Article

DOI:

https://doi.org/10.18845/te.v16i2.6169

Financial resources, eco-innovation and sustainability performance in automotive industry

Recursos financieros, eco-innovación y rendimiento sustentable en la industria automotriz

TEC Empresarial, Vol. 16, n°. 2, (May - August, 2022), Pag. 34 - 54, ISSN: 1659-3359

AUTHORS

Gonzalo Maldonado-Guzmán

Centro de Ciencias Económicas y Administrativas, Universidad Autónoma de Aguascalientes, México.

gonzalo.maldonado@edu.uaa.mx.

![]()

Sandra Yesenia Pinzón-Castro

Centro de Ciencias Económicas y Administrativas, Universidad Autónoma de Aguascalientes, México.

sandra.pinzon@edu.uaa.mx.

![]()

* Corresponding Author: Gonzalo Maldonado-Guzmán

ABSTRACT

Abstract

Eco-innovation is considered in the literature as one of the most important constructs that substantially improve the environmental sustainability of manufacturing companies. However, it has been shown that companies alone cannot adequately develop ecoinnovation activities, to achieve not only a higher level of eco-innovation activities, but also a significant improvement in the level of sustainable performance of manufacturing firms. In addition, little is known about the relationship between financial resources, eco-innovation and sustainable performance fill this gap in the literature and explore the relationship between these three main constructs through an extensive review of the literature. Likewise, a selfadministered questionnaire was distributed to a sample of 460 through confirmatory factor analysis and structural equation models. The results obtained suggest that financial resources have significant positive effects on eco-innovation, and eco-innovation has significant positive effects on the sustainable performance of firms in the automotive industry.

Keywords: Financial resources, eco-innovation, sustainability performance, México.

Resumen

La eco-innovación se considera en la literatura como uno de los constructos más importantes que mejoran sustancialmente la sostenibilidad ambiental de las empresas manufactureras. Sin embargo, se ha demostrado que las empresas por sí solas no pueden desarrollar adecuadamente actividades de eco-innovación, para lograr no solo un mayor nivel de actividades de eco-innovación, sino también una mejora significativa en el nivel de desempeño sostenible de las empresas manufactureras. Además, poco se sabe sobre la relación entre los recursos financieros, la eco-innovación y el desempeño sostenible. Llene este vacío en la literatura y explore la relación entre estos tres constructos principales a través de una revisión extensa de la literatura. Asimismo, se distribuyó un cuestionario autoadministrado a una muestra de 460 mediante análisis factorial confirmatorio y modelos de ecuaciones estructurales. Los resultados obtenidos sugieren que los recursos financieros tienen efectos positivos significativos en la eco-innovación, y la eco-innovación tiene efectos positivos significativos en el desempeño sostenible de las empresas de la industria automotriz.

Palabras clave: Recursos financieros, eco-innovación, rendimiento sustentable, México.

Introduction

1. Introduction

In the current literature of business and innovation sciences, different researchers, academics and industry professionals agree that eco-innovation activities, in addition to significantly reducing negative environmental impacts, are also generally considered as a factor essential in the transition between the generation of a more sustainable economy and society, supports mitigating the traditional dicotonomy between financial performance and sustainability (Carrillo-Hermosilla et al., 2010; OECD, 2012; Boons et al., 2013; Klewitz & Hansen, 2013; Bocken et al., 2014; Ghisetti & Rennings, 2014). In addition, eco-innovation activities also significantly improve the sustainable performance of manufacturing firms (Carrillo-Hermosilla et al., 2010), including those that make up the automotive industry.

Also, previous studies have provided theoretical and empirical evidence in the understanding of the transition that some of the manufacturing companies, are making to sustainability through a systematic transformation (Carrillo-Hermosilla et al., 2010; Adams et al., 2012; Boons & Lüdeke-Freund, 2013), through the implementation of circular economy activities (Braungart et al., 2007), and the implementation of more sophisticated business models (Könnölä et al., 2006; Adams et al., 2012; Boons & Lüdeke-Freund, 2013). In addition, sustainable performance has generally been analyzed through absolute contributions and related to environmental sustainability (eco-efficiency and eco-effectiveness) (Braungart et al., 2007; Carrillo-Hermosilla et al., 2010), and the creation of value, competition and its integration into new business models (Adams et al., 2012; Boons & Lüdeke-Freund, 2013; Ghisetti & Rennings, 2014).

Additionally, there are several studies in the literature that consider that the theoretical and empirical contribution of the essential characterization of eco-innovation activities is not sufficient, so that the studies of researchers, academics and industry professionals should be guide on it (Boons et al., 2013; Boons & Lüdeke-Freund, 2013; Klewitz & Hansen, 2013; Garrido-Azevedo et al., 2014; Iñigo & Albareda, 2016). In this sense, it is clear that studies have to be oriented in providing evidence that allows us to understand more clearly the different characteristics that surround the different activities of eco-innovation (Kesidou & Demirel, 2012; Boons & Lüdeke-Freund, 2013; Jakobsen & Clausen, 2016; Roscoe et al., 2016), and not focus only on one of them, as is the case of technology, as if it were the only solution of eco-innovation activities to all environmental problems (Motta et al., 2018).

However, there is empirical evidence that demonstrates that technology and companies alone cannot solve the environmental problems generated by organizations, so it is necessary to carry out collaborative activities with other companies and financial organizations, to mitigate changes climate and improve sustainable performance (Motta et al., 2018). In this context, eco-innovation is emerging in current literature as one of the substantial activities that can significantly improve the sustainable performance of companies (Hojnik & Ruzzier, 2015), through the creation and improvement of eco-innovation of products, processes, and management systems (Carrillo-Hermosilla et al., 2010). Therefore, the results obtained from the relationship between financial resources, eco-innovation, and sustainable performance can be considered as inconclusive (Motta et al., 2018), so this study contributes to the literature with the generation new knowledge.

For these reasons, the overall effect of the financial resources in eco-innovation and sustainability performance may still be considered inconclusive. Therefore, to complement and expand the limited body of knowledge, this paper addresses the following research question: What is the relationship between financial resources, eco-innovation and sustainability performance in the automotive industry? The rest of the paper is structured as follows: Section 2 presents the literature review and hypotheses; Section 3 introduces the research methodology; the analysis and interpretation of results are included in Section 4; lastly, Section 5 provides derived conclusions, limitations and future research directions.

2. Literature review

In the last decade the number of studies and the interest of researchers, academics and industry professionals has increased exponentially, in the analysis and discussion of eco-innovation practices, since it is considered by various researchers and academics as one of the fundamental factors in the investigation of solutions that optimize the use of natural resources in industrial production (Coenen & Díaz-López, 2010; Díaz-García et al., 2015). However, given the complexity that the term of eco-innovation represents for its management and that no company, can implement by itself the different activities that eco-innovation entails (De Marchi, 2012; Kanda et al., 2018), and that its conceptualization has a multifaceted character (Garcés-Ayerbe et al., 2016; Kiefer et al., 2017), it is necessary that the studies be oriented in providing greater theoretical and empirical evidence of their relationship with other constructs, such as example financial resources (Scarpellini et al., 2018), and sustainable performance (Motta et al., 2018).

Likewise, the analysis and discussion of internal factors, such as resources and capacities, related to eco-innovation activities have focused in terms of their conceptualization (Demirel & Kesidou, 2011; del Río et al., 2012, 2016a; He et al., 2018), and the resources and capabilities available to manufacturing companies, including those of the automotive industry, have shown that they are essential for obtaining better financial results in eco-innovation practices (Díaz-García et al., 2015). However, the relationship between eco-innovation and investments in manufacturing firms, particularly financial resources, has not been extensively analyzed and discussed in the current literature, so it is important that researchers, academics and professionals guide their studies in this direction (Scarpellini et al., 2018).

