Article

DOI:

https://doi.org/10.18845/te.v16i1.5980

Perceived new venture creation speed: The relevance of the university’s context and entrepreneurial experience

Percepción del tiempo necesario para crear una empresa: La importancia del contexto universitario y la experiencia emprendedora

TEC Empresarial, Vol. 16, n°. 1, (January - April, 2022), Pag. 20 - 43, ISSN: 1659-3359

AUTHORS

Paola Lafuente-González

Universidad Latinoamericana de Ciencia y Tecnología, San José, Costa Rica. This study is the academic output of the first author’s MBA thesis, Universidad Latinoamericana de Ciencia y Tecnología

(ULACIT), San José, Costa Rica

plafuentegonzalez@gmail.com.

![]()

Juan Carlos Leiva

Escuela de Administración de Empresas, Instituto Tecnológico de Costa Rica, Cartago, Costa Rica.

jleiva@itcr.ac.cr.

![]()

Corresponding Author: Paola Lafuente-González

ABSTRACT

Abstract

This study scrutinizes how the perceived new venture creation speed is explained by variables connected to the individuals’ human capital, the business planning process, and the university’s context. The empirical analysis employs an ordered logit model on a sample drawn from the GUESSS databases for 2018 that includes information for 636 Costa Rican university students who are involved in nascent entrepreneurial activities. The results highlight two different patterns of new venture creation speed among nascent entrepreneurs: older students who are carrying out tasks related to their potential venture—i.e., writing a business plan and searching for external funding—perceive that they need less time to create their new business, whereas university’s program learning slows down the perceived start-up speed among individuals with past entrepreneurial experience. Additionally, the findings highlight the importance of business planning tasks for developing practical and strategic capabilities, as well as of the business-specific cumulative knowledge generated by past entrepreneurial experience. Implications on how universities can promote students’ entrepreneurial activity by improving their entrepreneurial environment and program learning are discussed.

Keywords: New venture, perceived creation speed, nascent entrepreneurship, university students, Costa Rica, GUESSS.

Resumen

Este estudio analiza como la velocidad percibida en la creación de empresas se explica por variables conectadas al capital humano, la planeación de negocio y al contexto universitario. A partir de una base de datos del GUESSS que incluye 636 estudiantes universitarios costarricenses identificados como emprendedores nacientes para 2018, se utiliza un modelo logístico ordenado. Los resultados muestran que los estudiantes de mayor edad que cuentan con un plan de negocio escrito y que activamente buscan opciones de financiamiento externo perciben que necesitan menos tiempo crear su empresa; mientras que los estudiantes con menos experiencia en estos procesos perciben que los programas de aprendizaje universitarios hacen que tome más tiempo crear su negocio. Además, los resultados destacan la importancia de la planificación empresarial para desarrollar capacidades prácticas y estratégicas, así como del conocimiento acumulado generado por la experiencia empresarial. Finalmente, se discuten implicaciones sobre como las universidades pueden promover el emprendimiento vía mejoras en su ambiente y programas de aprendizaje.

Palabras clave: Nuevas empresas, velocidad de creación, emprendimiento naciente, estudiantes universitarios, Costa Rica, GUESSS.

Introduction

1. Introduction

Time is an important dimension of the entrepreneurial process; nevertheless, there is a limited understanding on the role of the university’s context on the speed at which new ideas are developed (e.g., Capelleras et al., 2010; Hechavarría et al., 2016), and how experiential learning—i.e., past entrepreneurial experience—and the relevant university contextual factors—in our case, program learning and the university’s entrepreneurial environment—meld together to explain differences in perceived venture creation speed among university students.

New venture creation speed can vary drastically, and prior work has identified a variety of factors that might contribute to explain the observed variation in venture creation speed, including, among others, the entrepreneurs’ human capital, access to financial resources (e.g., seed capital or business angel investments) (Capelleras et al., 2010; Hechavarría et al., 2016). Although opportunity-driven models have proved themselves convincing to explain entrepreneurial activity, scholars increasingly call for more research addressing the role of contextual factors on new venture creation speed (e.g., Tornikoski & Renko, 2014; Hechavarría et al., 2016; Qin et al., 2019).

Following this argument line, the objective of this research is to scrutinize how the perceived time needed to start a new business among nascent entrepreneurs is explained by variables connected to the individuals’ human capital, the business planning process, and the university’s entrepreneurial context. Specifically, this study attempts to shed light on whether past entrepreneurial experience and a more structured business planning process impact new venture creation speed. Moreover, and considering the increased relevance of universities for entrepreneurial activity (e.g., Bergmann, 2017; Gillanders et al., 2021), this study seeks to answer whether a university environment more conducive to entrepreneurship helps explain the observed variation in new venture creation speed among university students who are nascent entrepreneurs.

To achieve the objective of this study, an ordered logit model was applied to a sample obtained from the GUESSS databases for 2018 including information for 636 Costa Rican university students who are involved in nascent entrepreneurial activities. Even though this research only examines the pre-startup entrepreneurial activity (i.e., nascent entrepreneurship); the proposed analysis is important to better understand how both individuals’ human capital (i.e., past entrepreneurial experience), the business planning process (i.e., business plan and external funding) as well as variables connected to the university’s context (i.e., environment and program learning) impact students’ perceived new venture creation speed.

The core findings suggest that perceived venture creation speed is explained by past entrepreneurial experience and by a more structured business planning process. Furthermore, it was found that university’s program learning slows down the perceived time needed to start a new venture among students who have previous entrepreneurial experience. Results highlight the importance of business planning tasks for developing practical and strategic capabilities, as well as of the business-specific cumulative knowledge generated by past entrepreneurial experience.

By evaluating how individuals’ past entrepreneurial experience and university’s context impact perceived venture creation speed, this study adds valuable, relevant evidence to better grasp how universities can contribute to students’ entrepreneurship action via specific actions related to the development of an environment more conducive to entrepreneurship that includes, among others, a more participatory approach in which local stakeholders (e.g., entrepreneurs, chambers of commerce, public administrations) take part of university’s environment. Additionally, this study shows the relevance of program learning actions that promote the exploration and/or exploitation of students’ business ideas (e.g., business planning analysis, network building, among others).

The plan of the paper follows. Section 2 presents the background theory and proposed hypotheses. The description of the sample, the variables and the method are displayed in Section 3. Section 4 offers the empirical findings for the different models analyzed in the study. Section 5 presents the discussion and the implications that can be drawn from the study results. Finally, Section 6 concludes and offers suggestions for future research.

2. Background theory: What explains the speed of venture entry?

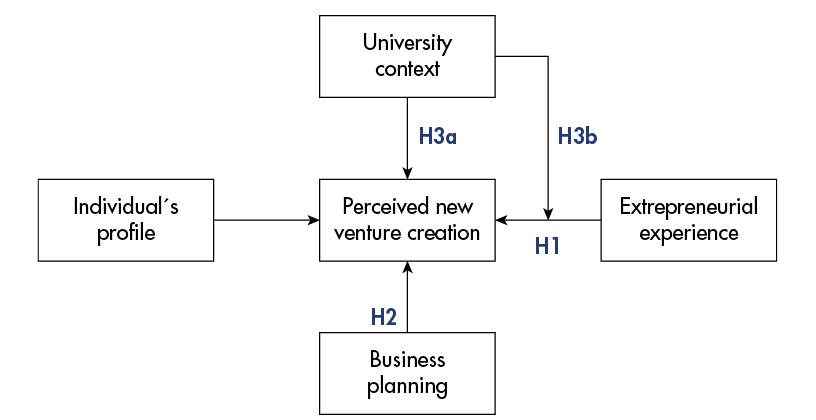

This section presents the theoretical framework and study hypotheses on the determinants of new venture creation speed. The conceptual framework proposed in this study—which is depicted in Figure 1—models new venture creation speed as a function of a number of factors related to the profile of the prospective entrepreneur (i.e., individual characteristics and previous entrepreneurial experience), the business planning process (in terms of writing a business plan, seeking for external funding, and composition of the entrepreneurial team), and the university’s entrepreneurship context (university environment and program learning).

