Article

DOI:

https://doi.org/10.18845/te.v16i3.6362

Location, market orientation, and firm performance: An analysis of the Colombian healthcare industry

Localización, orientación al mercado y desempeño empresarial: Un análisis del sector de la salud colombiano

TEC Empresarial, Vol. 16, n°. 3, (September - December, 2022), Pag. 34 - 54, ISSN: 1659-3359

AUTHORS

Juan C. Amézquita

Department of Business Management. School of Business Management. University ICESI, Colombia.

jcamezquitas@gmail.com.

![]()

Francisco Puig*

Department of Business Management. Faculty of Economics. University of Valencia, Spain.

francisco.puig@uv.es.

![]()

Marcelo Royo-Vela

Department of Commercialization and Market Research. Faculty of Economics. University of Valencia, Spain

marcelo.royo@uv.es.

![]()

Corresponding Author: Francisco Puig

ABSTRACT

Abstract

In the Latin American healthcare industry, there seems to be an association between the implementation of the marketing strategies and the firms' location that suggests the need to study the organizational performance under these aspects. To this end, this paper contrasts the relationships between an organization's market orientation (MO), its location (for example, within a service cluster), and performance. The quantitative analysis was carried out among managers' perceptions from 134 service companies belonging to the healthcare service companies operating in the city of Cali, Colombia. The results showed a positive association between being located in a service cluster and business performance. It was also shown that the strategic approach based on OM positively affects performance. Moreover, we noted that competitors' orientation is the only component of the OM construct that significantly influences performance. The conclusions of our study allow for guiding the strategic decisionmaking of the managers of these companies regarding the decisions of location and content of marketing strategies.

Keywords: Location, Cluster, Market Orientation, Performance, Competitor Orientation, Healthcare Industry.

Resumen

En el sector de la salud latinoamericano, parece existir una fuerte asociación entre el nivel de implementación de la estrategia de marketing y la localización de las empresas que sugieren la necesidad de estudiar el desempeño organizativo bajo esos aspectos. Para ello este trabajo contrasta las relaciones entre la orientación al mercado de una organización (OM), su localización (por ejemplo, dentro de un clúster de servicios), y el desempeño. El análisis cuantitativo se realizó entre las percepciones recogidas en 134 cuestionarios completados por gerentes y empresarios de empresas de servicios pertenecientes al sector de la salud que operan en la ciudad de Cali, Colombia. Los resultados muestran una asociación positiva entre estar localizado en un clúster de servicios y el desempeño empresarial. También se evidenció que el enfoque estratégico basado en la OM afecta positivamente al desempeño, y que es la orientación a los competidores el único componente del constructo de OM que influye significativamente en el desempeño. Las conclusiones de nuestro estudio permiten guiar la toma de decisiones estratégicas de los gerentes de esas empresas en lo que respecta a las decisiones de localización y contenido de las estrategias de marketing.

Palabras clave: Localización, Clúster, Orientación al mercado, Desempeño, Orientación a la competencia, Sector salud.

Introduction

1. Introduction

The healthcare industry is a multifaceted sector that includes hospitals and clinics of different sizes that provide medical services. It also consists of other firms that offer diagnostic support and paramedical services, as well as those that supply goods, medicines, and hospital and surgical equipment (Porter, 2010; Vecchiarini & Mussolino, 2013). The economic importance of this sector is growing in line with the level of a given country’s development. For example, the healthcare industry in Colombia accounted for 6.0% of the country’s GDP in 2019 (around a 20% more than in 2010). The increase in spending in the health sector is positively correlated with observed increases in income levels (De la Puente, 2017). Parallel to this evolution, the healthcare industry is facing new challenges brought about by globalization, the emergence of new players in the competitive arena, and a growing number of requests from their users (Smith & Puckzcó, 2014).

Authors such as Adam et al., (2012) or Davis & McMaster (2015) argued that healthcare and other social systems could be described as complex adaptive systems that adjust dynamically, and sometimes unpredictably, to changes within the system itself or in the context in which they operate. This has led the health industry to follow the trend of manufacturing firms that wish to relocate and assemble in specific geographic areas to form industrial clusters and benefit from agglomeration advantages. The best example of an industrial cluster is in the IT sector in Silicon Valley (USA), although thousands of examples exist in other industries and countries (Puig & Marques, 2010).

Socio-economic literature contains an enormous amount of research publications that focus on understanding the cluster effect in relation to the performance of firms located in these areas, although the results are generally inconclusive due to methodological shortcomings associated with the delimitation of the cluster and the relationships being analyzed (Martin & Sunley, 2003; Gonzalez-Loureiro et al., 2019). Nonetheless, Delgado et al., (2014) and Claver-Cortes et al., (2019) argued that cluster-based small-to-medium sized enterprises (SMEs) have a significant competitive advantage over firms that remain isolated due to the externalities generated by cluster dynamics and physical proximity. However, few studies have investigated this influence on service clusters (Nordin, 2003; McCann & Folta, 2009).