In this sense, more studies are needed that provide empirical evidence of the various financial resources that have significant positive effects on eco-innovation (Johnson & Lybecker, 2012; Lee & Min. 2015; Cai & Li, 2018), since the financial resources are considered in the literature as one of the basic pillars of the new business models (Gallo et al., 2018). In addition, different studies published in the innovation literature have focused their analysis on the resources and capabilities of companies separately, not providing clarity on the financial resources required to improve eco-innovation activities, or how those resources complement the capabilities of manufacturing firms necessary to improve their sustainable performance (López & Montalvo, 2015; Ramanathan et al., 2016).

2.1 Financial Resources and Eco-innovation

The relationship between financial resources and eco-innovation has been analyzed in studies previously published in the innovation literature (Scarpellini et al., 2018), obtaining dissimilar results. Some studies have found a negative relationship between both constructs (Biondi et al., 2002; del Brío & Junqueras, 2003; Ciccozzi et al., 2003; Ghisetti et al., 2017), while other studies have found a positive relationship (Ghisetti & Rennings, 2014; Ketata et al., 2014; Sierzchula et al., 2014; Galia et al., 2015; Lee & Min, 2015; Przychodzen & Przychodzen, 2015; Scarpellini et al., 2016, 2018). Therefore, the results obtained in the literature that analyze the effects of financial resources in the different activities of eco-innovation, establish that this relationship can be considered as inclusive, so that there is a need for more empirical evidence to demonstrate the existing relationship between both constructs (Scarpellini et al., 2018).

There are also studies published in the literature that have been oriented in the analysis of endogenous financial resources (Halila & Rundquist, 2011; Paraschiv et al., 2012; Cruz-Cázares et al., 2013; Lee & Min, 2015; Triguero et al., 2015), while other studies have focused on the analysis of access to financial capital, on the one hand, through credit institutions, venture capital, capital increase or private foundations and, on the other hand, through public foundations that financially support companies to reduce negative environmental impacts (Johnson & Lybecker, 2012), since it is commonly acceptable in the literature that the volume of financial investment in environmental activities generates various competitive advantages, to those manufacturing firms that have adopted and implemented eco-innovation activities (Lee & Min, 2015; Ociepa-Kubicka & Pachura, 2017; Ghisetti et al., 2017; Triguero et al., 2017).

In this sense, the level of financial investment has been considered by various researchers, academics and industry professionals as a relevant financial resource that significantly improves eco-innovation activities (Ding, 2014; Ketata et al., 2014; Lee & Min, 2015; Triguero et al., 2017). However, research is open for the contribution of more empirical evidence on the impact on some specific types of eco-innovation activities (eco-innovation in products, eco-innovation in processes, and eco-innovation in management), of such that it improves both the environment and the sustainable performance of the firms (Scarpellini et al., 2018), or so that the environmental resources available in manufacturing companies are substantially increased.

Additionally, García-Pérez-de-Lema et al. (2013) found a positive relationship between the use of external financing (public banks), and innovation activities, compared to the increase in capital or financial support of private foundations, with the effects of investors being consistent over the long term (Harford et al., 2017). In the same order of ideas, Bortolini (2013) analyzed the capital structure of companies in Italy, and found that manufacturing firms that had a high level of profit, generally tended to introduce a significant increase in their internal financial funds, but when manufacturing companies were making efforts to improve their innovation activities, commonly resorted to external financing, specifically the use of different lines of credit, which allows to establish a significant positive relationship between the use of external financing and eco-innovation (Guney et al., 2017).

However, Amore and Bennedsen (2016) found that a high dependence on external capital in certain sectors of economic activity, were one of the essential factors that reduced the activities of eco-innovation, which was measured through the number of green patents registered by the companies proposed by Durán-Romero and Urraca-Ruiz (2015), particularly in those business sectors with a high level of R&D investment (Johnson & Lybecker, 2012). To counteract these results, Scapellini et al. (2018) analyzed the different financial resources in innovation activities in manufacturing companies, including financing, and found a significant positive relationship between both constructs, so it is possible to establish that investment in R&D can generate significant positive effects on eco-innovation activities.

In addition, other financial factors have been analyzed in studies published previously in the eco-innovation literature, such as corporate debt or debt structure, which have been considered as explanatory variables of the behavior of the activities of the eco-innovation carried out by manufacturing companies, including those of the automotive industry, obtaining significant positive results (Lee & Min, 2015; Przychodzen & Przychodzen, 2015; Scarpellini et al., 2016). Likewise, Przychodzen and Przychodzen (2015) analyzed the relationship between financial performance and eco-innovation in manufacturing firms in Poland and Hungary, considering corporate debt as an indicator of financial risk, concluding that the companies that showed a low level of exposure to financial irrigation (debt reduction), achieved greater growth in eco-innovation activities.

Additionally, uncertainty implies a higher level of guarantees that facilitates the granting of loans required by manufacturing firms, due to the high risk involved in investing in eco-innovation activities (Kim et al., 2016), in addition to which reduces the flow of financial funds due to the risk in the investments made (Polzin et al., 2017). These effects are commonly applicable in economic systems dominated by commercial banks and private financial institutions, which are exposed to the regulations carried out by government entities in favor and support of eco-innovation activities (Scapellini et al., 2018). Thus, in countries such as Spain and Italy the degree of intermediation of commercial banks is too high, however the reduced capitalization to which companies have access, especially small and medium-sized ones, prevents them from entering the market (Aloise & Macke, 2017), since most of the financial resources come from commercial banks, compared to other types of external financing (Bortolini, 2013).

In this sense, previously published studies have emphasized the use of public subsidies, as a fundamental element that facilitates the activities of R&D and eco-innovation (Pereiras & Huergo, 2006). Regarding this issue, Triguero et al. (2017) found significant positive effects among public subsidies for R&D in environmental activities in eco-innovation. Similar results were obtained by Ghisetti and Rennings (2014), finding that public financing encourages manufacturing companies, including those that integrate the automotive industry, to the adoption of the different eco-innovation activities, particularly in those projects of character social and environmental sustainability care that are not as profitable for most manufacturing firms.

In general terms, the lack of financial resources has been identified in the current innovation literature as one of the basic factors that significantly limit the level of eco-innovation activities in companies (Ociepa-Kubicka & Pachura, 2017), in addition to having a strong influence on the development of the environmental strategies of small and medium enterprises (Noci & Verganti, 1999), particularly in those sectors that are too sensitive for the development of eco-innovation, such as case of manufacturing industry firms (Ghisetti et al., 2017). Therefore, the availability of financial resources is strongly associated with R&D activities, and if there is a possible restriction on access to financial resources, it will not only have negative effects on R&D activities, but also on eco-innovation (Lee et al., 2015).

Finally, the high level of uncertainty, complexity and specificity of eco-innovation activities, compared to conventional innovation activities (Zhang & Walton, 2017), implies that manufacturing firms must have all the information related to the different types of investment, as this will facilitate access to the financial resources necessary for eco-innovation (Polzin, 2017). Therefore, it is possible to establish that the availability of financial resources is considered in the current innovation literature, as one of the strategic elements that significantly improve eco-innovation activities (Ociepa-Kubicka & Pachura, 2017; Zulfiqar & Thapa, 2018). Thus, considering the information presented above, it is possible to raise the first of the research hypotheses:

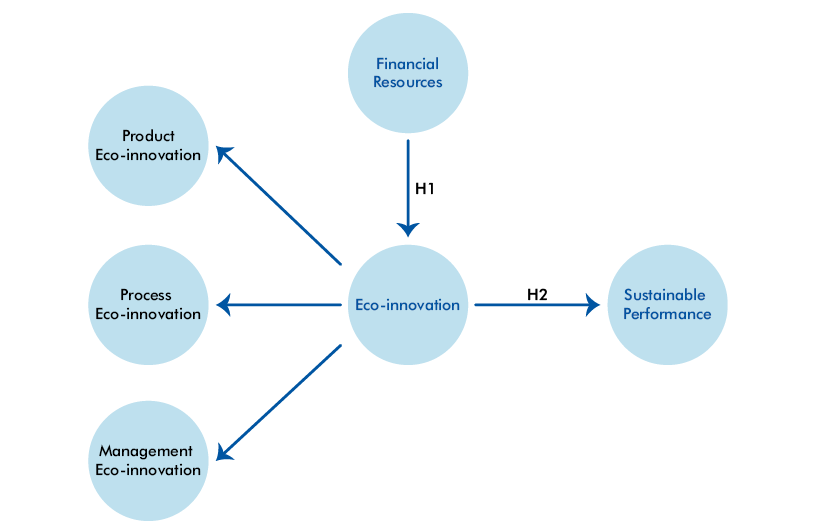

H1: Financial resources have significant positive effects on eco-innovation.

