Article

DOI:

https://doi.org/10.18845/te.v16i3.6355

Overconfidence, fear of failure, risk-taking and entrepreneurial intention: The behavior of undergraduate students

Exceso de confianza, miedo al fracaso, asunción de riesgo e intención emprendedora: El comportamiento de estudiantes de pregrado

TEC Empresarial, Vol. 16, n°. 3, (September - December, 2022), Pag. 16 - 33, ISSN: 1659-3359

AUTHORS

Eduart Villanueva *

Escuela de Administración, Universidad EAFIT, Medellín, Colombia.

evillanu@eafit.edu.co.

![]()

Izaias Martins

Escuela de Administración, Universidad EAFIT, Medellín, Colombia.

imartins@eafit.edu.co.

![]()

* Corresponding Author: Eduart Villanueva

ABSTRACT

Abstract

This study investigates the relationship between students’ behavior, risk evaluation and entrepreneurial intention (EI) to verify whether overconfidence, fear of failure, risktaking, and risk capacity affect overall risk evaluation. The study uses a sample of 828 undergraduate students from a variety of university programs, and the data were analyzed using exploratory factor analysis and hierarchical regression models. The results show that overconfidence, risk-taking, and risk capacity are related to EI. Further, overconfidence, fear of failure, and risk capacity are related to risk evaluation; thus, suggesting a relationship between students’ behavior, risk evaluation and EI. This study offers novel evidence that helps to better understand students’ risk behaviors and entrepreneurial decision-making.

Keywords: Overconfidence, Fear of failure, Risk-taking, Entrepreneurial intention, Student's risk propensity.

Resumen

Este estudio investiga la relación entre el comportamiento de los estudiantes, la evaluación del riesgo y la intención emprendedora (IE), y busca establecer si el exceso de confianza, el miedo al fracaso, la asunción de riesgos y la capacidad de riesgo afectan la evaluación general del riesgo. Este estudio se realizó a través de la evaluación de una muestra de 828 estudiantes de pregrado, de diversas carreras. Los datos fueron analizados mediante análisis factorial exploratorio y modelos de regresión jerárquica. Los resultados muestran que el exceso de confianza, la asunción de riesgos y la capacidad de riesgo están relacionados con la IE. Además, el exceso de confianza, el miedo al fracaso y la capacidad de riesgo están relacionados con la evaluación del riesgo. Por lo tanto, existe evidencia de una relación entre el comportamiento de los estudiantes, la evaluación del riesgo y la IE. Los hallazgos de la investigación podrían ampliarse aún más para fortalecer el conocimiento existente sobre el riesgo y la IE. Este estudio propone un modelo para ofrecer nuevos conocimientos sobre una mejor comprensión del comportamiento y la IE de los estudiantes.

Palabras clave: Exceso de confianza, Miedo al fracaso, Asunción de riesgos, Intención emprendedora, Propensión al riesgo del estudiante.

Introduction

1. Introduction

Less than 50% of ventures survive in the market during the first three to four years (Coad, 2018). This uncertainty regarding the future of entrepreneurship is associated, in part, with the dynamism of the environment (Joshi et al., 2019). The early stage of a venture is known as the “valley of death,” because it is considered the riskiest stage for a business (Jucevicius et al., 2016). For this reason, it is essential to train undergraduate students in entrepreneurial skills by simulating cognitive conditions regarding self-confidence and tolerance toward failure and risk (Looi, 2020; Martins et al., 2018).

New entrepreneurs have limited knowledge about the risks that contribute to failure, and they also risk overestimating the probability of success (Collins, 2010), which leads to an inadequate evaluation of risk (Fabricius & Büttgen, 2015).

Confidence and perceptual factors are vital traits of entrepreneurship because they encourage individuals to seize opportunities (Hayward et al., 2006; Mohan et al., 2018), however, this can also easily lead to overconfidence and result in poor risk evaluation (Fabricius & Büttgen, 2015). In contrast, the fear of failure can prevent a venture from even getting off the ground and is considered a negative emotional behavior (Morgan & Sisak, 2016).

Risk-taking is one of the primary characteristics of EI (Chipeta & Surujlal, 2017). Nonetheless, studies also suggest that risk-taking could impair risk evaluation (Maldonado et al., 2016). Risk capacity can encourage EI (Bayah et al., 2016), but it is critical to determine whether risk-taking affects risk evaluation (Shreenivasan et al., 2017).