As such, there is a critical research gap for at least two reasons. On the one hand, there are increasing instances of geographical concentrations of service firms in different parts of the world; for example, in tourist destinations like Benidorm (Spain) (Marco-Lajara et al., 2016), financial centers like London (UK) (Pandit et al., 2018) or the Colombian healthcare industry, the latter of which is agglomerated geographically in cities like Bogotá, Cali, and Medellín (Causado et al., 2018). On the other hand, the health firms (basically independent small-clinics led by entrepreneurs) see their future threatened by the irruption of large multinationals and other changes in consumer behavior that question their strategies (Brandt & Znotka, 2021).

To this end, there is a need to change the objective; that is, to shift the focus of the study from the traditional supplier-side to the demand environment in which these relationships take place (McCann & Folta, 2009). This means focusing more on clients than on suppliers (Porter & Lee, 2013). This type of approach requires an examination of the influence of the strategies implemented by firms. One of the most popular means of achieving this is by applying Porter’s generic strategies, and distinguishing firms that compete based on cost leadership or differentiation in terms of the service (Torgovicky et al., 2005). However, the extant literature on the healthcare industry, which largely focuses on medium- and large-sized hospitals, as well as primary care outpatient clinics, tends to propose general recommendations, and in many cases, these reflect corporate-level strategies (e.g., internationalization, alliances, acquisitions) (Torgovicky et al., 2005; Helmig et al., 2014). For these reasons, perspectives that focus on analyzing a firm’s strategic approach can be disregarded. Instead, emphasis should be placed on examining how the firm’s location, market orientation (MO), and performance intersect (Kovács & Szakály, 2022).

Therefore, the paper aims to analyze the effect of location and MO on the performance of firms in the healthcare industry. Our work contributes to managers and entrepreneurs by suggesting a critical link between these factors and firm performance in service clusters, which can serve as a reference for strategic responses facing globalization. At an academic level, it also contributes because it values the location in a little explored context, such as service clusters in emerging economies.

To achieve the research objectives, this paper is structured as follows: Section 1 contains the Introduction. Section 2 discusses literature concerning business clustering, market orientation, and performance in the context of health service firms. Section 3 describes the cross-sectional analysis based on a sample of 134 firms in the healthcare industry in the city of Cali (Colombia). Section 4 presents the results and discussion. Section 5 outlines the conclusions, highlights management implications and proposes directions for future research.

Literature review and hypotheses

2. Literature review and hypotheses

2.1 Location effect on performance

As Venkatraman & Ramanujam (1986) pointed out, performance is a recurrent management theme and is aligned with growth and survival. It is of interest to academic scholars and practicing managers to measure and evaluate the evolution of firms. Although the concept of performance is essential and has been widely debated in the literature, we must first acknowledge that in this paper, firm performance was assumed to be in line with Venkatraman & Ramanujam (1986) or Gerschewski & Xiao (2015) . For this reason, we adopted an integrated perspective and included measures of the three dimensions of financial and operational performance and organizational effectiveness (i.e., marketing, production, and human resources).

Related sectors and productive chains are components that authors such as Michel Porter established within a performance analysis model (Porter, 1998) . Within this component, clear recognition is given to the impact that geographical clusters, as a model of business agglomeration, have on firm performance, especially in those economic sectors where a firm is strong or enjoys significant previous experience (Pandit et al., 2018). These clusters are found due to the external economies and other benefits derived from their location in a specific area. These geographical agglomerations are important for the constituent firms and the sector's economy.

Authors have also underscored the importance of geographical proximity to firms, as this factor enables them to deal effectively with demand, innovation, and value creation in a globalized environment (Rodriguez-Victoria et al., 2017). Other authors have demonstrated the association between being located in a cluster and entrepreneurship (Lee, 2018) and have further examined the internationalization of companies (Pla-Barber & Puig, 2009) and the creation of social capital ( Molina-Morales & Martinez-Fernandez, 2003).

According to Porter (2000) , a cluster allows each member to benefit as if they had a larger scale or as if they had joined with others formally, without requirements to sacrifice their flexibility. Clusters are concentration models that generate externalities that support the region's development and firm competitiveness (Puig & Marques, 2010; Resbeut et al., 2019).

Locating in a cluster also allows companies to access several context-specific resources and capabilities, such as qualified workers, information, and knowledge (Keeble & Nachum, 2002; Lee, 2018). Specifically, in the case of healthcare firms, clusters create great market opportunities for health tourism (Nordin, 2003; Causado et al., 2018). Emerging countries have opted for this strategy to encourage more competitive services and strengthen their local and internationalization processes (Resbeut et al., 2019).