2.2 Intellectual capital and innovation

In the literature of business and innovation sciences there is a variety of studies that have conceptualized differently than eco-innovation (Adams et al., 2016), which are generally used in a similar way and as synonyms (Karakaya et al., 2014; Díaz-García et al., 2015; Xavier et al., 2017). Thus, in an exploratory study of the literature review, Schiederig et al. (2012) identified that the constructs of green innovation, ecological innovation, environmental innovation, and eco-innovation have been used interchangeably as synonyms for each other (Boons et al., 2013; Hojnik & Ruzzier, 2016). Therefore, for the purposes of this empirical study, the eco-innovation construct will be used, since this construct emphasizes the involvement of social activities, in a broader sense and the necessary changes required by the organizational structure (Motta et al., 2018).

Likewise, there are relatively few studies published in the current literature that relate eco-innovation and sustainability, even though evidence has been provided that innovation is considered as an essential variable that adds social, environmental and economic value to manufacturing companies (Doherty et al., 2014). Therefore, in the literature it is common to find that eco-innovation is considered as a substantial factor to achieve a higher level of sustainable development, even when it is necessary to make changes in manufacturing firms, since most of the changes are closely related to the central aspects of eco-innovation, which in turn generate a transition period to achieve more and better results in organizations, including a higher level of sustainable performance (Motta et al., 2018).

In this sense, most of the studies published in the literature that analyze the activities of eco-innovation have been published after the second decade of the current century (Karakaya et al., 2014; Díaz-García et al., 2015; Bossle et al., 2016; Xavier et al., 2017), which include an extensive review of the literature in recent years that provides a synthesis of eco-innovation and the constructs commonly used relates, among them sustainable performance (Motta et al., 2018). In addition, some studies have focused on the drivers of eco-innovation (Bossle et al., 2016; Hojnik & Ruzzier, 2016; del Río et al., 2016b), while others have focused on a specific context of the determinants of eco-innovation in small and medium-sized manufacturing companies (Pacheco et al., 2017), but relatively few studies have analyzed the relationship between eco-innovation and sustainable performance (Motta et al., 2018).

In addition, from a historical perspective several studies have recognized that the work done by Fussler and James (1996), fuels the first to use the term eco-innovation in the current specialized literature of innovation (Karakaya et al., 2014; Díaz-García et al., 2015; Pacheco et al., 2017). In their book Driving Eco-innovation, Fussler and James (1996: 15) define eco-innovation as “the development of new products and processes that provide superior value to both customers and companies, and with the generation of a significant reduction in environmental impact”. Similarly, other existing definitions in the literature differ from the definition of the authors mentioned above, especially in terms of the reduction of environmental impacts, as is the case of Rennings (2000), who observes this difference in terms of the content of the changes in the direction of the generation of greater sustainable performance.

In general terms, eco-innovation is totally neutral and is generally open in all possible directions, so it is possible to establish that eco-innovation is commonly motivated by the direction and content of progress and obtaining a better sustainable performance (Rennings, 2000). In addition, Oltra (2008) argued that the particularity of any environmental innovation not only has a positive impact on sustainable performance, but is also closely related to both environmental regulations and sustainable activities. Therefore, it is possible to establish that the particularity of eco-innovation has a double external problem, which, on the one hand, reduces the incentives for manufacturing firms to invest their financial resources in eco-innovation activities and, on the other hand, it demands the use of government policies and instruments that regulate the effects of eco-innovation on sustainable performance (Rennings, 2000; Oltra, 2008).

Other more published studies in the literature of innovation have focused on the search for new perspectives that allow reducing the negative impacts that manufacturing companies generate on the environment (Motta et al., 2018). Under this perspective, Andersen (2008) and Foxon and Andersen (2009) considered any type of innovation as eco-innovation to improve the sustainable profitability of firms in the market, reducing negative impacts on the environment and creation of value, and sustainable performance for organizations. For its part, Ekins (2010) considered eco-innovation as any change that benefits the environment and that, in addition, significantly improves the level of economic and sustainable performance of manufacturing firms, including those that make up the automotive industry.

In general terms, the perspective adopted by the various studies published in the innovation literature, focus on the analysis and discussion of the different drivers and determinants of the adoption of eco-innovation, and ignore the effects on sustainable performance (Bossle et al., 2016; del Río et al., 2016; Hojnik & Ruzzier, 2016; Pacheco et al., 2017), hence the importance of this empirical study. In addition, in several cases there is evidence that the main motivation for the adoption of eco-innovation by manufacturing firms, including those that make up the automotive industry, is not necessarily the significant improvement of environmental impacts, but rather the benefits that organizations can achieve, including a positive impact on their level of economic and sustainable performance (Oltra, 2008; EIO, 2016; Motta et al., 2017).

In addition, Carrillo-Hermosilla et al. (2010) considered that the care of the environment and other motivations are those that allow manufacturing companies to make the changes required to establish a close relationship between eco-innovation and business performance, including sustainable. Therefore, the concept of eco-innovation includes both those activities that minimize the use of natural resources, and those that significantly reduce negative impacts on the environment (EIO, 2016). Thus, eco-innovation activities are generally oriented in the life cycle of products of manufacturing firms, including those belonging to the automotive industry, which allows it to create opportunities for new business models through leasing, remanufacturing or reuse of materials and raw materials, which allows organizations to increase their level of sustainable performance (EIO, 2016; Motta et al., 2017). Therefore, considering the information presented above, it is possible to raise the following research hypothesis:

H2: Eco-innovation has significant positive effects on sustainable performance.

Figure 1 presented below, presents the relationships between the constructs and approach the research model.

Figure 1: Research model |

|

Methods

3. Methodology

In order to respond to the two hypotheses raised in this research work, an empirical study was carried out in the manufacturing companies of the Mexican automotive industry, in which the relationship between financial resources, eco-innovation and performance was particularly analyzed sustainable. In a first phase of the study, qualitative research was applied through the application of in-depth interviews with three academics from the innovation area and five businessmen from the automotive industry. The results obtained in this first phase allowed the design of a survey, which was reviewed by four academics experts in innovation and ten businessmen of the automotive industry, making minor adjustments in writing and spelling. Pilot studies are essential to ensure validity when questionnaires are self-administered or contain self-developed scales (Bryman, 2016; Hair et al., 2016). Table 1 show the main characteristics of the sample referring to the firms and the companies’ managers.

|

Variable |

Frequency |

Percentage |

|

Firm’s Age |

||

|

Young Companies (≥ 10 years old) |

156 |

33.9 |

|

Mature Companies (< 10 years old) |

304 |

66.1 |

|

Total |

460 |

100.0% |

|

Company size |

||

|

Small |

139 |

30.2 |

|

Medium |

199 |

43.3 |

|

Large |

122 |

26.5 |

|

Total |

460 |

100.0% |

|

Manager Age |

||

|

Young (18 – 35 years old) |

60 |

13.0 |

|

Adults (36 – 60 years old) |

357 |

77.6 |

|

Mature (More than 60 years old) |

43 |

9.4 |

|

Total |

460 |

100.0% |

|

Manager Antiquity |

||

|

1 - 10 years |

304 |

66.1 |

|

11 - 20 years |

108 |

23.4 |

|

More than 20 years |

48 |

10.5 |

|

Total |

460 |

100.0% |

3.1 Sample Design and Data Collection

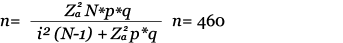

The frame of reference used in this study was the directory of the Mexican automotive industry firms, which had registered 909 firms as of November 30, 2018, the firms belonging to various organizations and local, regional and national business chambers, Therefore, the empirical study did not focus on a particular group or business association. In addition, the survey for the collection of information was applied to a sample of 460 companies selected by simple random sampling, with a maximum error of ± 4% and a level of reliability of 95%, said sample representing 50.6% of the total of the population, and applying the survey during the months of January to March 2019. Also, it should be noted that all managers interviewed are responsible for innovation activities in their respective companies, which allowed to obtain very valuable and interesting information by the deep knowledge and experience they have in the industry.