Past entrepreneurial experience.—Previous studies have shown that variables related to the individual’s human capital are relevant for explaining new venture creation speed (e.g., Capelleras et al., 2010; Ferreto-Gutiérrez et al., 2018). In the specific context of this study, in which university students are the unit of analysis, previous entrepreneurial experience represents the analyzed human capital variable. As part of a learning process, experienced entrepreneurs accumulate specific knowledge associated with venture creation and management (Lafuente et al., 2019). Entrepreneurial experience gives individuals the ability to identify more opportunities and leverage the resources required to pursue new business opportunities (Ucbasaran et al., 2008). Also, Capelleras et al. (2010) found that the knowledge and skills gained from prior experiences shape the capacity of entrepreneurially active individuals to speed up the creation process of their new venture.

Though venture creation is a highly idiosyncratic process and the exploitation of accumulated experience not always leads to superior performance, existing work dealing with expertise has shown that performance is impacted only when individual engage in deliberate practice (Ucbasaran et al., 2008; Westhead et al., 2009; Capelleras et al., 2010; Lafuente et al., 2019). From this argument line, it is plausible to argue that experienced entrepreneurs involved in a new entrepreneurial process will perform better than novice entrepreneurs, in terms of the time needed to create their new venture. Therefore, the following hypothesis is proposed:

H1: Prior entrepreneurial experience accelerates the perceived new venture creation process

Business planning. —Business planning is often seen as a powerful process for constructing and ordering temporal patterns of events for new ventures, thus allowing entrepreneurs to create their venture more quickly (Honig & Karlsson, 2004). Business planning is a multidimensional construct and is one out of the many tasks included in the ‘to do’ list to start any entrepreneurial project. This study analyzes three aspects related to business planning that are expected to accelerate new business creation processes, namely: writing a business plan, looking for external funding, and the composition of the entrepreneurial team.

Figure 1: Conceptual model |

|

| Source: Author’s elaboration |

Concerning the first studied task related to business planning—i.e., having a formal written business plan—Capelleras and Greene (2008) point to a direct and tangible negative association between writing a business plan and new venture creation speed. Writing a business plan requires additional and time-consuming investigation about markets, suppliers, legal aspects, and resources necessary to successfully launch the new venture (Cooper & Mehta, 2003; Delmar & Shane, 2003). Additionally, potential entrepreneurs who write a business plan will likely collect more information about the identified business opportunity, which equips them with purposeful means to developing better informed decision-making processes related to, for example, goal setting and contract formalization with prospective suppliers, other professionals (accountants and lawyers), and customers (Carter et al., 1996; Cooper & Mehta, 2003; Capelleras & Greene, 2008). This logic and evidence suggest that writing a business plan takes time and that the benefits of having a business plan would become evident during the venture creation process as well as once the business starts its operations. Thus, for the purpose of this research the expectation is that potential entrepreneurs who have written a formal business plan might take less time to create their new venture.

The second business planning factor relates to the access to external financial resources. While potential entrepreneurs from developed economies have often access to public programs or equity markets to start their new ventures, in most developing economies these two financial mechanisms are not available or developed enough to support the entrepreneurial spirit of individuals engaged in a new business project (Capelleras et al., 2010; Hechavarría et al., 2016). In developing settings, the access to credit is a decisive aspect that will likely determine the potential and survival possibilities of new ventures (Lafuente & Rabetino, 2011). Because this study analyzes new venture creation speed among university students from a developing economy (i.e., Costa Rica), special attention is paid to debt finance, typically channeled by banks. Financial constraints, in terms or low access to credit, might constitute a hard-to-overcome obstacle for entrepreneurship, and the main conclusion that can be extracted from previous work is that new venture creation speed is negatively correlated with the access to financial resources (Hechavarría et al., 2016).

The third business planning factor deals with the composition of the entrepreneurial team. From a management viewpoint, the entrepreneurial team equals the sum of the resources and capabilities of its members, which increase the credibility of the entrepreneurial project (e.g., Cooper et al., 1994). Also, the presence of an entrepreneurial team implies a potentially larger stock of human capital (Lafuente & Rabetino, 2011). Therefore, businesses created by teams would likely benefit from more efficient decision-making processes, increasing their market potential (Capelleras et al., 2010) as well as their future performance probabilities (Cooper et al., 1994; Schutjens & Wever, 2000; Ensley et al., 2002; Ruef et al., 2003).

Consequently, from this theory and evidence it is argued that business planning—which it is linked to writing a business plan, accessing external financial resources, and creating a new venture managed by an entrepreneurial team—is associated with a quicker venture creation process:

H2: Business planning—in terms of writing a formal business plan, looking for external financial resources, and creating a new venture with an entrepreneurial team—accelerates the perceived new venture creation process

University context. —Education (both formal and informal) equips individuals with knowledge, skills and self-confidence necessary to engage in entrepreneurial activities (e.g., Cooper et al., 1994; Ferreto-Gutiérrez et al., 2018). Ucbasaran et al. (2008) found entrepreneurs with higher education levels, work experience, business ownership experience, and managerial capability were significantly associated with an increased probability of identifying more business opportunities and with a greater capacity to deal with complex business-related problems. Nevertheless, previous studies have found how a multifaceted approach to entrepreneurship should transcend coursework, and that the role of formal education over entrepreneurial action is also conditional on universities’ contextual factors (e.g., Soutaris et al., 2007; Qin et al., 2019; Cui et al., 2021). The importance of universities’ contextual factors becomes evident in their role for enhancing integration, coordination, and balance among multiple components. Also, various aspects of the university’s environment can influence the decision to take an entrepreneurial career, such as group sizes, program duration, mandatory versus voluntary participation, professors’ profile, and offering entrepreneurship programs not only to students enrolled in business-related careers but also to students from other disciplines (Leiva et al., 2021). A second factor, driven by the university’s context, analyzed in this study is program learning.

Program learning is a multidimensional construct that reflects the entrepreneurship-specific knowledge that students acquire during their learning process at the university (Soutaris et al., 2007). At the university level, efficient program learning is aimed at transferring to students’ various forms of knowledge related to the understanding of entrepreneurial motivations, values as well as of the entrepreneurial process, the development of abilities and skills to identify business opportunities, start a business, and to the creation of business networks (Soutaris et al., 2007; Leiva et al., 2021).

Generally speaking, studies dealing with the universities’ environment and program learning support the notion that these two factors positively impact the entrepreneurial activity of university students by equipping students with meaningful knowledge to engage in entrepreneurship, and by improving the confidence that entrepreneurs need to start a new business (e.g., Soutaris et al., 2007; Herrera et al., 2020; Leiva et al., 2021). Additionally, others claimed how a context conducive to entrepreneurship contributes to shape students’ attitudes towards entrepreneurship as well as building self-efficacy, whereas effective program learning supported by educators help not only to increase students’ knowledge base but also to improve the perceived feasibility of their potential business ideas (Soutaris et al., 2007; Rauch and Hulsink, 2015; Hahn et al., 2020).

Underlying the resultant trajectory of change in students’ entrepreneurial intention reported by the abovementioned studies is the presumption that the effect of both the university context and program learning is homogeneous among students. Nevertheless, students interact with the university and their distinctive characteristics might condition the impact of the university environment and program learning. So, it is therefore plausible to argue that the university environmental factors moderate the relationship between new venture creation speed and relevant individual characteristics.

For example, the potentially positive effects of the university’s context can be extrapolated to the case of individuals with and without past entrepreneurial experience. For the Netherlands and nine Latin American countries respectively, Rauch and Hulsink (2015) and Leiva et al. (2021) found how various aspects of universities’ context—i.e., environment and program learning—have direct implications on students’ entrepreneurial intentions by improving student’s awareness of the importance of human capital and self-efficacy. Arguably, investing in the university’s environment program learning can compensate the lack of entrepreneurship-specific knowledge and experience among individuals without past entrepreneurial experience. Also, these learning and training actions can also contribute to develop the entrepreneurial and managerial capabilities of individuals with past entrepreneurial experience by improving business opportunity identification as well as the exploitation of potentially innovative business ideas (Ucbasaran et al., 2009).