Many studies have shown the impact of location on manufacturing and service firms (Canina et al., 2005; Puig & Marques, 2010; Wennberg & Lindqvist, 2010; Rodriguez-Victoria et al., 2017; Claver-Cortes et al., 2019). According to leading research studies, firms within business concentrations achieve better performance. In this literature, performance was regarded as an indicator of success (whether financial or otherwise) (Puig & Marques, 2010; Claver et al., 2019). In addition, some authors have proposed that good performance is achieved by collective efficiency and the impact of the relationships and networks formed among the cluster participants (Martin & Sunley, 2003). Considering all of the above, it is expected that healthcare firms located within a cluster will enjoy better performance than isolated firms in terms of their location mode. Therefore, we developed the following hypothesis:

H1: In the healthcare industry, firms located within a service cluster will perform better than those located outside a cluster.

2.2. Location effect on market orientation in the healthcare industry

Market orientation (MO) is a topic that has been studied extensively within the context of a firm’s strategy and culture, particularly given its effects on business performance and its potential to stimulate competitive advantage (Narver & Slater, 1990; Duffy et al., 2020). MO can be defined as the degree to which a firm implements marketing concepts (Kohli & Jaworski, 1990) and is understood as an organizational culture that supports the generation of competitive advantage through the creation of superior customer value (Narver & Slater, 1990; Zhou & Nakata, 2007; Kaur & Gupta, 2010). Two different approaches have been identified; the first regards MO as a firm culture or philosophy (Narver et al., 1998), and the second view it as a strategic or behavioral approach (Gounaris et al., 2004; Olson et al., 2005). While considering the objectives of this paper, we focused on the second approach.

Although solid empirical evidence supports the relationship between MO and business performance (Castellanos-Ordoñez & Solano-Arboleda, 2017), studies examining the effect of location on MO are scarce. Narver & Slater (1990) verified the relationship between MO and performance. These authors argued that MO is a multidimensional construct composed of three factors: customer orientation, competitor orientation, and interfunctional coordination. Customer orientation relates to knowledge about the customer, and generating greater customer value (Zhou & Nakata, 2007). Competitor orientation involves knowledge of the strengths and weaknesses of the competition, the firm’s capacity for development, and its long-term strategies (Gruber-Muecke & Hofer, 2015). Finally, interfunctional coordination aims to guide management concerning the organization's activities to coordinate its resources to generate greater value (Morgan & Vorhies, 2009).

According to Najib et al., (2011) , clusters are one of the main tools to strengthen SMEs' innovative behaviors and MO. Moreover, a service cluster can be regarded as particularly fertile ground for adopting and spreading successful innovations (Weidenfeld et al., 2010). The increased level of internal competition, which is brought about by the increasing density of medical services (e.g., hospitals, clinics) in the cluster, will call for improved strategies and new ways of doing business both internally and externally, as well as in collaboration with associated agents in the industry, while also attending to location and the application new competitive strategies.

In service industries, demand-oriented firms prefer to be located in clusters to reduce the cost of finding clients (McCann & Folta, 2009). In addition, specialized suppliers operate within these clusters, guaranteeing access to services that firms would not be able to access individually (McCann et al., 2015). Along the same lines, Porter (2000) argued that there is intense competition inside the concentrations to obtain new clients and retain them due to the strong incentives inside clusters.

The highly competitive environment within clusters should motivate businesses to actively carry out measures to analyze competitor characteristics, such as strategies and differentiators (Dev et al., 2009). Similarly, Porter (2000) argued that in highly concentrated markets, leading competitors have the opportunity to significantly alter market competition conditions, which translates into an increase in the use of tactics such as aggressive pricing, advertising, and the incorporation of new products and services. Thus, high levels of competitive and demand orientation should create a higher level of MO in the firms located in the cluster. In light of these considerations, we developed the second hypothesis:

H2: In the healthcare industry, firms in a service cluster will have a stronger MO than those located outside a cluster.

2.3. Market orientation effects on firm performance in the healthcare industry

The literature review revealed that many studies had confirmed the positive influence of MO on performance (Kumar et al., 2002; Castellanos-Ordoñez & Solano-Arboleda, 2017). In line with most studies, authors such as Kirka et al., (2005) found that the correlation between MO and performance was significant and more potent in manufacturing firms than in service firms. In the healthcare industry, the influence of MO on performance has also been verified, and large American hospitals are an example (Wood et al., 2000; Kumar et al., 2002). The study carried out by Kovács & Szakály (2022) on the Polish healthcare industry produced similar findings. A relevant factor in these studies is the tool used to measure performance based on the use of several subjective indicators. Morgan et al., (2009) concluded that a subjective measure of performance does not support a significant relationship between performance and MO while using more objective variables (e.g., financial variables) would strongly support it. However, other studies found a different relationship, as evidenced by Martín-Consuegra & Esteban’s (2007) research on the aeronautical services industry and Haugland et al.,’s (2007) study of the hotel industry. Thus, the expected relationship between MO and performance will be positive and significant when using subjective scales, such as those applied in this research. The following hypothesis synthesizes this idea:

H3: In the healthcare industry, firms that have a strong MO will perform better.