Likewise, a quantitative study was carried out through the application of personal surveys to the managers of the randomly selected companies, and to calculate the size of the probabilistic sample, a maximum degree of error of 4% was used with a level of confidence of 96%, and to ensure that the observable phenomenon is representative of the population under study, it was considered pertinent that the estimated percentage value of the sample be 50%. Considering the statistical equation proposed by Murray and Larry (2005) to calculate a sample within a defined and known population, it was carried out according to the following Equation 1:

(1)

(1)

3.2 Measure Development

One of the most recurring problems in the innovation literature and which researchers, academics and industry professionals face is how to measure innovation (Zhang et al., 2019), so it is important to precisely define the measurement of eco-innovation activities. Therefore, Klewitz and Hansen (2014) extensively reviewed the eco-innovation literature and found that it is commonly measured through three factors or dimensions: product eco-innovation, process eco-innovation and management eco-innovation, so in this empirical study these three indicators will be used, which are the most cited in the literature for the measurement of eco-innovation. Thus, for the measurement of eco-innovation, an adaptation was made to the scales proposed by Hojnik et al. (2014) and Segarra-Oña et al. (2014), being measured product eco-innovation through 4 items, process eco-innovation through 4 items, and management eco-innovation through 6 items.

In addition, for the measurement of financial resources, an adaptation to the scales proposed by Ghisetti et al. (2017), Polzin et al. (2017), Triguero et al. (2017), Ociepa-Kubicka and Pachura (2017), and De Massis et al. (2018), who considered that financial resources can be measured through 5 items. Finally, for the measurement of sustainable performance, an adaptation to the scale proposed by Gadenne et al. (2012), who measured this construct through 5 items. A five-point Likert-type scale was chosen to strike a balance between complexity for respondents and accuracy for analysis (Forza, 2016; Hair et al., 2016). Table 2 shows the items of the financial resources, eco-innovation and sustainable performance scales used in the study.

3.3. Reliability and Validity of Measurement Scales

For the evaluation of the reliability and validity of the scales of measurement of financial resources, eco-innovation and sustainable performance, a Confirmatory Factor Analysis (CFA) was applied using the maximum likelihood method with the support of the EQS software 6.2 (Bentler, 2005; Brown, 2006; Byrne, 2006). Therefore, for the measurement of reliability the Cronbach's alpha and the Composite Reliability Index (CRI) (Bagozzi & Yi, 1988) were used, and for the measurement of validity the Index of the Variance Excerpted (EVI) (Fornell & Larcker, 1981). Thus, according to the results obtained, all the values of the scales on greater than 0.7 for both indices (Cronbach's alpha and CRI), which justifies their internal reliability (Nunally & Bernstein, 1994; Hair et al., 2014). In addition, all items of related factors are significant (p < 0.001) and the size of all standardized factor loads is greater than 0.60 (Bagozzi & Yi, 1988).

The CFA results are presented in Table 3 and suggest that the measurement model provides a good fit of the statistical data (S-B X² = 991.815; df = 238; p = 0.000; NFI = 0.860; NNFI = 0.872; CFI = 0.889; RMSEA = 0.078). In addition, Table 3 shows a high internal consistency of the constructs, in each case Cronbach's Alpha exceeds the value of 0.70 recommended by Nunally and Bernstein (1994). The composite reliability represents the variance extracted between the group of observed variables and the fundamental construct (Fornell & Larcker, 1981), so that a CRI greater than 0.60 is considered desirable (Bagozzi & Yi, 1988), in this study this value it is widely surpassed. The EVI was calculated for each of the constructs, resulting in an EVI greater than 0.50 (Fornell & Larcker, 1981), in this paper 0.50 is exceeded in all factors. Table 3 shows the CFA final results.

|

Indicators |

Constructs |

|

Financial Resources (FRE) |

|

|

FRE1 |

Percent of the company's total revenues invested in environmental R&D (internal or external) for eco-innovation. |

|

FRE2 |

Percent of the company's total revenues invested in innovative equipment/ machines to reduce the company's environmental impact. |

|

FRE3 |

Percent of the investments in environmental R&D, eco-innovation or similar that are financed with the company's own funds. |

|

FRE4 |

Percent of environmental R&D investments, eco-innovation or similar that are financed through public funds (subsidies, tax deductions, incentives, bonuses, etc.). |

|

FRE5 |

Level to which the availability of the company's financial resources determines eco-innovation's implementation. |

|

Product Eco-Innovation (PEI) |

|

|

PEI1 |

It constantly improves its product life cycle standards and conducts product life cycle studies |

|

PEI2 |

It uses or develops new energy sources with a tendency to reduce CO2 emissions |

|

PEI3 |

It uses the eco-label system required by each destination country for its products |

|

PEI4 |

It uses and manufactures eco-innovative components and materials that are made from recycled raw materials. |

|

Process Eco-Innovation (PRE) |

|

|

PRE1 |

Treat your wastewater |

|

PRE2 |

It uses sterilization methods for its components or technological devices |

|

PRE3 |

Produces or uses fabric components that use fabric sanitizing technologies |

|

PRE4 |

Use ecological or recyclable paper in its processes |

|

Management Eco-Innovation (MEI) |

|

|

MEI1 |

Has a management system that reuses obsolete components and equipment |

|

MEI2 |

Has an ISO 14001 Certification or similar |

|

MEI3 |

It has constant audits of energy saving and ecology by the state and/or municipal authorities of its locality. |

|

MEI4 |

It constantly carries out seminars or training courses for staff related to Eco-innovation |

|

MEI5 |

It has well-defined policies that foster and support Eco-innovation activities throughout the organization. |

|

MEI6 |

It has a monitoring and control system for the wastewater generated by the company |

|

Sustainable Performance (SPE) |

|

|

SPE1 |

It has among its objectives the care of the environment |

|

SPE2 |

Makes great efforts to promote environmental care |

|

SPE3 |

It has a great commitment to invest in projects that protect the environment |

|

SPE4 |

Frequently discusses within the organization the results of environmental care performance |

|

SPE5 |

They have an excellent performance in protecting the environment compared to other companies in the same industry or sector. |