From this theory and evidence, it is hypothesized that:

H3a: A university context conducive to entrepreneurship—in terms of university environment and program learning—accelerates the perceived new venture creation process

H3b: The negative relationship between university’s contextual factors and new venture creation speed is weaker among individuals with past entrepreneurial experience

Methods

3. Data, variables and method

3.1 Data

The data used in this study comes from the 2018 database made available by the Global University Entrepreneurial Spirit Students’ Survey (GUESSS) for Costa Rica. GUESSS is an international research project that gathers data about students’ entrepreneurship behavior since 2003. Data are collected every 2-3 years and, for every period, a core team from the University of St. Gallen and the University of Bern (Switzerland) develops an online survey and sends it over to the GUESSS country teams (one per country) to start the collection process. While some parts of the survey remain stable in order to allow comparison across time, each survey has different conceptual focus in addition. The core team storages and prepares the data gathered from every university located in the participating countries (more details on GUESSS can be found at https://www.guesssurvey.org).

For the specific purpose of this study, the Costa Rican data includes a sample of 2,191 records where student is the unit of analysis. In line with the study research question, the data was filtered in order to include students who stated that they are currently trying to start their own business (i.e., nascent entrepreneurs). After removing from the sample students who are not nascent entrepreneurs, the final sample used in this paper includes 636 students.

3.2 Variables

Dependent variable. —The dependent variable used in this study is the perceived time needed by students to create their new venture. Similar to previous studies (e.g., Capelleras et al., 2010; Qin et al., 2017), the speed of new venture creation is ordered. Descriptive statistics for the speed of new venture creation are presented in Table 1. The data shows that 17.92% of students perceived they need up to six months to create their new business, whereas the highest concentration of observations is reported for the ‘more than 18 months’ speed category (45.75%).

Table 1: Perceived new venture creation speed. Descriptive statistics

|

Cases |

% |

|

|

Perceived new venture creation speed |

||

|

Between 1 and 6 months |

114 |

17.92% |

|

Between 7 and 12 months |

122 |

19.18% |

|

Between 13 and 18 months |

109 |

17.14% |

|

More than 18 months |

291 |

45.75% |

Gender. —In this study, the students’ gender is measured by a dummy variable taking the value of one for women, and zero for men. From Table 2 it can be seen that 53.77% of students included in the final sample are women.

Student’s age. —Similar to prior work (e.g., Capelleras & Greene, 2008; Lafuente et al., 2019), age is introduced in our model as the natural logarithm of years. From Table 2 it can be noticed that, on average, students are 35 years old. However, a closer examination of the data reveals that 25% of the sampled students are less than 22 years old (Table 2).

Previous entrepreneurial experience. —According to several studies into the role of entrepreneurial experience, serial entrepreneurs potentially run ever more successful businesses over time (Audia et al., 2000; Sarasvathy et al., 2013). For the specific purposes of this study, students were asked if they had previously created another business before, and their answer was codified in a dummy variable (1 = ‘yes’ and 0 = ‘no’). As shown in Table 2, 12.74% of the sampled students have prior entrepreneurial experience.

Table 2: Descriptive statistics for the selected independent variables

|

Mean |

Std. dev. |

p25 |

p75 |

|

|

Individuals Profile |

||||

|

Gender (1 for female) |

0.5377 |

0.4990 |

0 |

1 |

|

Age |

35.0126 |

111.1454 |

22 |

32 |

|

Entrepreneurial Profile |

||||

|

Serial Entrepreneur |

0.1274 |

0.3336 |

0 |

0 |

|

Business Planning |

||||

|

Written a Business Plan |

0.3082 |

0.4621 |

0 |

1 |

|

Attempted for External Funding |

0.1022 |

0.3032 |

0 |

0 |

|

Entrepreneurial Team |

0.6164 |

0.4867 |

0 |

1 |

|

University Environment |

||||

|

Atmosphere conducive to develop new business ideas |

4.9575 |

1.7320 |

4 |

6 |

|

University climate is favorable for entrepreneurship |

4.9098 |

1.7324 |

4 |

6 |

|

Students are encouraged to engage in entrepreneurship |

4.9952 |

1.7999 |

4 |

7 |

|

Program learning |

||||

|

Increased understanding of attitudes, values and motivations |

5.1611 |

1.6514 |

4 |

7 |

|

Increased understanding of the entrepreneurial process |

4.9430 |

1.7927 |

4 |

6 |

|

Enhanced practical management skills to start a business |

4.8780 |

1.7816 |

4 |

6 |

|

Enhanced abilities to develop networks |

4.6720 |

1.8268 |

4 |

6 |

|

Enhanced abilities to identify business opportunities |

4.8201 |

1.8287 |

4 |

6 |

Attempts to obtain external funding. —Previous studies dealing with new venture creation emphasize the role of both human capital and other forms of capital for a successful entrepreneurship process (e.g., Lafuente et al., 2019; Westhead & Storey, 1997). Additionally, Stayton and Mangematin (2019) reported that financial back-up to start up a new business constitutes a source of competitive advantage, giving the new venture greater flexibility and resilience than comparable ventures lacking sufficient financial resources. Therefore, from the data made available by the GUESSS project it is possible to know if students have already attempted to obtain any form of external funding to support their entrepreneurial project (1 = ‘yes’ and 0 = ‘no’). Table 2 shows that only 10.22% of students have attempted to obtain external funding for their new business initiative.

Entrepreneurial team. —Compared to individual efforts targeting a new business creation process, literature on entrepreneurship supports the notion that new businesses created by a group of individuals (i.e., entrepreneurial team) have greater access to human capital, potential to identify new business opportunities (e.g., new market niches or products), and a higher possibility to achieve short- and long-term goals (Cardon et al., 2017). This study includes a dummy variable identifying whether the new venture will be created by the entrepreneur only or by an entrepreneurial team (1= ‘entrepreneur team’ and 0 = ‘solo entrepreneurship’). In the final sample, 61.64% of students indicated their intention to create their business in collaboration with other individuals.

University context. —Students were asked to evaluate—using a seven-point Likert scale (1 = ‘not at all’ and 7 = ‘very much’)—their perception on the university’s environment, in terms of 1) whether the university inspires them to develop new business ideas, 2) offers a favorable climate for becoming an entrepreneur, and 3) encourage them to engage in entrepreneurial activities. This approach to measure university’s environment is consistent with previous studies on university students’ entrepreneurial activity (Franke & Lüthje, 2004; Geissler, 2013). To verify that the three questions accurately measure the proposed latent construct (‘university environment’) a factor analysis was performed. Concerning the goodness of fit statistics, the result of the Bartlett test of sphericity (p < 0.001) confirms that the correlation between the analyzed variables does not contaminate the factor results. The finding of the Kaiser-Meyer-Olkin (KMO) index of sampling adequacy is above the recommended cut-off point of 0.50 (0.7443), corroborating that the sample is factorable. The result of the reliability test (Cronbach’s alpha) for the factor obtained is 0.9198, confirming that the construct extracted from the factor analysis is internally consistent across items to measure the underlying category under evaluation (university environment). These results confirm that the proposed factor analysis is robust and appropriate (Nunnally & Bernstein, 1994).

Program learning. —Finally, the study model includes a variable linked to ‘program learning’. This perceptual construct, originally proposed by Souitaris et al. (2007), seeks to measure how attended courses contributed to enhance students’ entrepreneurial knowledge and skills. In line with prior work using the ‘program learning’ construct (Bergmann, 2017; Fayolle & Gailly, 2015), students were asked along a seven-point Likert scale to value the individual importance of a series of items identified as key aspects of their studies (1= ‘not at all’, 7= ‘very much’): 1) attitudes, values and motivations of entrepreneurs, 2) the entrepreneurial process, 3) practical management skills to start a business, 4) ability to develop networks, and 5) ability to identify business opportunities. Similar to the case of the ‘university environment’ construct, the validity of the five questions to measure the proposed latent construct (‘program learning’) was tested via a factor analysis. The result of the Bartlett test of sphericity (p < 0.001) corroborates that the correlation between the studied variables does not negatively affect the factor outcome, whereas the finding of the Kaiser-Meyer-Olkin (KMO) index confirms that the sample is factorable (KMO result = 0.8725). The finding of the Cronbach’s alpha statistic is 0.9383, which support that the construct extracted from the factor analysis is internally consistent across the five items to measure the analyzed latent construct: ‘program learning’.