2.4. Market orientation components and heterogeneous effect on performance

Narver & Slater (1990) found that the MO is a multidimensional construct formed by three different components: customer orientation, competitor orientation, and interfunctional coordination. Some studies have demonstrated that not all of the components of MO have the same effect on performance (Kumar et al., 2002; Haugland et al., 2007; Tsiotsou, 2010). Authors such as Deshpandé & Farley (1998) argued that customer orientation has the greatest impact, while interfunctional coordination has a smaller impact. Similarly, many studies have shown that the customer orientation factor positively affects innovations and financial performance (Dev et al., 2009; Tsiotsou, 2010; Boachie-Mensah & Issau, 2015). However, neither the influence is similar among manufacturing and services firms (Frambach et al., 2016) nor among public and private health businesses. Therefore, it would be beneficial to analyze the effect of the MO components on firm performance separately.

In Colombia, the services that are provided as part of the General System of Social Security in Healthcare scheme represent the vast majority of the activities carried out by firms in this industry. The government highly standardizes these services in order to encourage greater efficiency with respect to the use of health resources. This means that customer orientation is not an essential component of performance for healthcare firms, unless these firms treat domestic and foreign patients who privately fund their own treatments, although these patients represent a minority. In a study involving a sample of the Top 500 Taiwanese service firms, Cheng & Krumwiede (2010) found that competitor orientation positively influenced firm performance. Kumar et al., (2002) obtained similar results when investigating American hospitals that applied differentiation strategies. Thus, it might be expected that competitor orientation would positively affect the performance of healthcare firms since they have similar organizational procedures, and differentiation lies in the quality of the service provided. O'Dwyer & Gilmore (2017) suggested that SMEs seeking optimal business performance should pay close attention to direct and indirect competitors to identify opportunities and build sustainable competitive businesses. Therefore, we developed the following hypothesis:

H4a: In the healthcare industry, the intensity of the relationship between MO and performance will be higher in firms that are competitor oriented than in those that are customer oriented.

Kumar et al., (2002) studied large-sized hospitals in the United States. They demonstrated that interfunctional coordination positively affected firm performance in terms of efficiency. However, several other studies, such as those conducted by Haugland et al., (2007) and O'Dwyer & Ledwith (2009) , found that interfunctional coordination did not directly influence performance. Narver & Slater (1990) argued that, in SMEs, where a single person manages the business, decisions could not be made by different departments. Moreover, Lautamäki (2010) suggested that the socialization of customer and competitor knowledge may not be the most crucial issue for SMEs since entrepreneurs have centralized decision-making and control the firm's strategic direction. In small firms, such as small-scale clinics or consultancies, the reality is reflected in the abovementioned situation. We thus developed the following hypothesis:

H4b: In the healthcare industry, the intensity of the relationship between MO and performance will be higher in customer oriented firms than in firms that prioritize interfunctional coordination.

By logical deduction, one could argue that the effect of competitor orientation on performance is greater than that of interfunctional coordination. We developed the following hypothesis:

-

H4c: In the healthcare industry, the intensity of the relationship between MO and performance will be higher in competitor oriented firms than in firms that prioritize interfunctional coordination.

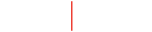

Figure 1 summarizes the conceptual benchmark described and the resulting hypotheses.

Figure 1: Conceptual benchmark and resulting hypotheses

<

<

Source: own elaboration.

Methodology

3. Data and methodology

3.1 Data collection and sample

Our empirical analysis drew on data gathered from firms located in the city of Cali, Colombia, which belonged to the healthcare industry according to the International Standard Industrial Classification (ISIC). We selected this context for our analysis for the following reasons: The first is methodological; every country has its own health system (Porter & Lee, 2013) and a well-defined cluster within the city, which is recognized by the market and community. The second reason is that the city of Cali has become a Latin American benchmark for plastic surgery and highly complex treatments (Molina & Martínez, 2005). Using the database of firms registered in the Cali Chamber of Commerce in the healthcare industry (Cámara de Comercio de Cali, 2012), we identified 710 firms. We deleted from our sample those firms which did not have complete information on the focal variables of our analysis. The main sample, therefore, consisted of 671 firms that were representative of the principal activity carried out by enterprises in Cali during the study period, which considered two location types: clustered and isolated.