|

Variable |

Indicator |

Factorial Loading |

Robust t-Value |

Cronbach’s Alpha |

CRI |

EVI |

|

Financial Resources |

FRE1 |

0.772*** |

1.000a |

0.897 |

0.898 |

0.651 |

|

FRE2 |

0.763*** |

25.406 |

||||

|

FRE3 |

0.826*** |

18.556 |

||||

|

FRE4 |

0.859*** |

16.341 |

||||

|

FRE5 |

0.810*** |

16.849 |

||||

|

Product Eco-innovation (F1) |

PEI1 |

0.667*** |

1.000a |

0.870 |

0.871 |

0.631 |

|

PEI2 |

0.779*** |

12.137 |

||||

|

PEI3 |

0.894*** |

11.279 |

||||

|

PEI4 |

0.820*** |

10.061 |

||||

|

Process Eco-innovation (F2) |

PRE1 |

0.859*** |

1.000a |

0.917 |

0.918 |

0.736 |

|

PRE2 |

0.883*** |

31.332 |

||||

|

PRE3 |

0.879*** |

26.801 |

||||

|

PRE4 |

0.809*** |

19.443 |

||||

|

Management Eco-innovation (F3) |

MEI1 |

0.777*** |

1.000a |

0.926 |

0.927 |

0.682 |

|

MEI2 |

0.760*** |

17.500 |

||||

|

MEI3 |

0.863*** |

21.834 |

||||

|

MEI4 |

0.888*** |

20.428 |

||||

|

MEI5 |

0.885*** |

21.062 |

||||

|

MEI6 |

0.768*** |

16.353 |

||||

|

Eco-Innovation |

F1 |

0.833*** |

6.210 |

0.831 |

0.832 |

0.626 |

|

F2 |

0.661*** |

5.281 |

||||

|

F3 |

0.813*** |

6.229 |

||||

|

Sustainability Performance |

SPE1 |

0.752*** |

1.000a |

0.910 |

0.911 |

0.672 |

|

SPE2 |

0.786*** |

22.352 |

||||

|

SPE3 |

0.868*** |

15.549 |

||||

|

SPE4 |

0.846*** |

14.226 |

||||

|

SPE5 |

0.840*** |

15.091 |

||||

|

S-B X2 = 991.815; df = 238; p = 0.000; NFI = 0.860; NNFI = 0.872; CFI = 0.889; RMSEA = 0.078 |

||||||

|

a = Constrained parameters to such value in the identification process |

||||||

|

*** = p < 0.01 |

||||||

Likewise, the discriminant validity of the theoretical model of financial resources, eco-innovation and sustainable performance were measured by means of two tests, which are presented in Table 4. First, the confidence interval test is presented (Anderson & Gerbing, 1988), which states that with a 95% confidence interval, none of the individual elements of the latent factors of the correlation matrix has the value of 1. Second, the test of the variance extracted (Fornell & Larcker, 1981), which states that the variance extracted from each pair of constructs is lower than its corresponding EVI. Therefore, according to the results obtained from the application of both tests, it is possible to conclude that sufficient evidence of the existence of discriminant validity is provided. Table 4 show the discriminant validity of the theoretical model.

|

Variables |

Financial Performance |

Eco-innovation |

Sustainability Performance |

|

Financial Performance |

0.651 |

0.106 |

0.130 |

|

Eco-innovation |

0.258 – 0.394 |

0.626 |

0.094 |

|

Sustainability Performance |

0.305 – 0.417 |

0.240 – 0.372 |

0.672 |

The diagonal represents the Extracted Variance Index (EVI), whereas above the diagonal the variance is presented (squared correlation). Below diagonal, the estimated correlation of factors is presented with 95% confidence interval.

Results

4. Results

To respond to the two hypotheses raised in this empirical study, a structural equation model (SEM) was applied with the support of the EQS 6.2 software (Bentler, 2005; Byrne, 2006; Brown, 2006), analyzing the nomological validity of the theoretical model of financial resources, eco-innovation and sustainable performance through the Chi-square test, by means of which the results obtained between the theoretical model and the measurement model were compared, obtaining non-significant results which allows establish an explanation of the relationships observed between latent constructs (Anderson & Gerbing, 1988; Hatcher, 1994). Table 5 shows in greater detail the results obtained from the application of the SEM.

Table 5 shows the results obtained from the application of the SEM and, with respect to the H1 hypothesis, the results obtained, β = 0.539 p < 0.001, indicate that financial resources have significant positive effects on the eco-innovation of manufacturing companies. Regarding the H2 hypothesis, the results obtained, β = 0.874 p < 0.001, indicate that eco-innovation has greater significant positive effects on the sustainable performance of manufacturing companies. In summary, the existence of a significant positive relationship between financial resources, eco-innovation and sustainable performance can be corroborated.

|

Hypothesis |

Structural Relationship |

Standardized Coefficient |

Robust t-Value |

|

H1: The higher level of financial resources, higher level of eco-innovation. |

Financial R. → Eco-innovation |

0.539*** |

12.371 |

|

H2: The higher level of eco-innovation, higher level of sustainability performance |

Eco-innovation → Sustainability P. |

0.874*** |

13.181 |

|

S-BX2 (df = 232) = 709.141; p < 0.000; NFI = 0.900; NNFI = 0.917; CFI = 0.930; RMSEA = 0.067 |

|||

*** = P < 0.01.

5. Discussion

The results obtained in this empirical study have various implications that are essential to establish, so that they can be considered in the analyzes. A first implication derived from the results obtained is that the information derived from the application of 460 surveys facilitated a general analysis of the positive relationship between financial resources, eco-innovation and sustainable performance in a specific sector of the economy (the Mexican automotive industry), for which it is future studies it will be pertinent to analyze these same three variables in longitudinal studies, or it is successful case studies to see their performance. Therefore, from the point of view of the evolution of innovation, the results obtained indicate that the financial resources available in organizations are nowadays becoming one of the determining constructs of the adoption and implementation of the activities of eco-innovation in manufacturing companies (Ghisetti et al., 2017).

A second implication emanating from the results obtained is that evidence has been provided that demonstrates that financial resources have a significant positive influence on eco-innovation, and as previously published studies had suggested (García-Pérez-de-Lema et al., 2013; Lee & Min, 2015; Scarpellini et al., 2016), especially in those companies that have a low level of indebtedness (Przychodzen & Przychodzen, 2015). Therefore, when manufacturing companies, including those that make up the automotive industry, have internal and external financial resources, they generally increase significantly not only the levels of eco-innovation activities, but also the level of sustainable performance, as proposed by some of the previously published studies in the innovation literature (Oltra, 2008; EIO, 2016; Motta et al., 2017).

A third implication of the results obtained is that government subsidies as sources of financing favor the adoption and implementation of eco-innovation activities, by reducing the risks related to investment and obtaining the necessary resources for the development of the eco-innovation (Triguero et al., 2017). Specifically, public financial resources are essential for manufacturing companies, since it facilitates the development of eco-innovation even when this concept is too complex (De Marchi, 2012), which requires for its correct measurement of the three types of knowledge (eco-innovation of products, processes and management) (Mazucchi & Montresor, 2017). However, there is a need for more empirical evidence of the effects exerted by external resources, including subsidy and public financing, on the various eco-innovation activities of manufacturing firms (Scarpellini et al., 2018).

A fourth implication derived from the results obtained is that even when the adoption and implementation of the different eco-innovation activities requires the availability of the financial resources necessary for the realization of substantial changes within organizations, especially in the use of the materials and components that are required for the production of eco-products (Kanda et al., 2016), External financing is essential not only because it helps companies to make these changes less drastic and obtain better both in the development of eco-innovation activities for products, processes and management that are more environmentally friendly (Kanda et al., 2018), as in the significant improvement of the level of sustainable performance of manufacturing companies (del Río et al., 2016b; Scarpellini et al., 2018).

Finally, a fifth implication derived from the results is that there are more and more environ-mental groups, consumers, suppliers, associations, communities and society in general that are putting pressure on manufacturing firms for environmental care and sustainable development, which is why one of the alternatives that are emerging in the literature is eco-innovation (Lozano, 2007; Carrillo-Hermosilla et al., 2010; Lee & Kim, 2011; de Medeiros et al., 2014). In addition, for manufacturing companies to adequately implement eco-innovation activities, they require the availability of financial resources, since various companies do not have the necessary financial resources to do so, so it would be impossible for them to adopt the activities of the eco-innovation, so the availability of financial resources is one of the most important alternatives that is emerging as a strategy to achieve eco-innovation.