Table 3: Descriptive statistics for the selected independent variables

|

University environment |

Program learning |

|

|

Items |

3 |

5 |

|

Cronbach’s alpha |

0.9198 |

0.9383 |

|

Eigenvalue |

2.3015 |

3.7436 |

|

% variance explained |

0.7671 |

0.7487 |

|

Bartlett test of sphericity (chi2 value) |

4909.21 (p-value < 0.001) |

9726.39 (p-value < 0.001) |

|

Kaiser-Meyer-Olkin (KMO) test of sampling adequacy |

0.7443 |

0.8725 |

3.3 Method

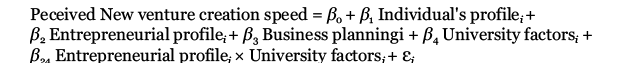

Similar to other multinomial-choice variables analyzed in previous research dealing with entrepreneurial activity (e.g., Capelleras et al., 2010), the speed to create a new business is inherently ordered. To better understand the factors that influence the speed of new business formation, an ordered logit model was chosen as econometric tool (Greene, 2003). The ordered logit model is built around a latent regression of the form y^*=βx^'+ε, where y^* is the dependent variable (speed of new business creation), x' is the vector of variables determining the discrete ordering for each observation, β is the vector of parameter estimates, and ε is the logistically distributed error term. The ordered logit model is flexible because it allows the perceived new venture creation speed probabilities to vary across categories, based on the explanatory variables (Greene, 2003). In this study, students choose the category that most closely represents their own perception on the time needed to create their new venture (Table 1). The ordered logit model that defines each category of the variable linked to new venture creation speed (j=1,…,4) has the following form:

yj=1=1 if y* ≤ μ1

yj=2=2 if μ1 ≤ y* ≤ μ2

yj=3=3 if μ2 ≤ y* ≤ μ3

yj=4=4 if y * ≥ μ3 (1)

In equation (1) μj are the observed thresholds for the different categories (j) of the dependent variable (y). Based on the framework presented in Section 2, the full model used in this study to verify the factors explaining new venture creation speed is the following:

(2)

(2)

In equation (2), ‘University factors’ are the two university-related variables computed via factor analysis (‘university environment’ and ‘program learning’), β are the unknown parameters estimated by the ordered logit model. Keep in mind that coefficients estimated by discrete choice models—including ordered logit models—only indicate the direction of the effect of the analyzed variable on the dependent variable. For interpretation purposes, the magnitude of the key independent variables is determined by the average marginal effect (AME). The AME is the average change in the probability of the response variable (y) as a result of a change in the independent variables across the sampled observations (i). Through this approach we can estimate robust marginal effects for each observation, thus the resulting AMEs capture individual-specific characteristics, thus offering more realistic estimations. Note that AMEs sum to zero, which is in accordance with the requirement that the probabilities add to one (Greene, 2003, p. 740).

In terms of the study hypotheses, a negative correlation between past entrepreneurial experience and perceived venture creation speed (β2Serial entrepreneur< 0) would confirm that prior entrepreneurial experience is associated with quicker perceived new venture creation processes (H1). The second hypothesis (H2) connecting business planning to a quicker perceived venture creation process will be confirmed if the correlation between perceived venture creation speed and the dummy variables related to business planning—i.e., business plan, external funding, and entrepreneurial team—is negative (β3Business planning > 0 for the six- and 12-month categories and/or β3Business planning < 0 for the speed categories of more than 12 months).

For the last set of hypotheses (H3a-H3b) connecting perceived venture creation speed to the university’s context and individuals’ entrepreneurial experience, a positive correlation between the university contextual factors and perceived venture creation speed would confirm that university’s environment and program learning are associated with a quicker perceived new venture creation processes (H3a) (β4 > 0 for the six- and 12-month speed categories and/or β4 < 0 for the speed categories of more than 12 months). Hypothesis H3b will be confirmed if the result of the interaction terms between university’s contextual variables and the ‘serial entrepreneur’ dummy is positive (β24Serial entrepreneur < 0 for the six- and 12-month speed categories and/or β24Serial entrepreneur > 0 for the speed categories of more than 12 months).

Results

4. Results

This section presents the results of the ordered logit model analyzing the factors that explain the speed of new venture creation among Costa Rican university students. Section 4.1 shows the results of the baseline model, while Section 4.2 presents the results of the full model including the interaction terms between the variables extracted from the factor model (‘university environment’ and ‘program learning’) and the serial entrepreneurship dummy.

4.1 Baseline results

The results for the baseline model are presented in this section (Table 4). To evaluate the threat of collinearity, the average variance inflation factor (VIF) was computed for all variables. The average VIF value—1.32 (range= 1.01-2.16)—is below the generally accepted rule of thumb value of 10. Therefore, the model presented in Table 4 does not present collinearity problems. Results indicate that some of the variables are significant and explained differences in the perceived time needed to start a new business among students (new venture creation speed).

Table 4: Ordered logit model: Results for the baseline model

|

Marginal effects (dependent variable: perceived venture creation speed) |

||||

|

1 to 6 months |

7 to 12 months |

13 to 18 months |

> 18 months |

|

|

Gender (female = 1) |

–0.0013 (0.0215) |

–0.0007 (0.0123) |

–0.0001 (0.0022) |

0.0022 (0.0360) |

|

ln age |

0.0550** (0.0261) |

0.0315** (0.0152) |

0.0057 (0.0036) |

–0.0922** (0.0437) |

|

Serial entrepreneur |

–0.0398 (0.0339) |

–0.0228 (0.0194) |

–0.0041 (0.0039) |

0.0668 (0.0566) |

|

Business Plan |

0.0695*** (0.0236) |

0.0398*** (0.0132) |

0.0072* (0.0037) |

–0.1165*** (0.0383) |

|

Attempted for External Funding |

0.0673* (0.0365) |

0.0386* (0.0206) |

0.0069 (0.0047) |

–0.1129* (0.0604) |

|

Entrepreneurial Team |

–0.0264 (0.0224) |

–0.0151 (0.0128) |

–0.0027 (0.0025) |

0.0442 (0.0374) |

|

University Environment |

–0.0071 (0.0172) |

–0.0041 (0.0099) |

–0.0007 (0.0018) |

0.0119 (0.0289) |

|

Program learning |

0.0007 (0.0171) |

0.0004 (0.0098) |

0.0001 (0.0018) |

–0.0012 (0.0287) |

|

Goodness of fit statistics: |

||||

|

Log likelihood value |

–806.0578 |

|||

|

Wald test (chi2) |

23.39*** |

|||

|

Pseudo R2 (McFadden) |

0.0136 |

|||

|

VIF (min-max) |

1.32 (1.01-2.16) |

|||

|

Cases |

636 |

|||

Robust standard errors are presented in parentheses. *, **, *** indicates significance at the 10%, 5% and 1%, respectively.

Concerning the individuals’ profile characteristics, the results in Table 4 show that the coefficient linked to the gender variable is not statistically significant. Contrary to prior studies on gender and entrepreneurial activity (e.g., Driga et al., 2009; Van der Zwan et al., 2012; Verheul et al., 2012), this shows that, in the study sample, gender is not a factor affecting students’ nascent entrepreneurial activity. Similar to Capelleras et al. (2010) and Leiva et al. (2021), the lack of significance in the ‘gender’ variable suggests that students’ sex does not impact the perceived speed of new venture creation among nascent entrepreneurs in a significant way.