The information was based on a questionnaire that addressed managers' perceptions of different factors related to their activities, relationships, location, market orientation, and performance. The fieldwork was carried out between November 2013 and July 2014. The questionnaires were distributed to the management or legal representatives of all the identified firms via e-mail, with information explaining the purpose of the research and how they could participate. Junior researchers from ICESI University, Cali, Colombia, participated in listing the firms and developing the process. The managers completed a structured questionnaire which was conducted by telephone. Finally, a total of 134 valid questionnaires were retrieved, with a high 20% response rate. The size of that sample can be considered acceptable due to the research objectives and the population's nature (Hashim, 2010).

Porter (2000) defined four levels of activities that permit the classification of the constituent organizations in a cluster. Level 1 is formed by primary firms or those that develop the core products or services of the cluster. Level 2 contains firms that supply the primary firms. In Level 3, the firms relate to Levels 1 and 2 by providing services or goods that complement the model. Finally, Level 4 is formed by the institutions that manage the cluster, essentially regulatory and control entities. McCann & Folta (2009) also identified different types of participation between suppliers and customers. Furthermore, concerning the MO strategy, authors such as Powers et al., (2020) have evidenced different assessments of the relationship between MO and firm performance related to the activity of the interviewed.

The firms that comprise the present study sample were actives in Levels 1 and 2 of the cluster. Level 1 (52% of the companies in the sample) included hospitals and clinics, specialized consultancies, dental services, alternative medicine centers, and aesthetic/spa centers. Level 2 (48% of the companies in the sample) included organizations that comprised the group of suppliers or distributors that were engaged with Level 1 firms. This group also included suppliers of goods, medicines, and hospital and surgical equipment, including specialist medical equipment for cosmetic surgery services. Some of these firms were providers of diagnostic support services, insurance firms, and firms that provided paramedical services.

3.2 Variables and factors measurement

The different variables (dependent and independents) taken into account in this study and the measurement scales used are described below.

The managers’ subjective performance was taken as the dependent variable. Although several objective measures of firm performance have been proposed in the literature (Gerschewski & Xiao, 2015; Wennberg & Lindqvist, 2010), including survival, innovation, productivity, and manager perception (Micheli & Manzoni, 2010), we used subjective indicators, while considering their solid explanatory power concerning the efficacy of formulated strategies and their implementation. This decision was in line with Martín-Consuegra & Esteban (2007) and Haugland et al., (2007) , who concluded that a subjective measure of performance is relevant to studying the relationship between performance and MO. The scale for performance measurement is based on the tool proposed by Camisón & Cruz (2008) , which consists of 14 items. Each variable is measured by comparing the respondent to their competitors for each item according to a 7-point scale (1 = “much worse than competitors”; 7 = “much better than competitors”) (Rodriguez-Victoria et al., 2017). The performance indicator is a global indicator of these values based on the average score reached among the 14 proposed items. The items analyzed are shown in Annex 1.

The independent variables in the study were defined by referring to the hypotheses, which focused on two aspects that directly influence firm performance: location and market orientation (MO).

Many different methods can be employed to identify or map clusters in terms of the measurement or the procedures by which the geographical boundaries of the clusters should be determined (Martin & Sunley, 2003). To address this issue we followed the methodology of Molina-Morales & Martínez-Fernández (2003) and the suggestions of Alcácer & Zhao (2016) and Perles-Ribes et al., (2015) . For this reason, in the current study, healthcare firms were regarded as clustered if they fulfilled two simultaneous conditions: 1) located in a place that satisfies the characteristics of a cluster in terms of the level of concentration or geo-visualization (Alcacer & Zhao, 2016), and after this analysis, we delimited the “Barrio Tenquedama” as the urban cluster of Cali; 2) managers perceive and feel that the firm belongs to a cluster (Molina-Morales & Martínez-Fernández, 2003). This methodology for delimitation of clusters is more appropriate than location quotients due to the smaller size of the geographic area and observations (O’Donoghue & Gleave, 2004).

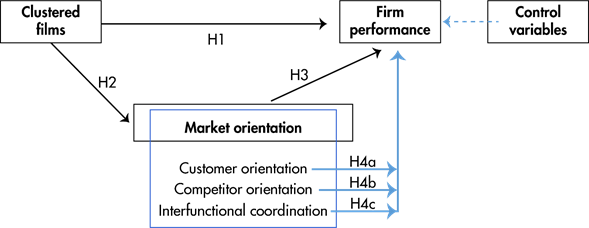

After this analysis, of the 134 surveyed companies, 34% (45) belonged to the urban cluster (Barrio Tenquedama), and 66% (89) were located outside it, representing about 20% of the population. Figure 2a shows the location of the city of Cali in Colombia, and Figure 2b the cluster area within Cali (Barrio Tenquedama). As can be seen in the figure, the mapped service cluster is located in the center-west of the city (streets 4 and 6, and between avenues 44 and 37), and it covers approximately 8 km² of the 712 km² area of Cali.