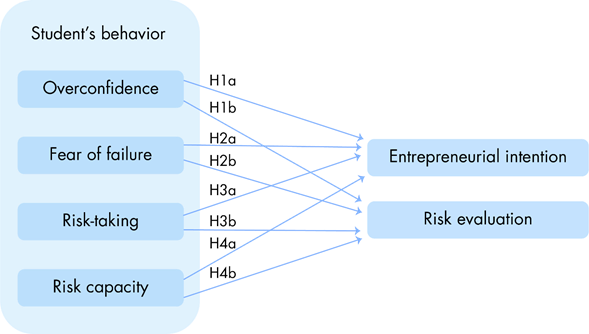

One of the originalities and main contribution of this study is the inclusion of the risk variables at the individual level, in a model that consider entrepreneurial intention. Despite the broad contribution of cognitive variables to the study of entrepreneurship, variables such as risk-taking has not been fully scrutinized in entrepreneurial intent studies. Moreover, the proposed model is one of the first studies applying risk-taking, risk capacity, overconfidence and fear of failure in an integrated students' behavior set to explain entrepreneurial intention and risk evaluation.

This article is structured in sections. First, the literature review and hypothesis are presented for explaining risk and its relation to EI. Next, the methodology used is described, which includes the sample size and the data collection. Thereafter, the results are presented. Afterwards, discussion and conclusions include the theoretical contribution of the study. Finally, limitations, implications and future research are detailed.

Literature review and hypotheses

2. Literature review and hypotheses

The present study is limited to an individual level analysis of risk, related to the possibility of adverse events occurring as the result of faulty objectives and strategies (Mikes & Kaplan, 2013). One of these risks is overestimating the probability of success where the existence of risk in a situation being analyzed is denied because of a bias for positive results (Collins, 2010).

The study focuses on EI, which has been investigated widely but needs to be explored further (Liñán & Fayolle, 2015). Since EI is an individual’s intention to start a new business (Meoli et al., 2020), there is a strong potential for developing EI studies that would better help understand decision-making in entrepreneurship (Fayolle & Liñán, 2014; Kim & Park, 2019).

Previous studies have shown that there is a positive link between entrepreneurship training programs and EI in undergraduate students; (Looi, 2020; Lopez et al., 2021) and as these programs also improve the ability of students to identify challenges and opportunities this improves EI in higher education (Leiva et al., 2021; Lima et al., 2015; Shi et al., 2019). Also, the favorable perception that a student has of the university and city environment has an impact on entrepreneurial intention (Lopez & Alvarez, 2019; Marulanda & Morales, 2016; Silva et al., 2021). Moreover, the development of evaluation tools is important for maximizing entrepreneurial potential and fostering entrepreneurship in entrepreneurship programs (Thomas & Wulf, 2019).

2.1 Overconfidence, EI, and risk evaluation

Overconfidence is a cognitive bias, and it can be defined as an individual’s tendency to overestimate the probability of success (Cheng, 2007). It has been demonstrated that overconfidence is one of the factors behind the creation of new entrepreneurships since it is positively correlated with the desire to be a pioneer (Hayward et al., 2006). Overconfidence in entrepreneurs is well documented. However, it is necessary to better understand this behavior in students (Giacomin et al., 2016). Overconfidence leads to risk-taking, reduces the performance of investment portfolios, and induces risky decision-making (Nosic & Weber, 2010), which decreases the rate of business survival (Dawson & Henley, 2013), and encourages individuals to define goals that are difficult to achieve (Collins, 2010).

It has been reported that overconfidence leads employers to overestimate the probability of business success (Hayward et al., 2006). Nonetheless, overconfidence is connected to business closure (Dawson & Henley, 2013) because entrepreneurs minimize the importance of risk and make poor risk evaluations (Fabricius & Büttgen, 2015). Individuals who feel powerful or overconfident believe they have control over their destiny and tend to underestimate risk (Lee et al., 2015). Therefore, the following hypotheses are proposed:

H1a: The higher the level of overconfidence, the higher will be the EI in undergraduate students.

H1b: The higher the level of overconfidence, the poorer will be the risk evaluation by undergraduate students.

2.2. Fear of failure, EI, and risk evaluation

Fear of failure affects the decision to start a business and is, hence, considered an obstacle to entrepreneurship around the world (Martins & Perez, 2020; Morgan & Sisak, 2016). Fear of failure also depends on the context of the situation (Mitchell & Shepherd, 2011; Riar et al., 2021). In the context of EI, the fear of failure reflects the tendency to avoid business failure (Bosma & Schutjens, 2011) and, consequently, affects the occupational choices of individuals (Martins & Perez, 2018).