Concluding

6. Conclusions

The results obtained in this empirical study generate different conclusions among the most important are the following. First, the theoretical model used has a high internal consistency by generating a high correlation between the three variables analyzed, which allowed the acceptance of the two research hypotheses raised in the model, so it is possible to conclude the existence of a significant positive relationship between financial resources, eco-innovation and sustainable performance. Second, by incorporating into the theoretical model the analysis of the three most cited factors in the literature of the measurement of eco-innovation (eco-innovation of products, processes and management), it is possible to conclude that this generates not only an overview but also more holistic of the main financial resources and eco-innovation activities carried out by manufacturing companies in the automotive industry.

Thirdly, there are relatively few studies published in the literature that analyze the relationship between financial resources, eco-innovation and sustainable performance, compared to those studies that have been oriented in its conceptualization (Scarpellini et al., 2018), which from our point of view lack a substantial contribution to knowledge, so it is possible to conclude that the relationship between these three important constructs is an unfinished topic that is open to discussion (Motta et al., 2018). Fourth, the results obtained show that financial resources have significant positive effects on eco-innovation, but the greatest effects are established by eco-innovation with sustainable performance, so it is possible to conclude that this study provides empirical evidence and new knowledge of the relationship between these three constructs in the field of manufacturing companies in the automotive industry.

In this sense, the results obtained in this study of the relationship between financial resources and eco-innovation activities are similar to those obtained by Polizin (2017), Ociepa-Kubicka (2017), and Zulfiqar and Thapa (2018), who found a positive relationship between these two constructs in their respective studies. Regarding the results obtained between eco-innovation activities and sustainable performance, these results are similar to those obtained by del Río et al. (2016), Pacheco et al. (2017), and Motta et al. (2017), who found a positive relationship between both constructs, and differ from the results obtained by Bossle et al. (2016), and Hojnik and Ruzzier (2016), who found that process eco-innovation and management eco-innovation, respectively, did not have a positive impact on sustainable performance.

Finally, fifthly, the results obtained in this study contribute to the generation of knowledge, both from previous studies published in the literature that analyze the relationship between financial resources and eco-innovation (Polzin, 2017: Ociepa-Kubicka & Pachura, 2017; Zulfiqar & Thapa, 2018), as of those studies that analyze the relationship between eco-innovation and sustainable performance (Bossle et al., 2016; del Río et al., 2016; Hojnik & Ruzzier, 2016; Pacheco et al., 2017; Motta et al., 2017). It is therefore possible to conclude, in general terms, that the financial resources available to organizations are essential for the adoption and implementation of eco-innovation activities in the manufacturing companies of the automotive industry, as measured by the product eco-innovation, process eco-innovation, and management eco-innovation.

Additionally, this study has several limitations that are important to consider when performing the analysis and interpretation of the results obtained. A first limitation is the use of the scales of measurement of financial resources, eco-innovation and sustainability performance, since these three variables were measured through subjective indicators obtained from the survey (subjective data). Therefore, in future studies it will be necessary to incorporate various objective data of the companies of the automotive industry (e.g. percentage of investments in R&D, percentage of debt derived from loans of financial resources, amount of eco-innovations made by firms, number of brands recorded, percentage of renewable energy use, percentage of treated water use), in order to verify whether the results obtained differ or not from those obtained in this empirical study.

A second limitation is that financial resources and eco-innovation may have better results if product eco-innovation, process eco-innovation and management eco-innovation are analyzed separately, or if incorporated into to the analysis to some moderating variable of the particular characteristics of the manufacturing firms of the automotive industry (e.g. size, age, location), or of the managers (e.g. leadership, experience, skills). Therefore, in future studies it would be necessary to use some essential variable that moderates the effects of various financial resources have on eco-innovation and the sustainable performance of firms, in order to corroborate whether the results obtained differ or not of the results obtained in this empirical study.

A third limitation of this study, and possibly one of the most essential, is that eco-innovation activities in most manufacturing companies are commonly closely related to various certification processes, among which quality certification (ISO-9001), health and safety (ISO-45001), environment (ISO-14001), which significantly affect all company operations and this can condition not only the effect of eco-innovation on sustainable performance of the organizations, but also the amounts of the financial investment in the adoption and implementation of this type of certification, for which in future studies it would be important to consider these or other certification processes to corroborate whether the results obtained differ or not from those obtained. in this studio.

Finally, a fourth limitation is that in this study only five types of financial resources were considered (importance of income invested in eco-innovation activities, in the purchase of machinery and equipment to reduce environmental impacts, and in environmental R&D or eco-designs, importance of the guarantees requested for the financing of eco-innovation, and financial support of organizations for eco-innovation), as well as the three types of eco-innovation most cited in the current literature (eco- product innovation, process eco-innovation and management eco-innovation), so that in future studies it would be necessary to consider other types of eco-innovation activities (e.g. marketing, technology, systems), in order to corroborate if the results obtained are similar or not to those obtained in this study.

References

References

Adams, R., Jeanrenaud, S., Bessant, J., Denyer, D., & Overy, P. (2016). Sustainability-oriented innovation: A systematic review. International Journal of Management Review, 18(1), 180-205.

Adams, R., Jeanrenaud, S., Bessant, J., Overy, P., & Denyer, D. (2012). Innovation for sustainability. Network Business Sustainability, 107(1), 1-11.

Aloise, P.G., & Macke, J. (2017). Eco-innovations in developing countries: The case of Manaus free trade zone (Brazil). Journal of Cleaner Production, 168(1), 30-38.

Amore, M.D., & Bennedsen, M. (2016). Corporate governance and green innovation. Journal of Environmental and Economic Management, 75(1), 54-72.

Andersen, M.M. (2008). Eco-innovation: Towards a taxonomy and a theory. In DRUID 25th Celebration Conference 2008: Entrepreneurship and Innovation Organizations, Institutions, Systems and Regions. 17-20 June, Copenhagen.

Anderson, J., & Gerbing, D. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 13(1), 411-423.

Bagozzi, R.P. and Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74-94.

Bentler, P.M. (2005). EQS 6 Structural Equations Program Manual. Encino, CA: Multivariate Software.

Biondi, V., Iraldo, F., & Meredith, S. (2002). Achieving sustainability through environmental innovation: The role of SMEs. International Journal of Technology Management, 24(1), 6-12.

Bocken, N., Short, S., Rana, P., & Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production, 65(1), 42-56.

Boons, E., & Lüdeke-Freund, F. (2013). Business model for sustainable innovation: State of the art and steps towards a research agenda. Journal of Cleaner Production, 45(1), 9-19.

Boons, F., Montalvo, C., Quist, J., & Wagner, M. (2013). Sustainable innovation, business models and economic performance: An overview. Journal of Cleaner Production, 45(1), 1-8.

Bortoloni, E. (2013). Capital structure and innovation: Causality and determinants. Empirica, 40(2), 111-115.

Bossle, M.B., de Bercellos, M.D., Vieira, L.M., & Sauvée, L. (2016). The drivers for adoption of eco-innovation. Journal of Cleaner Production, 113(1), 861-872.

Braungart, M., McDonough, W., & Bollinger, A. (2007). Cradle-to-cradle design: Creating healthy emissions: A strategic for eco-effective product and system design. Journal of Cleaner Production, 15(1), 1337-1348.

Brown, T. (2006). Confirmatory Factor Analysis for Applied Research. New York, NY: The Guilford Press.

Bryman, A. (2016). Social Research Methods. 5th ed. Oxford: Oxford University Press.

Byrne, B. (2006). Structural Equation Modeling with EQS, Basic Concepts, Applications, and Programming. 2th edition. London: LEA Publishers.

Cai, W., & Li, G. (2018). The drivers of eco-innovation and its impact on performance: Evidence from China. Journal of Cleaner Production, 176(1), 110-118.

Carrillo-Hermosilla, J., del Río, P., & Könnölä, T. (2010). Diversity of eco-innovations: Reflections from selected case studies. Journal of Cleaner Production, 18(10/11), 1073-1083.

Cicozzi, E., Checkenya, R., & Rodríguez, A.V. (2003). Recent experiences and challenges in promoting cleaner production investments in developing countries. Journal of Cleaner Production, 11(1), 629-638.