We used the MKTOR scale developed by Narver & Slater (1990) to measure MO. It is the most commonly used scale when estimating MO in different sectors and countries (González et al., 2005; Kovács & Szakály, 2022). Many studies have applied this scale for research purposes (Narver & Slater, 1990; Haugland et al., 2007; Boachie-Mensah & Issau, 2015), and it has also been employed in studies on the healthcare industry (Kovács & Szakály, 2022). This methodological strategy based on this instrument's use allows us to understand better the relationships between the different variables of our research.

Source: own elaboration.

To determine the underlying structure of dimensions, we conducted an exploratory factor analysis in SPSS version 22. The indicators were evaluated using a 7-point Likert scale (1 = total disagreement; 7 = total agreement), with a midpoint representing indifference. Three factors and 15 indicators form this construct. In general, our items measured each construct accurately (individual item reliability), explaining 73.1 % of the variance. The table in Annex 2 lists the components of each dimension: customer orientation was measured by five indicators (the first five items listed in the table), competitor orientation by four indicators (the following four items), and interfunctional coordination by the last four items. The indicator related to post-sales service (“we attach great importance to after-sales service”) was removed from the analysis (item-total correlation was below the cut-off point of 0.5).

We also included a set of control variables in our analysis: level and size. According to Porter (2000) , a dummy variable for the level was created to capture differences between firms at Level 1 (e.g., health services, dental services, alternative medicine services, and beauty and spa services) and firms at Level 2 (e.g., pharmaceutical and medicinal products merchants, medical and hospital equipment and supplies companies, marketers of aesthetic surgery products, companies that carry out diagnostic activities, organizations that provide paramedical emergency services, and health insurers). We measured firm size as the log of the number of employees because it has been shown that this dimension is related to firm performance in clustered firms (Kukalis, 2010).

3.3 Preliminary analysis

To better interpret the sign and scope of the results, we carried out a preliminary analysis regarding other possible levels of association between the variables "location" and "level," as well as between "location" and "MO." From the first analysis, which was carried out with contingency tables, the results did not detect a significant overrepresentation or many more cases than expected under the assumption of independent distribution in any of the cells. This allowed us to affirm an acceptable level of independence (Hair et al., 2000). Table 1 presents the variables' means, standard deviations, and correlations. Quite reasonably, only the three factors that formed the MO construct showed a certain level of collinearity. Tolerance, variance inflation factor (VIF), and condition index scores indicated no severe multicollinearity problems (Gujarati, 1997).

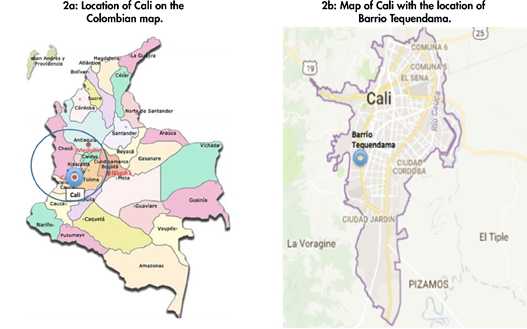

This data must be interpreted cautiously because they were largely based on subjective rather than objective indicators (Gerschewski & Xiao, 2015). In addition, it is essential to highlight the high value registered by the performance (5.07). The fact that this value is higher among the companies that belong to the cluster (5.4 versus 4.9) is relevant (Figure 3a) according to Hypothesis 1. In terms of MO, a high mean value (6.04) was also observed, which is in line with Mason & Harris (2005) for example, who found that managers tend to overestimate their MO level. Furthermore, in line with Hypothesis 2, we found no differences in the primary construct (both were around 6.0) or its components (6.1, 5.75, and 5.35). In line with Hypotheses 4a, b, and c, it was detected that there were differences in implementation levels between these components (Figure 3b).

Table 1: Summary table of the selected cases

Figure 3: Analysis of means in the main constructs

Source: own elaboration.

3.4 Analysis Technique

To test the hypotheses, we performed multiple linear regression analyses. The method chosen for selecting variables in the regression model has been the confirmatory specification. We are the ones who have control over the variables that make up each of the models (Hair et al., 2000). In line with the formulated hypotheses, prior to estimating each model, various adjustments and evaluations were made following the specifications of Gujarati (1997) . On the one hand, the bivariate correlations were analyzed. On the other, different residuals were analyzed to determine the fulfillment of the regression assumptions and the impact of multicollinearity.