For the variable age a significantly negative effect on perceived new business creation speed was found (Table 4). This suggests that older nascent entrepreneurs (students) are more likely to perceive that their new business will be created within the next six or twelve months (Table 4: 0.0550 and 0.0315, respectively), that is, older people need less time to create their new venture. This result is in line with prior work emphasizing that more mature entrepreneurs, with more accumulated skills and experience, are in a better position to cope with the effects of aging (Westhead et al., 2009; Lafuente & Vaillant, 2013).

For interpretation purposes, keep in mind that all models used the logged value of students’ age so; therefore, an additional computation is needed to interpret the AME for age. Specifically, if we compare two identical students but one is 30 years old and the other is 36 years old, the older student is one percentage point more likely to perceive that his/her new venture will be created within the next six months (AMEβ×ln(1.2) =0.0550×0.1823). Based on the same example, the result of the marginal effect for the speed category ‘more than 18 months’ reveals that, other things equal, the 36 years old student is 1.68 percentage points less likely to state that the perceived timed needed to start his/her new venture is more than 18 months (AMEβ×ln(1.2)=-0.0922×0.1823).

In the case of the variable associated with past entrepreneurial experience, the findings in Table 4 indicate that this factor does not impact new venture creation speed in a significant way. Although entrepreneurial experience has been found to equip individuals with the necessary knowledge and skills to engage in new venture processes (e.g., Ucbasaran et al., 2008; Capelleras et al., 2010; Lafuente et al., 2019), the results in this study suggest that, in the study sample, past entrepreneurial experience is not a decisive factor conditioning the activity of nascent entrepreneurs, in terms of new venture creation speed. Thus, the first hypothesis (H1) stating that past entrepreneurial experience accelerates the perceived new venture creation process cannot be confirmed.

For the variables related to business planning processes (i.e., writing a business plan, looking for external funding, and developing the entrepreneurial process with a team), the findings in Table 4 show that, similar to prior work (e.g., Cooper & Mehta, 2003; Capelleras & Greene, 2008), students who have a written business plan are more likely to perceive that they need less time to create their new venture. For example, for the ‘1-6 months’ speed category the AME result indicates that, other things equal, students with a written business plan are 6.95 percentage points more likely to perceive that his/her new venture can be created within the next six months, compared to the probability of students who do not have a business plan. Also, notice that students with a written business plan are 11.65 percentage points less likely to fall in the ‘more than 18 months’ category, compared to the probability reported by students without a formal business plan.

A similar result was found for the variable linked to external funding: having an external funding action plan supports the entrepreneurial process (Lafuente & Rabetino, 2011), in this case measured via the speed of the new venture creation process. From Table 4 it can be seen that, other things equal, students who attempted to obtain external funding for their venture are more likely to fall in the speed categories ‘1-6 months’ (AME: 6.73 percentage points) and ‘7-12 months’ (AME: 3.86 percentage points). Finally, from Table 4 it can be noticed that, contrary to what has been reported in previous studies (e.g., Ensley et al., 2002; Ruef et al., 2003; Capelleras et al., 2010), the variable linked to the presence of an entrepreneurial team—i.e., nascent entrepreneurs seek to create their new businesses with a team—does not explain differences in new venture creation speed.

Overall, the second hypothesis (H2) connecting the business planning process—in terms of writing a formal business plan, looking for external financial resources, and creating a new venture with an entrepreneurial team—to a quicker perceived new venture creation process can be confirmed for the variables linked to writing a business plan and attempting to obtain external funding, whereas this hypothesis cannot be confirmed in the case of the variable linked to entrepreneurial teams.

Finally, notice that the two variables linked to university’s context are not significant. These initial results only indicate that the university’s context—i.e., environment and program learning—does not have a homogeneous impact on students’ perceived speed of new venture creation. But, following the logic of this study’s theoretical framework, the hypotheses related to the specific impact of these variables on new venture creation speed will be tested in Section 4.2.

4.2 Full model results

This section presents the findings for the full model including the analyzed interaction terms. Specifically, Table 5 presents the results for the interaction between the dummy identifying serial entrepreneurs and the two factor variables. Notice that the coefficients of the ordinal logit model are presented in Appendix 2.

Similar to the baseline model presented in Section 4.1, the average variance inflation factor (VIF) was computed to assess potential collinearity problems. The average VIFs for the model presented in Table 5 is 1.58 (range= 1.01-2.46). Therefore, the results of this diagnostic test do not raise collinearity concerns.

Similar to the baseline results reported in Table 4, from the findings in Table 5 it was found that age, business plan and external funding are significantly correlated with new venture creation speed, whereas the variables linked to students’ gender and entrepreneurial team are not statistically significant.

In the case of the two university context factors analyzed in this study (i.e., environment and program learning), the findings in all panels of Table 5 indicate that these two factors are not connected to new venture creation speed in a significant way. Contrary to Soutaris et al. (2007), Rauch and Hulsink (2015) and Leiva et al. (2021), this result suggests that, in the study sample, the general (homogeneous) effect of these two factors over students’ perceived new venture creation speed is not statistically significant. Therefore, hypothesis 3a (H3a) stating that a university context conducive to entrepreneurship—in terms of university environment and program learning—accelerates the perceived new venture creation process cannot be confirmed.

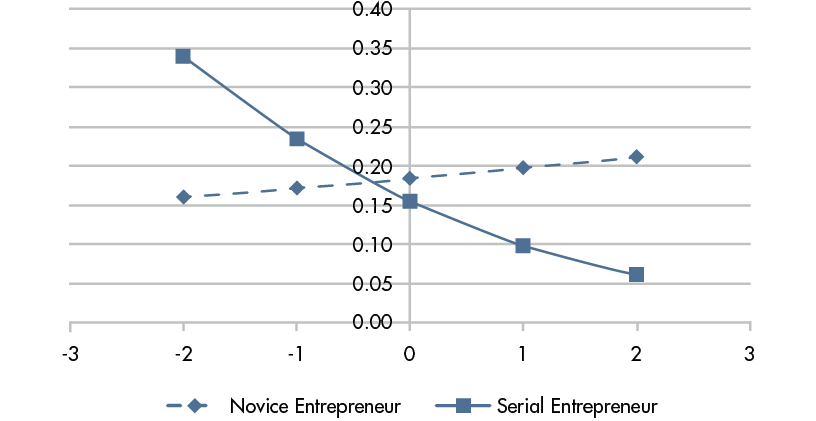

Concerning the key analyzed effects, the results for the interaction between the ‘serial entrepreneur’ dummy and the university factors are presented in Table 5. To ease in the interpretation of the results, figures A1a-A1d in Appendix 3 plot—for each speed category—the estimated probability of new venture creation speed for different levels of ‘program learning’ among novice and serial entrepreneurs.

The findings indicate that the variable linked to past entrepreneurial experience remains as not significant; however, the result for the interaction term between the ‘serial entrepreneur’ dummy and the ‘program learning’ factor suggests that past entrepreneurial experience moderates the relationship between ‘program learning’ and new venture creation speed. Specifically, for the analysis of the first new venture creation speed category (‘1 to 6 months’), results in Table 5 indicate that, other things equal (including ‘program learning’ levels), students with past entrepreneurial experience are 8.89 percentage points less likely to fall in this speed category. That is, past entrepreneurial experience negatively affects the relationship between ‘program learning’ and a venture creation speed level ranging between 1 and 6 months.