Coenen, L., & Díaz-López, F.J. (2010). Comparing systems approaches to innovation and technological change for sustainable and competitive economies: An explorative study into conceptual commonalities, differences and complementarities. Journal of Cleaner Production, 18(1), 1149-1160.

Cruz-Cázares, C., Beyona-Sáez, C., & García-Marco, T. (2013). You can’t manage right what you can’t measure well: Technological innovation efficiency. Responsibility Policy, 42(1), 1239-1250.

De Marchi, V. (2012). Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Responsible Policy, 41(3), 614-623.

De Massis, A., Audretsch, D., Uhlaner, L., & Kammerlander, N. (2018). Innovation with limited resources: management lessons form the German mittelstand. Journal of Production Innovation and Management, 35(2), 125-146.

de Medeiros, J.F., Ribeiro, J.L., & Cortimiglia, M.N. (2014). Success factors for environmentally sustainable product innovation: A systematic literature review. Journal of Cleaner Production, 65(1), 76-86.

del Brío, J.A., & Junqueras, B. (2003). A review of the literature on environmental innovation management in SMEs: Implications for public policies. Technovation, 23(2), 939-948.

del Río, P., Carrillo-Hermosilla, J., Könnölä, T., & Bleda, M. (2016b). Resources, capabilities and competences for eco-innovation. Technological and Economic Development of Economy, 22(2), 274-292.

del Río, P., Carrillo-Hermosilla, J., Könnölä, T., & Bleda, M. (2012). Business strategies and capacities for eco-innovation. In The XXIII ISPIM Conference – Actions for innovation: Innovating from Experience. Barcelona.

del Río, P., Peñasco, C., & Romero-Jordán, D. (2016a). What drives eco-innovators? A critical review of the empirical literature based on econometric methods. Journal of Cleaner Production, 112(1), 2158-2170.

Demirel, P., & Kesidou, E. (2011). Stimulating different types of eco-innovation in the UK: Government policies and firm motivations. Ecology Economic, 70(2), 1546-1557.

Díaz-García, C., González-Moreno, A., & Sáez-Martínez, F.J. (2015). Eco-innovation: Insights from a literature review. Innovation, 17(1), 6-23.

Ding, M. (2014). Supply chain collaboration toward eco-innovation: An SME analysis of the inner mechanism. In Proceedings of 2014 IEEE International Conference on Service Operations and Logistics, and Informatics. https://doi.org/10.1109/SOLI.2014.6960706.

Doherty, B., Haugh, H., & Lyon, F. (2014). Social enterprises as hybrid organizations: A review and research agenda. International Journal of Management Review, 16(1), 417-436.

Durán-Romero, G., & Urraca-Ruiz, A. (2015). Climate change and eco-innovation: A patent data assessment of environmentally sound technologies. Innovation and Policy Practice, 17(1). 1-11.

EIO (2016). Policies and Practices for Eco-Innovation Up-take and Circular Economy Transition: EIO Bi-Annual Report 2016. Brussels: Eco-Innovation Observatory.

Ekins, P. (2010). Eco-innovation for environmental sustainability: Concepts, progress and policies. Journal of Economic Policy, 7(2-3), 267-290.

Fornell, C., & Larcker, D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

Forza, C. (2016). Surveys. In: C. Karlsson (Ed.), Research Methods for Operations Management. 2nd Ed. New York, NY: Routledge.

Foxon, T., & Andersen, M.M. (2009). The greening of innovation systems for eco-innovation: Towards an evolutionary climate mitigation policy. In DRUID Summer Conference 2009: DRUID Society. 17-19 June, Copenhagen.

Fussler, C., & James, P. (1996). Driving Eco-Innovation: A Breakthrough Discipline for Innovation and Sustainability. London: Pitman Publishing.

Gadenne, D., Mia, L., Sands, J., Winata, L., & Hooi, G. (2012). The influence of sustainability performance management practices on organizational sustainability performance. Journal of Accounting & Organizational Change, 8(2), 210-235.

Galia, F., Ingham, M., & Pekovic, S. (2015). Incentives for green innovation in French manufacturing firms. International Journal of Technology and management Sustainability, 14(1), 3-16.

Gallo, P.J., Antolin-López, R., & Montiel, I. (2018). Associative sustainable business models: Cases in the bean-to-bar chocolate industry. Journal of Cleaner Production, 174(1), 905-916.

Garcés-Ayerbe, C., Scarpellini, S., Velero-Gil, J.J., & Rivera-Torres, P. (2016). Proactive environmental strategy development: From laggard to eco-innovative firms. Journal of Organizational Change Management, 29(1), 1-17.

García-Pérez-de-Lema, D., Borona-Zuloaga, B., & Madrid-Guijarro, A. (2013). Financiación de la innovación en las Mipyme iberoamericanas. Estudios Gerenciales, 29(1), 12-16.

Garrido-Azevedo, S., Brandenburg, M., Carvalho, H., & Cruz-Machado, V. (2014). Developments and directions of Eco-innovation: Lessons from experience and new frontiers in theory and practice. In Azevedo, S., Brandenburg, M., Carvalho, H. and Cruz-Machado, V. (Eds.), Eco-Innovation and the Development of Business Models. London: Springer International Publishing.

Ghisetti, C., & Rennings, K. (2014). Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. Journal of Cleaner Production, 75(1), 106-117.

Ghisetti, C., Mancinelli, S., Mazzanti, M.M., & Zoli, M. (2017). Financial barriers and environmental innovations: Evidence from EU manufacturing firms. Climate Policy, 17(2), 131-147.

Guney, Y., Karpuz, A., & Ozkan, N. (2017). R&D investment and credit lines. Journal of Corporate Finance, 46(2), 261-283.

Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2014). Multivariate Data Analysis. 7th ed. Harlow, UK: Pearson Education.

Hair, J.F., Celsi, M., Money, A., Samouel, P., & Page, M. (2016). Essentials of Business Research Methods. 3rd Ed. New York, NY: Routledge.

Halila, F., & Rundquist, J. (2011). The development and market success of eco-innovations: A comparative study of eco-innovations and other innovations in Sweden. European Journal of Innovation Management, 14(1), 278-302.

Harford, J., Kecskés, A., & Mansi, S. (2017). Do long-term investors improve corporate decision-making? Journal of Corporate Finance, 50(1), 424-452.

Hatcher, L. (1994). A Step-by-Step Approach to Using the SAS System for Factor Analysis and Structural Equation Modeling, Cary, NC: SAS Institute Inc.

He, F., Miao, X., Wong, C.W., & Lee, S. (2018). Contemporary corporate eco-innovation research: A systematic review. Journal of Cleaner Production, 174(1), 502-526.

Hojnik, J., & Ruzzier, M. (2015). What drives eco-innovation? A review of an emerging literature. Environment Innovation Social Transformation, 3(1), 1-11.

Hojnik, J., & Ruzzier, M. (2016). The driving forces of process eco-innovation and its impact on performance: Insights from Slovenia. Journal of Cleaner Production, 133(1), 812-825.

Hojnik, J., Ruzzier, M., & Lipnik, A. (2014). Pursuing eco-innovation within southeastern European clusters. The IUP Journal of Business Strategy, 11(3), 41-59.

Iñigo, E.A., Albareda, L. (2016). Understanding sustainable innovation as a complex adaptive system: A systematic approach to the firm. Journal of Cleaner Production, 126(1), 1-20.

Jakobsen, S., & Clausen, T.H. (2016). Innovating for a green future: The direct and indirect effects of firms’ environmental objectives on the innovation process. Journal of Cleaner Production, 128(1), 131-141.

Johnson, D.K.N., & Lybecker, K.M. (2012). Paying for green: An economics literature review on the constraints to financing environmental innovation. Electronic Green Journal, 1(1), 1-10.

Kanda, W., Sakao, T., & Hjelm, O. (2016). Components of business concepts for the diffusion of large scaled environmental technology systems. Technology Policies Strategy, 128(1), 156-167.