Depending on the context in which the fear of failure presents itself, some individuals would tend to suppress their desire to start a business whereas others would feel stimulated because of their innate tendency to take risks (Mitchell & Shepherd, 2011). The impact of fear of failure on individual behavior could be beneficial; however, one previous study considered this variable as a limitation (Cacciotti & Hayton, 2015). From a psychological perspective, the fear of failure is a negative emotional behavior related to an individual’s decision-making process and affects the individual’s evaluation of business opportunities (Welpe et al., 2012). In addition, it has been demonstrated that risk perception is strongly linked to EI (Nabi & Liñán, 2013). In view of these considerations, the following hypotheses are proposed:

H2a: The higher the fear of failure, the poorer will be the EI among undergraduate students.

H2b: The higher the fear of failure, the higher will be the risk evaluation by undergraduate students.

2.3. Risk-taking, EI, and risk evaluation

Risk-taking is venture into the unknown in uncertain environments such as the entrepreneurial activity (Rauch et al., 2009). This is fundamental for fostering EI (Chipeta & Surujlal, 2017; Gurel et al., 2021; Tan et al., 2021). Some studies have found evidence that shows the higher the risk-taking, the higher is the EI (Mwiya et al., 2018). Moreover, subjects with higher risk-taking tendencies could identify more business opportunities (Welter, 2012). Previous studies have focused on the personal behaviors that favors EI, like risk-taking, innovation, and self-control, although motivational factors have also been investigated, like the desire for status, financial reward, and security (Ehsanfar et al., 2021).

Using a risk-based approach could change risky behaviors (Maldonado et al., 2016) because of the existence of bias during risk evaluation (Chang et al., 2017), and could lower the risk perception among those who like to venture into risky situations (Singh et al., 2018). One study conducted in adolescents found that risk evaluation was not only affected by risk-taking but also depended on the context being analyzed, like security, recreational, social, or business situations (Zhang et al., 2016). These considerations allow for the following hypotheses to be formulated:

H3a: The higher the risk-taking, the higher will be the EI in undergraduate students.

H3b: The higher the risk-taking, the poorer will be the risk evaluation by undergraduate students.

2.4. Risk capacity, EI, and risk evaluation

By risk capacity, we consider the financial resource that individuals can afford to invest and perhaps lose in order to reach their goals (Zanella, 2015). Can be an obstacle to new business development because a lack of financial support can frustrate EI (Bayah et al., 2016). It has been shown that the higher the funding for entrepreneurship, the higher will be the EI among students (Kakouris, 2016). When combined with access to bank credit and motivation to invest, can stimulate business development (Gill et al., 2017).

A previous study has shown that risk capacity adversely affects risk evaluation, although there did seem to be gender differences (Shreenivasan et al., 2017). This finding was not in line with those of other studies, wherein investors invested a smaller amount of money in risky assets and made better risk evaluations as their risk capacity increased (Zanella, 2015). Financial planning affects individual behaviors in the presence of risks (Gontarek, 2016). The more funds a person has to invest, the less importance he/she gives to the evaluated risks (Pompian, 2017). In this respect, studies have also indicated that, on some occasions, individuals can tolerate risks greater than their capacity to assume risks-they are willing to assume more risks than they should-which would affect risk evaluation (Shreenivasan et al., 2017). Nevertheless, individuals who reported having EI decided to save money, demonstrating the link between risk capacity and EI (Gill et al., 2017). In view of this, the following hypotheses are proposed:

H4a: The higher the risk capacity, the higher will be the EI in undergraduate students.

H4b: The higher the risk capacity, the poorer will be the risk evaluation by undergraduate students.

The hypotheses described above are summarized in Figure 1.

Figure 1: Relationship between student's behavior, entrepreneurial intention, and risk evaluation.

Research design

3. Research design

The research population for this case consist of Colombian undergraduate university students, and as such, Colombia is an emerging economy. It has been observed that in emerging economies, the entrepreneurial intention is greater than in developed countries (Sieger et al., 2021). Colombia is among the Latin American countries with the best rating of current entrepreneurial activity (Bosma & Kelley, 2019). According to university students, these environments favour their entrepreneurial opportunities (Martins et al., 2022; Moreno-Gómez et al., 2020).