Table 5: Ordered logit model: Results for the full models

|

Marginal effects (dependent variable: perceived venture creation speed) |

||||

|

Independent variables |

1 to 6 months |

7 to 12 months |

13 to 18 months |

> 18 months |

|

Gender (female = 1) |

–0.0035 (0.0215) |

–0.0020 (0.0123) |

–0.0004 (0.0022) |

0.0059 (0.0360) |

|

ln age |

0.0548 (0.0268)** |

0.0313 (0.0154)** |

0.0057 (0.0037) |

–0.0918 (0.0446)** |

|

Serial entrepreneur |

–0.0314 (0.0338) |

–0.0179 (0.0193) |

–0.0033 (0.0037) |

0.0526 (0.0563) |

|

Business Plan |

0.0653 (0.0237)*** |

0.0373 (0.0133)*** |

0.0068 (0.0036)** |

–0.1094 (0.0386)*** |

|

Attempted for External Funding |

0.0682 (0.0369)* |

0.0389 (0.0208)* |

0.0071 (0.0047) |

–0.1141 (0.0609)* |

|

Entrepreneurial Team |

–0.0256 (0.0224) |

–0.0146 (0.0127) |

–0.0027 (0.0025) |

0.0429 (0.0373) |

|

University Environment |

–0.0123 (0.0184) |

–0.0070 (0.0105) |

–0.0013 (0.0020) |

0.0206 (0.0308) |

|

Program learning |

0.0127 (0.0187) |

0.0072 (0.0107) |

0.0013 (0.0020) |

–0.0213 (0.0312) |

|

Serial entrepreneur x University Environment |

0.0285 (0.0514) |

0.0163 (0.0294) |

0.0030 (0.0055) |

–0.0478 (0.0862) |

|

Serial entrepreneur x Program learning |

–0.0889 (0.0400)** |

–0.0508 (0.0231)** |

–0.0092 (0.0056)* |

0.1489 (0.0666)** |

|

Goodness of fit statistics: Log likelihood value = -803.0382; Wald test (chi2) = 28.06***; Pseudo R2 (McFadden) = 0.0162; VIF (min-max) = 1.58 (1.01-2.46) |

||||

Robust standard errors are presented in parentheses. Sample size = 636 cases. *, **, *** indicates significance at the 10%, 5% and 1%, respectively.

This result is graphically presented in Figure A1a in Appendix 3. For low ‘program learning’ levels, the probability that the perceived venture creation speed falls in this category is greater among students with past entrepreneurial experience, whereas for high ‘program learning’ levels this predicted probability is higher for novice nascent entrepreneurs.

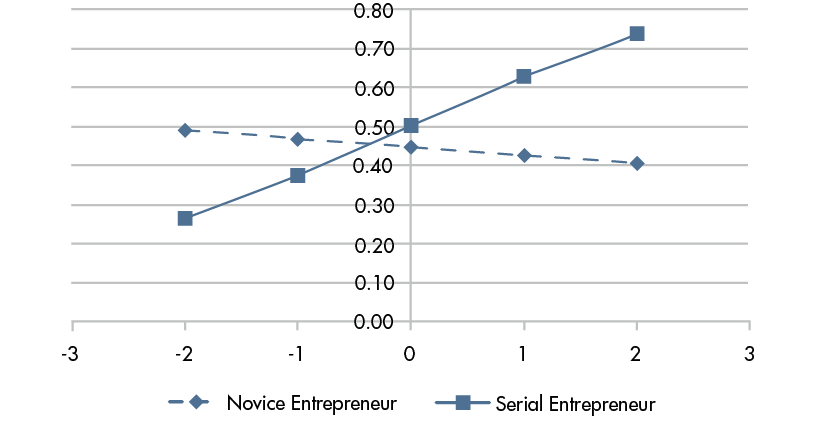

On contrary, past entrepreneurial experience positively moderates the relationship between ‘program learning’ and longer venture creation processes (Table 5: ‘more than 18 months’). More concretely, students with past entrepreneurial experience are 14.89 percentage points more likely to perceive that the creation of their new business will take longer than 18 months, compared to the probability of students without past entrepreneurial experience. That is, past entrepreneurial experience positively affects the relationship between ‘program learning’ and longer venture creation processes (‘more than 18 months’ category). This finding is graphically represented in Figure A1d (Appendix 3). The figure shows the increasing relationship between ‘program learning’ and new venture creation speed among serial entrepreneurs, while this relationship is slightly negative for the group of students without past entrepreneurial experience.

From the findings presented in Table 5, the hypothesis 3b (H3b) which states that the negative relationship between university’s contextual factors and perceived new venture creation speed is weaker among individuals with past entrepreneurial experience is confirmed.

5. Discussion and implications

Existing work has highlighted the decisive role of entrepreneurship for the economic performance of territories as well as the innovative capacity of new and incumbent businesses (Lafuente et al., 2020; Leiva et al., 2021). As relevant as the study of entrepreneurial action, the analysis of perceived start-up speed among nascent entrepreneurs constitutes a valuable exercise with the potential to unveil the determinants of this relevant precursor of entrepreneurial activity. Following this argument line, this study evaluated how the university’s context and entrepreneurial experience affect the perceived temporal trajectory of the new venture creation process—i.e., perceived start-up speed—in a developing setting, namely Costa Rica.

Prior research, mostly focused on developed economies, emphasizes the large variability in the time spent by nascent entrepreneurs to create a new business (Capelleras et al., 2010; Davidsson & Gordon, 2012; Hechavarría et al., 2016; Qin et al., 2017). The core findings indicate that two variables of the planning process—i.e., writing a business plan and searching for external funding—accelerate perceived start-up speed. In the case of the business plan, the result supports the notion that writing a business plan gives nascent entrepreneurs relevant information about the market, potential suppliers, and resources, which is necessary to make better informed decision-making processes (e.g., Capelleras et al., 2010).

In the specific context of this study, searching for funding can be a costly process in developing economies where institutional backing to entrepreneurship is low (Lafuente & Rabetino, 2011). In their pursuit of financial resources, nascent entrepreneurs need to carefully assess the short- and medium-term prospects for the business (Hechavarría et al., 2016). The implication of these findings is clear: if, as suggested by the study results, a business plan and external funding are key aspects prioritized by nascent entrepreneurs in developing settings, universities should include new business analytics and the development of business plans in their entrepreneurship programs in order to support better-informed entrepreneurial processes based on the information provided by the deep assessment of new ideas with economic potential.

The findings suggest that program learning increases the perceived time needed to start a new business among students who have past entrepreneurial experience. Universities’ entrepreneurship programs are designed both to compensate students’ lack of experience and to increase students’ knowledge on the entrepreneurial process. But, the results indicate that these programs are mostly capitalized by students with entrepreneurial experience who take these programs as an opportunity for conducting more systematic and analytical decision-making processes (Capelleras et al., 2010).

In other words, the study findings indicate that program learning is not equally effective among individuals without past entrepreneurial experience. From a policy viewpoint, these findings invite to evaluate the design of university’s entrepreneurship programs. If these programs do not equip students without entrepreneurial experience with the knowledge necessary to develop their potential entrepreneurial career, it can be said that program learning mostly boosts the exploitation of business ideas of individuals with market experience, while proving potentially hard-to-grasp information to students without such experience. Obviously, I do not disregard investments in program learning. Rather, the findings support the re-design of universities’ entrepreneurship programs in an effort to offering students purposeful knowledge in a collaborative context in which various stakeholders participate. Examples of such actions might include, among others, meetings with other entrepreneurs (i.e., role models), SME managers, or public administrations (Lafuente & Vaillant, 2013; Hechavarría et al., 2016; Hahn et al., 2020).

Regardless of the direction of the estimated effects, a relevant question that is worth highlighting is whether a more accelerated venture creation process (perceived or actual) is always desirable. From the findings of this study an interesting pattern was observed among the sampled nascent entrepreneurs: students actively involved in the business planning process—i.e., writing a business plan and searching for funding—mostly perceived that less time will be needed to start their business, whereas university’s program learning increases the perceived business creation time among students with past entrepreneurial experience.

In other words, program learning promotes entrepreneurship-specific aspects such as the understanding of the entrepreneurial process, managerial skills, network development, and the identification of business opportunities. Current experiential knowledge resulting from developing business planning tasks—which is compatible with program learning activities—helps to reduce the perceived start-up speed among students by giving students information on the entrepreneurial process. On contrary, students with prior entrepreneurial experience may see in the university’s program learning an opportunity to strengthen specific aspects of their prospective venture, which materializes in a more extended perceived start-up time as a result of the joint exploitation of program learning outcomes (e.g., stronger networks, or renovated managerial skills) and the cumulative knowledge generated by previous venturing experiences.