Kanda, W., Hjelm, O., Clausen, J., & Bienkowska, D. (2018). Roles of intermediaries in supporting eco-innovation. Journal of Cleaner Production, 205(1), 1006-1016.

Karakaya, E., Hidalgo, A., & Nuur, C. (2014). Diffusion of eco-innovations: A review. Renewable Sustainability Energy Review, 33(1), 392-399.

Kesidou, E., & Demirel, P. (2012). On the drivers of eco-innovations: Empirical evidence from the UK. Responsibility Policy, 41(2), 862-870.

Ketata, I., Sofka, W., & Grimpe, C. (2014). The role of international capabilities and firms’ environment for sustainable innovation: Evidence from Germany. R&D Management, 45(1), 60-75.

Kiefer, C.P., Carrillo-Hermosilla, J., del Río, P., & Callealta-Barroso, F.J. (2017). Diversity of eco-innovations: A quantitative approach. Journal of Cleaner Production, 166(1), 1494-1506.

Kim, S., Lee, H., & Kim, J. (2016). Divergent effects of external financing on technology innovation activity: Korean evidence. Technological Forecast and Social Change, 106(1), 22-30.

Klewitz, J., & Hansen, E.G. (2014). Sustainability-oriented innovation in SMEs: A systematic review. Journal of Cleaner Production, 65(1), 57-75.

Könnölä, T., Unruh, G.C., & Carrillo-Hermosilla, J. (2006). Prospective voluntary agreements for escaping techno-institutional lock-in. Ecology Economics, 57(1), 239-252.

Lee, K.H., & Kim, J.W. (2011). Integrating suppliers into green product innovation development: An empirical case study in the semiconductor industry. Business Strategy and the Environment, 20(8), 527-538.

Lee, K.H., & Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. Journal of Cleaner Production, 108(1), 534-542.

Lee, N., Sameen, H., & Cowling, M. (2015). Access to finance for innovative SMEs since the financial crisis. Responsibility Policy, 44(2), 370-380.

López, F.J.D., & Montalvo, C. (2015). A comprehensive review of the evolving and cumulative nature of eco-innovation in the chemical industry. Journal of Cleaner Production, 102(1), 30-43.

Lozano, R. (2007). Collaboration as a pathway for sustainability. Sustainable Development, 15(3), 370-381.

Mazucchi, A., & Montresor, S. (2017). Forms knowledge and eco-innovation modes: Evidence from Spanish manufacturing firms. Ecology Economic, 131(1), 208-221.

Motta, W., Prado, P., & Issberner, L.R. (2017). Eco-innovations: Kick-starting the circular economy. In ECSEE Official Conference Proceedings 2017: The European Conference on Sustainability, Energy & Environment. 7-9 July, Brighton.

Motta, W.H., Issberner, L.R., & Prado, P. (2018). Life cycle assessment and eco-innovations: What kind of convergence is possible? Journal of Cleaner Production, 187(1), 1103-1114.

Murray, R., & Larry, J. (2005). Estadística. México: McGraw-Hill.

Noci, G., & Verganti, R. (1999). Managing green product innovation in small firms. R&D Management, 29(1), 3-15.

Nunally, J.C., & Bernstein, I.H. (1994). Psychometric Theory. 3ª Ed. New York, NY: McGraw-Hill.

Ociepa-Kubicka, A., & Pachura, P. (2017). Eco-innovations in the functioning of companies. Environment Responsibility, 156(2), 284-290.

OECD (2012). The Future of Eco-Innovation: The Role of Business Models in Green Transformation. Copenhagen: OECD.

Oltra, V. (2008). Environmental innovation and industrial dynamics: The contributions of evolutionary economics. Working Papers of GREThA, 2018-28. Available at: http://cahiersdugretha.u-bordeaux4.fr/2008-20.pdf

Pacheco, D.A., ten Caten, C.S., Jung, C.F., Ribeiro, J.L.D., Navas, H.V.G., & Cruz-Machado, V.A. (2017). Eco-innovation determinants in manufacturing SMEs: Systematic review and research directions. Journal of Cleaner Production, 142(1), 2277-2287.

Paraschiv, D.M., Voicu-Dorobantu, R., Langa-Olaru, C., & Laura-Nemonianu, E. (2012). New models in support of the eco-innovative capacity of companies: A theoretical approach. Economic Computational, Economic Cybernetic and Studies Responsibilities, 5(1), 1-10.

Pereiras, M.S., & Huergo, E. (2006). La financiación de actividades de investigación, desarrollo e innovación: Una revision de la evidencia sobre el imapcto de las ayudas públicas. Documento de Trabajo 01.

Polzin, E. (2017). Mobilizing private finance for low-carbon innovation: A systematic review of barriers and solutions. Renewal and Sustainable Energy Review, 77(1), 525-535.

Polzin, E., Sanders, M., & Täube, F. (2017). A diverse and resilient financial system for investments in the energy transition. Current Opinion in Environment Sustainability, 28(1), 24-32.

Przychodzen, J., & Przychodzen, W. (2015). Relationship between eco-innovation and financial performance: Evidence from publicly trade companies in Poland and Hungary. Journal of Cleaner Production, 90(1), 253-263.

Ramanathan, R., Ramanathan, U., & Zhang, Y. (2016). Linking operations, marketing and environmental capabilities and diversification to hotel performance: A data envelopment analysis approach. International Journal of Production Economic, 176(1), 111-122.

Rennings, K. (2000). Redefining innovation-eco-innovation research and the contribution from ecological economics. Ecology Economics, 32(2), 319-332.

Roscoe, S., Cousins, P.D., & Lammings, R.C. (2016). Developing eco-innovations: A three-stage typology of supply networks. Journal of Cleaner Production, 112(1), 1948-1959.

Scarpellini, S., Marín-Vinuesca, L.M., & Portillo-Tarragona, P. (2018). Defining and measuring different dimensions of financial resources for business eco-innovation and the influence of the firms’ capabilities. Journal of Cleaner Production, 204(1), 258-269.

Scarpellini, S., Valero-Gil, J., & Portillo-Tarragona, P. (2016). The economic-finance interface for eco-innovation projects. International Journal of Project Management, 34(2), 1012-1025.

Schiederig, T., Titze, F., & Herstatt, C. (2012). Green innovation in technology and innovation management. R&D Management, 42(2), 180-192.

Segarra-Oña, M., Peiró-Signes, A., & Payá-Martínez, A. (2014). Factors influencing automobile firm’s eco-innovation orientation. Engineering Management Journal, 26(1), 31-38.

Sierzchula, W., Bakker, S., Maat, K., & Van Wee, B. (2014). The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy, 68(1), 183-194.

Triguero, A., Cuerva, M.C., & Alvarez-Aledo, C. (2017). Environmental innovation and employment: Drivers and synergies. Sustainability, 9(1), 1-11.

Triguero, A., Moreno-Mondajar, L., & Davia, M.A. (2015). Eco-innovation by small and medium-sized firms in Europe: From end-of-pipe to cleaner technologies. Innovation Policy Practice, 17(1), 24-40.

Xavier, A.F., Naveiro, R.M., Aoussat, A., & Reyes, T. (2017). Systematic literature review of eco-innovation models: Opportunities and recommendations for future research. Journal of Cleaner Production, 149(1), 1278-1302.

Zhang, D., Rong, Z., & Ji, Q. (2019). Green innovation and firm performance: Evidence from listed companies in China. Resource, Conservation & Recycling, 144(1), 48-55.

Zhang, J.A., & Walton, S. (2017). Eco-innovation and business performance: The moderating effects of environmental orientation and resource commitment in green-oriented SMEs. R&D Management, 47(1), 26-39.

Zulfiqar, F., & Thapa, G.B. (2018). Determinants and intensity of adoption of better cotton as a innovative cleaner production alternative. Journal of Cleaner Production, 172(1), 3486-3478.