Establishing different models makes it possible to compare alternative models by isolating changes in model fit and determining the explanatory power of the variables (Gujarati, 1997). To display the results, we defined four models. In each model, we studied the different effects of the independent and control variables on the dependent variable. Isolated location and Level 1 were set as the baseline case.

Moreover, to ensure the reliability of the data obtained and that their interpretation has been adequate, we have triangulated the information obtained. For this, we have followed the suggestions of Yin (2009) and interviewed six representative actors of the industry (three located inside and three located outside the cluster). To do this, we conducted semi-structured interviews. In these face-to-face interviews, questions related to the impact of location and the importance of the relational framework, performance, OM, as well as the reality of the health sector in Colombia were asked.

Discussion

4. Hypotheses testing and discussion

4.1 Effect of Location on firm performance (Hypothesis 1)

Table 2 shows the results of the linear regression analysis. To interpret the magnitude of the relationship between an independent variable and the dependent variable in linear regression, the table includes, for each independent variable, the estimated coefficient (β), significance (*), and standard error (SE). In addition, it is essential to keep in mind that the size variable was significantly positive in all cases, which indicated that larger-sized firms performed better.

Table 2: Regression Models. Dependent variable: Performance.

One of the objectives of the present study aimed to confirm if cluster location had a positive and significant effect on firm performance in the case of healthcare firms. From the results (Model 1 and later), it can be inferred that the firms benefited from agglomeration advantages (0.41; p <0.05) due to the relationships and networks that were formed between the cluster participants, which increased their performance (Canina et al., 2005; Wennberg & Lindqvist, 2010; Rodriguez-Victoria et al., 2017). In this way, the externalities generated by a cluster strengthened the performance of those firms, which, if operating alone, would be less competitive (McCann & Folta, 2009), particularly in the healthcare industry, where services provided within the general system require a high level of efficiency and complementarity in terms of the quality of care processes. The cluster strengthened the vertical relationships between firms that belonged to Levels 1 (mainly hospitals and clinics) and 2 (mostly suppliers or distributors of the Level 1 firms). Moreover, in discussions with the Managers on the benefits of being inside the cluster, the interviewees commented that the cluster had a significant daily flow of people seeking health services and the fact that they were located there and had a sign on the street served to attract customers. This result verified Hypothesis 1.

4.2 Effect of Location on MO (Hypothesis 2).

Hypothesis 2 (H2) posited that location impacts the level of MO in healthcare firms. The results of the analysis of variance (ANOVA) test showed that the level of MO of firms inside (6.0) and outside the cluster (6.1) was not statistically different (t = - 0.512; p = 0.610) (figure 3a).

While understanding that a cluster is a set of firms that have relationships in terms of knowledge, skills, demand, and inputs that generate externalities (Delgado et al., 2016), it is to be expected that not all components of the MO construct will have the same relevance for firms (Dawes et al., 2000). Beyond generating an important customer orientation or an effective inter functional coordination, the competitive environment of a cluster-based in a city causes firms to focus their attention on their competitors in an effort to strengthen their differentiation in terms of customer service. This is also related to the characteristics and features of the Colombian social system, where healthcare services are standardized, which leaves little scope to use customer orientation to offer better value (Molina, & Martínez, 2005; Causado-Rodríguez et al., 2018).

Another factor that possibly ensures there is no significant difference between the MO of the firms both inside and outside the cluster is that the enterprises were largely micro-enterprises and SMEs, and administrators usually do not have the knowledge to design effective MO strategies (Lautamäki, 2010; Powers et al., 2020). In many cases, the administrators or firm owners in the healthcare field are professionals who, in addition to attending to their patients, must manage their businesses, which leaves little opportunity to develop processes to ensure more effective administration and strategic management. In fact, an interviewed manager, when talking about his education and training, commented that he had no training in marketing because he was a bacteriologist, and regarding management, he told us that he had not studied it or had any training. I have been learning through on-the-job training in the exercise of my profession, he concluded. This result did not support Hypothesis 2.

4.3 Effect of MO on firm performance (Hypothesis 3).

We will now discuss the results regarding Hypothesis 3, which proposed that highly market-oriented firms enjoy better performance. The results showed a significant, positive, and strong relationship (0.40; p <0.01) between MO and the performance of firms in the healthcare industry (Model 2).

This result was consistent with the findings of other studies that confirmed the positive influence of this construct on performance (Boachie-Mensah & Issau, 2015; Castellanos-Ordoñez & Solano-Arboleda, 2017). In fact, previous findings demonstrated that the relationship between MO and performance was significant for both cluster and non-cluster firms. Thus, it can be affirmed that healthcare firms, according to the managers’ perceptions, enjoy a higher level of performance as they become more market-oriented. These results supported the findings of Wood et al., (2000) and Kumar et al., (2002) . They validated this effect in large hospitals in the United States and provided empirical evidence in the case of micro-enterprises and SMEs in the healthcare industry (Kovacs & Szakaly, 2022). These results verified Hypothesis 3.