This is an important contribution of this study as these results attest to the importance of developing practical and strategic capabilities via the business planning process, as well as of the business-specific learning and other forms of psychological capital (e.g., optimism and self-efficacy) generated by past entrepreneurial experience (Lafuente et al., 2019).

In conclusion, this research provides insights into how university students who are involved in nascent entrepreneurship perceive venture creation speed. Results are valuable for scholars and policy makers interested in promoting entrepreneurship as well as specific policies and training programs which are often anchored within universities. The coupling between universities, local businesses and chambers of commerce may prove itself effective in helping the local community to promote entrepreneurship programs with relevant societal implications.

Concluding

6. Concluding remarks and future research

By using an ordered logit model on a sample of 636 Costa Rican university students obtained from the GUESSS databases for 2018, this study analyzed the effect of relevant individual and contextual factors on nascent entrepreneurs’ perceived new venture creation speed.

Overall, the results suggest two different patterns of new venture creation speed among nascent entrepreneurs. On the one hand, experienced (older) students who are actively carrying out various tasks related to their potential venture—i.e., writing a business plan and searching for external funding—are more likely to perceive that they need less time to create their new business. On the other hand, it was found that university’s program learning slows down the perceived start-up speed among individuals with past entrepreneurial experience. Additionally, findings indicate that the gender gap is not a factor that explains the observed differences in the perceived start-up speed.

The results of this study contribute to improve our understanding on the determinants of perceived start-up speed among nascent entrepreneurs. Nevertheless, similar to other studies on venture creation speed (e.g., Capelleras et al., 2010; Hechavarría et al., 2016; Qin et al., 2017), the analysis proposed in this research is open to further verification. First, future research should consider other relevant variables identified in the literature (e.g., industry or role models) (e.g., Lafuente & Vaillant, 2013). Also, future studies on how the interaction between the university and local stakeholders (e.g., chamber of commerce, public administration) improves new venture creation processes are desirable. For example, future work should explore if the interaction between the university and stakeholders helps nascent entrepreneurs to build meaningful business networks or facilitates the access to financial resources.

Second, future research would benefit from a detailed analysis of the role played by the business plan in the venture creation process. Specifically, an interesting research avenue deals with the analysis of the entrepreneur’s motivation for writing a business plan and its effect on the venture creation process. For example, future work should evaluate whether a deliberate (‘intended’) business plan has the same effect on start-up speed, relative to that reported for individuals whose motivation for writing a business plan is not linked to the study of the economic potential of their business idea (e.g., when the business plans is requested by the bank). Third, an extension to the business plan analysis, future work should evaluate if nascent entrepreneurs who have written a business plan face less constraints when it comes to access to financial resources.

Finally, although the approach adopted in this study to analyze perceived venture creation speed is robust, future research may enrich the literature by replicating the analysis proposed in this study in other geographic settings or in other specific contexts that can also be conducive to entrepreneurship (e.g., business incubators, science parks, et cetera). Also, future work might employ structural equation modeling (e.g., PLS models) for the analysis of complex relationships, such as new venture creation process. As with any cross-section study, the typical cautions apply in the interpretation of the study findings. In this sense, future research should attempt to analyze the connections between universities’ contextual factors and entrepreneurial action using longitudinal data that can give a greater perspective to this study’s approach to perceived venture creation speed.

Notes

1 This study is the academic output of the first author’s MBA thesis, Universidad Latinoamericana de Ciencia y Tecnología (ULACIT), San José, Costa Rica

Appendix

APPENDIX

Appendix 1: Correlation matrix

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

||

|

1 |

Venture creation speed |

1 |

|||||||

|

2 |

Gender (female = 1) |

-0.0089 |

1 |

||||||

|

3 |

ln age |

-0.0797** |

-0.0269 |

1 |

|||||

|

4 |

Serial entrepreneur |

0.0223 |

-0.0715* |

0.1290*** |

1 |

||||

|

5 |

Business plan |

-0.1339*** |

-0.0027 |

-0.0075 |

0.0617 |

1 |

|||

|

6 |

Attempted to obtain external funding |

-0.1068*** |

-0.0203 |

0.0110 |

0.0579 |

0.2694*** |

1 |

||

|

7 |

Entrepreneurial team |

0.0454 |

-0.0181 |

-0.1254*** |

-0.0284 |

0.0784** |

0.0420 |

1 |

|

|

8 |

University environment |

0.0250 |

-0.0259 |

-0.0814** |

0.0414 |

0.0441 |

0.0115 |

-0.0096 |

1 |

|

9 |

Program learning |

0.0153 |

-0.0190 |

-0.0437 |

0.0846** |

0.0959** |

0.0332 |

0.0405 |

0.7382*** |

*, **, *** indicates significance at the 10%, 5% and 1%, respectively.

Appendix 2: Ordered logit model: Coefficient results (robust standard error is presented in parentheses)

|

Baseline model (Table 4) |

Full models (Table 5) |

|

|

Gender (female = 1) |

0.0089 (0.1491) |

0.0244 (0.1495) |

|

ln age |

–0.3815 (0.1820)** |

–0.3819 (0.1867)** |

|

Serial entrepreneur |

0.2762 (0.2351) |

0.2187 (0.2352) |

|

Business Plan |

–0.4820 (0.1619)*** |

–0.4550 (0.1635)*** |

|

Attempted for External Funding |

–0.4670 (0.2517)* |

–0.4747 (0.2552)* |

|

Entrepreneurial Team |

0.1829 (0.1549) |

0.1782 (0.1557) |

|

University Environment |

0.0491 (0.1197) |

0.0855 (0.1281) |

|

Program learning |

–0.0049 (0.1188) |

–0.0884 (0.1302) |

|

Gender x University Environment |

||

|

Gender x Program learning |

||

|

ln age x University Environment |

||

|

ln age x Program learning |

||

|

Serial entrepreneur x University Environment |

–0.1987 (0.3587) |

|

|

Serial entrepreneur x Program learning |

0.6191 (0.2794)** |

|

|

Cutoff 1 |

–2.8627 (0.6277)*** |

–2.8533 (0.6417)*** |

|

Cutoff 2 |

–1.8456 (0.6218)*** |

–1.8333 (0.6368)*** |

|

Cutoff 3 |

–1.1297 (0.6175)* |

–1.1131 (0.6330)* |

|

Log likelihood value |

–806.0578 |

–803.9382 |

|

Wald test (chi2) |

23.39*** |

28.06*** |

|

Pseudo R2 (McFadden) |

0.0136 |

0.0162 |

|

VIF (min-max) |

1.32 (1.01-2.16) |

1.58 (1.01-2.46) |

|

Cases |

636 |

636 |

Robust standard errors are presented in parentheses. *, **, *** indicates significance at the 10%, 5% and 1%, respectively.

APPENDIX III

Figure A1a: The relationship between past entrepreneurial experience, program learning and perceived venture creation speed (estimated probability for the ‘1-6 months’ speed category) |

|

Figure A1b: The relationship between past entrepreneurial experience, program learning and perceived venture creation speed (estimated probability for the ‘7-12 months’ speed category) |

|

Figure A1c: The relationship between past entrepreneurial experience, program learning and perceived venture creation speed (estimated probability for the ‘13-18 months’ speed category) |

|

Figure A1d: The relationship between past entrepreneurial experience, program learning and perceived venture creation speed (estimated probability for the ‘more than 18 months’ speed category) |

|

References

References

Audia, P.G., Locke, E.A., & Smith, K.G. (2000). The paradox of success. Academy of Management Journal, 43(5), 837–853.

Bergmann, H. (2017). The formation of opportunity beliefs among university entrepreneurs: an empirical study of research-and non-research-driven venture ideas. Journal of Technology Transfer, 42(1), 116-140.

Capelleras, J.L., & Greene, F.J. (2008). The determinants and growth implications of venture creation speed. Entrepreneurship and Regional Development, 20(4), 317-343.

Capelleras, J.L., Greene, F.J., Kantis, H., & Rabetino, R. (2010). Venture creation speed and subsequent growth: Evidence from South America. Journal of Small Business Management, 48(3), 302-324.