A systematic survey was performed to measure the perception, intention, and entrepreneurial attitude of undergraduate students attending an entrepreneurship course. The survey was conducted in an emerging economy, in a private and long-established university, located in Medellín, Colombia. The data were collected in second semester of 2018. The study sample included 828 students, of which 51.1% were women and 48.9% were men. Of the total sample, 70.3% were aged 16 to 20 years, 28.1% were aged 21 to 25 years, and 1.9% were aged >26 years. The participants were enrolled in administration, engineering, humanities, economics, law, or science courses.

Concerning techniques for the control of bias in the common method, there are two ways to reduce this influence: through research design, and by using statistical control techniques (Podsakoff et al., 2003). In this sense, in the design of the instrument, the anonymity of the participants was guaranteed to minimize common effects such as answer consistency, social convenience and emotionally positive or negative mood at the time of the survey. In turn, the Harman factor test was also considered and for this a factorial analysis was carried out to observe that a single factor was not generated and that most of the covariance was not concentrated in one of the factors; it occurs when there is an important amount of common method variance (Meade et al., 2007; Podsakoff et al., 2003).

3.1 Variables of the study

Dependent variables

Entrepreneurial Intention. The scale used to measure EI was by Liñan and Chen (2009) . The questions are measures using a seven-point scale. The scale has been tested by different studies (Eid et al., 2019; Fayolle and Liñán, 2014). EI had a KMO (Kaiser-Meyer-Olkin) value of 0.848 using Bartlett’s sphericity test (p<0.01) and a Cronbach’s alpha of 0.918. The total variance obtained for EI was 86.34%.

Risk evaluation. Was measured by presenting the following hypothetical situation to the students: ‘You have 100 million pesos to start a business with which you can double your investment or lose everything with a 50% chance for going either way. Using a seven-point scale, where one represents ‘no risk’ and seven represents ‘very high risk’, how would you evaluate the risk of this undertaking’? (Nosic & Weber, 2010).

Independent variables

Overconfidence. There were four questions related to the lack of business skills, lack of experience in administration and accounting, lack of knowledge in business and marketing, and lack of general knowledge that were scored using a seven-point scale. These questions had also been used in other studies to measure overconfidence (Genesca & Veciana, 1984; Giacomin et al., 2016).

Risk-taking. There were five questions using a seven-point scale, that assessed risk assumption were directed at individuals who consider risk-taking challenging, those with a tendency to act boldly in risky situations, those who believe risk-taking increases the probability of business success, those with a tendency to take risks when they envision the possibility of high returns, and those who like to venture into the unknown (Bolton & Lane, 2012; Covin & Slevin, 1991; Mwiya, et al., 2018; Popov et al., 2019).

There were two factors that emerged from the exploratory factor analysis (Table 1).

Cronbach’s alpha was greater than 0.8 for both factors, indicating good reliability. The KMO values were greater than 0.65, demonstrating that unidimensional was acceptable. In both cases, p-values were smaller than 0.00, indicating that these two factors could be correlated. The percentage variance obtained was 66.40 for overconfidence and 60.42 for risk-taking, and these values were considered high.

Next, confirmatory factor analysis was performed, and some adjustment indexes were used to evaluate the results, including the standardized chi-square (chi-square divided by the degrees of freedom) (Kline, 2015; Schumacker & Lomax, 2016), the comparative fit index (CFI) (Fan et al., 1999), the root mean square error of approximation (RMSEA) (Kline, 2015), and the GFI and AGFI goodness-of-fit indexes. These results are shown in Table 2.

Table 1: Exploratory factor analysis

| Factor | Cronbach’s alpha | KMO | Bartlett’s sphericity test | Percentage of the variance explained |

|---|---|---|---|---|

| Overconfidence | 0.83 | 0.78 | 0.00 | 66.40 |

| Risk-taking | 0.83 | 0.84 | 0.00 | 60.42 |

Table 2: Adjustment indices for confirmatory factor analysis.

| Index | Value | Acceptance level |

|---|---|---|

| Chi-square | 106.068 | |

| Degrees of freedom (DF) | 26 | |

| CFI | 0.97 | CFI > 0.9 |

| GFI | 0.97 | GFI > 0.9 |

| AGFI | 0.95 | AGFI > 0.9 |

| RMSEA | 0.06 | RMSEA ≤ 0.08 |

| Chi-square/DF | 4.08 | 1 < chi-square < 5 |

The adjustment indices for confirmatory factor analysis met all the criteria established in the literature, demonstrating an adequate level of adjustment for the variable's overconfidence and risk-taking.