4.4 Effects of the components of MO on performance (Hypotheses 4a, b, and c).

To test Hypotheses 4a, b, and c, we constructed multivariate linear regression Model 3. According to the summary presented in the table, the model's predictive ability is significant (p <0.001), and 32% of subjective performance was explained jointly by customer orientation, competitor orientation, and inter-functional coordination.

The results proved that of the three components of MO, only competitor orientation (0.31, p< 0.01) significantly affected performance. On the one hand, the statistical model showed that customer orientation did not significantly affect performance (-0.08; p = 0.50).

This could be related to the high level of standardization of services in the Colombian Health System and that firms think their customers are price sensitive (Zhou et al., 2009), which means that only a small percentage of all services require an understanding of the diverse needs and expectations of their clients. On the other hand, in an environment where differentiation is not easy, a high degree of a competitor orientation should be generated, particularly with respect to areas such as care and the availability of appointments. In addition, a competitor orientation can help firms to acquire resources and establish relationships with other firms (Dev et al., 2009).

Regarding interfunctional coordination, the results obtained (0.17, p = 0.13) lead us to argue that interfunctional coordination has no significant effect on performance. It should be remembered that the research sample primarily consisted of micro-enterprises and SMEs, wherein decisions are made solely by the manager, making it difficult to create adequate interfunctional coordination. In an interview with a manager, we noted these aspects because it became clear that they were constantly talking about competitors to be able to keep them in mind all the time, to be able to react and act (other aspects as customers were less relevant). In short, Hypothesis 4a was accepted, and Hypothesis 4b and Hypothesis 4c were rejected.

Conclusions

5. Conclusions

This paper analyzes the effect that location and MO have on the performance of companies in the health sector using a questionnaire that managers and entrepreneurs of these companies answered. This research addresses a scarcely studied sector and geographic context. One of the main motivations of the same was to contrast if the companies benefited from the advantages of the agglomeration.

Other reasons that justified this research are that the socio-economic importance of the healthcare industry is becoming critical. People are investing more and more resources to avail of the services provided by these firms, and market deregulation (globalization) has led to the emergence of new competitors, such as India, Thailand, and Singapore, which threatens the growth of other Latin American countries, like Colombia or Venezuela, that have so far remained leaders in this industry. Under this scenario, a question emerged, what could these firms do?

We noted that a MO organizational culture that seeks to respond effectively to customer requirements seems vital. Moreover, location is another decisive factor. Aside from decisions about location at a country or city level, firms must choose to locate in a particular area within the city, that is, inside or outside a service cluster. However, our results have also shown that it is not only a matter of being located within the cluster but also having an adequate size. Therefore, specialization and cooperation for smaller companies also emerge as other valid and necessary strategies to implement together with marketing strategies that public policies should promote and facilitate.

5.1 Theoretical and practical implications

These results have theoretical and practical implications. The findings elucidate the cluster effect and the MO of healthcare firms' service companies at an academic level. This area has been thus far neglected and offers great potential for future work. At a managerial level, a competitor orientation means that a service provider understands the short-term strengths and weaknesses and the long-term capabilities and strategies of critical current and potential competitors. This implies that, in geographical concentrations of companies in the healthcare sector, competitive advantage is obtained by continuously monitoring the actions of competitors while considering that knowledge of competitors is vital. However, an overly focused approach on competitors could encourage the formulation of strategies based on low prices, while strategies based on differentiation are abandoned.

In other words, for firms in the healthcare industry in emerging economies, MO and being located in a cluster are practical tools that can help a firm to achieve a higher level of business performance, mainly if it focuses on a competitor orientation. However, given the potential emergence of other international competitors from Asia who enjoy competitive advantages in terms of price, companies should pay greater attention to other dimensions of MO, such as customer orientation. For these reasons, given the dynamic environment in which they are involved, these findings explain the uneven performance among firms and call for further management and marketing training.

5.2 Limitations and future research

Finally, this study had some limitations and potential for future research. The sample size was small, and we only measured MO. Including other marketing philosophies may shed additional light on the impact of location on SMEs in terms of production, product, and selling concepts in healthcare and other service clusters. Another significant limitation of the work is that the fieldwork was carried out during 2014; an aspect that currently requires replication with more recent data, especially in a post-pandemic scenario. A further limitation was the subjective cross-sectional measurement of performance. This factor does not allow us to speak of causal relationships but an association at a given moment. Concerning the quantitative analysis techniques, future studies should employ a complementary PLS estimation to explain the variance of the targeted performance construct and the presence of possible mediator variables.

References