Cardon, M.S., Post, C., & Forster, W.R. (2017). Team entrepreneurial passion: Its emergence and influence in new venture teams. Academy of Management Review, 42(2), 283-305.

Carter, N., Gartner, W., & Reynolds, P. (1996). Exploring startup event sequences. Journal of Business Venturing, 11, 151-166.

Cooper, A.C., & Mehta, S. (2003). Preparation for entrepreneurship: does it matter? In Bygrave, W.D., Brush, C.G., Davidsson, P., Fiet, J.O., Greene, P.G., Harrison, R.T., Lerner, M., Meyer, G.D., Sohl, J. and Zacharakis, A. (Eds.), Frontiers of Entrepreneurship Research 2003 (Wellesley, MA: Babson College).

Cooper, A.C., Gimeno-Gascon, F.J., & Woo, C.Y. (1994). Initial Human and Financial Capital Predictors of New Venture Performance. Journal of Business Venturing, 9, 371-395.

Cui, J., Sun, J., & Bell, R. (2021). The impact of entrepreneurship education on the entrepreneurial mindset of college students in China: the mediating role of inspiration and the role of educational attributes. The International Journal of Management Education, 19(1), 100296.

Davidsson, P., & Gordon, S.R. (2012). Panel studies of new venture creation: A methods-focused review and suggestions for future research. Small Business Economics, 39(4), 853-876.

Delmar, F., & Shane, S. (2003). Does business planning facilitate the development of new ventures? Strategic Management Journal, 24, 1165-1185.

Driga, O., Lafuente, E., & Vaillant, Y. (2009). “Reasons behind the relatively lower entrepreneurial activity levels of rural women: looking into rural Spain”, Sociologia Ruralis, Vol. 49 No. 1, pp. 70-96.

Ensley, M.D., Pearson, A.W., & Amason, A.S. (2002). Understanding the dynamics of new venture top management teams: cohesion, conflict and new venture performance. Journal of Business Venturing, 17(4), pp. 365-386.

Fayolle, A., & Gailly, B. (2015). The impact of entrepreneurship education on entrepreneurial attitudes and intention: Hysteresis and persistence. Journal of Small Business Management, 53(1), 75-93.

Ferreto-Gutiérrez, E., Lafuente, E., & Leiva, J.C. (2018). Human capital and sociological factors as determinants of entrepreneurship. TEC Empresarial, 12(3), 43-49.

Franke, N., & Lüthje, C. (2004). Entrepreneurial intentions of business students—A benchmarking study. International Journal of Innovation and Technology Management, 1(3), 269-288.

Geissler, M. (2013). Determinanten des Vorgründungsprozesses. Wiesbaden: Springer Fachmedien Wiesbaden.DOI: https://doi.org/10.1007/978-3-658-01665-4

Gillanders, R., Lyons, R., & van der Werff, L. (2021). Social sexual behaviour and co-worker trust in start-up enterprises. Small Business Economics, 57, 765-780.

Greene, W. (2003). Econometric analysis, fifth edition. Englewood Cliffs, NJ: Prentice Hall.

Hahn, D., Minola, T., Bosio, G., & Cassia, L. (2020). The impact of entrepreneurship education on university students’ entrepreneurial skills: a family embeddedness perspective. Small Business Economics, 55 (1), 257-282.

Hechavarría, D. M., Matthews, C. H., & Reynolds, P.D. (2016). Does start-up financing influence start-up speed? Evidence from the panel study of entrepreneurial dynamics. Small Business Economics, 46(1), 137-167.

Herrera, D., Mora-Esquivel, R., & Leiva, J.C. (2020). Ecosistema emprendedor universitario costarricense y su vínculo con la intención emprendedora: un estudio exploratorio. TEC Empresarial, 14 (2), 64-83.

Honig, B., & Karlsson, T (2004). Institutional forces and the written business plan. Journal of Management, 30, 29-48.

Lafuente, E., Acs, Z.J., Sanders, M., & Szerb, L. (2020). The global technology frontier: productivity growth and the relevance of Kirznerian and Schumpeterian entrepreneurship. Small Business Economics, 55, 153-178.

Lafuente, E., & Rabetino, R. (2011). Human capital and growth in Romanian small firms. Journal of Small Business and Enterprise Development, 18(1), 74-96.

Lafuente, E., & Vaillant, Y. (2013). Age driven influence of role-models on entrepreneurship in a transition economy. Journal of Small Business and Enterprise Development, 20(1), 181-203.

Lafuente, E., Vaillant, Y., Vendrell-Herrero, F., & Gomes, E. (2019). Bouncing back from failure: Entrepreneurial resilience and the internationalisation of subsequent ventures created by serial entrepreneurs. Applied Psychology, 68(4), 658-694.

Leiva, J.C., Mora-Esquivel, R., Krauss-Delorme, C., Bonomo-Odizzio, A., & Solís-Salazar, M. (2021). Entrepreneurial intention among Latin American university students. Academia Revista Latinoamericana de Administración, in press, doi: https://doi.org/10.1108/ARLA-05-2020-0106

Nunnally, J.C., & Bernstein, I.H. (1994). Psychometric Theory, third edition. McGraw-Hill, NewYork.

Qin, F., Wright, M., & Gao, J. (2017). Are ‘sea turtles’ slower? Returnee entrepreneurs, venture resources and speed of entrepreneurial entry. Journal of Business Venturing, 32(6), 694-706.

Qin, F., Wright, M., & Gao, J. (2019). Accelerators and intra-ecosystem variety: How entrepreneurial agency influences venture development in a time-compressed support program. Industrial and Corporate Change, 28(4), 961-975.

Rauch, A. & Hulsink, W. (2015). Putting entrepreneurship education where the intention to act lies: an investigation into the impact of entrepreneurship education on entrepreneurial behavior. Academy of Management Learning and Education, 14 (2), 187-204.

Ruef, M., Aldrich, H.E., & Carter, N.M. (2003). The structure of organizational founding teams: homophily, strong ties, and isolation among US entrepreneurs. American Sociological Review, 68(2), 195-222.

Sarasvathy, S., Menon, A., & Kuechle, G. (2013). Failing firms and successful entrepreneurs: Serial entrepreneurship as a temporal portfolio. Small Business Economics, 40, 417-434.

Schutjens, V., & Wever, E. (2000). Determinants of new firm success. Papers in Regional Science, 79(2), 135-159.

Stayton, J., & Mangematin, V. (2019). Seed accelerators and the speed of new venture creation. Journal of Technology Transfer, 44(4), 1163-1187.

Souitaris, V., Zerbinati, S., & Al-Laham, A. (2007). Do entrepreneurship programmes raise entrepreneurial intention of science and engineering students? The effect of learning, inspiration and resources. Journal of Business Venturing, 22(4), 566-591.

Tornikoski, E., & Renko, M. (2014). Timely creation of new organizations: The imprinting effects of entrepreneurs’ initial founding decisions. Management, 17(3), 193-213.

Ucbasaran, D.,Westhead, P., & Wright, M. (2008). Opportunity identification and pursuit: does an entrepreneur’s human capital matter? Small Business Economics, 30(2), 153-173.

Ucbasaran, D., Westhead, P., & Wright, M. (2009). The extent and nature of opportunity identification by experienced entrepreneurs. Journal of Business Venturing, 24(2), 99-115.

Van der Zwan, P., Verheul, I., & Thurik, A.R. (2012). The entrepreneurial ladder, gender, and regional development. Small Business Economics, 39(3), 627-643.

Verheul, I., Thurik, R., Grilo, I., & Van der Zwan, P. (2012). Explaining preferences and actual involvement in self-employment: Gender and the entrepreneurial personality. Journal of Economic Psychology, 33(2), 325-341.

Westhead, P., & Storey, D.J. (1997). Financial constraints on the growth of high technology small firms in the United Kingdom. Applied Financial Economics, 7(2), 197-201.

Westhead, P., Ucbasaran, D., & Wright, M. (2009). Information search and opportunity identification: the importance of prior business ownership experience. International Small Business Journal, 27(6), 659-680.