Fear of failure. Assumed a value of one if a student responded that this would prevent him/her from starting a business and a value of zero when he/she indicates the opposite as the answer. This variable was also used in previous studies (Martins & Perez, 2018).

Risk capacity. Was an independent dichotomous variable that assumed a value of one if a student stated that he/she was saving money to start a business and a value of zero if the opposite was the case (Zanella, 2015).

Control variables

Age. The age variable allowed for determining the possible effects of age differences in EI and risk evaluation. The mean and standard deviation of this continuous variable was 19.84 and 2.23, respectively. Other studies had found a significant relationship between age and EI (Hatak et al., 2015).

Semester. The identification of the semester allowed determining if the level of higher education affected EI and risk evaluation (Herman & Stefanescu, 2017; Passaro et al., 2018).

3.2 Research technique

This study employed multivariate analysis technique: hierarchical linear regression model. Where overconfidence, fear of failure, risk-taking and risk capacity are independent variables and have direct influence on the EI and risk evaluation. The control variables are age and course semester. This analysis technique is used to observe the effect of different independent variables on the dependent variable (Hair et al., 1999). The equation of the model is presented below.

γ i =β 0 + β j X i + β j Z i + ε i i= 1,….., N

Where

γ = dependent variables: entrepreneurial intention or risk evaluation

X = control variables: age and semester

Z = independent variables: overconfidence, fear of failure, risk-taking and risk capacity

ε = error

N= number of individuals (i) in the sample

Results

4. Results

Before performing the regressions, possible links between the independent variables were determined, including a marginal negative correlation between risk capacity and fear of failure, and a marginal positive association between risk capacity and risk-taking. However, these correlations were shown to be insignificant and do not represent multicollinearity problems for the hierarchical regression model (Hair et al., 1999). The relationships between the variables are summarized in Table 3.

The hypotheses raised by the present study were tested using multiple regression models. The regressions were analyzed using two steps. The first step included the dependent variable EI, and the second step included the dependent variable risk evaluation.

4.1. Step 1 dependent variable: Entrepreneurial Intention

The first model included only the control variables and found a positive and significant correlation (level of confidence of 95%) between age and EI, and a negative and significant correlation (level of confidence of 99%) between the course semester and EI. The second model included both the control and the explanatory variables. In it, age was no longer significantly associated with the other variables. Overconfidence was negatively and significantly correlated (level of confidence of 90%) with EI, refuting the H1a hypothesis. There was a non-significant correlation between fear of failure and EI, no confirming the H2a hypothesis. Moreover, there was a positive and significant association (level of confidence of 99%) between risk-taking and EI, confirming the H3a hypothesis, and a positive and significant association (level of confidence of 99%) between risk capacity and EI, confirming the H4a hypothesis. This model presented an adjusted R² of 0.387, demonstrating that the explanatory power of model 2 was significantly higher than that of model 1, and confirming the explanatory power of the independent variables. These two models are shown in Table 4.

Table 4: Regression analysis results on entrepreneurial intention.

4.2. Step 2 dependent variable: risk evaluation

The first model only included the control variables. There was a negative and significant association (level of confidence of 95%) between age and risk evaluation and a non-significant correlation between course semester and risk evaluation. The control and explanatory variables were included to build the second model. In this model, age was not strongly associated with risk evaluation. There was a negative and significant relationship (level of confidence of 99%) between overconfidence and risk evaluation, confirming the H1b hypothesis, and a positive and significant association (level of confidence of 99%) between fear of failure and risk evaluation, confirming the H2b hypothesis.

Risk-taking was not significantly associated with risk evaluation in the study sample, no confirming the H3b hypothesis. There was a negative and significant correlation (level of confidence of 95%) between risk capacity and risk evaluation, corroborating the H4b hypothesis. The model had an adjusted R² of 0.037, indicating that the explanatory power of model 2 was higher than that of model 1. These parameters are shown in Table 5.

Table 5: Regression analysis results on risk evaluation.

