has been widely used since 2013 for research purposes, and as such all ambiguous or misleading questions had already been deleted or corrected before 2016. The incoming data was checked and filtered under a strict procedure. Only companies with all the requisite data available were subjects of subsequent analysis. In connection to this, companies employing less than 5 employees, and those that came under bankruptcy, liquidation in case of solvency, liquidation in case of insolvency, or involuntary dissolution proceedings before 28th March 2022 were omitted from the list. This process of filtration and preparation resulted in a sample size of n=1,243. Table 3 shows a detailed breakdown of the sample in terms of firm size categories based on the number of employees.

Table 3: Composition of the sample based on firm size categories (n=1 243)

The average business employs 26.0 employees and has 21.1 years of market experience. 26.3% of companies are active in the industrial sector (construction sector excluded), 13.4% in the construction sector, 28.8% in the retail trade and vehicle repair industries within the tertiary sector, and 31.5% in other service industries within the tertiary sector. The survey included questions related to the areas, intensity, and success rate of the existing/new product/service and existing/new technological innovations in the sense of the Oslo Manual; and the intellectual capital components.

In the sample, 36.7% of the 1,243 SMEs having 5-249 employees undertook activities to improve the existing/new products/services and technologies. The relative frequency of innovative business increases with firm size: Only 28% of the larger sized microbusiness engaged in innovation, the same ratio stood at 33% in the case of the smaller sized small business, 45% in the case of the larger sized small business, and 50% in the case of the medium business. Table 4 provides a detailed breakdown of the areas of these development efforts, based on firm size.

Table 4: The intellectual capital components and some innovation measures among the innovating SMEs in different size categories (n=456)

Note: INNO: product/service and/or technology innovators; OEP/S: only existing product/service innovators; ONP/S: only new product/service innovators; E&NP/S: existing and new product/service innovators; OETech: only existing technology innovators; ONTech: only new technology innovators; E&NTech: new and existing technology innovators.

Among the innovative SMEs, the ratio of those that conduct both product/service and technology innovation is 80.2%, so if a business is innovating it is innovating in more than one type. Among the innovating business, product innovation is the most “popular”, 92.8% of companies practice it. Moreover, a decisive majority of these business (more than 3/4) is developing their existing and new products simultaneously. Technology innovation is practiced by 84.0% of the 456 SMEs, 71.3% of which strive to both develop existing technologies and to introduce new products/services.

Table 5 shows the success rate of innovation efforts. It can be concluded that approximately 2/3 of initiatives are successful, and that no meaningful difference can be observed between different types of innovation.

Table 5: The success rate of the existing/new product/service and existing/new process innovation (n=456)

Intellectual capital consists of three components based on the CEDEFOP (2012) categorization (in details see Appendix 1 ). We captured the human capital components through the entrepreneurial capabilities of the leader, employee excellence, and the related human resource management functions. The variables describing the sophistication of production management and quality control systems, the uniqueness and application of ICT assets, information management, decision making, and administrative proceedings are suited for the components of structural capital. For the relational capital factor, we included business development, as well as the external contacts/partners supporting business development and innovation. The average normalized values of the intellectual capital in different size categories are reported in Table 6 (the descriptive statistics of these variables can be found in Appendix 2 ).

Table 6: The intellectual capital components and some innovation measures among the innovating SMEs in different size categories (n=456)

According to Table 6, the intensity of innovation activity, the outcomes of initiatives, and the level of intellectual capital components all increase with business size. Table 7 presents the Pearson correlation coefficient values of the three intellectual capital components. While human, structural and relational capitals are significantly correlated to each other, the strengths of the correlations are at the medium level.