Discussion and conclusions

5. Discussion and conclusions

The main objective of this study was to assess the link between risks (propensity and evaluation) and entrepreneurial intention. The results indicate that undergraduate students with EI may overestimate the probability of business success, and students were biased when assessing risk and hence, would minimize the importance of the risks inherent to entrepreneurial activity. Age was the control variable with a positive and significant correlation with EI-the older the person, the higher was the EI. In contrast, age was negatively and significantly associated with risk evaluation, indicating that risk evaluation was poorer as age increased. These results corroborate those of other studies on individual behaviors in entrepreneurship (Curran & Blackburn, 2001). In turn, the course semester, was negatively and significantly correlated with EI, indicating that students in more advanced semesters had lower EI. These results coincide with what was found in other studies conducted in emerging economies (Lima, et al., 2015; Soria-Barreto et al., 2016). The foregoing reinforces that the university environment influences the entrepreneurial intention (Leiva et al., 2021; Lopez & Alvarez, 2019), and the relationship between entrepreneurial education with the EI is confirmed, consistent with that presented by the literature previously (Thomas & Wulf, 2019). The course semester was not significantly associated with risk evaluation in study participants. It is important to highlight that in some of the careers there are no mandatory courses on risks.

Regarding the explanatory variables, the findings confirm that there was a link between overconfidence and EI, and these findings are consistent with those of previous studies (Hayward et al., 2006). Nonetheless, overconfidence decreased risk evaluation, demonstrating that individuals with this behavioral trait might overestimate the probability of business success. Having this overconfidence can generate risks. It gives the wrong perception of the analysis that must be done of all the factors that influence an enterprise. This corroborates what was previously presented in the literature (Fabricius & Büttgen, 2015; Nosic & Weber, 2010).

Regarding fear of failure, our results do not confirm a direct effect on EI, which reinforces previous findings in other geographical contexts that analyzed the relationship of the impact of entrepreneurial role models on the entrepreneurial intention (Lafuente et al., 2007). But it is contrary to what was found in a previous study that showed a negative effect of fear of failure on IE (Quartey et al., 2018), and in some cases affecting more women than men (Driga et al. , 2009). However, this was positively and significantly associated with risk evaluation, indicating that the participants with more fear of failure would give more importance to risk evaluation. This can induce the individual to give greater importance to the risks than what really are there. The foregoing provides more evidence than previously found in the literature (Fabricius & Büttgen, 2015).

Risk-taking was positively and significantly correlated with EI, corroborating the results of the literature (Chipeta & Surujlal, 2017; Ehsanfar et al., 2021; Mwiya et al., 2018). This finding, which indicates that the desire that an individual has to face risky situations will also promote the inclination to create their own company. In this study, however, it was not significantly associated with risk evaluation, indicating that risk-taking did not produce biases during risk evaluation by the entrepreneurs.

There was a positive and significant relationship between risk capacity and EI, which is consistent with the results of other studies (Bayah et al., 2016; Kakouris, 2016). This suggests that having financial backing helps increase the intentions of a student to become an entrepreneur. However, there was a negative and significant association between risk capacity and risk evaluation, demonstrating that the higher the risk capacity, the poorer was the risk evaluation, which increases the risk of overestimating the probability of success. These results show similarities with what is stated in the literature (Gill et al., 2017; Shreenivasan et al., 2017).

These results indicate that students’ behavior can increase the risk of overestimating the probability of success, consequently minimizing the risk evaluation, and not adequately responding to the risks.

The interpretation of our findings is subject to some limitations. Nevertheless, there are possibilities for future research in line with the results. Although a model built based on a solid theoretical framework was utilized, these results can, to some extent, be favoured by studying a single, private university with entrepreneurial-focused strategies, where individuals have similar business behaviors. Further similar studies in other countries or assessing comparative studies in different types of universities, (public or private) would be welcome.

Moreover, future studies should evaluate not only undergraduate students who intend to start a new business but also individuals who want to start a business either because they are not satisfied with their current work or are unemployed. These limitations prevent the generalization of results of this study to all undergraduate students and should be addressed in future research. Another limitation is the use of a single data source-the survey. Future studies should use other types of data sources to confirm these findings and reduce the biases inherent in self-reported data.

This research highlights the need to further investigate entrepreneurship using a comprehensive risk management approach, which allows for better understanding of the theoretical aspects associated with EI and its relationship with risk variables. This approach could increase the knowledge of EI and risk evaluation because of the close link between the variables in the proposed model. Overconfidence, which is studied within the theoretical framework of EI, is also a predictor of risk evaluation, indicating that these two variables can be analyzed jointly.

References